Life insurance and 401(k)s are two of the most popular ways to plan for your family's financial future. While both options offer distinct advantages, there are important differences between the two that you should be aware of when deciding how to secure your family's financial future.

What You'll Learn

Pros and cons of a 401(k)

Pros of a 401(k)

A 401(k) is a tax-advantaged retirement savings plan, and the dominant retirement plan scheme that most people in the US will use. There are several benefits to a 401(k):

- High contribution limits, which increase over time.

- Tax benefits, including investing with pre-tax dollars and tax-deferred growth on the account until distribution.

- Possible employer matching, which can boost your retirement savings.

- Loans in the event of an emergency or financial crisis.

- Automatic payroll deductions make it an easy way to save for the future.

- You can borrow money from yourself.

- Professionals manage your investment choices.

- You can choose from a menu of investment options.

Cons of a 401(k)

There are also some challenges and disadvantages to a 401(k):

- Limited investment choices.

- Lack of liquidity—your money is tied up and there are penalties for early withdrawal.

- You must take RMDs (required minimum distributions) at a certain age.

- Fees can be high, especially in smaller company plans.

- You need to monitor and manage your plan over time, with little advice or guidance from the plan provider.

Life Insurance Payouts: Are They Taxable?

You may want to see also

Pros and cons of life insurance

Pros of Life Insurance

Life insurance is a contract between you and the insurance provider. It is designed to provide for your family in the event of your death. The two most popular types are Term Life Insurance and Whole Life Insurance. Here are some of the pros of life insurance:

- Financial protection for your family: Life insurance provides financial protection for your family in the event of your death. It ensures that your loved ones will be able to file a claim and collect a death benefit, which can help cover various expenses such as funeral costs, debts, everyday bills, and college tuition.

- Peace of mind: Life insurance gives you peace of mind, knowing that your loved ones will have the financial support they need if something happens to you.

- Affordable premiums for younger and healthier individuals: If you are young and healthy, life insurance premiums can be relatively affordable and can fit within most budgets.

- No medical questions: Many life insurance companies allow you to apply online and may not require you to undergo a medical examination or answer underwriting questions.

- Flexibility and customization: Life insurance is not a one-size-fits-all product. You can choose from different types of policies and add-ons to meet your specific budget and goals.

- Tax advantages: In some cases, you may be able to pay for life insurance using pre-tax dollars, resulting in tax savings. Additionally, the death benefit paid to beneficiaries is typically income tax-free.

- Wealth-building: Some life insurance policies, such as whole life insurance, have a cash value component that grows over time, providing a wealth-building opportunity. This cash value can be withdrawn or borrowed against while you are still alive.

- Dividends: Policies from mutual life insurance companies may pay out dividends to policyholders, further enhancing the cash value of the policy.

- Permanent coverage: Whole life insurance provides permanent coverage, meaning your beneficiaries will receive a death benefit regardless of when you pass away.

Cons of Life Insurance

- Higher premiums for older individuals: Life insurance premiums increase with age, as the likelihood of passing away during the policy period is higher for older individuals.

- Potential for lower returns: While some life insurance policies offer a cash value component that grows tax-free, there is no guarantee of high returns.

- Cost of permanent life insurance: Permanent life insurance policies, such as whole life insurance, tend to be significantly more expensive than term life insurance.

- Complexity: Life insurance, especially when purchased through a qualified retirement plan, can be complex to administer and may require strict adherence to regulatory requirements.

- Limited to plan participants: If life insurance is purchased through a qualified retirement plan, the policy can only be held while the insured is a participant in the plan. Unwinding the insurance upon retirement or termination of the plan can be complex.

- Limited investment options: When investing in life insurance through a 401(k) or similar plan, you are limited to the investment options available within that plan.

Marine Health Insurance: Lifetime Coverage for Veterans?

You may want to see also

How to choose between a 401(k) and life insurance

When it comes to choosing between a 401(k) and life insurance, it's important to understand the differences between the two and how they can benefit you and your family.

