Life insurance for the elderly is a topic that is important to address to ensure financial security for loved ones. Life insurance for seniors works in the same way as it does for younger individuals, but with some key differences. Seniors may have fewer policy options and often face higher premiums due to their increased age and risk of developing health conditions. The best life insurance policy for an elderly individual will depend on their financial goals and physical health. Various types of life insurance are available for seniors, including term life, whole life, universal life, and burial life insurance, each with its own advantages and considerations. It is essential to carefully review the options, consider personal circumstances, and seek advice from financial professionals to make an informed decision.

| Characteristics | Values |

|---|---|

| Options | Term, permanent, whole, universal, variable universal, no-exam, final expense, guaranteed issue |

| Age restrictions | Yes, vary by company and policy type |

| Premiums | Higher for elderly than younger applicants |

| Coverage | Varies, some policies offer up to $5,000,000 |

| Purpose | Support loved ones, cover final expenses, pay off debts |

| Policy length | Varies, some policies offer coverage for the entire life |

| Application process | Medical exam may be required |

What You'll Learn

Term life insurance

As you get older, term lengths may be restricted by the insurer or not offered at all. Fees also tend to rise as you age. You may also need to fill out a health questionnaire and undergo a medical exam as part of the application process, unless you opt for a simplified or guaranteed issue term life insurance plan.

Overall, term life insurance can be a good choice for seniors who want affordable coverage for a specific period of time and are in good health. It can provide peace of mind that your loved ones will be taken care of financially if something happens to you during the term of the policy.

Who Gets the Life Insurance Payout?

You may want to see also

Whole life insurance

As a general rule, your life insurance options become more limited as you age. People in their fifties will have access to a wider variety of whole life policies than those in their sixties, seventies, or eighties. Additionally, the amount of coverage they are eligible to receive may be lower.

Comparing Life Insurance: What You Need to Know

You may want to see also

Simplified & guaranteed issue life insurance

Simplified issue whole life insurance is a policy with minimal health questions that does not require a medical exam or a review of medical records. It is a form of permanent coverage that lasts an entire lifetime, with premiums that never increase and a cash value that builds over time. This type of insurance is ideal for those who want to secure coverage quickly and avoid a medical exam, as well as those with pre-existing health issues. The application process is short and can often be approved in less than 10 minutes. The coverage maximum typically ranges from $50,000 to $100,000, with monthly costs for a $25,000 policy ranging from $50 to $250 for men and $50 to $200 for women.

Simplified issue life insurance is a quick and convenient option for those who don't want to undergo a lengthy medical underwriting process. The application only requires answers to a handful of health-related questions, and the insurer decides on approval much faster than with standard underwriting. Additionally, it is generally cheaper than guaranteed issue life insurance and offers higher coverage amounts. However, it may have a graded death benefit, with full benefits only payable if the policy has been in place for at least two years. The coverage amounts are also lower than those of traditional life insurance policies.

Guaranteed issue life insurance, on the other hand, has no underwriting requirements and does not involve health questions or medical exams. This type of insurance is geared towards individuals in poor health who are looking for coverage to pay for funeral or final expenses. It tends to be more expensive and has lower coverage limits, typically $25,000 or less.

When considering life insurance for seniors, it is important to evaluate factors such as financial situation, age, and health. Consulting a licensed insurance agent or financial advisor can help determine the most suitable coverage options.

Life Insurance: Accidental Death Abroad, Are You Covered?

You may want to see also

Final expense insurance

The beneficiaries of a final expense insurance policy can use the payout to cover funeral service costs, cremation, medical bills, nursing home bills, obituaries, flowers, and more. The death benefit can also be used for any other purpose, such as paying property taxes or taking a vacation.

Chlamydia and Life Insurance: Does It Affect Your Premiums?

You may want to see also

No-exam life insurance

AARP

AARP offers a range of no-exam life insurance plans, including term life, permanent life, permanent life with living benefits, and guaranteed acceptance. Their plans are available to people aged 50 and above, with no medical exam required. AARP's term life plan offers coverage ranging from $10,000 to $150,000, while their permanent life plans have a maximum benefit of $50,000. The guaranteed acceptance plan has a maximum benefit of $25,000 and does not require any health questions. However, AARP membership fees can increase over time, and the whole life coverage maximum is $50,000.

Globe Life Insurance

Globe Life Insurance is known for its "$1 for $100,000 benefit" promotion for the first month of any plan. They offer term, whole, and final expense plans without a medical exam for people under 75. The benefits for term life insurance range from $5,000 to $100,000, while whole life benefits range from $5,000 to $50,000. Globe Life's premiums are competitive, but they increase automatically every five years.

Mutual of Omaha

Mutual of Omaha offers whole life insurance plans with benefits ranging from $2,000 to $25,000 for seniors up to 85 years old without a medical exam. Their plans are highly customizable, allowing seniors to adjust the benefit amount to fit their budget. However, the premiums can be pricey, and the maximum coverage limit is $25,000 for whole life insurance.

Fidelity Life

Fidelity Life offers no-exam life insurance plans for seniors between 50 and 70 years old, with maximum benefits up to $150,000. Their RAPIDecision Final Expense and Whole Life plans are ideal for final expense coverage, with affordable premiums. However, the maximum issue age for their policies is relatively low, ranging from 65 to 70.

TruStage

TruStage is an insurance broker that helps seniors find carriers and plans that offer the right premiums and benefits without medical exams. They offer term life, whole life, and guaranteed acceptance plans, with benefits up to $100,000 for term life and $300,000 for whole life. TruStage keeps premiums stable, only increasing them every five years. However, they have been criticised for their lack of online systems and frustrating claim request processes.

Haven Life Insurance: MyVisaJobs' Comprehensive Guide

You may want to see also

Frequently asked questions

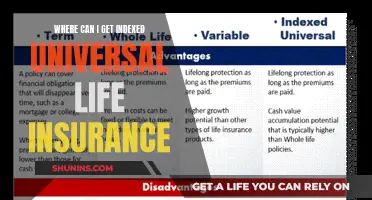

Seniors can choose from the same types of life insurance as everyone else. This includes term life insurance, which is available through age 80, and cash value life insurance, which includes whole life and universal life insurance and can be obtained through age 85.

The cost of life insurance for seniors is primarily affected by age and health, as well as the type of coverage and smoking status. Seniors can generally expect to pay higher premiums than younger applicants.

The best type of life insurance for seniors depends on their individual needs and circumstances. Term life insurance may be a good option for healthy seniors with few financial obligations, while whole or universal life insurance may be better for those who want to leave something behind for their family. Burial insurance, also known as final expense insurance, is a good option for those who only want to cover funeral expenses.

You can get a quote for life insurance online or by speaking to a licensed insurance agent. You will need to provide some personal information, such as your age, gender, and ZIP code.