Life insurance is an important consideration for married couples, as it provides financial protection for the surviving spouse in the event of their partner's death. It ensures that the surviving spouse can maintain their lifestyle and cover expenses without facing financial strain. There are various types of life insurance policies available for married couples, including term life insurance, permanent life insurance, and joint life insurance policies, each with its own benefits and features. While some couples opt for separate life insurance policies to customise coverage according to their individual needs, others prefer joint life insurance policies for convenience and potential cost savings. It is essential to consider the unique circumstances of each couple before making a decision.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial stability for a surviving spouse |

| Income replacement | Lost income |

| Debt repayment | Mortgage, personal loans, credit card balances |

| Childcare | Children's needs, educational expenses |

| Estate equalization | Balance the distribution of assets among the children or other beneficiaries |

| Final expenses | Funeral and burial expenses |

What You'll Learn

Income replacement

Life insurance can be a crucial financial tool for income replacement, especially when a spouse is a primary or sole earner. It helps protect your family from financial hardship and ensures financial stability for the surviving spouse. Here are some key points to consider:

Understanding Income Replacement

Types of Income Replacement Insurance

There are two main types of income replacement insurance:

- Short-Term Disability Insurance: Covers a limited period, usually up to six months, for temporary disabilities.

- Long-Term Disability Insurance: Provides coverage for an extended period, sometimes until retirement age, for long-term disabilities.

Other types include group disability insurance (offered through employers) and individual disability income insurance (purchased directly by individuals).

Benefits of Income Replacement Insurance

- Financial Stability: It provides a steady income to maintain the family's financial stability, covering essential expenses.

- Lifestyle Protection: This insurance helps maintain the insured person's standard of living, preventing the need to dip into savings or retirement funds.

- Medical Coverage: Some policies cover medical bills arising from injuries or illnesses that cause an inability to work.

- Long-term Security: Many policies offer benefits for several years or until retirement, crucial for dealing with chronic conditions or lengthy recovery periods.

- Customizable Plans: Income replacement insurance policies can often be tailored to the insured person's needs, including coverage amount, waiting period, and benefit period.

- Tax Benefits: In some cases, income replacement insurance premiums may be tax-deductible, and benefits may be tax-free depending on the policy and local laws.

Drawbacks of Income Replacement Insurance

However, income replacement insurance also has potential downsides, such as:

- High Premium Costs: The cost of income replacement insurance can be high, especially for older individuals or those in high-risk occupations.

- Lengthy Waiting Periods: Policies often have waiting periods before benefits kick in, ranging from 30 to 180 days or more, which can be financially challenging.

- Limited Coverage Amounts: Most policies only cover a percentage of the insured person's income, typically between 50% and 70%, which may not be sufficient to maintain their previous lifestyle.

- Strict Disability Definitions: Insurance companies have specific definitions of disability, and benefits may not be provided if the insured person's condition does not meet their criteria.

- Exclusions and Limitations: Policies may exclude certain conditions or limit benefits for specific illnesses or injuries, so reading the fine print is crucial.

Calculating Income Replacement for Life Insurance

When determining the amount of life insurance needed for income replacement, it is recommended to multiply your annual income by the number of years you want to provide financial support for your dependents. This period typically ranges from 5 to 10 years, depending on your family's needs and future goals. This calculation ensures that your dependents can maintain their current lifestyle and cover essential expenses.

Life Insurance and Suicide: Willy's Story

You may want to see also

Debt and mortgage repayment

Life insurance can be a crucial tool for debt and mortgage repayment for the surviving spouse. Here are some ways life insurance can help in this area:

Debt Repayment:

- Life insurance can provide the necessary funds to pay off outstanding debts, such as personal loans or credit card balances, that the surviving spouse would be responsible for.

- It ensures that the surviving spouse is not burdened by these financial obligations on top of dealing with the loss of their partner.

Mortgage Repayment:

- Life insurance can help repay the remaining mortgage on a couple's home, ensuring the surviving spouse has one less financial worry.

- This is especially important if the deceased spouse was the primary breadwinner, as it allows the surviving spouse to continue living in the family home without the immediate financial strain of mortgage payments.

Financial Stability:

- By covering debt and mortgage repayment, life insurance provides financial stability for the surviving spouse, helping them maintain their current lifestyle and plan for the future.