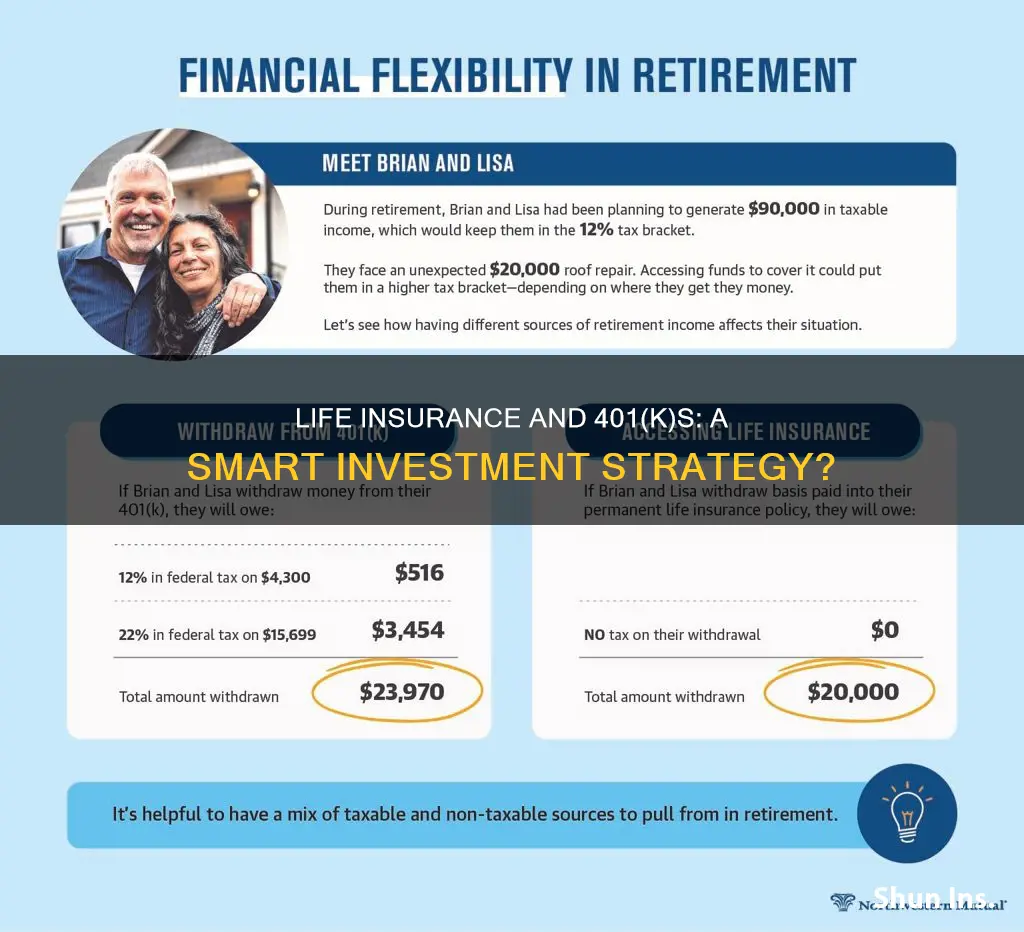

A 401(k) is a retirement savings and investment plan offered by employers, allowing eligible employees to make pre-tax contributions through payroll deductions. Some employers may also match these contributions up to a certain percentage. While it's designed for retirement, withdrawing from a 401(k) before the age of 59 1/2 typically incurs federal income tax and a penalty.

Life insurance, on the other hand, provides financial protection for your family in the event of your death. The two most common types are Term Life Insurance, which offers temporary coverage for a specific period, and Whole Life Insurance (or Permanent Insurance), which provides lifetime coverage as long as premiums are paid.

Benefits of a 401(k):

- Contributions reduce your taxable income for the year.

- Your employer may match your contributions up to a certain percentage.

- The average yearly return is higher than that of whole life insurance, typically ranging from 5% to 8%.

- It provides financial peace of mind for you and your family while you're alive.

Drawbacks of a 401(k):

- Early withdrawals before the age of 59 1/2 usually result in taxes and penalties.

- Investment options are limited to what's available in the plan.

- You may be restricted from making additional contributions or receiving matching contributions when switching jobs.

Benefits of Life Insurance:

- It ensures your family is financially provided for in the unfortunate event of your death.

- Term Life Insurance offers the highest coverage for the lowest premium compared to other forms of protection.

- Whole Life Insurance provides lifetime protection and builds cash value over time.

- Life insurance purchased through a qualified retirement plan can be paid for using pre-tax dollars, resulting in tax savings.

Drawbacks of Life Insurance:

- Whole Life Insurance is typically more expensive than Term Life Insurance.

- Term Life Insurance does not provide any cash value or living benefits if the policy is cancelled or expires before your death.

- Life insurance purchased through a qualified retirement plan can be complex and costly to set up, and it must follow strict regulatory requirements.

- The life insurance policy is usually only valid while you are a participant in the plan, and it can be complicated to unwind the insurance when you retire or if the plan is terminated.

In conclusion, both a 401(k) and life insurance offer distinct advantages and should ideally serve complementary roles in your financial strategy. A 401(k) provides tax advantages and retirement savings, while life insurance offers financial protection for your loved ones in the event of your death. It's important to carefully consider your personal circumstances, financial goals, and risk tolerance when deciding how to allocate your resources between these two important tools.

Notary and Life Insurance: Can One Person Do Both?

You may want to see also

Life insurance in a qualified retirement plan

Life insurance can be purchased as part of a qualified retirement plan, such as a 401(k) or a defined benefit plan, but specific rules and limitations apply. This strategy is often used by business owners who control their company retirement plan and need a large, expensive life insurance policy. It can also be a good option for high-income taxpayers in certain situations.

Advantages

There are several advantages to buying life insurance in a qualified retirement plan:

- You can use pre-tax dollars to pay premiums that would otherwise not be tax-deductible.

