Life insurance is a financial product that provides a safety net for individuals and their families, offering peace of mind and financial security. It is a complex business, and understanding what makes it profitable is essential for both consumers and providers. The profitability of life insurance stems from a combination of factors, including the careful selection of policyholders, the calculation of premiums, and the management of claims. Insurers assess risk through medical exams, health history, and lifestyle factors to determine the likelihood of an individual filing a claim. This risk assessment allows companies to set appropriate premium rates, ensuring they can cover potential payouts while generating a profit. Additionally, the investment of premiums in various financial instruments contributes to the overall profitability of life insurance companies.

What You'll Learn

- Risk Assessment: Analyzing mortality rates and statistical models to set premiums

- Investment Portfolios: Diversified investments generate returns to cover administrative costs

- Regulatory Compliance: Adherence to laws ensures fair practices and consumer protection

- Customer Service: Efficient claims processing and support enhance customer satisfaction and loyalty

- Market Competition: Competitive pricing and innovative products attract and retain customers

Risk Assessment: Analyzing mortality rates and statistical models to set premiums

Life insurance companies rely on a deep understanding of risk to ensure their profitability, and at the heart of this is the critical process of risk assessment. This involves a meticulous analysis of mortality rates and the application of statistical models to determine the appropriate premiums for insurance policies. By evaluating these factors, insurers can strike a balance between offering competitive rates and maintaining a healthy profit margin.

The foundation of risk assessment lies in understanding mortality rates, which are the statistical measures of the likelihood of death for a specific population. Insurers collect and analyze data on various demographics, such as age, gender, health status, and lifestyle choices. For instance, older individuals generally face higher mortality rates, making them more expensive to insure. Similarly, smokers or those with pre-existing health conditions may be considered higher-risk, leading to higher premium calculations. This data-driven approach allows insurers to identify and categorize individuals based on their risk profiles.

Statistical models play a pivotal role in this process, providing a structured framework to interpret the collected data. These models employ complex algorithms and mathematical formulas to predict the likelihood of death for different policyholders. Actuaries, experts in this field, use these models to calculate the expected long-term costs associated with insuring a particular individual or group. The models consider various factors, including historical mortality data, life expectancy, and the impact of risk factors. For example, a statistical model might account for the increased mortality risk associated with smoking by adjusting the premium accordingly.

Insurers use these statistical models to set premiums, ensuring that the rates charged are sufficient to cover potential payouts and administrative costs while also generating a profit. The process involves a delicate balance; insurers must offer competitive rates to attract customers while also ensuring that the premiums are high enough to cover the expected claims. This is where the expertise of actuaries becomes crucial, as they employ their knowledge of statistics and risk assessment to determine the optimal premium structure.

By combining mortality rate analysis and statistical modeling, life insurance companies can make informed decisions about premium pricing. This approach enables them to offer tailored policies, ensuring that the risk assessment accurately reflects the individual's circumstances. Ultimately, this meticulous risk assessment process is essential for the financial sustainability of life insurance providers, allowing them to manage their liabilities effectively and provide valuable coverage to their policyholders.

Life Insurance Broker: What You Need to Know

You may want to see also

Investment Portfolios: Diversified investments generate returns to cover administrative costs

The concept of investment portfolios is a cornerstone of life insurance profitability, and at its heart lies the principle of diversification. This strategy is a powerful tool for managing risk and maximizing returns, which is essential for the financial health of life insurance companies. By spreading investments across various asset classes, sectors, and geographic regions, insurers can create a robust and resilient portfolio.

Diversification works by reducing the impact of any single investment's poor performance on the overall portfolio. Each investment in a well-diversified portfolio is expected to have a slightly different risk and return profile. When one investment underperforms, others may excel, thus balancing the overall returns. This approach is particularly crucial in the context of life insurance, where policyholders rely on consistent and stable returns to fund the company's obligations.

The returns generated from these diversified investments are vital to covering administrative costs, which include expenses related to policy administration, customer service, and regulatory compliance. These costs can be substantial, especially for large insurance companies with millions of policyholders. By investing in a wide array of assets, such as stocks, bonds, real estate, and alternative investments, insurers can ensure that their portfolios are not overly exposed to any one market or sector. This strategy enables them to generate sufficient returns to meet their financial obligations and maintain a strong financial position.

