Prescription drugs play a significant role in healthcare costs, and their impact on insurance premiums is a critical issue. The rising cost of medications is a major factor in the increasing premiums for health insurance. This is because insurance companies often have to cover the expenses of prescription drugs, which can be substantial, especially for chronic conditions. When patients require long-term medication, the financial burden on insurance providers can be immense, leading to higher premiums to sustain these costs. Understanding the relationship between prescription drugs and insurance rates is essential to address the challenges faced by both patients and insurance companies in managing healthcare expenses.

What You'll Learn

- Prescription Drug Costs: High drug prices lead to increased insurance premiums

- Generic vs. Brand: Generics are cheaper, but insurance may prefer brand drugs

- Patient Copays: Higher copays for prescriptions can drive up insurance costs

- Drug Formulary: Insurance companies manage drug lists, affecting prescription coverage

- Pharmacy Networks: In-network pharmacies offer lower rates, impacting insurance premiums

Prescription Drug Costs: High drug prices lead to increased insurance premiums

The rising cost of prescription drugs has a significant impact on insurance premiums, creating a complex relationship between drug prices and insurance coverage. When pharmaceutical companies set high prices for their medications, it directly affects the healthcare system and insurance providers. Insurance companies often have to account for these increased costs when determining premium rates for their policies. This is because the higher the cost of prescription drugs, the more financial risk insurance carriers face, especially when covering a large number of policyholders. As a result, insurance premiums tend to rise to cover these additional expenses.

One of the primary reasons for this correlation is the market dynamics of the pharmaceutical industry. Drug manufacturers often have the power to set prices based on demand and market exclusivity. When a new drug is released, it can carry a premium price due to limited competition, and this can lead to higher overall costs for insurance providers. Over time, as more drugs enter the market, competition may drive prices down, but the initial impact of high-priced medications can still be felt by insurance companies for an extended period.

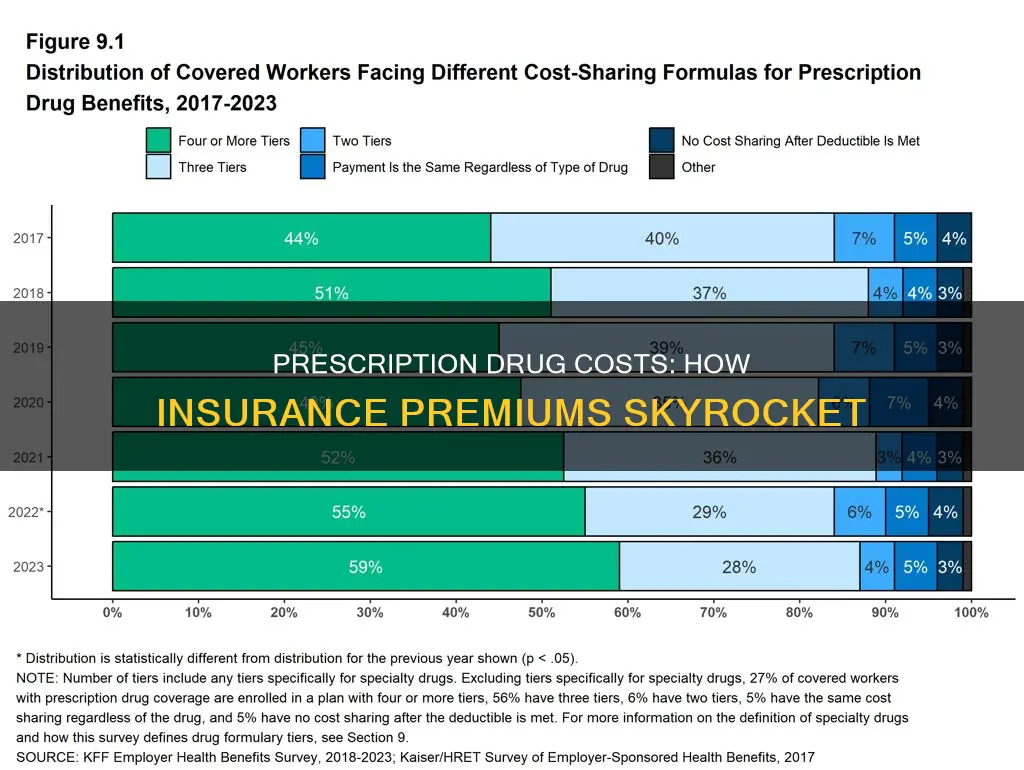

Furthermore, the complexity of drug formularies and coverage policies contributes to the issue. Insurance companies often have different tiers of drug coverage, with higher-priced medications typically falling into more expensive tiers. This structure incentivizes patients to opt for cheaper alternatives, but it also means that insurance providers have to allocate more funds to cover the costs of these higher-priced drugs. As a result, the increased demand for expensive medications directly translates to higher insurance premiums.

Another factor is the negotiation power of insurance companies with pharmaceutical firms. While insurance providers negotiate prices for various medical services and products, the complexity of drug pricing structures can make it challenging to secure lower rates. Pharmaceutical companies may offer discounts or rebates to specific insurers, but these agreements are often confidential and vary widely, making it difficult to generalize the impact on insurance premiums.

