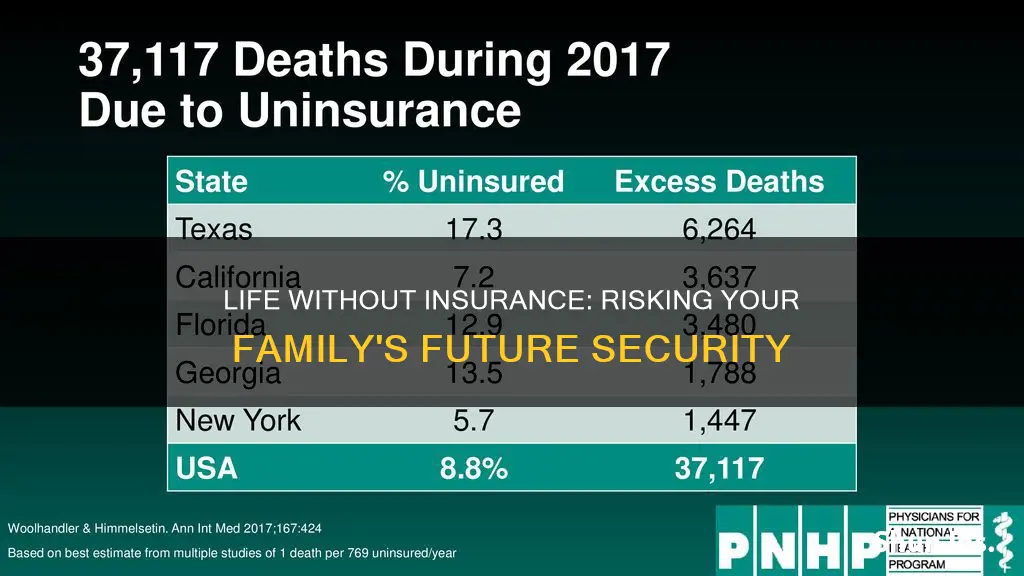

Life insurance is an important part of financial planning, but what happens if you don't have it? Not having life insurance can have serious consequences, especially if you have financial dependents such as children or a partner who relies on your income. In the event of your death, your loved ones may be left with significant financial burdens, such as mortgage payments, car loans, or other debts. Additionally, not having life insurance can impact your ability to plan your estate, provide for a child with special needs, or leave a financial legacy for your heirs.

Another consequence of not having life insurance is the potential impact on your retirement savings. Without life insurance, you may need to rely more heavily on your retirement savings to cover end-of-life expenses, which could leave your spouse or dependents with reduced financial resources. Furthermore, if you own a business, not having life insurance can affect business succession planning and the ability to repay business loans in the event of your death.

While the consequences of not having life insurance can be significant, it's important to note that there are alternatives, such as final expense insurance or burial insurance, which can help cover end-of-life costs. Additionally, there are ways to extend or convert term life insurance policies to ensure continuous coverage. However, it is always advisable to consult with a financial advisor or licensed insurance professional to make informed decisions based on your specific circumstances.

| Characteristics | Values |

|---|---|

| Coverage | No longer covered |

| Premiums | Lost |

| Conversion | Possible to convert to permanent life insurance |

| New policy | Possible to buy a new term life insurance policy |

What You'll Learn

You can convert to a permanent policy

If you have a term life insurance policy and are considering converting to a permanent policy, there are several factors to consider. Firstly, check if your current policy includes a conversion option, as not all term life insurance policies are convertible. If it does include this option, review the conversion period specified in your policy documents, as there may be a deadline by which the conversion must take place.

Converting a term life policy to a permanent policy is generally a straightforward process and does not require undergoing a medical examination or the underwriting process again. You simply need to contact your insurance company and fill out the necessary paperwork. There are usually no fees for converting, but your premium payments will increase. The amount of the increase will depend on factors such as your age, the amount of coverage you choose, and the type of permanent policy you select.

When deciding whether to convert to a permanent policy, consider your financial goals and budget. Permanent life insurance offers lifelong coverage and can be useful if you want to leave an inheritance for your children or cover final expenses. It also has a cash value component, allowing you to access the cash during retirement or for other reasons, tax-free. However, permanent policies are more expensive than term policies, so you need to ensure you can afford the higher premiums, especially in retirement.

Additionally, consider your health status. If your health has declined, converting to a permanent policy can be advantageous as it allows you to extend your coverage without undergoing the underwriting process again, which could result in higher rates or even make you uninsurable. On the other hand, if your health has improved, it may be more cost-effective to purchase a new term policy rather than converting to a permanent one.

Comcast's Life Insurance Offering: What You Need to Know

You may want to see also

You can buy a new term policy

Life insurance is an important part of your financial plan, and it's worth thinking through your options before making a decision. If you don't currently have life insurance, you can buy a new term policy. Term life insurance is temporary and provides coverage for a specific period, such as 10, 15, 20, or 30 years. It is often more affordable than permanent life insurance, making it a popular option for many people.

When purchasing a term life insurance policy, you can choose the length of coverage that best suits your needs. You will then pay premiums for that specified term, and if you pass away during that time, your beneficiaries will receive a death benefit. However, if you outlive your term policy, it will typically end, and you will no longer owe payments or be covered.

One advantage of term life insurance is that it often includes the option to convert it to permanent life insurance. Permanent life insurance provides lifetime coverage and can build cash value over time. This means that even if your term policy expires before your death, you may have the opportunity to extend your coverage by converting it to a permanent policy. This option may be available during a specified time frame or within a certain number of years after your term policy expires.