For instance, a life insurance company might allocate a portion of its portfolio to equity investments in various industries, ensuring exposure to the technology, healthcare, and financial sectors. Simultaneously, they could invest in government bonds and corporate debt securities to provide a stable source of income and a hedge against market volatility. Additionally, alternative investments like private equity, real estate, or infrastructure funds can offer higher returns and lower correlation with traditional asset classes, further enhancing portfolio resilience.

In summary, investment portfolios play a critical role in life insurance profitability by employing diversification as a risk management strategy. This approach ensures that insurers can generate the necessary returns to cover administrative costs and fulfill their financial commitments to policyholders. By carefully selecting and managing a wide range of investments, life insurance companies can navigate market fluctuations and maintain a strong financial foundation.

Prudential Life Insurance: Grace Period and Late Payment Options

You may want to see also

Regulatory Compliance: Adherence to laws ensures fair practices and consumer protection

Regulatory compliance is a critical aspect of the life insurance industry, as it ensures that companies operate within legal boundaries, maintain ethical standards, and protect the interests of their customers. The insurance sector is heavily regulated to safeguard consumers and maintain the integrity of the market. Here's an overview of how regulatory compliance contributes to the profitability and sustainability of life insurance companies:

Life insurance companies must navigate a complex web of laws and regulations to ensure their operations are lawful and transparent. These regulations are designed to protect policyholders, prevent fraudulent activities, and promote fair business practices. Compliance with these rules is essential for several reasons. Firstly, it builds trust with customers. When a company adheres to legal standards, it demonstrates a commitment to ethical behavior, which is crucial for attracting and retaining clients. Consumers are more likely to choose insurers that prioritize transparency and accountability. This trust can lead to increased market share and long-term customer loyalty, ultimately boosting profitability.

Regulatory bodies set guidelines for insurance products, including life insurance policies. These guidelines ensure that policies are fair, understandable, and tailored to meet the needs of the insured. For instance, regulations may dictate the minimum coverage requirements, policy terms, and the information that must be disclosed to policyholders. By adhering to these standards, insurers can offer competitive products without compromising consumer protection. This balance between profitability and compliance ensures that companies can generate revenue while maintaining a positive reputation and customer satisfaction.

Compliance also plays a vital role in risk management. Insurance companies must assess and manage risks effectively to ensure their long-term viability. Regulatory frameworks provide guidelines for risk evaluation, including methods for calculating premiums and assessing policyholder risks. By following these rules, insurers can accurately price their products, manage their risk portfolios, and make informed decisions. This risk management approach is essential for profitability, as it enables companies to offer competitive rates while minimizing potential losses.

Furthermore, regulatory compliance helps prevent fraudulent activities and protects consumers from unfair practices. Insurance fraud can significantly impact a company's financial health and reputation. By implementing strict regulations and oversight, authorities can deter fraudulent behavior and ensure that claims are processed fairly. This not only protects the insurer's interests but also safeguards the financial well-being of policyholders. A robust regulatory environment encourages fair competition, discourages unethical business practices, and promotes a stable and profitable insurance market.

In summary, regulatory compliance is integral to the life insurance industry's profitability and sustainability. It ensures fair practices, protects consumers, and fosters trust. By adhering to legal standards, insurance companies can offer competitive products, manage risks effectively, and maintain a positive reputation. This compliance-driven approach enables insurers to generate profits while upholding ethical standards and contributing to a healthy insurance market.

Life Insurance After 85: Is It Possible?

You may want to see also

Customer Service: Efficient claims processing and support enhance customer satisfaction and loyalty

Efficient claims processing and exceptional customer support are fundamental pillars in the success and profitability of life insurance companies. When a policyholder's claim is promptly and accurately processed, it not only ensures a positive experience for the customer but also reinforces the company's reputation for reliability and trustworthiness. This aspect of customer service is crucial in an industry where trust and long-term relationships are paramount.

The process of claims handling often begins with a customer service representative who is the first point of contact for the policyholder. This representative plays a pivotal role in setting the tone for the entire claims experience. They must be adept at quickly understanding the nature of the claim, gathering all necessary documentation, and providing clear, concise information about the next steps. A friendly and empathetic approach can significantly impact the customer's emotional state during a potentially stressful time.