- It gives them the breathing room to focus on dealing with their loss and navigating the challenges that arise, without the added stress of immediate debt and mortgage concerns.

Planning for the Future:

- With the financial burden of debt and mortgage lifted, the surviving spouse can start planning for the future, including saving for retirement, their children's education, or other financial goals.

- Life insurance thus acts as a safety net, providing the opportunity to rebuild and secure a stable future for themselves and their family.

Customizable Options:

- Life insurance policies can be tailored to meet specific needs, including debt and mortgage repayment.

- Spouses can choose between separate or joint life insurance policies, term or permanent coverage, and add riders for additional benefits like spousal coverage.

- Consulting a financial advisor or insurance professional can help determine the best course of action based on the couple's unique circumstances.

Life Insurance and Experimental Vaccines: What's Covered?

You may want to see also

Childcare and education

Life insurance can be a crucial safety net for your family in the event of your death. It can provide financial security and support to your surviving spouse and children, helping them maintain their lifestyle and cover essential expenses.

When it comes to childcare and education, life insurance can be a lifesaver for surviving spouses. Here's how:

- Financial Means for Childcare and Education: Life insurance provides the surviving spouse with the financial resources to continue caring for the children and meeting their educational needs. This includes covering daily expenses, school fees, extracurricular activities, and other related costs.

- Child Insurance Plans: Some insurance companies offer child insurance plans that specifically address the future needs of children, even in the absence of their parents. These plans ensure that the child's future financial needs, such as education and medical expenses, are taken care of. They often provide a combination of insurance coverage and investment options, creating a corpus for the child's education and other milestones.

- Education Funding: Life insurance can help secure funding for your children's education, including college or university fees. This ensures that your children can pursue their educational goals without financial constraints, even if one spouse passes away.

- Partial Withdrawal Options: Child insurance plans may offer partial withdrawal facilities in case of emergencies or unexpected expenses related to the child's medical condition or accident. This can act as an additional source of funds to supplement health insurance plans.

- Tax Benefits: In some countries, premiums paid towards child insurance plans may be eligible for tax benefits. For example, under certain tax laws, premiums may be exempted from income tax, and maturity benefits may also be tax-exempt.

- Collateral for Education Loans: Child insurance plans can also be used as collateral when applying for education loans. This can help secure favourable loan terms and provide additional financial support for your child's education.

- Long-Term Savings: Child insurance plans encourage disciplined, long-term savings, which can be challenging for parents. Starting early allows for the accumulation of a significant corpus to meet future education expenses and other milestones, such as marriage.

By including life insurance in your financial planning, you can ensure that your children's future is protected and that they have the necessary financial support to pursue their dreams, even in your absence.

