Variable universal life insurance is a type of permanent life insurance that offers both death benefit protection and investment opportunities. Unlike traditional whole life insurance, which has a fixed premium and death benefit, variable universal life insurance allows policyholders to adjust their premiums and death benefits based on their financial goals and market performance. This flexibility is achieved through an investment component, where a portion of the premium is invested in a separate account, typically a mutual fund, which can grow and decline in value. Policyholders can allocate their investments among various options, providing them with a degree of control over their insurance portfolio. Understanding the features and benefits of variable universal life insurance is essential for individuals seeking a comprehensive financial planning tool that combines insurance coverage with investment potential.

What You'll Learn

- Definition: Variable universal life insurance combines life coverage with investment options, offering flexibility and potential for higher returns

- Benefits: It provides permanent life coverage, tax-deferred growth, and investment opportunities to adapt to changing financial goals

- Investment Options: Policyholders can allocate premiums to various investment accounts, offering control over risk and potential returns

- Cost Structure: Premiums are flexible, but fees can be higher due to investment management and administrative costs

- Risk Management: This policy offers protection against financial loss and provides a safety net for beneficiaries

Definition: Variable universal life insurance combines life coverage with investment options, offering flexibility and potential for higher returns

Variable universal life insurance is a unique financial product that offers individuals a way to secure their loved ones' financial future while also providing an opportunity to grow their wealth. This type of insurance is a hybrid of two essential components: life insurance and investment accounts.

At its core, variable universal life insurance provides a death benefit to the policyholder's beneficiaries in the event of the insured's passing. This is similar to traditional life insurance policies, ensuring financial security for one's family or dependents. However, what sets it apart is the investment aspect. The policyholder can allocate a portion of their premium payments into various investment options, such as stocks, bonds, or mutual funds. These investment accounts are typically offered by the insurance company and provide the policyholder with a degree of control over their financial decisions.

The beauty of variable universal life insurance lies in its flexibility. Policyholders can adjust their investment strategies over time, allowing them to adapt to changing market conditions and personal financial goals. They can choose to increase their investments to potentially grow their money faster or reduce the investment allocation if they prefer a more conservative approach. This adaptability is a significant advantage, especially for those who want to actively manage their finances and potentially benefit from market growth.

One of the key advantages is the potential for higher returns compared to traditional fixed-rate life insurance policies. The investment accounts within the policy can offer a wide range of investment choices, each with its own level of risk and potential reward. This allows individuals to tailor their investment strategy to their risk tolerance and financial objectives. Over time, successful investment management could result in substantial growth, providing a more substantial financial safety net for the insured's beneficiaries.

In summary, variable universal life insurance is a powerful financial tool that combines the security of life coverage with the potential for wealth accumulation through investment. It offers policyholders the flexibility to make informed financial decisions, adapt to market changes, and potentially achieve higher returns. This type of insurance is particularly appealing to those who want to take control of their financial future and make the most of their insurance premiums.

Life Insurance Proceeds: Minnesota's Tax Laws Explained

You may want to see also

Benefits: It provides permanent life coverage, tax-deferred growth, and investment opportunities to adapt to changing financial goals

Variable Universal Life (VUL) insurance is a flexible and adaptable life insurance policy that offers a range of benefits to policyholders. One of its primary advantages is providing permanent life coverage, ensuring that your loved ones are protected even if your financial situation changes over time. This type of insurance is designed to offer long-term security, allowing you to build a substantial cash value that can be used for various purposes.

The tax-deferred growth aspect of VUL is particularly attractive. Unlike some other investment vehicles, VUL allows your money to grow tax-free until it's withdrawn. This means that the earnings and any subsequent gains can accumulate without being taxed annually, providing a significant advantage over traditional savings accounts or investments. As a result, your money has the potential to grow faster and more efficiently.

Another key benefit is the investment opportunities it presents. VUL policies typically offer a wide range of investment options, allowing you to customize your portfolio according to your risk tolerance and financial goals. You can choose from various investment accounts, such as stocks, bonds, and mutual funds, which can be adjusted over time as your financial situation and objectives evolve. This adaptability is a significant advantage, as it enables you to stay on track with your investment strategy and make changes when necessary.

With VUL, you have the freedom to adapt your policy to changing financial goals. For example, if you want to increase your coverage, you can allocate more funds to the investment portion of the policy. Conversely, if you need to access some of the cash value, you can take withdrawals or loans without compromising your life coverage. This flexibility ensures that your insurance policy remains relevant and beneficial throughout your life's journey.

In summary, Variable Universal Life insurance offers a unique combination of benefits, including permanent life coverage, tax-efficient growth, and customizable investment opportunities. It provides a flexible and powerful tool for individuals seeking to secure their loved ones' financial future while also growing their wealth over time. By understanding and utilizing these advantages, you can make informed decisions about your insurance and investment needs.