Streamlining the claims process is essential to enhance efficiency. This involves implementing digital tools and systems that automate routine tasks, reduce manual errors, and expedite the overall process. For instance, using advanced software for document verification and data entry can significantly speed up the initial stages of claims processing. Additionally, having a well-defined workflow and clear guidelines for claim handlers ensures consistency and reduces the likelihood of delays or errors.

Timely and accurate claims processing also has financial implications. Faster resolution times can lead to reduced administrative costs for the insurance company. Moreover, efficient service can prevent policyholders from incurring unnecessary financial burdens, such as the costs associated with prolonged illness or unexpected events. By efficiently managing claims, insurance providers can maintain a healthy cash flow, which is vital for the company's financial stability and ability to pay out claims promptly.

In the long term, a commitment to efficient claims processing and customer support fosters a loyal customer base. Satisfied customers are more likely to renew their policies and recommend the company to others. Word-of-mouth referrals and positive online reviews are powerful marketing tools in the insurance industry, helping to attract new customers and reinforce the company's reputation. Thus, investing in customer service excellence is not just a strategic decision but a necessity for life insurance companies to thrive in a competitive market.

Understanding Voluntary Life Insurance: Employee Payment Options

You may want to see also

Market Competition: Competitive pricing and innovative products attract and retain customers

In the highly competitive life insurance market, companies are constantly vying for customers' attention and loyalty. One of the key strategies to gain a competitive edge is through competitive pricing and the development of innovative products. This approach not only attracts new customers but also helps in retaining existing ones, ensuring a steady and loyal customer base.

When it comes to pricing, life insurance companies must strike a balance between profitability and competitiveness. Setting prices too high might deter potential customers, while pricing too low can lead to reduced profit margins. The ideal strategy is to offer competitive rates that are attractive to the market without compromising the financial health of the company. This involves thorough market research to understand the pricing strategies of competitors and identifying the sweet spot that maximizes customer acquisition while maintaining a healthy profit.

