The loss ratio is a metric used in the insurance industry to evaluate the financial health and

| Characteristics | Values |

|---|---|

| Definition | A fundamental financial metric used in the insurance industry to measure the profitability of an insurance company |

| Calculation | The ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned premiums over a specified period |

| Interpretation | A loss ratio above 100% means the company is making a loss on its policies. A loss ratio of 100% means the company is breaking even. A loss ratio below 100% indicates a profitable business |

| Importance | Serves as a critical benchmark for evaluating an insurer's financial health, underwriting practices, and overall business performance |

| Components | Incurred losses and earned premiums |

| Ideal Range | 40% to 60% |

What You'll Learn

Loss ratio formula

The loss ratio formula is used in the insurance industry to assess the financial health and profitability of an insurance company. The formula is calculated as follows:

Loss Ratio = (Incurred Losses / Earned Premiums) x 100

Incurred losses refer to the total amount of claims paid out by the insurance company over a specific period, including loss adjustment expenses. Loss adjustment expenses are costs incurred in the process of investigating, verifying, and settling claims.

Earned premiums refer to the total premiums collected by the insurance company during the same period. This is the amount of money paid by clients to the insurance company to cover risk.

The loss ratio formula calculates the percentage of earned premiums that an insurance company pays out in the form of incurred losses. A lower loss ratio generally indicates better profitability, as it means the company is paying out less in claims relative to the premiums collected. Conversely, a higher loss ratio may suggest that the company is experiencing financial difficulties.

For example, if an insurance company pays out $80 in claims for every $160 in collected premiums, the loss ratio would be 50%. This means that for every dollar of premium collected, the insurance company incurred 50 cents in losses.

The ideal loss ratio varies depending on the type of insurance and the specific company's business model. For instance, the loss ratio for health insurance providers tends to be higher than that for property and casualty insurance providers. Therefore, when comparing loss ratios between different insurance companies, it is important to consider the context and the specific type of insurance being offered.

California's No-Fault Auto Insurance: What You Need to Know

You may want to see also

Loss ratio calculation examples

The loss ratio is a key financial metric used in the insurance industry to assess the profitability of an insurance company. It is calculated by dividing the total incurred losses by the total earned premiums over a specific period. Incurred losses refer to the total amount of claims paid out, while earned premiums represent the total premiums collected by the insurance company during that same period. The formula to calculate the loss ratio is:

Loss Ratio = (Incurred Losses / Earned Premiums) x 100

Example 1:

Let's say an insurance company has paid out a total of $800,000 in claims and collected $1,200,000 in premiums during a given period. To calculate the loss ratio, we divide the incurred losses by the earned premiums and then multiply by 100:

Loss Ratio = ($800,000 / $1,200,000) x 100 = 66.67%

This means that the insurance company is paying out 66.67% of its earned premiums in claims.

Example 2:

Consider a scenario where an insurance company has paid $500,000 in claims and incurred $75,000 in loss adjustment expenses over a specific period. During the same period, they have collected a total of $1,500,000 in premiums. To calculate the loss ratio, we add the claims and loss adjustment expenses and then divide by the earned premiums, finally multiplying by 100:

Loss Ratio = (($500,000 + $75,000) / $1,500,000) x 100 = 45%

This loss ratio of 45% indicates that the insurance company is in a profitable position, as they are paying out less in claims and expenses compared to the premiums earned.

Example 3:

Suppose an insurance company has the following figures for a given year: $2,000,000 in total earned premiums, $1,200,000 in claims paid, and $300,000 in loss adjustment expenses. We can calculate the loss ratio as follows:

Loss Ratio = (($1,200,000 + $300,000) / $2,000,000) x 100 = 75%

In this case, the loss ratio of 75% suggests that the insurance company is paying out a significant portion of its earned premiums in claims and expenses, which may indicate financial distress.

Example 4:

Let's consider a situation where an insurance company has collected $800,000 in premiums, paid out $650,000 in claims, and incurred $50,000 in loss adjustment expenses over a specific period. We can calculate the loss ratio as follows:

Loss Ratio = (($650,000 + $50,000) / $800,000) x 100 = 93.75%

A loss ratio above 100% indicates that the insurance company's total claims and expenses exceed the total premiums earned, suggesting that they are making a loss on their policies.

Half-Year Florida Auto Insurance: Possible?

You may want to see also

Loss ratio interpretation

The loss ratio is a key metric in the insurance industry, used to assess the financial health and profitability of an insurance company. It is calculated as the ratio of incurred losses (including claims paid, loss adjustment expenses, and in some cases, loss reserves) to the earned premiums over a specified period.

