Progressive Life Insurance offers a unique approach to life insurance, focusing on providing comprehensive coverage tailored to individual needs. Unlike traditional insurance companies, Progressive emphasizes transparency and customization, allowing policyholders to build a policy that aligns with their specific goals and circumstances. By offering a range of coverage options, from term life to permanent life insurance, Progressive ensures that individuals can find a policy that suits their financial situation and long-term objectives. This personalized approach, combined with competitive rates and a commitment to customer satisfaction, sets Progressive apart in the life insurance market, making it an attractive choice for those seeking a more flexible and tailored insurance experience.

| Characteristics | Values |

|---|---|

| Product Offerings | Progressive does not offer traditional term or whole life insurance policies. They focus on accident and critical illness insurance. |

| Target Market | Progressive's insurance products are often marketed towards individuals who may have gaps in their coverage or those seeking more specialized protection. |

| Pricing Model | The company utilizes a pay-as-you-go model, allowing customers to pay for insurance based on their specific needs and activities. |

| Flexibility | Progressive's insurance plans are designed to be flexible, catering to various lifestyles and risk profiles. |

| Specialized Coverage | They offer unique coverage options like accident-only insurance and critical illness insurance, filling specific protection gaps. |

| Online Presence | Progressive has a strong online presence, allowing customers to easily compare and purchase insurance policies. |

| Customer Service | The company provides customer support through various channels, including phone, email, and online chat. |

| Market Position | Progressive is known for its competitive pricing and innovative approach to insurance, but it may not offer the same comprehensive coverage as traditional insurers. |

| Regulatory Compliance | As with any insurance provider, Progressive must adhere to relevant regulations and industry standards. |

| Customer Reviews | Reviews often highlight the ease of purchasing and managing policies online, but some customers may prefer more personalized interactions. |