In summary, the high cost of prescription drugs has a direct and significant effect on insurance premiums. This relationship is driven by market dynamics, the complexity of drug coverage, and the negotiation power of both pharmaceutical companies and insurance providers. Understanding this connection is crucial for policymakers, healthcare professionals, and consumers alike, as it highlights the need for strategies to manage prescription drug costs and, consequently, insurance expenses.

Auto Insurance: Canceling Early

You may want to see also

Generic vs. Brand: Generics are cheaper, but insurance may prefer brand drugs

The healthcare industry often grapples with the challenge of balancing cost-effectiveness and quality, especially when it comes to prescription drugs. One of the key factors influencing these costs is the choice between generic and brand-name medications. While generics are generally more affordable, insurance companies often lean towards prescribing brand-name drugs, which can be more expensive. This preference for brand drugs is a strategic decision that impacts both the insurer and the patient.

Generics are essentially bioequivalent to their brand-name counterparts, containing the same active ingredients and delivering the same therapeutic benefits. However, they are produced by different manufacturers and are typically available at a significantly lower price. This cost difference is primarily due to the absence of research and development (R&D) costs associated with bringing a new drug to market, which are substantial for brand-name drugs. Insurance companies, being cost-conscious entities, often view generics as a more economical option for their policyholders.

Despite their lower cost, insurance providers may still favor brand-name drugs for several reasons. Firstly, brand drugs often have a well-established track record and a longer history of use, providing a more comprehensive understanding of their safety and efficacy. This can be particularly important for drugs used to treat chronic conditions or those with complex mechanisms of action. Insurance companies may also consider the potential for higher patient compliance with brand drugs, as they are more recognizable and may be perceived as being of higher quality.

Another factor influencing insurance preferences is the potential for higher reimbursement rates from pharmaceutical companies. Brand-name drug manufacturers often have more resources for marketing and promotional activities, which can lead to more favorable terms in their agreements with insurance providers. This includes negotiated prices that are higher than the actual production cost, allowing the companies to maintain profit margins while still providing a financial incentive for insurance companies to promote their products.

In summary, while generics offer a more cost-effective solution, insurance companies may still prefer brand-name drugs due to factors such as established safety profiles, patient compliance, and negotiated reimbursement rates. This dynamic highlights the complex interplay between cost, quality, and market strategies in the prescription drug industry, ultimately influencing the choices made by insurance providers and, consequently, the patients they serve. Understanding these factors is crucial for both healthcare consumers and providers to make informed decisions regarding medication choices.

Understanding Insurance: Coverage Beyond the Wheel

You may want to see also

Patient Copays: Higher copays for prescriptions can drive up insurance costs

The relationship between prescription drugs and insurance costs is a complex one, and patient copays play a significant role in this dynamic. When patients are required to pay higher copays for their prescriptions, it can have a direct impact on their insurance premiums. Here's how:

Direct Financial Impact: Higher copays mean patients spend more out-of-pocket for their medications. This increased financial burden can lead to a higher overall cost for insurance companies. Insurance providers often negotiate with pharmaceutical companies to secure lower prices for medications, but these discounts don't always trickle down to patients. As a result, patients may face higher copays, which can be a significant expense, especially for those with chronic conditions requiring long-term medication use.

Medication Adherence and Management: Copay structures can influence patient behavior. Some individuals might opt for less expensive, less effective medications to avoid higher copays, potentially compromising their health. This can lead to suboptimal treatment outcomes and increased healthcare costs in the long run. Moreover, patients may be less likely to fill prescriptions or seek necessary medications, impacting their overall health management.

Insurance Payouts and Premiums: Insurance companies often have to cover the costs of prescriptions, especially for chronic conditions. When copays are high, patients might be more inclined to use generic alternatives or delay filling prescriptions, increasing the likelihood of insurance payouts. This, in turn, can drive up insurance costs as companies need to account for these higher claims. To mitigate this, insurance providers might adjust premiums, making them more expensive for policyholders.

Market Dynamics: The prescription drug market is competitive, with various pharmaceutical companies offering medications. Insurance companies negotiate prices, and higher copays can impact these negotiations. If patients consistently face high copays, it may encourage them to switch to different insurance plans or even change healthcare providers, potentially affecting the market dynamics and insurance company profitability.

In summary, patient copays for prescriptions have a direct correlation with insurance costs. Higher copays can lead to increased financial strain on patients, potentially impacting their medication adherence. This, in turn, can result in higher insurance payouts and, consequently, higher premiums for policyholders. Understanding these dynamics is crucial for patients, healthcare providers, and insurance companies to make informed decisions regarding medication management and insurance coverage.

Understanding Auto Insurance Loss Ratios: Claims and Costs

You may want to see also

Drug Formulary: Insurance companies manage drug lists, affecting prescription coverage

The concept of a drug formulary is a powerful tool used by insurance companies to manage costs and determine coverage for prescription medications. This formulary, often referred to as a "covered drug list," is a curated selection of medications that an insurance provider deems appropriate and cost-effective for their policyholders. It plays a pivotal role in shaping the prescription coverage offered to members, influencing both the availability and affordability of medications.