When interpreting a loss ratio, it is important to consider the context and the type of insurance being offered. Generally, a loss ratio between 40% and 60% is considered ideal, indicating that the insurance company is effectively managing its risk exposure, underwriting policies, and pricing its products.

If the loss ratio is above this ideal range, it suggests that the insurance company may be facing financial difficulties. A high loss ratio may be due to inadequate underwriting, pricing, or risk management practices, resulting in a higher frequency or severity of claims. In such cases, the company may need to reevaluate its strategies to maintain financial stability and ensure long-term sustainability.

On the other hand, if the loss ratio is below the ideal range, it could indicate that the insurer is being too conservative in its underwriting practices, potentially missing out on business opportunities or charging premiums that are too high, leading to customer dissatisfaction and a potential loss of market share. While a low loss ratio may indicate better profitability in the short term, it can negatively impact the company's competitiveness in the long run.

When the loss ratio is equal to 100%, it means that the insurance company is breaking even, with claims and expenses matching the premiums earned.

A loss ratio greater than 100% indicates that the insurance company is making a loss on its policies, as the total claims and expenses exceed the premiums collected. This situation is unfavourable and may put the company at risk of going out of business.

In summary, a loss ratio is a critical tool for evaluating an insurance company's financial health and stability. A good loss ratio indicates effective management of risk exposure, underwriting policies, and pricing strategies, while a bad loss ratio suggests potential financial difficulties. By interpreting the loss ratio, insurance companies, regulators, and investors can make informed decisions to ensure sustainable growth and financial stability.

Get Your Auto Insurance License in North Carolina

You may want to see also

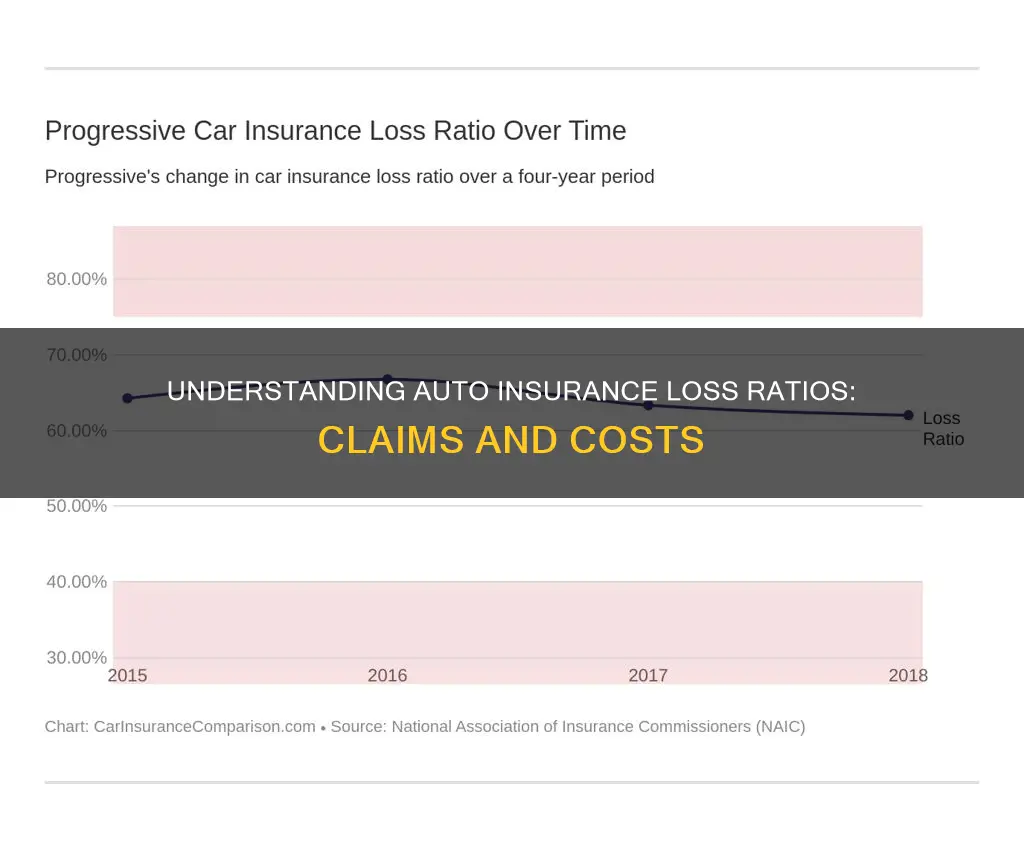

Loss ratio in auto insurance

A loss ratio is a financial metric used in the insurance industry to assess an insurance company's profitability and financial health. It represents the ratio of losses incurred by an insurance company to the premiums it collects from its policies. In the context of auto insurance, the loss ratio can be calculated by dividing the total claims paid for car-related incidents by the total premiums earned from auto insurance policies.