What You'll Learn

- Affordability: Progressive offers competitive rates for life insurance

- Customization: Policies can be tailored to individual needs and budgets

- Simplicity: The application process is straightforward and user-friendly

- Financial Security: Provides coverage for loved ones' financial well-being

- Trustworthy: A reputable company with a strong financial rating

Affordability: Progressive offers competitive rates for life insurance

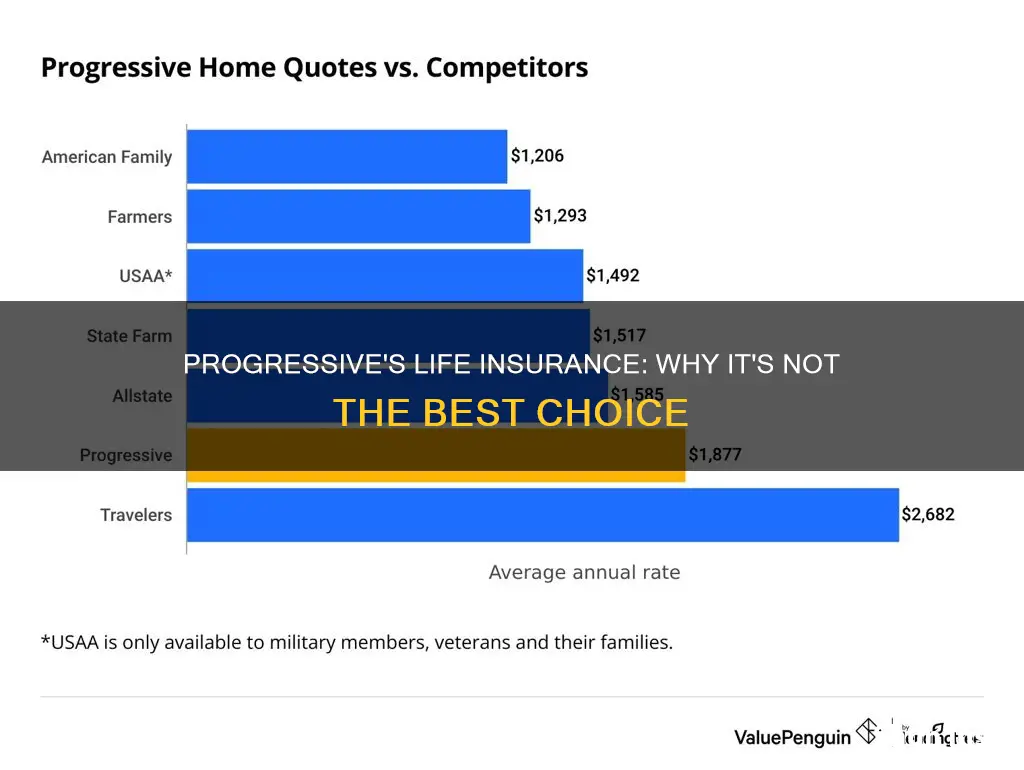

Progressive Insurance is known for its commitment to providing affordable and competitive life insurance options to its customers. When it comes to life insurance, many people are often concerned about the cost, especially those who are new to the insurance market or have specific financial needs. Progressive understands this and aims to offer rates that are not only competitive but also tailored to individual circumstances.

One of the key factors that contribute to Progressive's affordability is its extensive network of insurance providers and carriers. By partnering with multiple insurers, Progressive can negotiate rates and terms that are favorable for its customers. This allows them to offer a range of life insurance products at competitive prices without compromising on coverage. Whether it's term life insurance, whole life insurance, or a combination of both, Progressive strives to provide options that suit various budgets and requirements.

The company's approach to affordability also involves a personalized underwriting process. Progressive takes into account individual factors such as age, health, lifestyle, and financial situation to determine the most suitable and cost-effective coverage. This tailored approach ensures that customers receive quotes that are accurate and reflective of their specific needs, making life insurance more accessible and affordable. By considering these factors, Progressive can offer competitive rates that may be lower than traditional insurance providers, especially for those with unique circumstances or pre-existing conditions.

Furthermore, Progressive's online platform and digital tools play a significant role in making life insurance more affordable. Their user-friendly website and mobile app allow customers to obtain quotes, compare policies, and make adjustments easily. This convenience enables individuals to explore different coverage options and find the most affordable plan without the need for extensive research or multiple consultations. Progressive's digital approach also streamlines the application process, making it quicker and more efficient, ultimately saving customers time and money.

In summary, Progressive's focus on affordability is evident through its competitive rates, extensive network of insurers, personalized underwriting, and user-friendly digital platform. By offering a range of life insurance products at competitive prices, Progressive aims to make insurance more accessible and cost-effective for individuals with diverse financial needs. This commitment to affordability is a key reason why many people consider Progressive when researching life insurance options.

Progressive's Term Life Insurance: What You Need to Know

You may want to see also

Customization: Policies can be tailored to individual needs and budgets

Progressive, a well-known insurance company, offers a range of life insurance policies that can be customized to suit individual requirements and financial situations. This level of customization is a key advantage for those seeking tailored coverage. When it comes to life insurance, one size does not fit all, and Progressive understands this. The company recognizes that each person's needs are unique, and their policies reflect this by allowing for personalized adjustments.

The customization process begins with a thorough understanding of the individual's circumstances. Progressive's agents or representatives engage in detailed conversations with potential policyholders to gather information about their current and future financial goals, family structure, health status, and any specific requirements they may have. This comprehensive approach ensures that the policy is designed to meet the client's expectations. For instance, a young professional with a growing family might opt for a term life insurance policy, which provides coverage for a specified period, ensuring financial security for their loved ones during that time.

In contrast, an older individual with a substantial estate might prefer a permanent life insurance policy, which offers lifelong coverage and includes an investment component. Progressive's ability to customize means that the policy can be structured to align with the client's financial objectives. For example, the policyholder can choose the death benefit amount, the duration of the policy, and even the type of coverage (whole life, term, or universal life) based on their preferences and financial capabilities. This level of flexibility ensures that the insurance policy becomes a valuable tool for achieving personal financial goals.

