When considering life insurance, understanding the average cost can be crucial for making informed decisions. For a 250-life insurance policy, the average premium can vary significantly depending on several factors, including age, health, lifestyle, and the specific coverage amount. Generally, the younger and healthier an individual is, the lower the premium. However, for a 250-life insurance policy, the average cost might range from $10 to $50 per month, but this can fluctuate based on individual circumstances. It's essential to shop around and compare quotes from different insurance providers to find the best coverage at a competitive price.

What You'll Learn

- Cost Factors: Age, health, coverage amount, term length, and insurer all impact 250 life insurance premiums

- Term Length: Longer terms (10-30 years) typically offer lower monthly payments than shorter terms (5 years)

- Age & Health: Younger, healthier individuals often qualify for lower rates than older, less healthy individuals

- Coverage Amount: Higher coverage amounts result in higher premiums due to increased financial risk for the insurer

- Insurer & Market: Premiums vary by insurer and market conditions, with some offering competitive rates

Cost Factors: Age, health, coverage amount, term length, and insurer all impact 250 life insurance premiums

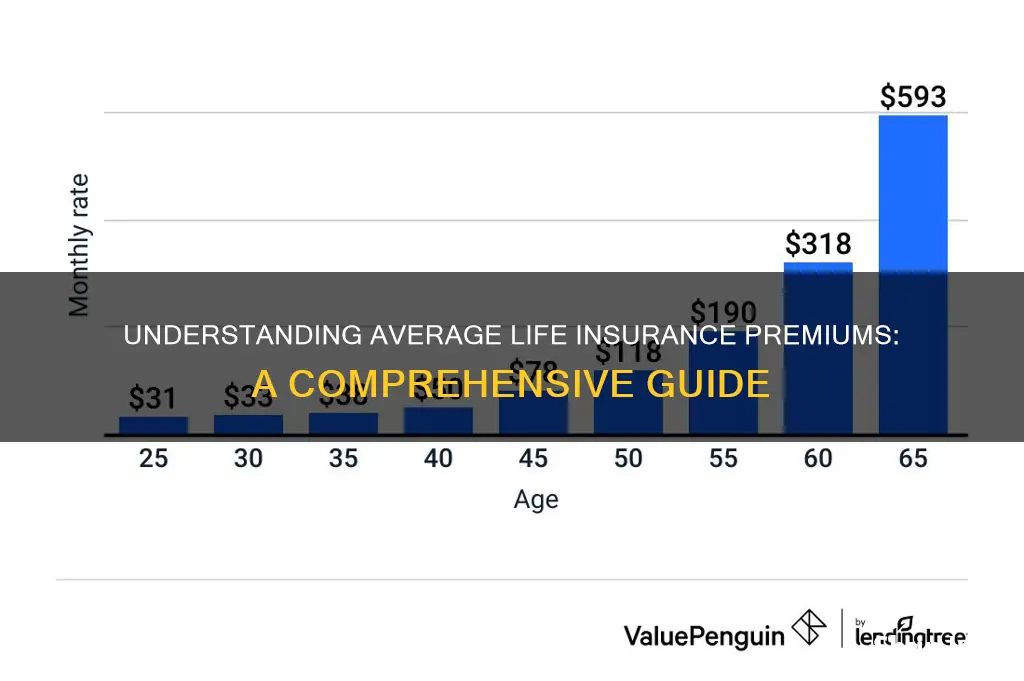

The average cost of a 250 life insurance policy can vary significantly depending on several key factors. Firstly, age plays a crucial role in determining premiums. Younger individuals typically pay lower rates as they are considered less risky by insurers. This is because younger people have a longer life expectancy, and the likelihood of making a claim is lower. Conversely, older applicants may face higher premiums due to the increased risk associated with age.

Health status is another critical factor. Insurers will assess your overall health, including any pre-existing medical conditions, to determine the risk of insuring you. A healthy lifestyle with no significant health issues can lead to more favorable rates. For instance, non-smokers or those with a history of chronic illnesses might be charged more due to the potential health risks associated with their condition.

The coverage amount you choose also impacts the premium. A higher coverage amount means a larger payout if you pass away during the policy term, which can result in higher premiums. Insurers need to compensate for this increased risk by charging more. Conversely, a lower coverage amount may be more affordable, but it won't provide as much financial security for your beneficiaries.

Term length is a significant consideration as well. 250 life insurance policies can be taken out for a specific period, typically 10, 15, 20, or 30 years. Longer-term policies often have lower annual premiums, but they can be more expensive overall due to the extended coverage period. Shorter-term policies, while potentially more affordable upfront, may not provide the same level of long-term financial security.