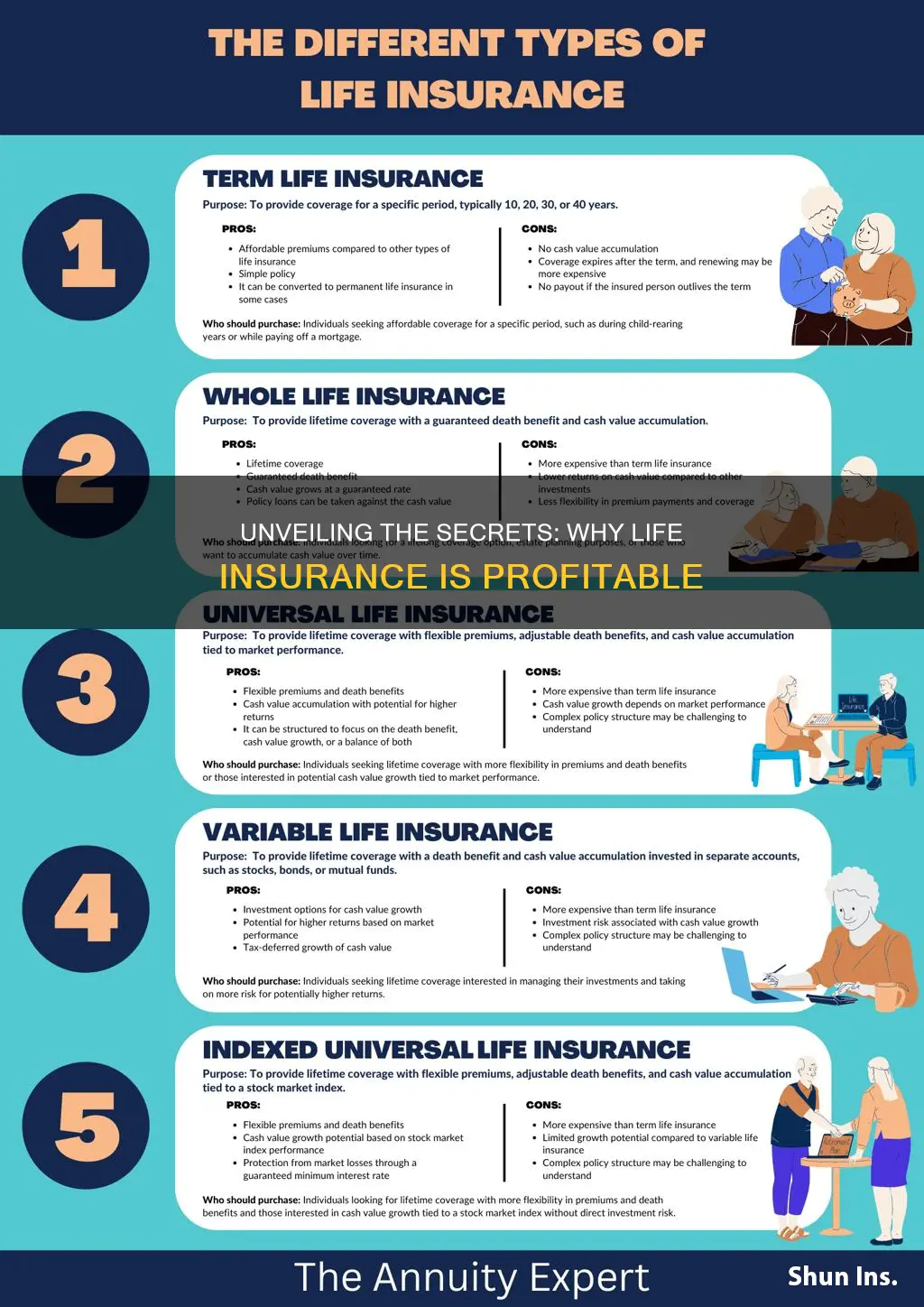

Innovative products are another powerful tool in the life insurance industry's arsenal. By introducing new and improved products, companies can differentiate themselves from the competition and cater to a wider range of customer needs. For instance, developing term life insurance with customizable coverage options allows customers to tailor their policies to their specific requirements, making the product more appealing and relevant. Additionally, incorporating digital technology into policy management and claims processing can enhance customer experience, making the entire process more efficient and user-friendly.

The introduction of new products can also address emerging market trends and customer preferences. For example, with the growing awareness of environmental sustainability, some insurance providers are offering eco-friendly policies that support green initiatives. These innovative products not only attract environmentally conscious customers but also position the company as a forward-thinking and socially responsible entity.

In summary, market competition in the life insurance sector is intense, and companies must employ strategic pricing and product innovation to thrive. Competitive pricing ensures that the company remains attractive to customers, while innovative products differentiate the company and cater to diverse customer needs. By combining these approaches, life insurance providers can effectively attract and retain a loyal customer base, ultimately contributing to the profitability and sustainability of the business.

The True Cost of Supplemental Life Insurance

You may want to see also

Frequently asked questions

Life insurance companies make profits by collecting premiums from policyholders and investing those funds. They offer a range of products, including term life, whole life, and universal life insurance, which provide financial protection to individuals and their families in the event of the insured's death. The key to profitability lies in the difference between the premiums collected and the claims paid out over time.

Investment is a critical component of life insurance profitability. Insurance companies invest the premiums they receive in various financial instruments such as stocks, bonds, real estate, and fixed-income securities. These investments generate returns that contribute to the company's overall financial strength and allow them to pay out claims and offer competitive interest rates on cash value accounts or investment options within the policies.

The cost of life insurance is calculated based on several factors, including the insured's age, health, lifestyle, and the desired coverage amount. Insurance companies use complex actuarial tables and statistical models to assess the risk associated with insuring an individual. They consider factors like mortality rates, longevity, and the likelihood of claim occurrences to set premium rates that ensure profitability while providing adequate coverage.

Term life insurance, which provides coverage for a specified period, typically offers lower premiums compared to permanent life insurance. While term life insurance may not accumulate cash value, it can still be profitable for insurance companies due to the lower administrative costs and the fact that they don't have to invest in long-term care or retirement benefits. The key to profitability in term life insurance is accurate risk assessment and efficient claim management.

Regulatory bodies play a crucial role in ensuring the stability and profitability of life insurance companies. They set guidelines, rules, and capital requirements to protect consumers and maintain market integrity. Insurance regulators monitor investment practices, claim settlements, and the overall financial health of insurance companies. By adhering to these regulations, life insurance providers can maintain profitability while ensuring customer trust and long-term sustainability.