Furthermore, Progressive's customization extends to the payment options. Policyholders can select the frequency and amount of premium payments, making the policy more affordable and adaptable to their budget. This flexibility is particularly beneficial for those who prefer a more manageable monthly payment or those who want to ensure that the insurance remains affordable as their financial situation evolves. By offering such customization, Progressive ensures that life insurance becomes accessible and adaptable to a wide range of individuals.

In summary, Progressive's approach to life insurance is centered around customization, allowing individuals to design policies that fit their unique circumstances. This level of personalization ensures that the insurance becomes a practical and effective tool for managing financial risks and achieving personal goals. With Progressive, customers can have peace of mind knowing that their life insurance is tailored to their needs, providing comprehensive coverage without compromising their financial flexibility.

Unlocking Variable Universal Life Insurance: A Comprehensive Guide

You may want to see also

Simplicity: The application process is straightforward and user-friendly

The application process for life insurance with Progressive is designed with simplicity in mind, ensuring that customers can easily navigate the steps to secure their coverage. This user-friendly approach is a key factor in why Progressive has gained a reputation for making life insurance more accessible. When you initiate the process, you'll find that it is a seamless journey from start to finish. The company provides clear and concise instructions, guiding applicants through the necessary steps without unnecessary complexity.

One of the strengths of Progressive's application process is its efficiency. Customers can quickly provide the required information, which is essential for obtaining an accurate quote and ensuring a smooth underwriting process. The form is structured logically, allowing applicants to move through it at their own pace. This streamlined approach saves time and reduces the potential for errors, making the entire experience less daunting for those new to life insurance.

Simplicity is further enhanced by the availability of online resources. Progressive offers a comprehensive FAQ section and helpful guides on its website, addressing common concerns and providing valuable insights. These resources enable applicants to gather the necessary knowledge before starting the application, ensuring they have all the required details readily available. As a result, the process becomes more transparent and less intimidating, especially for those who prefer handling their insurance needs independently.

Additionally, Progressive's customer support team plays a vital role in maintaining the simplicity of the application process. They are trained to assist applicants throughout their journey, offering guidance and promptly addressing any queries or concerns. This level of support ensures that even those with limited insurance knowledge can navigate the application successfully. The combination of user-friendly forms, online resources, and dedicated customer support makes Progressive's life insurance application process a seamless and straightforward experience.

In summary, Progressive's approach to life insurance applications emphasizes simplicity, making it an attractive option for those seeking a hassle-free experience. By combining efficient processes, user-friendly resources, and reliable customer support, Progressive ensures that obtaining life insurance coverage is a straightforward and accessible process for its customers. This simplicity is a significant advantage, encouraging more individuals to consider and ultimately purchase life insurance.

Understanding W-9: Life Insurance and Its Benefits

You may want to see also

Financial Security: Provides coverage for loved ones' financial well-being

Progressive, a well-known insurance company, does not offer traditional life insurance policies. This decision is primarily due to the nature of life insurance and the specific needs it addresses. Progressive's focus has been on providing comprehensive coverage for various aspects of life, such as auto, home, and renters insurance, as well as specialized products like motorcycle and boat insurance. While they excel in these areas, life insurance is a different beast.

Life insurance is designed to provide financial security for the beneficiaries in the event of the insured's death. It offers a lump-sum payment or regular income to cover expenses such as mortgage payments, children's education, funeral costs, and other financial obligations. Progressive, being a direct insurance company, has historically focused on offering competitive rates and a wide range of coverage options to its customers. By not offering life insurance, they can maintain their expertise in areas where they have a direct impact on customer satisfaction and financial protection.

The absence of life insurance from Progressive's portfolio can be attributed to several factors. Firstly, life insurance is a highly regulated industry, with specific requirements and standards that insurance companies must adhere to. Progressive, known for its innovative and customer-centric approach, might have found it challenging to align its business model with the traditional life insurance market. Additionally, life insurance policies often require extensive underwriting, which can be a complex and time-consuming process. Progressive's business model has often been about providing quick and efficient coverage, which may not align with the lengthy underwriting process associated with life insurance.