When considering a new term policy, it's important to compare different insurance companies and their offerings. Factors to consider include the length of coverage, premium costs, conversion options, and any additional riders or add-ons. Additionally, it's essential to review the financial strength and customer satisfaction ratings of the insurance company to ensure they have a strong track record.

By purchasing a new term life insurance policy, you can gain peace of mind knowing that your loved ones will be financially protected in the event of your untimely death. It is a responsible step towards securing your family's future and ensuring they can maintain their standard of living even in your absence.

Life Insurance After Military Service: What's Covered?

You may want to see also

You won't get a death benefit payout

Life insurance is a way to provide financial support to your loved ones after your death. A death benefit is a payout to the beneficiary of a life insurance policy when the insured person dies. This money can be used for everyday expenses, such as groceries and utilities, or for larger debts like a mortgage.

If you don't have life insurance, your beneficiaries won't receive a death benefit payout. This means that your loved ones won't have the financial support that could help them pay for any outstanding debts or expenses. They may struggle to cover the cost of your funeral or memorial service, and could be left with a significant financial burden.

Without life insurance, there is no guarantee that your beneficiaries will receive any money after your death. This could leave them in a difficult financial situation, especially if they were relying on this money to cover essential expenses.

Term life insurance policies are only valid for a set period, such as 10, 20, or 30 years. If you don't have a term life insurance policy and pass away within that time frame, your beneficiaries won't be able to claim any death benefits.

Permanent life insurance policies, on the other hand, are designed to stay in force for your entire life. However, if you don't have this type of policy and pass away, your beneficiaries will again miss out on receiving any death benefits.

In conclusion, not having life insurance means that your beneficiaries won't receive a death benefit payout, which could result in financial difficulties for them. It's important to consider the potential impact on your loved ones when deciding whether or not to purchase life insurance.

Life Insurance: Creating an Immediate Estate

You may want to see also

Your coverage will end

Life insurance is a contract between an insurance company and a policyholder. In exchange for a premium, the life insurance company agrees to pay a sum of money to one or more named beneficiaries upon the death of the policyholder. The purpose of life insurance is to help provide financial security to your loved ones upon your death.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers the policyholder for a fixed term, such as 10, 20, or 30 years. If the policyholder dies during this period, their beneficiaries will receive a death benefit. However, if the policyholder outlives the term, the policy will simply end, and coverage will no longer be provided.

Term life insurance policies typically do not build up any cash value, and the policyholder will not get any refund of their premiums if they outlive the policy term. However, some term life insurance policies offer a return-of-premium rider, which allows policyholders to get a refund of their premiums if they outlive the policy term. While this provides peace of mind, it comes at a significant cost, with premiums for these policies being much higher.

In contrast, permanent life insurance policies do not expire and will cover the policyholder for their entire life, as long as they continue to pay the premiums. Permanent life insurance policies also have a cash value component, which functions like a savings account, allowing the policyholder to build up cash value over time. This cash value can be used for various purposes, such as taking out loans or paying policy premiums.

If you have a term life insurance policy and your coverage period is coming to an end, you have a few options. You can choose to let the policy lapse and forgo any further coverage. Alternatively, you may have the option to convert your term life insurance policy into a permanent life insurance policy, ensuring continued coverage. It is important to review your policy or consult your insurance company to understand your options for extending coverage beyond the initial term.

Haven Life Insurance: Your Ultimate Financial Safety Net

You may want to see also

You may be able to get premiums back

If you're concerned about losing the money you've paid into a life insurance policy, you can add a return-of-premium rider to your insurance coverage. This means that if you outlive your term life insurance policy, you will get a refund of the premiums you paid.

However, adding a return-of-premium rider to your policy will cost extra. In fact, it can be around 30% more expensive than a standard term life insurance policy. You are essentially providing an interest-free loan to the insurer.

Return-of-premium life insurance is usually a type of term life insurance. You lock in a rate for the level term period, such as 10, 20 or 30 years. If you outlive the policy, the insurer will refund the premiums you paid.

If you don't pay your premiums or cancel the policy, you may not get a premium refund. The exact rules vary by insurer.

Some companies that offer return-of-premium life insurance include:

- State Farm

- Cincinnati Life

- Illinois Mutual

- AAA Life Insurance

- Lincoln Financial

- Mutual of Omaha

- Pacific Life

- Protective

Choosing the Right Term Life Insurance Duration

You may want to see also

Frequently asked questions

If your term life insurance expires and you're still alive, the policy ends. However, you may have the option to convert it to permanent life insurance or buy a new term insurance policy.

Term life insurance provides coverage for a specific period, typically 10 to 30 years, whereas permanent life insurance offers lifelong protection. Term life insurance is also more affordable than permanent life insurance.

Yes, it is possible to get your premiums back by adding a return-of-premium rider to your insurance coverage. However, this option can be costly, with costs for return-of-premium plans being around 30% higher than standard term life insurance policies.

Driving without insurance is against the law in almost every U.S. state. The consequences can vary, but penalties can include fines, suspension of your license, having your car impounded, and even jail time for repeat offenders.

If you get into an accident without insurance, you will be liable for paying for the damages, including repairs to the other person's vehicle and their medical expenses. You may also face legal consequences, such as license suspension and having your wages garnished if you are unable to pay the damages in full.