Foresters Life Insurance has been awarded an A rating from A.M. Best, indicating an excellent ability to pay claims to beneficiaries. This international fraternal organisation, founded in 1874, aims to make life insurance accessible and affordable for its members. Foresters offers a range of term, whole, and universal life insurance policies, with additional benefits such as financial guidance and legal support. While Foresters has a solid financial outlook, it has received more complaints than expected for a company of its size, according to the National Association of Insurance Commissioners (NAIC).

| Characteristics | Values |

|---|---|

| AM Best Rating | A |

| NAIC Complaint Index | 1.70-1.71 |

| J.D. Power Customer Satisfaction Study | Not included |

| Better Business Bureau Rating | A+ |

What You'll Learn

Foresters' AM Best rating of A indicates excellent ability to pay claims

Foresters Financial, a Canada-based life insurance provider, has been awarded an "A" rating from A.M. Best, indicating excellent financial strength and an exceptional ability to pay insurance obligations. This rating is a strong indicator of Foresters' ability to meet financial commitments and pay out claims to beneficiaries.

The A rating signifies that Foresters possesses a strong balance sheet, solid operating performance, and well-managed total debt. This rating is a testament to Foresters' financial stability and ability to honour claims.

Foresters, founded in 1874, has a long history of serving its customers with a range of life insurance products. The company offers term, whole, and universal life insurance plans, differentiating itself as a nonprofit fraternal benefit society. Foresters' unique structure allows it to reinvest profits into enriching the lives of its members and their communities.

In addition to its financial strength, Foresters also stands out for its generous riders and dividend-paying whole life policies. The company offers more than ten life insurance riders, many of which are included at no additional charge, providing customers with enhanced coverage and benefits.

While Foresters has received more complaints than expected for a company of its size, according to the National Association of Insurance Commissioners (NAIC), its overall customer sentiment seems positive, with an "A+" rating from the Better Business Bureau.

Foresters' A rating from A.M. Best is a strong indicator of its financial stability and ability to meet its insurance obligations, including paying out claims. This rating provides confidence to customers that Foresters is a reputable and reliable life insurance provider.

Life Insurance Accumulation Value: Understanding Your Policy's Worth

You may want to see also

Foresters' life insurance products include term, whole and universal plans

Foresters Financial offers a range of life insurance products, including term, whole, and universal plans. Each type of insurance plan has different features and benefits to cater to the diverse needs of individuals and families.