- You have the option to pay for the insurance using your existing retirement plan savings.

- If you die while working, your retirement benefit will be fully funded.

- Your policy beneficiaries will receive an income-tax-free death benefit.

- Your assets will be protected from creditors, as an Employee Retirement Income Security Act (ERISA) plan.

Disadvantages

There are also some disadvantages to consider:

- The life insurance policy can only be held in the plan while you are a participant.

- It can be complex and costly to unwind the insurance when you retire or if the plan is terminated.

- The organization sponsoring the plan needs to offer a qualified plan that allows for life insurance. These plans tend to be expensive to set up and require annual reporting and ongoing administration.

- Plans must abide by ERISA rules that require all eligible employees to be included and prohibit discrimination in favor of certain participants.

Rules and Limitations

When purchasing life insurance in a qualified retirement plan, several rules and limitations apply:

- The decision to offer life insurance in a qualified retirement plan is up to the sponsor, typically the employer.

- The premiums paid for life insurance coverage must be considered "reasonable and necessary" by the IRS and cannot be excessive compared to the benefits provided.

- The death benefits provided by life insurance coverage cannot exceed the lesser of the employee's actual death benefit or $5 million.

- The premiums paid for life insurance coverage are tax-deductible, but the death benefits received by the employee's beneficiary are typically subject to income tax.

- The Employee Retirement Income Security Act (ERISA) requires that the fiduciaries of a qualified retirement plan act in the best interests of the plan participants and beneficiaries, ensuring that the plan's life insurance coverage is appropriate and cost-effective.

Alternatives to Life Insurance in a Qualified Retirement Plan

It is important to note that life insurance should not be considered a replacement for traditional retirement plans, such as 401(k)s and IRAs, as the rate of return is typically lower. For most people, a 401(k) or IRA will be a better option for retirement savings due to their affordability and higher returns. Additionally, the cash value component of some life insurance policies can be used to supplement retirement income, but this is generally more expensive and may not provide the same level of coverage.

Life Insurance for Children: Is It Necessary?

You may want to see also

Life insurance as an investment

Life insurance can be a valuable investment, providing financial security for your loved ones after you pass away. There are several types of life insurance policies that can be used as investment tools, including whole life insurance, universal life insurance, variable universal life insurance, and indexed universal life insurance. These policies offer a cash value component that can be used to supplement retirement income, take out a policy loan, or withdraw funds.

One of the key advantages of investing in life insurance is the guaranteed interest. Most policies offer a minimum interest rate of 0%, which protects you from losses during an unexpected stock market downturn. Additionally, the cash value in a life insurance policy grows tax-deferred, meaning you don't have to pay taxes on the funds as they grow. This can result in significant tax savings over time.

However, there are also disadvantages to consider. Life insurance policies often come with high fees and premiums, which can make them costly to maintain. For example, the average fees for a 401(k) plan are approximately 0.57%, while the expenses and fees for a permanent life insurance policy can be 3% or higher. Additionally, the rates of return on life insurance policies tend to be lower than those of other investment options. For instance, recent research found that employee 401(k) plans grew by an average of 15.6% per year, compared to a fixed interest rate of 2-3% on a permanent life insurance policy.

When deciding whether to invest in life insurance, it is essential to weigh your personal circumstances and financial goals. Life insurance as an investment may be suitable for high-income earners with dependents who require lifelong financial support. However, for most people, maximizing contributions to a 401(k) plan or IRA is typically a more affordable and effective way to save for retirement. Consulting with a financial advisor can help you determine the best course of action for your specific situation.

In conclusion, life insurance can be a valuable investment, but it is important to carefully consider the advantages and disadvantages before making a decision. By understanding your financial goals and seeking professional advice, you can make an informed choice that aligns with your needs and circumstances.

Get a Life Insurance License: PA Requirements Guide

You may want to see also

Frequently asked questions

A 401(k) plan is a company-sponsored retirement savings plan that allows employees to save and invest a portion of their salary on a tax-deferred basis. Employees can contribute a percentage of their pre-tax salary into the plan up to an annual limit set by the IRS.

There are several benefits to a 401(k) plan. Firstly, contributions are made pre-tax, which can lower an employee's taxable income and reduce their tax bill. Secondly, many employers offer matching plan contributions up to a certain percentage of the employee's salary, helping them save more for retirement. Finally, the contributions are portable, meaning employees can take their vested account balance with them if they change jobs.

Life insurance is a policy that pays out a sum of money to beneficiaries in the event of the policyholder's death. There are two main types of life insurance: term life insurance, which provides coverage for a specific period, and whole life insurance (or permanent insurance), which provides coverage for the entire life of the insured as long as the premium is paid.

Investing in life insurance within a 401(k) plan can offer several advantages, including the ability to use pre-tax dollars to pay premiums, the option to pay for insurance using existing retirement plan savings, and providing an income-tax-free death benefit to beneficiaries. Additionally, it can help ensure that the retirement benefit is fully funded in the event of the policyholder's premature death.