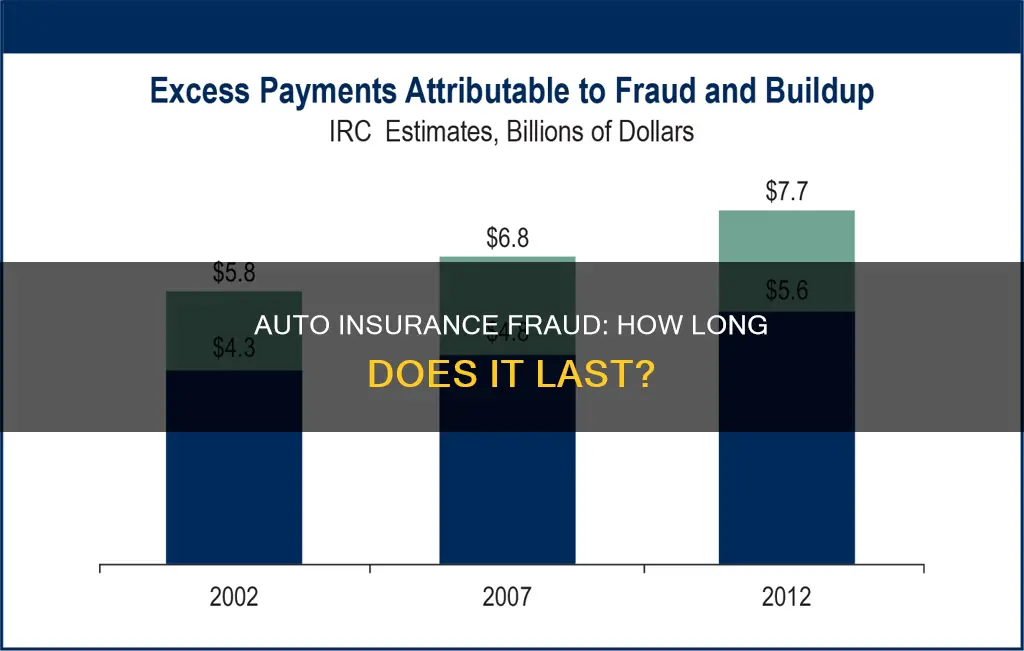

Auto insurance fraud is a serious issue that occurs when someone lies or misrepresents facts to receive a better insurance rate or an increased payout. This can take many forms, from soft fraud, such as exaggerating a claim, to hard fraud, like faking an accident. The consequences of auto insurance fraud are severe and can result in jail time, fines, and increased insurance premiums for consumers. With billions of dollars lost annually due to auto insurance fraud, it is essential for drivers to be aware of the different types of scams, such as staged accidents, billing scams, and dishonest agents, to protect themselves from becoming victims.

| Characteristics | Values |

|---|---|

| Types of auto insurance fraud | Crash and Buy, Paper Collision, Organized Ring, Faked Property Damages, Inflated Damages, Premium Fraud |

| Punishment for auto insurance fraud | Misdemeanor conviction: fine and probation; Felony conviction: prison time and significant fines |

| Auto insurance fraud costs | $308.6 billion per year |

| Auto insurance fraud detection | Anti-fraud technology, e.g. predictive analytics, link and social media analysis, AI |

What You'll Learn

Staged accidents

- Swoop and Squat: This usually involves three vehicles; two are driven by criminals, and the other is the victim. The "squat" vehicle pulls in front of the victim's car, and the "swoop" vehicle pulls ahead of the "squat" vehicle and cuts it off, causing the victim to rear-end the "squat" vehicle. The "swoop" vehicle then races off, leaving the victim responsible for the damage and injury claims.

- Panic Stop: The criminal drives an older vehicle filled with passengers and positions it in front of the victim's car. They wait for the victim to be distracted and then slam on the brakes, causing a rear-end collision.

- Drive Down: The criminal motions for the victim to merge into traffic or pull out of a parking space, and then intentionally smashes into their vehicle, later claiming to be injured.

- Sideswipe: This typically occurs at busy intersections with dual left turn lanes. The criminal positions their vehicle in the outer lane and sideswipes the victim's vehicle when they drift into the adjacent lane.

