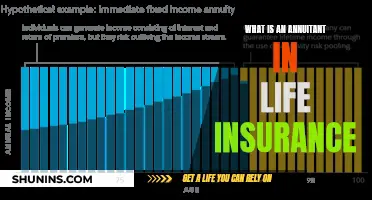

Life insurance is a crucial financial safety net for millions of families, and Prudential is one of the largest providers. But what happens if you miss a premium payment? Most life insurance contracts include a grace period, a provision that allows policyholders to make a payment for a certain period after the due date without facing late fees or losing coverage. This period is typically around 30 days, and it ensures that a policyholder doesn't lose coverage simply because they missed a payment due to an emergency or unexpected circumstance.

| Characteristics | Values |

|---|---|

| Grace period | 30 days |

| What happens if the premium is not paid during the grace period | The policy will lapse and the cover will terminate |

| What happens if the life assured dies during the grace period | The death benefit is usually paid out, though the outstanding premium may be deducted |

| What happens if the policy lapses | The insurer will accept the premium for an additional 30 to 60 days and restore the coverage |

| How to revive a lapsed policy | Apply for reinstatement by paying any past-due premiums and any interest on the missed payments |

What You'll Learn

What is a grace period?

A grace period is the provision in most life insurance contracts that allows premium payments to be received for a certain period of time after the actual due date. If the policyholder pays the due premium during this period, no late fees or interest are charged, and the late payment does not result in default or cancellation of the policy. A typical grace period is 30 days, though it can vary by lender and loan type.

In the context of credit cards, a grace period refers to the period between the end of a billing cycle and the date your payment is due. During this time, you may not be charged interest as long as you pay your balance in full by the due date. Credit card companies are not required to give a grace period, but most credit cards provide one for purchases. Grace periods typically do not apply to cash advances or balance transfers.

A mortgage grace period is the number of days late you can make a payment without penalty, usually about 15 days. A student loan grace period is the time between exiting school and the start of loan payments, typically lasting six to nine months.

PCOS and Life Insurance: What You Need to Know

You may want to see also

How long is the grace period?

The grace period in life insurance refers to the extra time provided by insurers for policyholders to pay their premiums after the premium due date has passed. If the policyholder fails to pay the premium during this time, the policy will lapse and the cover will terminate. The grace period is usually 15 to 31 days, with a typical grace period being 30 days. It is worth noting that the grace period may vary depending on the payment mode and provider. For instance, it is usually 30 days for annual, bi-annual, and quarterly premium payment modes, but it can be 15 days for monthly premiums.

During the grace period, the sum assured remains unaffected even if the premium is not paid within the due date. This means that if the policyholder dies within the grace period, the insurance provider will deduct the value of the premium from the death benefit paid to the nominee, but the sum assured will not be affected.

It is important to pay the missed payment as soon as possible, as the policy will lapse if the grace period passes without payment. This means that the coverage will end, and the policyholder may have to apply for a new policy with higher rates. To revive a lapsed policy, the policyholder can apply for reinstatement by paying any past-due premiums, as well as any interest on missed payments and late fees.

Group Life Insurance: Nonforfeiture Benefits Explained

You may want to see also

What happens if the premium isn't paid during the grace period?

Life insurance companies typically offer a grace period of around 15 to 31 days. This is a cushion that allows policyholders to make premium payments after the due date without incurring late fees or penalties. However, if the premium remains unpaid during the grace period, the policy will lapse, and the coverage will terminate.

When a policy lapses, the insurer will no longer provide insurance coverage, and the policyholder may have to apply for a new policy, potentially facing higher rates. In the event of the policyholder's death during a lapse, the life insurance beneficiary will not receive a payout.

To revive a lapsed policy, the policyholder can apply for reinstatement. This process typically involves paying any past-due premiums, along with interest on the missed payments and possible late fees. Reinstatement is generally more cost-effective than purchasing a new policy, as it is based on the policyholder's initial age and health status.

It is important to note that the grace period may vary depending on the payment mode and provider. For example, it is usually 30 days for annual, bi-annual, and quarterly premium payment modes, while it may be shorter, around 15 days, for monthly premiums.

To avoid missing premium payments and the potential consequences of a lapse in coverage, it is advisable to set up payment reminders, ensure timely delivery of mailed checks, utilise online payment options, and consider automatic payments from a bank account.

Life Insurance and Taxes: What's the Connection?

You may want to see also

What happens if the policyholder dies during the grace period?

Life insurance is intended to financially protect your loved ones after you pass away. In the event that a policyholder dies during the grace period, the policy remains valid, and the death benefit is typically paid out to the beneficiaries. However, it is important to note that the outstanding premium for the current year may be deducted from the total sum assured. This means that the beneficiaries will receive the sum assured minus any unpaid premiums.

The grace period is a provision in most life insurance contracts that allows policyholders extra time to make premium payments after the actual due date without incurring late fees or penalties. This period typically lasts for 30 days for annual, semi-annual, and quarterly premium payment modes, and 15 days for monthly premiums. During this time, the policy remains active, and the insurance company will inform the policyholder before the due date and after entering the grace period.

If the policyholder fails to pay the premium during the grace period, the policy will lapse, and the coverage will terminate. However, the beneficiaries are still eligible to receive the death benefit if the policyholder passes away during this lapsed period. It is important to note that active cancellations do not come with a grace period. If you are switching insurance providers, it is recommended to keep the previous insurance active until the new plan is in place to ensure continuous coverage.

To ensure uninterrupted coverage, it may be beneficial to switch to a more manageable payment mode, such as monthly or quarterly payments, if the policyholder is unable to pay an annual premium due to financial constraints. Additionally, setting up reminders and being proactive about premium payments can help avoid missing payments and potential lapses in coverage.

Life Insurance and Suicide in Australia: What's Covered?

You may want to see also

What happens if the grace period ends and the premium is still unpaid?

If the grace period ends and the premium is still unpaid, the policy will “lapse”, meaning the coverage ends. In this case, you might have to apply for a new policy, which could have higher rates.

After the grace period, the insurer will typically accept the premium for an additional 30 to 60 days, depending on the company, and restore the coverage. To revive a lapsed policy after that time, you can apply to have it reinstated. You will have to pay any past-due premiums, and you may be charged interest on the missed payments, along with penalties such as late fees. You can usually apply for reinstatement within three to five years of your policy lapsing, but it's better to act quickly. If your policy has been lapsed for longer than a couple of months, you’ll often have to prove you’re not too risky to insure by answering health questions or even taking another life insurance medical exam.

If you die before reinstating or replacing your lapsed policy, your life insurance beneficiary won't receive a payout.

Kroger Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, Prudential life insurance does have a grace period. This is a provision in most life insurance contracts that allows premium to be received for a certain period of time after the actual due date. A typical grace period is 30 days.

If you don't pay your premium during the grace period, your policy will lapse, and your cover will terminate. This means that your insurance coverage will end, and you may have to apply for a new policy with higher rates.

If the life assured dies during the grace period, the life insurance policy typically remains valid, and the death benefit is usually paid out, though the outstanding premium may be deducted.

Here are a few tips to help you avoid missing premium payments:

- Create reminders for life insurance bill due dates.

- If you mail a check, allow enough time for the check to be delivered.

- Pay online to ensure your payment is not delayed in the mail.

- Set up automatic payments from your bank account.