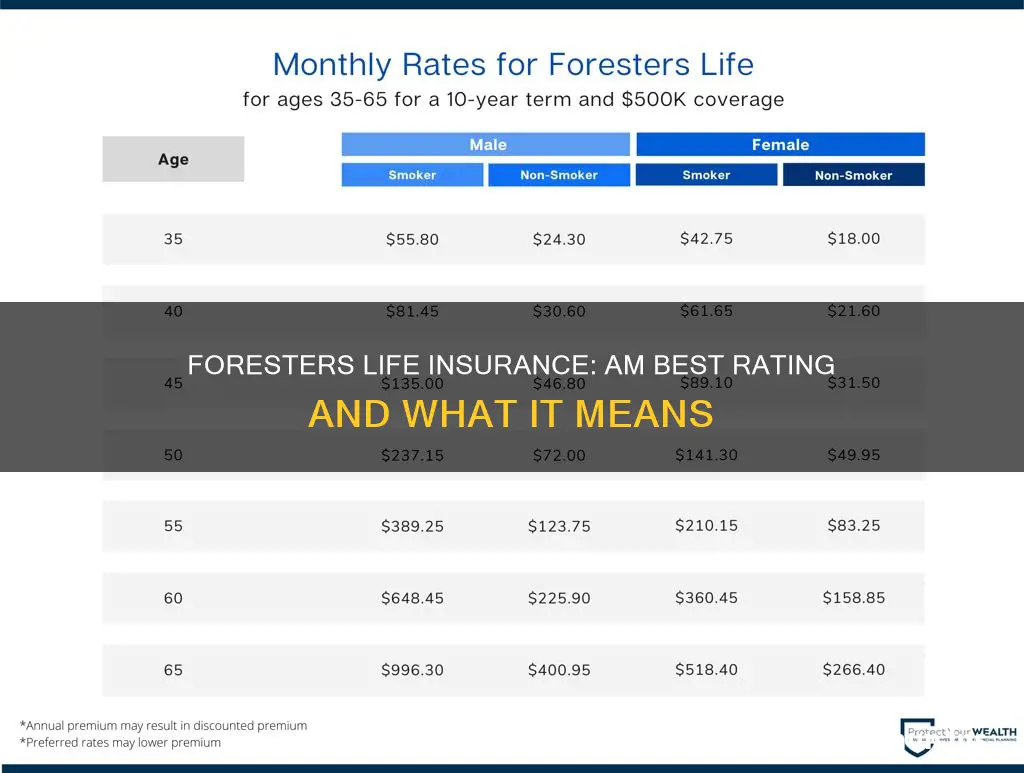

Term life insurance is ideal for those seeking coverage for a specific time period, such as 10, 15, or 20 years. It offers a fixed premium and a set amount of coverage, making it a good choice for planning for college education or covering long-term debts. Foresters' term life product, "Your Term", allows individuals to lock in premiums and choose from various term lengths.

Whole life insurance, on the other hand, provides lifetime protection. Foresters offers three whole life insurance policies: PlanRight Whole Life, Advantage Plus II Whole Life, and BrightFuture Children's Whole Life. PlanRight Whole Life is designed for individuals aged 50 to 85 and offers lifetime death benefit protection up to age 121, guaranteed cash value, and guaranteed premiums. Advantage Plus II Whole Life allows individuals to pay premiums up to age 100 or for just 20 years, and the policy can be used as collateral for a loan. BrightFuture Children's Whole Life is designed for children under the age of 18 and guarantees future insurability regardless of health changes.

Universal life insurance offers lifelong coverage, flexible premiums, and the potential for additional cash growth through interest and dividends. Foresters' SMART Universal Life policy includes a 10-year no-lapse guarantee if minimum monthly payments are made.

Foresters' life insurance products provide a range of options to meet the diverse needs of its customers. The company's plans offer flexibility, affordability, and additional benefits such as riders and member perks. However, it is important to note that Foresters has received more complaints than expected for a company of its size, which may indicate issues with aspects of its customer experience.

Simple Life Insurance: Haven's Peace of Mind

You may want to see also

Foresters offers nine riders for its policies

The Common Carrier Accidental Death Rider offers an additional death benefit if you die from an accident as a passenger on a plane, bus, or train. This rider is included on most policies and can provide added peace of mind for those who frequently travel by these means of transport.

The Family Health Benefit Rider pays a benefit for family health expenses incurred from natural disasters such as hurricanes, tornadoes, or earthquakes. This rider can be especially valuable for those who live in areas prone to such natural disasters and want to ensure their family's health costs are covered in the event of an emergency.

The Accelerated Death Benefit Rider pays a portion of the death benefit if the insured person is diagnosed with a chronic, terminal, or critical illness. This rider can provide financial support during a difficult time and help with medical or other related expenses.

The Waiver of Monthly Deductions Rider waives monthly deductions if you become totally disabled and can’t work. This rider can provide financial relief during a period of disability and help ease the financial burden of monthly expenses.

The Waiver of Premium Rider allows policyholders to stop paying premiums and keep their coverage if they become disabled and can’t work. Similar to the previous rider, this option provides financial flexibility during a challenging time.

The Accidental Death Rider provides an additional death benefit if the insured person dies in a covered accident. This rider can be beneficial for those who engage in risky activities or occupations and want added protection in the event of an accident.

The Guaranteed Purchase Option Rider offers the option to increase your coverage by up to $50,000 on each option date without further underwriting. This rider provides flexibility to increase coverage over time without the need for additional medical exams or paperwork.

The Children's Term Rider offers term insurance to cover a policyholder's children. This rider can provide peace of mind for parents or guardians who want to ensure their children have financial protection in the event of their untimely death.

The Single and Flexible Paid-up Additions Riders allow the option to purchase additional, paid-up whole life insurance without further underwriting. These riders offer the flexibility to increase coverage and build cash value over time without the need for additional medical exams or complex paperwork.

