Cash value life insurance is a type of permanent life insurance that includes a cash value feature. Cash value is the portion of your policy that accumulates over time and may be available for you to withdraw or borrow against for long-term savings needs. Permanent life insurance policies such as whole life and universal life can accumulate cash value over time. The cash value of life insurance earns interest, and taxes are deferred on the accumulated earnings. While premiums are paid and interest accrues, the cash value builds over time. As the life insurance cash value increases, the insurance company’s risk decreases, because the accumulated cash value offsets part of the insurer’s liability.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance |

| Cash value | Can be used for several purposes, including borrowing or withdrawing cash, or using it to pay policy premiums |

| Cost | More expensive than term life insurance |

| Expiry | Doesn't expire after a specific number of years |

| Interest | Earns interest |

| Tax | Withdrawals from the cash value of a policy are tax-free, but any cash value growth beyond what you paid in premiums is taxed as income |

| Beneficiaries | In most circumstances, beneficiaries will not receive any cash value after the policyholder dies |

What You'll Learn

Borrowing against life insurance

When you borrow against your life insurance policy, you are essentially borrowing from yourself, and there is no approval process or credit check. The loan is also not recognised as income by the IRS, so it remains tax-free as long as the policy stays active. However, it is important to pay back the loan with interest in a timely manner, as interest accrues and can cause the loan to exceed the policy's cash value, resulting in a lapse in coverage. If the loan is not paid back before the insured person's death, the loan amount and interest will be deducted from the death benefit.

The amount you can borrow against your life insurance policy is typically limited to 90% of its cash value. It is important to note that taking out a loan against your life insurance policy will reduce the death benefit and may tamper with the guarantee, as permanent insurance guarantees are based on certain assumptions, such as premium payments and cash accumulation. Additionally, you may end up paying more money as some policies will ensure the guarantee when you take out cash, but at a higher cost.

Life Insurance Options for Pancreatic Cancer Patients

You may want to see also

Cash value vs surrender value

Cash value and surrender value are two different things, and it's important to understand the difference between them when it comes to life insurance.

Cash value is a feature of permanent life insurance policies, such as whole life and universal life insurance. It is the sum of money that grows inside the policy over time and can be accessed by the policyholder in various ways, such as through loans or withdrawals. The cash value component can be used as a savings account, with the potential for investment gains, and it grows tax-deferred. However, only a portion of the premium payments goes into the cash value, and it may take time to build up a significant amount.

On the other hand, surrender value is the actual amount of money a policyholder will receive if they choose to terminate or surrender their policy before its maturity or the insured's death. The surrender value is the cash value minus any surrender fees or charges, which are penalties imposed by the insurance company for early withdrawal. These fees typically decrease over time and may no longer be in effect after a certain period, usually 10 to 15 years, at which point the cash value and surrender value become the same.

It's important to note that withdrawing cash value or surrendering a policy will reduce the death benefit and may have tax implications if the amount withdrawn exceeds the sum of premiums paid. Additionally, surrendering a policy means losing the life insurance protection, which is an important consideration when deciding between accessing the cash value or surrendering the policy.

Life Insurance and Mental Illness: What's Covered?

You may want to see also

Cashing out your life insurance prematurely

Understanding Cash Value

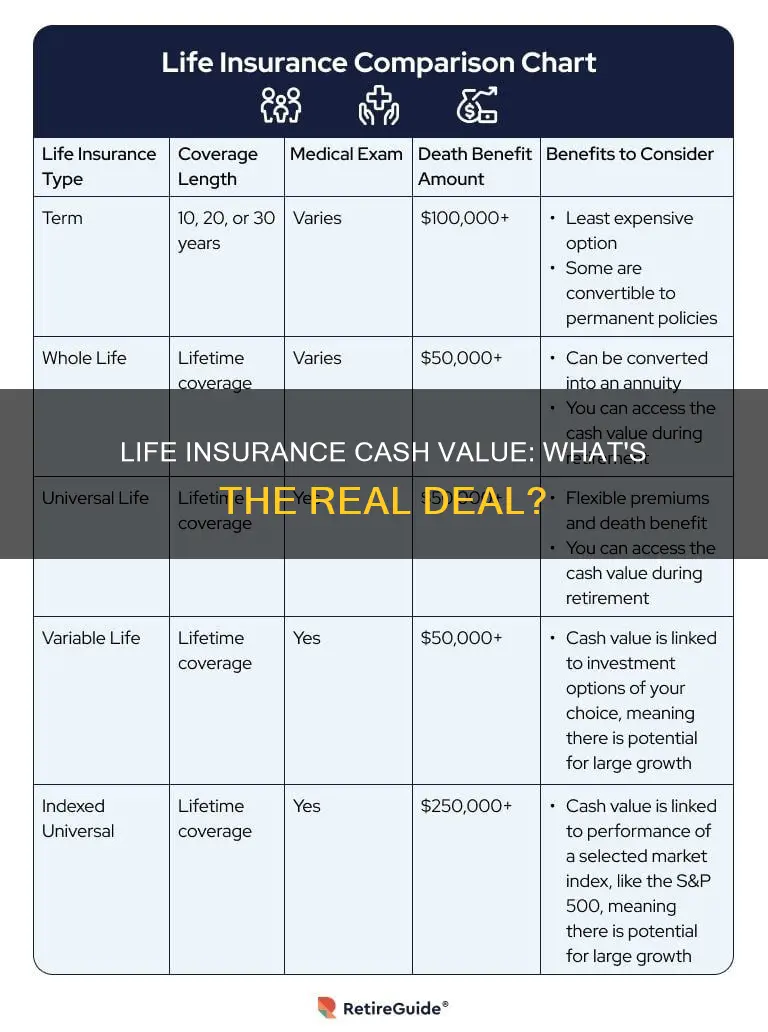

First, it's important to understand that not all life insurance policies have a cash value component. Term life insurance, for example, does not build cash value and therefore cannot be cashed out. On the other hand, permanent life insurance policies such as whole life and universal life insurance accumulate cash value over time. This cash value can be used for various purposes while the policyholder is still alive.