Life Insurance and Taxes: What You Need to Know

You may want to see also

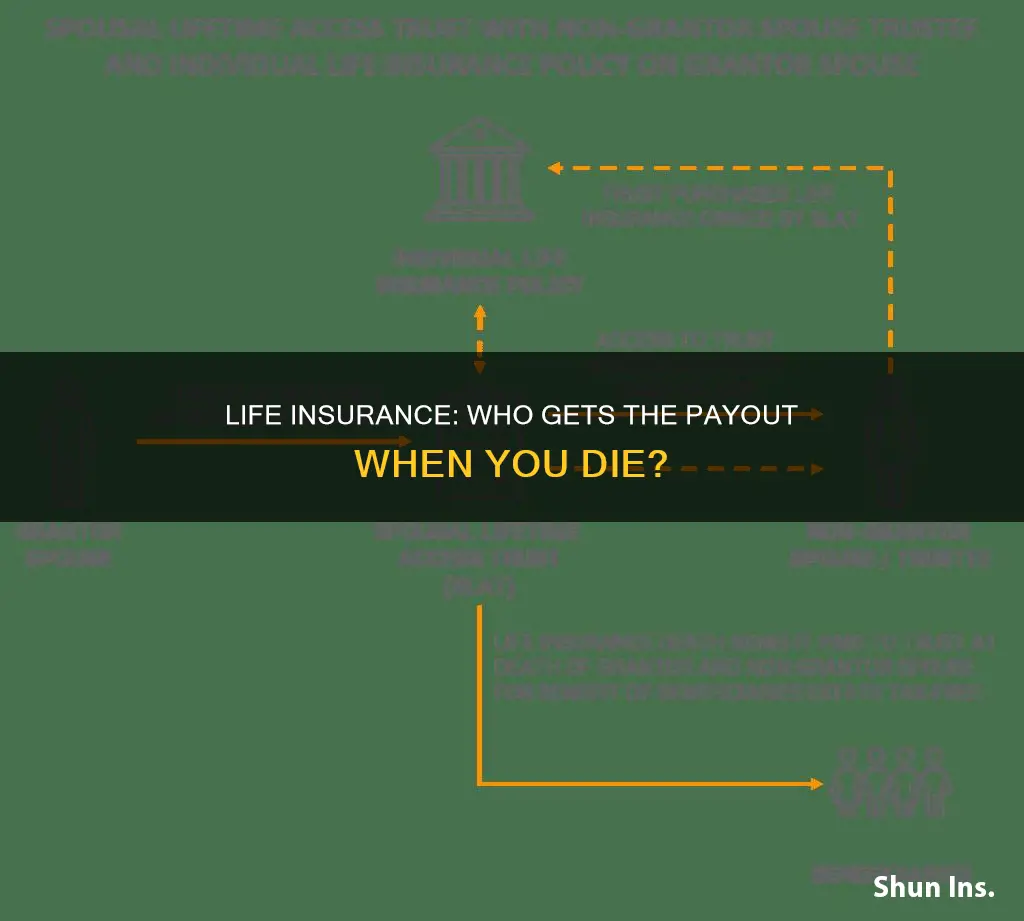

Estate equalization

For example, a business owner may plan to pass on their business to one child, but they have other children to whom they want to gift their assets. In this case, the owner can use estate equalization to ensure all beneficiaries get a fair share. The owner can bequeath the business to the child who will continue running it and then set up a life insurance policy, naming the other children as beneficiaries. This way, the business owner treats their children fairly, but not necessarily equally.

Life insurance is a perfect solution in these cases as it provides a known benefit amount at the right time. The policy premiums are fixed, and the death benefit is known throughout the life of the contract. This eliminates uncertainty and achieves fairness.

PPI and Life Insurance: Are You Covered?

You may want to see also

Final expenses

Final expense insurance, also known as burial insurance, is a type of whole life insurance policy that covers end-of-life costs. It is designed to help your loved ones with the financial burden of your passing, including funeral arrangements and any remaining medical or legal expenses.

The average funeral can cost $8,300 to $10,000 or more, and final expense insurance can help your family cover these costs. It can also be used to pay for any outstanding medical, legal, or credit card bills. Final expense insurance is one of the most affordable types of life insurance, with rates starting at $63 per month for coverage ranging from $5,000 to $40,000.

There are two types of final expense life insurance plans:

- Full face value from policy issue if death is due to an accident or natural causes.

- Accidental death full benefit immediately, and non-accidental death limited benefit for policy years 1 & 2, and full benefit for policy year 3.

The application process for final expense insurance is simple and quick, and coverage can be issued in days or even on the same day. There is usually no need for a medical exam, just a brief health questionnaire. The policy remains in place as long as the premiums are paid and it can build cash value over time, which can be used to borrow against or as a non-forfeiture benefit.

Final expense insurance is a popular choice among seniors due to its affordable price, smaller benefit amounts, and focus on covering funeral costs. It is a smart and compassionate solution for those looking to protect their loved ones from rising funeral expenses.

Globe Life: Whole Life Insurance Options and Benefits

You may want to see also

Frequently asked questions

Spouse life insurance is a way to ensure that if either spouse or partner dies unexpectedly, the surviving spouse or beneficiaries will not be burdened by financially devastating financial burdens.

Income replacement, household services replacement, and debt, college planning, and retirement are some of the reasons to buy life insurance on your spouse.

Unless you are a high net-worth individual, the answer is yes. Even if a couple is considered high net worth, the cost of purchasing life insurance for each spouse is more economically sensible than using liquid assets.

One spouse can purchase life insurance for the other by acting as the policy owner and paying the premiums, ensuring that both spouses are adequately covered.