Insurance companies meticulously review and analyze a vast array of drugs, considering factors such as efficacy, safety, cost, and clinical guidelines. This process involves extensive research and collaboration with healthcare professionals to ensure that the formulary includes medications that provide the best value and clinical outcomes. By managing the drug list, insurers can negotiate lower prices with pharmaceutical companies, pass on the savings to policyholders, and control overall healthcare expenditure.

The impact of the drug formulary is twofold. Firstly, it directly influences the medications that patients can access. Insurance plans typically cover drugs listed on the formulary, while excluding those not included. This means that patients may have limited options for their prescriptions, potentially requiring them to switch to more affordable alternatives or even go without certain medications. Secondly, the formulary affects the financial burden on patients. Insurers often implement copayments or coinsurance based on the formulary tiers, with higher costs for non-formulary drugs. This pricing strategy incentivizes patients to choose covered medications, further emphasizing the insurance company's control over prescription coverage.

Furthermore, insurance formulary management allows companies to prioritize cost-effective treatments while ensuring patient access to essential medications. This approach often involves negotiating with pharmaceutical manufacturers to secure lower prices for popular drugs, which can significantly reduce insurance premiums. However, it may also lead to challenges for patients who require specialized or newer medications that are not yet covered, requiring them to seek alternative solutions or additional financial support.

In summary, the drug formulary is a critical mechanism through which insurance companies manage prescription coverage and costs. By curating a list of covered medications, insurers can influence patient treatment choices and financial obligations. This process highlights the intricate relationship between prescription drugs, insurance coverage, and the economic considerations that shape healthcare accessibility and affordability. Understanding the drug formulary's impact is essential for both patients and healthcare providers to navigate the complexities of insurance-covered medications effectively.

Gap Insurance: Stalling Tactics Exposed

You may want to see also

Pharmacy Networks: In-network pharmacies offer lower rates, impacting insurance premiums

Pharmacy networks play a crucial role in managing prescription drug costs and, consequently, insurance premiums. These networks are carefully curated lists of pharmacies that have negotiated lower rates with insurance companies. When a patient uses an in-network pharmacy, they benefit from reduced prices on their prescription medications, which directly translates to lower out-of-pocket expenses. This model is designed to encourage patients to use cost-effective pharmacy options while still providing access to necessary medications.

The primary goal of pharmacy networks is to create a win-win situation for both patients and insurance providers. By offering lower rates, in-network pharmacies help insurance companies manage their costs, which can lead to more competitive insurance premiums. This strategy is particularly effective in controlling the rising trend of prescription drug expenses, which has been a significant concern for both healthcare providers and patients. When patients fill their prescriptions at in-network locations, they contribute to a more sustainable healthcare system.

Insurance companies often negotiate discounted rates with pharmacy chains and independent pharmacies to be included in their network. These negotiations result in lower acquisition costs for the insurance provider, which can then be reflected in reduced premiums for policyholders. The network structure allows insurance companies to control and manage the spending on prescription drugs, ensuring that the financial burden is distributed more equitably among their customer base.

For patients, the benefits of using in-network pharmacies are twofold. Firstly, they pay less for their medications, which can be a significant savings, especially for those with multiple prescriptions. Secondly, by utilizing in-network pharmacies, patients contribute to a more efficient healthcare system, which can lead to better overall service and potentially lower insurance premiums in the long term. This approach encourages patients to take an active role in managing their healthcare costs.

In summary, pharmacy networks and in-network pharmacies are essential components in the strategy to control prescription drug costs and, by extension, insurance premiums. By offering lower rates, these networks provide a more affordable healthcare option for patients while also helping insurance companies manage their expenses. This model promotes a sustainable healthcare system where patients can access necessary medications at reduced costs, and insurance providers can offer competitive premiums.

Canceling AAA Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Prescription drugs can significantly influence insurance costs due to their potential for misuse, high costs, and the associated health risks. Insurance companies often consider the patient's medication history when setting premiums, especially for drugs with a high potential for abuse or those that require long-term management.

Yes, prescription drugs can affect insurance rates for a broader population. When a specific medication is in high demand or has a high price, insurance providers may increase premiums to cover the additional costs and manage the risk associated with prescribing such drugs. This can lead to higher overall insurance expenses for individuals and groups.

Several factors contribute to the insurance impact of prescription drugs. These include the drug's classification (e.g., controlled substances, specialty drugs), its effectiveness and perceived value, patient adherence to the treatment plan, and the availability of generic alternatives. Insurance companies also consider the prevalence of the condition being treated and the overall healthcare spending trends.

Patients can take several steps to manage the financial burden. These include exploring generic or less expensive brand-name alternatives, utilizing patient assistance programs offered by pharmaceutical companies, negotiating with healthcare providers for more affordable treatment plans, and regularly reviewing insurance coverage and prescription drug benefits to ensure they are cost-effective.