Lastly, the insurance company can influence the cost. Different insurers have their own pricing models and risk assessments, which can lead to variations in premiums. Some companies may offer more competitive rates for certain demographics or health profiles, while others might cater to a specific market niche. It's essential to compare quotes from multiple insurers to find the best value for your circumstances.

Life Without Insurance: Risking Your Family's Future Security

You may want to see also

Term Length: Longer terms (10-30 years) typically offer lower monthly payments than shorter terms (5 years)

When considering life insurance, the term length is a crucial factor that can significantly impact your financial planning. One common misconception is that longer-term policies are always more expensive. However, the reality is quite the opposite, especially when it comes to the average cost of a $250 life insurance policy.

Term life insurance is designed to provide coverage for a specific period, known as the 'term.' The term length can vary, and it's essential to understand the implications of choosing a longer or shorter duration. Longer-term policies, typically ranging from 10 to 30 years, often come with a unique advantage: lower monthly premiums. This is because the insurance company calculates the risk and cost of providing coverage over a more extended period. By spreading the risk across more years, the monthly payments become more manageable and, on average, less expensive compared to shorter-term policies.

For instance, if you opt for a 10-year term life insurance policy with an average premium of $250 per month, you'll likely find that the monthly cost is lower than a 5-year term policy with the same coverage amount. This is because the longer term allows the insurance company to assess and manage potential risks more effectively, resulting in more competitive pricing. As a result, you can secure a substantial death benefit for a more extended period without breaking the bank.

It's worth noting that while longer-term policies may offer lower monthly payments, they also provide more extended coverage, ensuring your loved ones are protected for an extended period. This is particularly beneficial if you want to ensure financial security for your family during significant life milestones, such as mortgage payments, children's education, or business ventures.

In summary, when evaluating life insurance options, remember that longer-term policies can be more affordable due to lower monthly premiums. This aspect of term life insurance is often overlooked, but it can significantly impact your financial planning and overall peace of mind. Understanding the relationship between term length and premium costs is essential to making an informed decision about your life insurance coverage.

Max Life Insurance: Safe Investment Option?

You may want to see also

Age & Health: Younger, healthier individuals often qualify for lower rates than older, less healthy individuals

The average life insurance policy amount of $250 can vary significantly based on several factors, with age and health being two of the most critical. Younger, healthier individuals often qualify for lower rates than older, less healthy individuals. This is because insurance companies consider age and health as key risk factors when determining the cost of a life insurance policy.

Younger individuals typically have a longer life expectancy, which means they are less likely to make a claim on their policy. As a result, insurance companies offer them lower rates as they pose a lower risk. Additionally, younger people are more likely to be in better physical health, with lower chances of developing chronic illnesses or conditions that could impact their life expectancy.

In contrast, older individuals may face higher insurance premiums due to the increased likelihood of health issues and potential medical expenses. As people age, they are more prone to developing health problems such as heart disease, diabetes, or cancer, which can significantly impact their life expectancy and, consequently, the cost of their insurance policy.

Furthermore, health status plays a crucial role in determining insurance rates. Individuals with a history of chronic illnesses or those who smoke, drink heavily, or have a sedentary lifestyle may be considered higher-risk by insurance companies. These factors can lead to higher premiums or even denial of coverage. On the other hand, those who maintain a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits, are likely to qualify for lower rates as they present a reduced risk to the insurance provider.

It is essential to understand that age and health are not the only factors considered when determining life insurance rates. Other variables, such as occupation, lifestyle choices, and the amount of coverage required, also play a role. However, for younger, healthier individuals, these factors often contribute to more affordable life insurance policies, providing financial security and peace of mind.

HIV Testing for New York Life Insurance

You may want to see also

Coverage Amount: Higher coverage amounts result in higher premiums due to increased financial risk for the insurer

The relationship between coverage amount and insurance premiums is a fundamental aspect of life insurance. When considering a 250-life insurance policy, it's essential to understand that the higher the coverage amount, the more the insurer stands to lose in the event of a claim. This increased financial risk is a primary factor in determining the premium rates.

In the context of life insurance, the coverage amount represents the financial benefit paid out to the policyholder's beneficiaries upon their passing. A higher coverage amount indicates a larger financial commitment from the insurer, as they are taking on a more significant risk. For instance, if a policy has a coverage amount of $250,000, the insurer is promising to provide a substantial financial cushion to the policyholder's family in the event of their death. This substantial payout can be crucial for covering various expenses, such as mortgage payments, education costs, or other financial obligations.