- Wave-In: The criminal waves the victim forward to change lanes in heavy traffic and then deliberately smashes into their car. When the police arrive, the criminal denies having waved the victim forward, making the victim look at fault.

- Hit and Run: A suspect driver uses a pre-damaged vehicle, drives it to a public location, and falsely reports being involved in a hit-and-run accident.

If you suspect you are a victim of a staged accident, it is important to document the extent of the damage, count the number of passengers, and be wary of individuals offering unsolicited advice and services. Contact the police and your insurance company, and consider calling the National Insurance Crime Bureau's toll-free hotline to report suspected fraud.

The Gendered Road: Navigating Auto Insurance's Intricacies

You may want to see also

Counterfeit airbags

Auto insurance fraud occurs when someone lies about an event to receive an insurance payout or a better rate. This can take the form of false claims, lies of omission on applications, or providing a false address. One example of auto insurance fraud is "crash and buy", where an individual purchases an insurance policy after a collision and lies about when the accident occurred to obtain coverage. Another example is "paper collision", where parties create the illusion of a legitimate accident using pre-damaged vehicles or by intentionally inflicting damage on a vehicle.

One specific type of auto insurance fraud involves the use of counterfeit airbags. Airbags are crucial safety features in vehicles, designed to protect occupants in the event of a crash. Counterfeit airbags, on the other hand, are fake airbags that are often sold to unsuspecting consumers or procured by unscrupulous vehicle repair shops looking to cut costs. These counterfeit airbags do not function properly and can cause severe injuries or even death. According to the National Highway Traffic Safety Administration (NHTSA), counterfeit airbags consistently malfunction, either by not deploying at all or by expelling metal shrapnel during deployment.

The issue of counterfeit airbags is a growing national concern. It is challenging for consumers to identify whether an airbag is counterfeit, as they often look identical to genuine manufacturer airbags. In some cases, even the vehicle repair shops may not be aware that they are installing counterfeit airbags. This makes it difficult for consumers to protect themselves from this type of fraud.

To address the issue of counterfeit airbags, consumers can take a few precautions. Firstly, when turning on the ignition, pay attention to the airbag dashboard light. If the light stays on, flashes, or doesn't come on at all, it could indicate a problem with the airbag system. Additionally, before purchasing a used vehicle, it is advisable to have it inspected by a certified mechanic, specifically checking the airbags. Moreover, if your vehicle is involved in a crash where the airbag deploys, consider having the airbag replaced at an authorized car dealership repair shop to ensure the authenticity and proper functioning of the replacement airbag.

While the exact duration of auto insurance fraud involving counterfeit airbags is unknown, it is important to recognize that this type of fraud can have severe consequences. Not only does it pose a significant risk to the safety of vehicle occupants, but it can also lead to financial losses and legal repercussions. To combat this issue, states are gradually adopting counterfeit airbag laws, and organizations such as the National Insurance Crime Bureau (NICB) are actively tracking and engaging in counterfeit airbag bills to protect consumers from this dangerous form of fraud.

Florida: Selling Auto Insurance with a 440 License

You may want to see also

Windshield replacement scams

In a typical windshield replacement scam, scammers will approach car owners and claim that their windshield needs to be repaired or replaced, even if there is no visible damage. They may offer incentives such as free car washes, movie tickets, or gift cards, or even claim that the repair will be completely free. However, their true intention is often to profit from your insurance policy by filing a fraudulent claim. They may inflate the damage, charge your insurer for multiple replacements, or even replace an undamaged windshield, resulting in unnecessary costs that are passed on to all policyholders in the form of higher premiums.

To protect yourself from these scams, it is important to be vigilant and ask questions. If someone approaches you about repairing or replacing your windshield, inquire about their company and experience. Ask for references and don't trust them blindly. Be cautious if they don't have business cards or clothing with company logos, as legitimate salespeople will usually have these.

Before agreeing to any repairs or replacements, get multiple written estimates from reputable auto glass shops. Consult organisations like the Auto Glass Safety Council (AGSC) and the National Windshield Repair Association (NWRA) to find quality companies. Always read the fine print before signing any documents, as you may unknowingly sign away insurance benefits to a dishonest company. Remember, if an offer seems too good to be true, it probably is.