The loss ratio formula is:

Loss Ratio = (Insurance Claims Paid + Loss Adjustment Expenses) / Premium Earned

Loss adjustment expenses refer to the costs associated with investigating, verifying, and settling claims, including personnel and administrative costs.

For example, if an insurance company collects $1,000,000 in premiums for auto insurance policies and pays out $600,000 in claims for car accidents, the loss ratio would be 60% ($600,000 / $1,000,000 x 100).

A loss ratio of less than 100% indicates that an insurance company is profitable, as its claims and expenses are lower than the premiums it collects. Conversely, a loss ratio greater than 100% suggests that the company is losing money on its policies, as the claims and expenses exceed the premiums earned.

The ideal loss ratio range varies depending on the type of insurance and the company's business model. For example, a health insurance provider may have a higher acceptable loss ratio compared to a property and casualty insurance company. Generally, a loss ratio between 40% and 60% is considered healthy for an insurance company, indicating a balance between claims payouts and premium collection.

In the auto insurance industry, maintaining an appropriate loss ratio is crucial for insurance providers to ensure sustainable growth and financial stability. It helps them assess their underwriting practices, pricing strategies, and overall business performance. Additionally, regulators, investors, and consumer advocates rely on loss ratios to evaluate the financial health and stability of insurance companies.

Homelessness and Auto Insurance: Is It Possible?

You may want to see also

Improving loss ratio

The auto insurance loss ratio is defined as the ratio of losses to premiums earned. This ratio is a key indicator of an insurer's financial performance and is used to determine how much money is going out of the business. Improving the loss ratio means improving the bottom line.

Insurtechs are revolutionizing the industry by leveraging big data and AI to lower loss ratios. Here are some ways in which insurtech is helping:

- Real-time data analytics: With real-time data, insurers can now analyze loss ratios on a second-by-second basis, gaining dynamic insights into the cause, effect, and nature of accidents. This helps in better predicting future behaviour and mitigating risk.

- Advanced analytics with AI/ML: By utilizing large amounts of data from various sources, AI and ML models can identify environmental factors, road conditions, driver history, and traffic patterns to more accurately assess risk at any given point in a driver's journey.

- Real-time alerts: Insurtechs can send real-time alerts to drivers and insurers about abnormal driving patterns, traffic disasters, or other potential dangers during a journey. This helps reduce the number of claims, thereby lowering the overall claims cost.

- AI Risk Engines: Insurtechs use AI to develop a granular understanding of risk data and detect risk patterns for trips, enabling them to provide fairer pricing models and superior insights.

- Fraud detection: Insurtechs employ AI and ML to constantly analyze claims data and detect fraudulent activities, helping to minimize insurance fraud and reduce expenses.

In addition to leveraging technology, there are other strategies that can help improve loss ratios:

- Accurate risk assessment: Ensure a comprehensive assessment of clients' risk profiles to avoid underestimating their risk and offering lower premiums than warranted.

- Natural disaster preparedness: Develop strategies to mitigate the impact of natural disasters, which can lead to a significant increase in claims and losses.

- Efficient operations: Optimize claims handling processes and employ skilled insurance adjusters to reduce unnecessary expenses.

- Targeted pricing strategies: Implement targeted price increases to maintain profitability, especially in response to rising claim costs and severe accidents.

Unlicensed Vehicles: Need Insurance?

You may want to see also

Frequently asked questions

A loss ratio is a metric used in the insurance industry to evaluate the financial health and profitability of an insurance company. It is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to the earned premiums over a specified period.

The loss ratio formula is: Loss Ratio = (Incurred Losses / Earned Premiums) x 100. Incurred losses include claims paid, loss reserves, and loss adjustment expenses, while earned premiums refer to the total premiums collected by the insurance company during the specified period.

Generally, a lower loss ratio is considered preferable, as it indicates that an insurance company is paying out fewer claims relative to the premiums collected. However, the ideal loss ratio can vary depending on the type of insurance and the company's business model. For example, a loss ratio for health insurance tends to be higher than the loss ratio for property and casualty insurance.