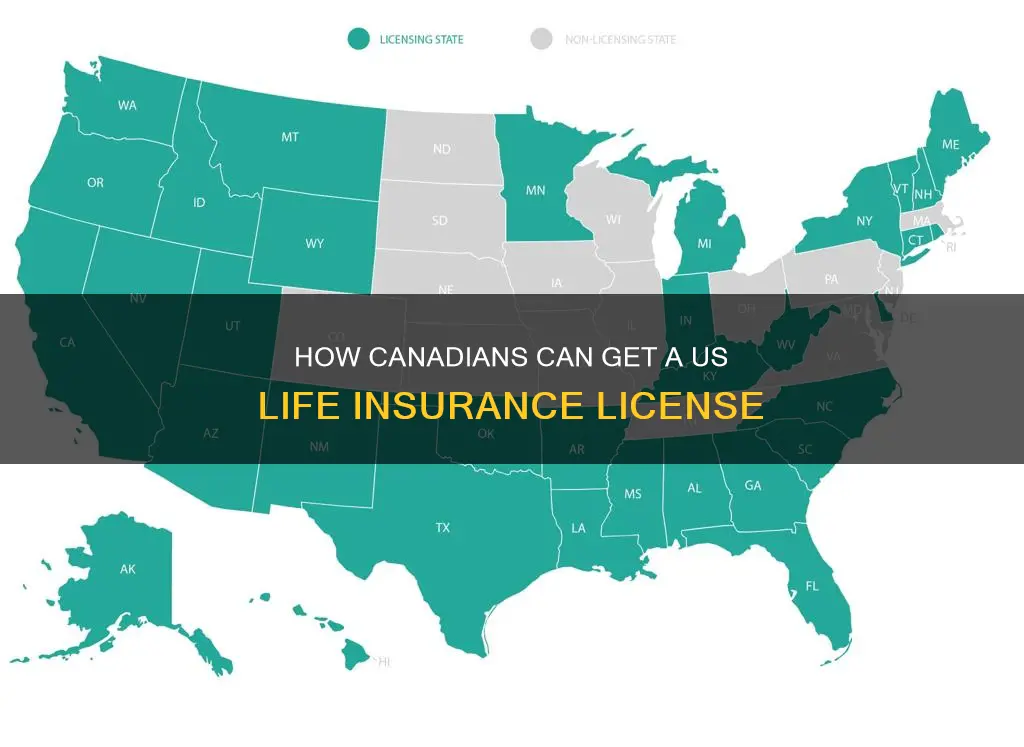

Canadian citizens can get life insurance in the United States, but the process is more complex and requires specific qualifications. It is essential to determine whether you are a permanent resident, a visa holder, or a non-resident, as this impacts the requirements and eligibility for US life insurance. Permanent residents with green cards are generally treated similarly to US citizens and have access to a range of life insurance products. Visa holders may be eligible, depending on the type of visa and the insurance company's criteria. Non-residents must meet certain criteria, such as having substantial ties to the US and staying in the country during the application and approval process. Additionally, specific regulations and tax considerations come into play when a Canadian citizen includes a US person in their insurance planning.

| Characteristics | Values |

|---|---|

| Citizenship status | Canadian citizens can get life insurance in the US with the right qualifications |

| Residency status | Must have a full-time, permanent US residence and not live outside of the US for more than 3 months a year |

| Documentation | Green card, visa, Social Security number or Tax ID |

| Application process | Submit medical records, complete diagnostic tests, fill out application forms in the US |

| Payment | Must be able to pay policy premiums with US funds from a US bank account |

What You'll Learn

Permanent residency and visa requirements

Permanent Residency:

- Green Card: If you have a valid US Green Card, you are considered a permanent resident, which grants you access to most life insurance carriers and their best rates. You will need to provide a photocopy of your Green Card to the insurance company to confirm your permanent residency status.

- Social Security Number or Tax ID: A Social Security Number is typically required for life insurance applications. If you don't have one, you may be able to use a Tax Identification Number (TIN) or an Individual Taxpayer Identification Number (ITIN) if you are not a US taxpayer.

- Financial Requirements: You must demonstrate the ability to pay policy premiums in US funds. This usually involves having a US bank account to facilitate premium payments without complicated international transfers.

- Presence and Interest in the US: Most carriers require you to have lived in the US for at least a year to establish substantial presence. Some may require up to five years for their best rates. You must also show significant interest or ties to the US, such as owning a home or business, being married to a US citizen, or having US investments.