As the coverage amount increases, the insurer's potential loss in the event of a claim also rises. This heightened risk is a direct result of the larger financial commitment made by the insurer. To mitigate this risk and ensure the sustainability of their business, insurers adjust the premiums accordingly. Higher coverage amounts require insurers to charge more to maintain their profitability and ensure they can meet their financial obligations.

The calculation of premiums is a complex process that takes into account various factors, including age, health, lifestyle, and, of course, the desired coverage amount. For a 250-life insurance policy, the insurer will consider the increased risk associated with a higher coverage amount and factor this into the premium calculation. This means that individuals seeking higher coverage amounts may find themselves with higher monthly or annual premiums.

It's important to note that while higher coverage amounts can provide more comprehensive financial protection, they also come with a higher cost. Policyholders should carefully consider their financial needs and risk tolerance when deciding on the appropriate coverage amount. Striking a balance between adequate coverage and affordable premiums is essential to ensure that life insurance remains a valuable financial tool without becoming a financial burden.

Life Insurance Payouts: Who Gets Them and How?

You may want to see also

Insurer & Market: Premiums vary by insurer and market conditions, with some offering competitive rates

The cost of 250-life insurance can vary significantly depending on several factors, including the insurance provider, your personal circumstances, and the current market conditions. This variability is primarily due to the competitive nature of the insurance industry, where different insurers set their own rates based on their risk assessment and business strategies.

When considering 250-life insurance, it's essential to understand that the average premium can range from a few dollars per month to several hundred dollars, depending on the aforementioned factors. For instance, some insurers might offer more competitive rates for younger individuals with healthier lifestyles, while others may cater to specific demographics or provide lower premiums for certain policy types. Market conditions also play a crucial role, as economic factors and industry trends can influence the overall cost of insurance.

The insurance market is dynamic, with rates often fluctuating based on supply and demand, interest rates, and even government regulations. During periods of economic growth, for example, insurers might offer more attractive rates to attract customers. Conversely, in a volatile market, premiums may increase to account for potential risks. As such, it is advisable to shop around and compare quotes from multiple insurers to find the best deal that suits your needs and budget.

Additionally, the type of 250-life insurance policy you choose can impact the premium. Term life insurance, which provides coverage for a specified period, typically costs less than permanent life insurance, which offers lifelong coverage. The duration of the policy also matters; longer coverage periods usually result in higher premiums.

In summary, the average cost of 250-life insurance is not a fixed number but rather a range that varies based on numerous factors. Prospective policyholders should research and compare options from different insurers, considering their individual circumstances and the current market landscape to make an informed decision. This approach ensures that you find a competitive rate that provides adequate coverage without unnecessary financial burden.

Uncovering Your Brother's Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The average cost of a 250-life insurance policy can vary significantly depending on several factors, including age, health, lifestyle, and the specific insurance company. Generally, term life insurance policies with a coverage amount of $250,000 are more affordable for younger individuals in good health. For a 30-year-old non-smoker, the average annual premium could be around $150 to $250. However, for older individuals or those with health conditions, the cost can be higher, sometimes reaching $500 or more per year.

Insurance companies use various factors to determine the premium for a 250-life insurance policy. These factors include age, gender, health status, lifestyle choices (such as smoking or excessive alcohol consumption), family medical history, occupation, and the desired coverage amount. Younger and healthier individuals typically pay lower premiums as they pose less risk to the insurance company.

Yes, many insurance companies offer no-exam or simplified issue life insurance policies with coverage amounts up to $250,000. These policies are designed for individuals who may have health issues or are considered high-risk. The application process is usually less extensive, and the underwriting may be based on a simplified medical questionnaire. However, the premiums for these policies can be higher compared to standard term life insurance.

Term life insurance is a temporary policy that provides coverage for a specified period, typically 10, 20, or 30 years. It offers a fixed death benefit if the insured person passes away during the term. Whole life insurance, on the other hand, is a permanent policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit and also includes an investment component, allowing the policy to accumulate cash value over time. The key difference is that term life is more affordable for a specific period, while whole life provides lifelong coverage but at a higher cost.

Yes, several discounts can make 250-life insurance more affordable. Common discounts include healthy lifestyle discounts for non-smokers or individuals with a healthy weight, occupation discounts for certain professions with lower risk profiles, and group discounts for employees offered through employer-sponsored plans. Additionally, some insurance companies offer discounts for bundling life insurance with other policies, such as auto or home insurance.