Options for Cashing Out

If you have a permanent life insurance policy with accumulated cash value, there are generally three options for cashing out:

- Full Surrender: You can cancel the policy and receive the surrender value cash payment. However, this option comes with several drawbacks. You will no longer have life insurance coverage, and the cash received will be reduced by any fees and charges. Surrender fees can be significant, especially for newer policies.

- Partial Withdrawal: You can choose to withdraw a portion of the cash value while keeping the policy active. This option allows your loved ones to still receive a death benefit, although it will likely be smaller than originally intended. Withdrawals may be subject to income taxes, depending on the amount withdrawn and the specifics of your policy.

- Borrowing: If you've had your policy for several years, you may be able to borrow money from the policy's cash value. This option usually doesn't incur taxes on the borrowed amount, but interest payments will be deducted from your cash value balance. If the loan is not repaid before your death, the outstanding balance and interest will be subtracted from the death benefit.

Considerations

Before cashing out your life insurance prematurely, carefully consider the potential consequences:

- Reduced Death Benefit: Withdrawing or borrowing from your cash value will likely result in a reduction in the death benefit for your beneficiaries.

- Tax Implications: Withdrawing more than the amount you've paid into the policy may result in taxes on the gains. Surrendering the policy may also trigger taxes on any gains.

- Loss of Coverage: Surrendering the policy means losing your life insurance coverage. If you still need insurance, you may need to purchase a new policy, which could be more expensive.

- Fees and Charges: Surrendering a policy, especially during the early years, often incurs significant fees and charges, reducing the cash value you receive.

- Impact on Premiums: Withdrawing or borrowing from your cash value may affect your premiums. If the cash value is used to pay premiums, ensure you understand the rules and potential implications.

In conclusion, while cashing out your life insurance prematurely is an option, it's important to carefully weigh the benefits against the potential drawbacks. Consider discussing your options with a financial professional to make an informed decision that aligns with your long-term goals.

Life Insurance and 401(k)s: A Smart Investment Strategy?

You may want to see also

Pros and cons of cash value life insurance

Cash value life insurance is a permanent life insurance policy that includes a savings component. It is designed to provide coverage for the policyholder's entire life, and the cash value can be used for various purposes, such as borrowing or withdrawing cash or paying policy premiums. While it offers several benefits, there are also some drawbacks to consider.

Pros of Cash Value Life Insurance:

- Lifelong coverage: Cash value life insurance is a permanent policy, which means it can provide coverage for the insured's entire life, as long as the premiums are paid.

- Death benefit: In the event of the insured person's death, a death benefit is paid to the beneficiaries, ensuring financial security for their loved ones.

- Dividends: Many whole life insurance policies are "participating," meaning there is a potential to receive life insurance dividends if the policy is from a mutual insurance company. These dividends can be taken as cash, used to increase the cash value, or pay premiums.

- Riders for extra coverage: Cash value life insurance often includes riders, such as an accelerated death benefit, which provides additional coverage for chronic or critical illness and long-term care.

- Tax advantages: The cash value accumulates tax-deferred, and any loans or withdrawals from the policy are typically tax-free. Additionally, the death benefit paid to beneficiaries is also tax-free.

- Retirement and savings: The cash value can be accessed during retirement to supplement income or for other significant expenses, such as a child's education or a down payment on a home.

Cons of Cash Value Life Insurance:

- Higher cost: Cash value life insurance policies tend to have higher premiums than term life insurance policies due to the lifelong coverage and the cash value component.

- Time to build cash value: It can take a significant amount of time, sometimes decades, for the cash value to accumulate to a substantial amount that can be accessed.

- Cash value not paid to beneficiaries: In most cases, the cash value is retained by the insurance company upon the insured's death, and the beneficiaries receive only the death benefit minus any loans or withdrawals made.

- Policy lapse: If the policyholder borrows too much against the cash value, it may lead to a lapse in the policy, resulting in a loss of coverage.

- Tax implications: Withdrawing cash value above the amount of premiums paid may result in tax liabilities. Additionally, if the policy is surrendered or cancelled, taxes may be owed on the interest or investment gains.

Life Insurance Payouts: Are They Taxable?

You may want to see also

Whole life insurance

The cash value of a whole life insurance policy can be accessed in several ways. Policyholders can request a withdrawal, take out a loan, surrender the policy, or apply the cash value to premiums. Withdrawing more than the amount paid into the cash value will result in taxable gains. Surrendering the policy will provide the policyholder with the accumulated cash value, minus any surrender charges, but will also cancel the death benefit. Applying the cash value to premiums can help in times of financial strain but may deplete the cash value too much, causing the policy to lapse.

Life Insurance Broker: HIPAA Compliance and You

You may want to see also

Frequently asked questions

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. The cash value is the portion of your policy that accumulates over time and may be available for you to withdraw or borrow against.

There are a few ways to access the cash value of your life insurance policy. You can take out a loan against the policy, surrender the policy, or make a withdrawal.

Cash value life insurance offers several benefits, including lifelong coverage, flexible access to funds, and reasonable premiums. It can also be used as a source of wealth, providing funds for retirement, covering premiums, or increasing a death benefit.