For those seeking financial security for their loved ones, there are alternative options available. Progressive customers can explore other insurance providers that specialize in life insurance. These companies offer a variety of policies, including term life, whole life, and universal life insurance, each with its own benefits and considerations. By choosing a dedicated life insurance provider, individuals can ensure that their loved ones are protected financially, even in the event of their passing. This allows individuals to make informed decisions about their insurance needs and find the right coverage to suit their specific requirements.

In summary, Progressive's decision not to offer life insurance is a strategic one, allowing them to focus on their core strengths in other insurance sectors. While they may not provide life insurance directly, customers can still access this essential coverage through other reputable insurance companies. Understanding the unique aspects of life insurance and exploring the options available can help individuals make informed choices to ensure the financial well-being of their loved ones.

Converting Whole Life Insurance to Irrevocable: What You Need to Know

You may want to see also

Trustworthy: A reputable company with a strong financial rating

When considering life insurance, one of the key factors that often comes into play is the financial stability and trustworthiness of the insurance provider. In the case of Progressive, a well-known name in the insurance industry, there might be some confusion or skepticism regarding their involvement in life insurance. However, it is important to understand that Progressive is a reputable company with a strong financial rating, which is crucial for any insurance provider.

Progressive Corporation, commonly known as Progressive, is a leading insurance company in the United States. They have a long-standing history of providing various insurance products, including auto, home, and renters insurance. When it comes to life insurance, Progressive has not traditionally been a major player in this market. However, this does not diminish their reputation or financial stability. In fact, Progressive's strong financial rating is a testament to their reliability and ability to honor their commitments to policyholders.

A strong financial rating is an indicator of a company's financial health and its ability to meet its obligations. For life insurance companies, this rating is especially important as it directly impacts their ability to pay out claims to beneficiaries. Insurance regulators and rating agencies, such as A.M. Best, Moody's, and Standard & Poor's, evaluate insurance companies based on various factors, including their financial strength, management quality, business profile, and operating performance. Progressive has consistently maintained a high financial rating, often in the 'A' or 'A-' range, which is considered excellent and indicates a very strong financial position.

This strong financial rating provides reassurance to policyholders and potential customers. It means that Progressive has the financial resources to withstand economic downturns and financial shocks, ensuring that policyholders' benefits and claims are honored. Moreover, a reputable insurance company like Progressive is more likely to have a robust infrastructure, efficient claims processing, and a customer-centric approach, further enhancing the trustworthiness of the company.

In summary, while Progressive may not be as widely recognized for life insurance as some other providers, their strong financial rating and reputable standing in the insurance industry make them a trustworthy choice. Policyholders can have confidence in Progressive's ability to fulfill their financial obligations, providing peace of mind and security for their loved ones. It is always advisable to research and compare different insurance providers, but Progressive's financial stability is a significant advantage in the life insurance market.

Life Insurance: Asset or Liability?

You may want to see also

Frequently asked questions

Progressive offers life insurance as a way to provide financial protection and peace of mind to individuals and their families. It ensures that loved ones are financially secure in the event of the insured person's death.

Progressive's life insurance policies are designed to be flexible and customizable. They offer various coverage options, allowing customers to choose the amount of coverage that aligns with their specific needs and budget. This flexibility sets Progressive apart from traditional insurance providers.

Progressive's life insurance is available to a wide range of individuals, including those with pre-existing health conditions. They consider various factors, such as age, health, lifestyle, and occupation, to determine eligibility and set premiums.

Progressive provides several advantages, including competitive rates, straightforward application processes, and personalized service. They aim to make life insurance accessible and affordable for everyone, ensuring that customers can find a policy that suits their unique circumstances.

Yes, Progressive offers a simple and quick way to get a quote for life insurance. Customers can visit their website, provide basic personal and health information, and receive an instant estimate. This process allows individuals to explore their options and make an informed decision about their life insurance coverage.