- Application Process: The entire application process, including the medical exam and policy delivery, must be completed while you are in the US.

Visa Requirements:

- Accepted Visa Types: Not all visas are accepted for life insurance coverage. The most commonly accepted visas include the E, H1B, K, L, O, and TN/TD visas. Student visas are generally not accepted, but some companies may consider them with stringent requirements.

- Documentation: Visa holders typically need more documentation than Green Card holders. This includes providing proof of your visa, residency, and legal status in the US.

- Additional Hurdles: Visa holders may face more hurdles during the application process, as carriers will assess your risk profile.

- US Address: A residential address in the US is typically required to obtain life insurance for both correspondence and legal purposes.

- Financial Requirements: Like permanent residents, visa holders must also demonstrate the ability to pay policy premiums, often by showing sufficient assets or income.

Primerica's Term Life Insurance: Loan Options Explored

You may want to see also

Application and approval process

The application and approval process for a US life insurance license for Canadian citizens is a lengthy and time-consuming process. Here is a step-by-step breakdown of the process:

Quote

During this initial step, you will discuss your residency, financial ties to the US, health, lifestyle, needs, and budget. This information will be used to tailor the coverage based on your specific situation and find a company that looks most favourably at your circumstances.

Application

Once you have selected the coverage that suits your needs, the application process can begin. This involves submitting an electronic application to the carrier and scheduling a medical exam, if required.

Medical Exam

Many carriers require applicants to complete a medical exam as part of the underwriting process. Typically, a nurse will come to your home or workplace to take your vitals. However, some carriers may not require a medical exam, and in these cases, the policy may be issued within a few days.

Approval and Delivery

After the carrier approves your application, you will need to finalise the policy. This includes reviewing the information to ensure there are no changes and scheduling payments. Please note that all payments must be made in US dollars, and most carriers require automatic premium deductions from a US-based bank account.

Documentation

As a Canadian citizen, there are specific documents you will need to provide during the application process. These include:

- Proof of residency status: Whether you are a permanent resident (green card holder) or a visa holder, you will need to provide a copy of your residency or visa documentation.

- Social Security Number or Tax ID: This is required for all individuals, regardless of citizenship, to purchase life insurance in the US.

- Economic ties to the US: Carriers may also consider your economic ties to the country, such as employment, family, homeownership, or business ownership.

Additional Considerations

It is important to note that the entire application and approval process must be completed while you are physically present in the United States. This includes the application submission, medical exam, and policy delivery. Most carriers also require you to have some form of long-term ties to the country, and you may need to provide proof of these ties.

Additionally, the minimum policy limit for non-US residents is typically $250,000, and the maximum age for full policy issuance is 70 years old.

Life Insurance Proceeds: Marital Property or Separate Asset?

You may want to see also

Medical exams

The medical exam consists of two parts: a health history screening and a physical examination. During the health history screening, the examiner will ask questions about the applicant's medical history, including tobacco, alcohol, and drug use, psychiatric or psychological issues, and any chronic conditions. The physical examination includes measuring height, weight, pulse, blood pressure, as well as taking blood, urine, or saliva samples. In some cases, additional tests such as an electrocardiogram (EKG), chest X-ray, or treadmill stress test may be required.

It is recommended to prepare for the medical exam by getting adequate sleep, staying hydrated, and wearing comfortable clothing. Fasting and avoiding caffeine, nicotine, and strenuous exercise in the hours leading up to the exam may also improve results.

The results of the medical exam are shared with the insurance company and used to determine the applicant's risk class and premium costs. The entire underwriting process, including repeat medical exams if necessary, usually takes a couple of months.

If an applicant prefers to avoid the medical exam, some insurers offer no-exam life insurance policies, although these tend to be more expensive and have lower coverage limits.

Life Insurance for Breast Cancer Patients: Is It Possible?

You may want to see also

Payment methods

Payment Requirements

When applying for life insurance in the US as a Canada citizen, it is essential to understand the payment requirements specified by insurance providers. Most life insurance carriers in the US require policy premiums to be paid in US funds and often mandate automatic premium deductions from a US-based bank account. This means that you will need to have a US bank account set up to facilitate these payments.