Understanding Life Insurance: Face Value Fundamentals

You may want to see also

Foresters has an above-average volume of complaints

Foresters Life Insurance has received more complaints than expected for a company of its size and scale of operations. According to the National Association of Insurance Commissioners (NAIC), Foresters has an above-average volume of complaints, with an average complaint score of 1.71. This is indicative of potential issues in the company's customer experience, such as delayed claims, unsatisfactory claim payouts, and unexpected policy cancellations.

The high volume of complaints suggests that Foresters may be falling short in meeting the expectations of its policyholders. Delayed claims and unsatisfactory payouts can be a significant source of frustration for customers, especially during difficult periods. Unexpected policy cancellations can also leave customers feeling vulnerable and unprotected. These issues highlight potential challenges in the company's claims handling processes and customer service.

The above-average complaint index raises concerns about the overall customer experience offered by Foresters Life Insurance. It is important for insurance providers to strike a balance between competitive rates, comprehensive coverage, and responsive customer service. While Foresters offers competitive rates and a solid range of term and permanent life insurance policies, the high number of complaints may deter prospective customers.

Prospective customers considering Foresters Life Insurance should carefully review the company's policies, terms, and conditions. While Foresters offers attractive rates and coverage options, customers should also evaluate the responsiveness and efficiency of the company's claims handling processes. It is crucial for insurance providers to strike a balance between competitive pricing and reliable customer service to ensure a positive overall experience for their policyholders.

In conclusion, the above-average volume of complaints against Foresters Life Insurance highlights potential shortcomings in their customer experience. Prospective customers should carefully weigh the benefits of the company's competitive rates and coverage options against the possibility of encountering challenges with claims handling and customer service. Conducting thorough research and consulting independent reviews can help individuals make informed decisions about their life insurance choices.

Employee Life Insurance: Voluntary Benefits Worth the Cost?

You may want to see also

Foresters offers unique member perks for customers

Foresters Life Insurance offers unique member perks for customers. The company has a long history dating back to 1834 when it was founded as the Ancient Order of Foresters. Today, Foresters Life Insurance customers join The Independent Order of Foresters, a fraternal benefit society that provides various perks, including financial counselling, retail discounts, academic scholarships, legal services, and grants.

One of the standout member perks offered by Foresters is its focus on community and charitable initiatives. Foresters has a strong commitment to helping protect hard-working families and has donated millions of dollars to communities in need, funding initiatives such as building playgrounds. In addition, Foresters offers scholarships and grants to its members, further demonstrating its dedication to supporting and giving back to its community.

Foresters also provides simplified issue policies, which do not require a medical exam, making it more accessible to individuals who may have pre-existing health conditions or prefer not to undergo a medical exam. This feature, along with its competitive rates, especially for term life policies, makes Foresters an attractive option for those seeking life insurance coverage.

Furthermore, Foresters offers a range of life insurance products, including term, whole, and universal life plans, providing flexibility to meet the diverse needs of its customers. The company also stands out for its wide range of riders, including the Common Carrier Accidental Death Rider, Family Health Benefit Rider, and Accelerated Death Benefit Rider, allowing customers to customise their coverage according to their specific requirements.

Overall, Foresters Life Insurance's unique member perks, community focus, competitive rates, and comprehensive range of products and riders make it a compelling choice for individuals seeking life insurance coverage.

New York Life Insurance: Offering Humana Insurance Plans?

You may want to see also

Frequently asked questions

AM Best has awarded Foresters Life Insurance an "A" rating, indicating an excellent ability to pay claims.

Foresters Life Insurance is a life insurance provider that offers term, whole, and universal life insurance plans. It is a nonprofit fraternal benefit society rather than a for-profit company, and it has been in business for over 145 years.

The pros of Foresters Life Insurance include competitive rates, no-exam coverage options, and an array of membership benefits. However, a con is that customers must work with an advisor to get quotes and purchase coverage.

Foresters offers term life, whole life, and universal life insurance policies. Their term life insurance policies are renewable and convertible to permanent life insurance, while their whole life insurance policies offer lifetime coverage and cash value accumulation. Their universal life insurance policies provide flexible premiums and coverage amounts.