Managing Field Agents: The Life Insurance Superheroes

You may want to see also

Investment Options: Policyholders can allocate premiums to various investment accounts, offering control over risk and potential returns

Variable Universal Life (VUL) insurance is a type of life insurance that offers both an insurance component and an investment component. It provides a flexible way to secure your loved ones' financial future while also allowing you to potentially grow your money through various investment options. One of the key features of VUL is the ability for policyholders to allocate their premiums into different investment accounts, giving them a degree of control over their financial strategy.

When you purchase a VUL policy, you typically have the option to choose from a range of investment accounts, often referred to as "investment options" or "investment sub-accounts." These investment accounts are designed to offer policyholders the opportunity to invest their premiums in various asset classes, such as stocks, bonds, and money market instruments. By allocating your premiums to these investment accounts, you can actively manage your risk and return potential.

The investment accounts within a VUL policy are often structured as separate, distinct portfolios. Each portfolio may have its own investment strategy, risk profile, and performance objectives. Policyholders can choose to allocate a portion or all of their premiums to these different investment options, depending on their financial goals, risk tolerance, and market conditions. This flexibility allows individuals to customize their VUL policy to align with their investment preferences.

One of the advantages of this investment approach is that it provides policyholders with a high degree of control over their investment decisions. They can adjust their allocations over time based on market trends, their financial situation, and changing goals. For example, during periods of market growth, a policyholder might choose to allocate more funds to stock-based investment accounts to potentially maximize returns. Conversely, in a more conservative environment, they may opt for bond-based investments to reduce risk.

Additionally, VUL policies often offer a range of investment choices, including growth-oriented, income-oriented, and balanced portfolios. This variety ensures that policyholders can find investment options that align with their specific financial objectives. By regularly reviewing and rebalancing their investment allocations, policyholders can stay on track to meet their long-term financial goals while also ensuring that their VUL policy remains a valuable part of their overall financial plan.

Life Insurance Proceeds: Are Employer-Paid Benefits Taxable?

You may want to see also

Cost Structure: Premiums are flexible, but fees can be higher due to investment management and administrative costs

Variable Universal Life (VUL) insurance is a type of life insurance that offers both death benefit protection and an investment component. Unlike traditional life insurance, VUL policies allow policyholders to allocate a portion of their premiums to various investment options, providing an opportunity for potential growth. This flexibility in investment choices is a key feature that sets VUL apart from other insurance products.

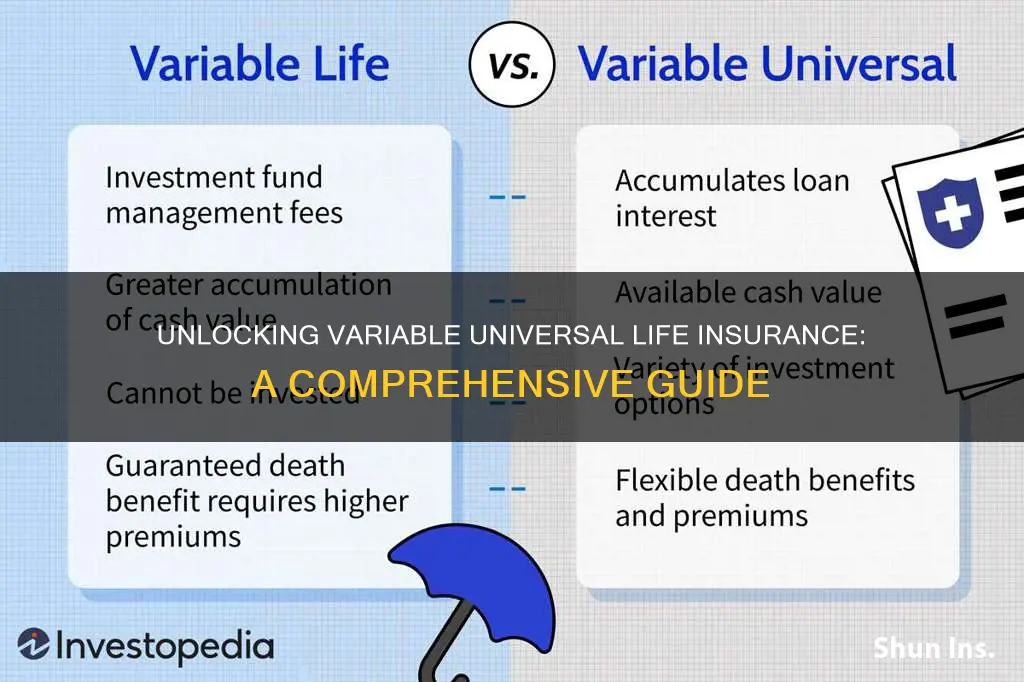

When it comes to the cost structure of VUL insurance, it's important to understand that while premiums can be adjusted, the associated fees can vary significantly. The primary reason for these higher fees is the investment management and administrative costs involved. VUL policies invest a portion of the premiums in various investment vehicles, such as stocks, bonds, and mutual funds. These investments are managed by professional fund managers who charge fees for their services. The investment management fees can vary depending on the specific investment options chosen by the policyholder and the performance of the underlying investments.