Payment Options

The specific payment options available to you may vary depending on the insurance carrier and the type of policy you choose. Here are some common payment methods accepted by US life insurance providers:

- Automatic Premium Deductions: Many insurance carriers prefer or require automatic premium deductions, where the policy premiums are automatically withdrawn from your US bank account on a set schedule. This ensures timely payments and helps maintain your policy without the risk of missed payments.

- Cheque or Money Order: Some insurance companies may also accept payments by cheque or money order. This option allows you to manually send in your premium payments, typically on a monthly, quarterly, or annual basis, depending on the agreed-upon payment schedule.

- Online Payments: With the advancement of technology, many insurance providers now offer online payment portals. You can usually log in to your account on the insurance company's website or mobile app and make secure payments using your US bank account or credit card.

- Electronic Funds Transfer (EFT): EFT is another convenient payment method where you can authorize the insurance company to withdraw funds directly from your bank account on specific dates. This method is often used for recurring payments and can be set up through your online banking platform.

- Credit Card Payments: In some cases, insurance providers may accept credit card payments. This option provides flexibility, especially if you don't have a US bank account set up yet. However, it's important to check with the insurance company beforehand, as not all carriers offer this payment method.

It is always advisable to clarify the accepted payment methods with your chosen insurance carrier before finalising your application. Additionally, be mindful of any potential processing fees or transaction charges associated with different payment options.

Life Insurance: Rising Costs and What to Expect

You may want to see also

Tax implications

As a Canadian citizen, you may be wondering about the tax implications of applying for a US life insurance license. It's important to understand the tax consequences to make informed decisions and ensure compliance with the law. Here are some key points to consider:

- Income Tax: As a non-US citizen, your US-sourced income may be subject to withholding tax. Any income earned from insurance premiums or commissions in the US could be subject to this tax. You should consult with a tax professional to understand the specific tax rates and rules that apply to your situation.

- Tax Identification Number: To comply with tax regulations, you will likely need to obtain a Tax Identification Number (TIN) or an Individual Taxpayer Identification Number (ITIN). This number is used for tax reporting and payment purposes. It is important to note that the requirements for obtaining a TIN or ITIN may vary, and you should refer to the guidelines provided by the Internal Revenue Service (IRS).

- Tax Filing and Reporting: As a non-resident alien, you may be required to file US tax returns and report your income, including any income earned from your insurance business in the US. The specific requirements depend on the tax laws and regulations in the US, and it is advisable to consult with a tax advisor to ensure compliance.

- Estate Taxes: Life insurance proceeds are generally exempt from income tax for the beneficiaries. However, there may be estate tax implications, especially if the policy is owned by a non-US citizen. The estate tax exemption for non-residents is significantly lower than that for US residents. Consult a tax professional to understand how estate taxes may apply to your specific situation.

- Cross-Border Tax Issues: As a Canadian citizen, you may need to consider the tax implications in both the US and Canada. There could be tax treaties or agreements between the two countries that impact your tax obligations. It is essential to seek advice from tax professionals in both countries to ensure compliance with the tax laws of each jurisdiction.

- Withholding Tax on Premiums: In some cases, insurance companies may withhold a portion of the premiums paid by policyholders to cover potential tax liabilities. This is particularly relevant if the policy is owned by a non-US citizen. Be sure to understand the withholding tax rules and how they may affect your income from insurance premiums.

- Tax Treatment of Policy Loans and Withdrawals: If you have a permanent life insurance policy with a cash value component, there may be tax implications when you take out loans or make withdrawals. The tax treatment of these transactions can vary depending on your residency status and the specific tax laws in the US. Consult a tax advisor to understand the potential tax consequences of such actions.

Navigating the tax implications of obtaining a US life insurance license as a Canadian citizen can be complex. It is always recommended to seek personalized advice from qualified tax professionals in both the US and Canada to ensure compliance with the tax laws and regulations of each country.

Debtor Groups: Can They Own Group Life Insurance?

You may want to see also

Frequently asked questions

Yes, a Canadian citizen can apply for a US life insurance license, but they must meet certain requirements. These include having a Green Card or a carrier-approved Visa, and having lived in the US for at least a year.

In addition to having a Green Card or approved Visa, and having lived in the US for a certain period of time, non-US citizens must also complete the life insurance application in the US, take the medical exam in the US, stay in the US while the policy is being approved, and pay premiums from a US bank account.

Life insurance for non-US citizens provides the same benefits as it does for US citizens, including tax-free death benefits, customizable coverage, and income protection for loved ones.