By being informed and cautious, you can help protect yourself and others from falling victim to windshield replacement scams and the negative consequences that come with them.

Uncovering Auto Accident Insurance Claims: A Comprehensive Guide

You may want to see also

Tow truck fraud

Auto insurance fraud occurs when someone deliberately deceives an insurance company to obtain illegitimate gains. This can take the form of soft fraud or hard fraud. Soft fraud involves exaggerating a claim or providing misleading information on an application to obtain a lower premium. Hard fraud, on the other hand, is a more serious offence, such as faking an accident or abandoning a vehicle and claiming it as stolen. While both types of fraud can result in legal consequences, the punishment for hard fraud is typically more severe.

Now, let's focus on tow truck fraud:

- Predatory towing from private property: This occurs when a car is towed from the parking lot of a business that the driver is not visiting. While this practice is often legal, it becomes fraudulent when legitimately parked cars are towed.

- Excessive fees: Some tow truck companies charge additional fees that are not allowed or exceed the local market rates. These may include towing fees, mileage, storage fees, and release fees.

- Insisting on specific repair shops: In some cases, tow truck drivers insist on taking the vehicle to a particular repair shop, where they may charge excessive fees for storage and repairs.

- "Bandit" tow truck operators: These operators monitor private parking lots and tow away vehicles whose owners are not patrons of the associated businesses. They may disregard the fact that the car owner did patronize a business before going elsewhere.

- Con artists posing as tow truck operators: In this scam, con artists call a business, pretending to bring in a vehicle for repairs. They do the paperwork, hand over a set of random keys, and collect a towing fee, even though there is no actual car being towed.

- Profiling vehicles: Some towing companies target specific makes and models of cars that are likely to bring in higher impound fees and have a lower risk of damage during towing.

To avoid becoming a victim of tow truck fraud, it is essential to know your local laws and parking rules. If you believe you have been scammed, contact your local police department and file a report. Additionally, you can dispute charges with your bank or credit card company if you can prove fraudulent activity.

Autoimmune Disorders and Insurance Coverage: Unraveling the Blood Work Mystery

You may want to see also

Premium evasion

- Providing a false address: Insurance rates are often based on the location where the car is usually parked overnight. Policyholders may provide a false address from a lower-premium area to reduce their insurance costs.

- Failing to disclose additional drivers: Policyholders may intentionally omit a driver, such as a teenager, on the family policy to avoid increased rates.

- Underreporting mileage: Policyholders may underestimate the number of miles driven to qualify for lower premiums.

- Violations and accidents: Policyholders may not disclose violations or accidents to obtain more favourable insurance rates.

- False garaging: Policyholders may provide false information about the primary location of their vehicle to benefit from lower premiums in that area.

To combat premium evasion, insurance companies verify the information provided by policyholders and cross-reference it with various data sources. Additionally, advanced technologies, such as predictive modelling and link analysis, are employed to identify potential fraud before approving applications or paying out claims.

U.S.A.A. vs Geico: Competitive Auto Insurance Rates

You may want to see also

Frequently asked questions

Auto insurance fraud is when someone lies or misrepresents facts to get a better insurance rate or receive a larger claim payout.

Some examples of auto insurance fraud include providing a false address, abandoning or destroying a car and reporting it as stolen, and filing multiple claims for a single accident.

The consequences of auto insurance fraud can vary depending on the state and the severity of the fraud. It may result in fines, jail time, probation, and court-ordered restitution to the insurance company. In California, auto insurance fraud is a felony and can result in up to 5 years in prison and a fine of $50,000.

Auto insurance fraud is quite common, with billions of dollars lost annually due to fraudulent claims. According to a study, nearly seven out of ten consumers are unaware of insurance fraud schemes, making them susceptible to falling victim.

To protect yourself from auto insurance fraud, it is essential to be vigilant and aware. Keep your vehicle insurance information private, verify the legitimacy of your agent and insurance company, practice defensive driving, and be cautious of insurance prices that seem too good to be true.