In addition to investment management fees, VUL policies also incur administrative costs. These costs cover the expenses associated with policy administration, such as processing premiums, issuing policy documents, and providing customer service. Administrative fees are typically a percentage of the policy's value and are charged on a regular basis. The combination of investment management and administrative fees contributes to the overall cost structure of VUL insurance, making it more expensive compared to some other life insurance products.

It's worth noting that while VUL premiums can be flexible, allowing policyholders to adjust them over time, the fees associated with investment management and administration are generally non-negotiable. These fees are determined by the insurance company and are based on the complexity of the investment options and the administrative processes involved. As a result, policyholders should carefully consider their investment choices and understand the associated costs before purchasing a VUL policy.

Understanding the cost structure of VUL insurance is crucial for making informed decisions. While the flexibility in premiums is an attractive feature, the higher fees due to investment management and administrative costs should be carefully evaluated. Policyholders should seek professional advice to ensure they choose the right investment options and understand the long-term implications of their VUL policy's cost structure.

Life Insurance Cash Value: What's the Real Deal?

You may want to see also

Risk Management: This policy offers protection against financial loss and provides a safety net for beneficiaries

Variable Universal Life (VUL) insurance is a type of life insurance that offers both a death benefit and an investment component. It provides a safety net for beneficiaries in the event of the insured's death, ensuring that their financial needs are met. This policy is particularly attractive to those seeking a flexible and customizable insurance solution.

The risk management aspect of VUL insurance is a critical feature. It offers protection against financial loss, which is a primary concern for individuals and families. When you purchase VUL, you are essentially buying a contract with an insurance company that promises to pay out a specified amount upon your death. This payout can be a significant financial safety net for your loved ones, especially if you have dependents or financial obligations. The policy's death benefit is typically tax-free, providing a direct benefit to the beneficiaries without any tax implications.

One of the key advantages of VUL is its ability to adapt to changing financial circumstances. Unlike traditional life insurance, VUL policies allow policyholders to adjust the death benefit and investment allocations over time. This flexibility is crucial for risk management as it enables individuals to ensure that their insurance coverage remains appropriate as their financial situation evolves. For instance, if you experience a significant life event like a career change or the birth of a child, you can increase the death benefit to reflect your new financial responsibilities.

The investment component of VUL also plays a vital role in risk management. Policyholders can allocate a portion of their premiums to various investment options, such as stocks, bonds, or mutual funds. This investment aspect allows VUL to potentially grow the value of the policy, providing a financial cushion that can be used to meet various financial goals. For example, you might use the policy's investment growth to build a substantial cash value, which can be borrowed against or withdrawn to cover unexpected expenses or provide additional financial security.

In summary, VUL insurance is a powerful tool for risk management and financial protection. It offers a safety net for beneficiaries by ensuring a death benefit, and its investment features allow policyholders to manage and potentially grow their financial resources. With its flexibility and adaptability, VUL provides individuals with a comprehensive solution to address their evolving financial needs and risks.

Understanding Accumulated Value in Permanent Life Insurance Policies

You may want to see also

Frequently asked questions

Variable Universal Life Insurance is a type of permanent life insurance that offers both death benefit protection and an investment component. It provides flexibility in premium payments and allows policyholders to allocate their premiums between guaranteed and variable components. The variable portion of the policy invests in a separate account, where the money can be invested in various investment options, such as stocks, bonds, and mutual funds. This feature enables policyholders to potentially earn higher returns compared to traditional fixed-rate life insurance.

The investment aspect of this insurance policy is tied to the performance of the separate account. Policyholders can choose from a range of investment options offered by the insurance company. These investments can be actively managed or indexed, and the performance of the separate account directly impacts the cash value of the policy. If the investments perform well, the policyholder can benefit from higher cash value growth, which can be used to pay future premiums or taken out as loans. However, there is also a risk involved, as the value of the investments can fluctuate, and there is no guarantee of returns.

Variable Universal Life Insurance offers several advantages over traditional whole life or term life insurance. Firstly, it provides more flexibility in premium payments, allowing policyholders to adjust their contributions based on their financial situation. Secondly, the investment component allows for the potential of higher returns, which can be beneficial for those seeking to grow their wealth. Additionally, the policy can be customized to fit individual needs, and the death benefit can be adjusted over time to reflect changing circumstances. This type of insurance also offers tax-deferred growth and can be a valuable tool for long-term financial planning.