Life insurance is a financial product that provides peace of mind to individuals and their families. The cost of life insurance is influenced by various factors, including age, gender, health, and lifestyle choices. While term life insurance is generally more affordable, permanent life insurance offers additional benefits such as cash value components. Understanding these factors and the different types of policies available can help individuals make informed decisions about their coverage needs and budget.

What You'll Learn

How much is life insurance?

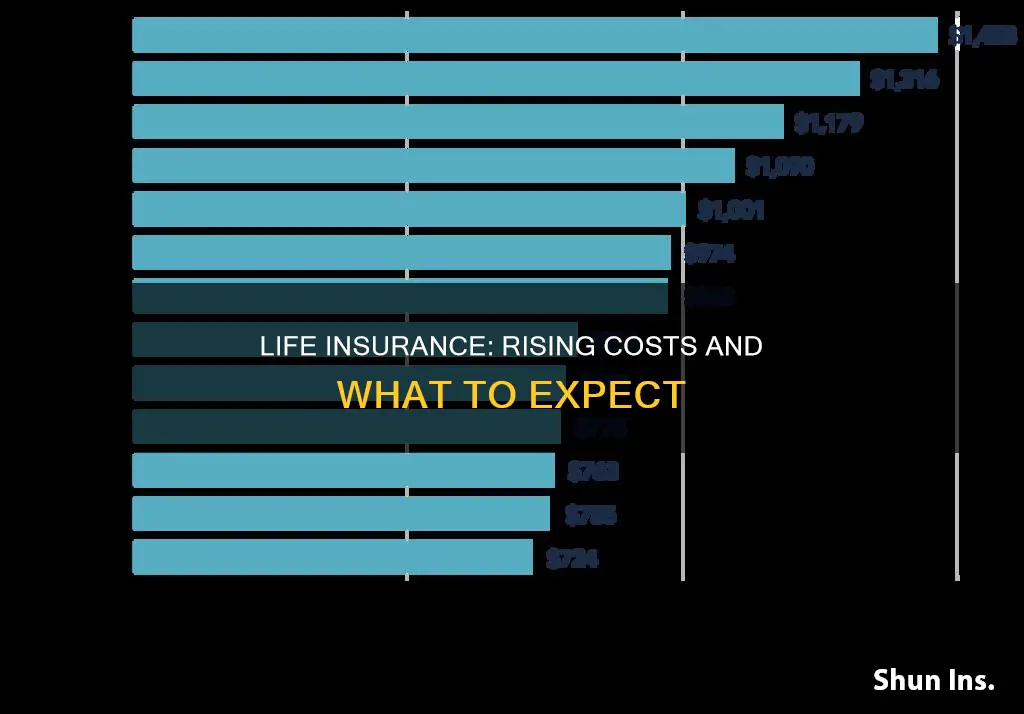

The average cost of life insurance is $26 a month. This is based on data provided by Covr Financial Technologies for a 40-year-old buying a 20-year, $500,000 term life policy, which is the most common term length and amount sold. However, life insurance rates can vary dramatically among applicants, insurers, and policy types.

Life insurance premiums are based primarily on life expectancy. Generally, the younger and healthier you are, the cheaper your premiums. Insurers typically classify applicants using terms like "super preferred", "preferred", and "standard", with super preferred being the healthiest category.

- Your age: Generally, younger people pay less for life insurance. This is because as you age, your life expectancy decreases and the likelihood of your insurer having to pay out increases.

- Your gender: Women have longer life expectancies, so they will almost always pay less than men of the same age and health.

- Your smoking status: Smokers are at a higher risk of developing health issues, so life insurance for smokers tends to be more expensive.

- Your health: This includes any pre-existing conditions, as well as your blood pressure and cholesterol levels. Insurers will also look at your height and weight.

- Your family medical history: Your insurer may ask if you have a family history of serious health conditions such as heart disease, cancer, or diabetes.

- Your driving record: If you have DUIs, DWIs, and major traffic violations on your record, your insurer might consider you a high-risk applicant and charge higher rates.

- Your occupation and lifestyle: If you have a hazardous or high-risk job, or participate in risky activities, you can expect to pay more.

The type of life insurance you choose also affects the average cost. Term life insurance is the least expensive because it lasts a set number of years and simply offers coverage without building cash value. Permanent life insurance, on the other hand, typically lasts a lifetime and includes a cash value component, so you'll pay substantially more for these policies.

Additionally, adding life insurance riders to your policy can increase your premium. For example, a child rider worth $10,000 can cost an additional $50 to $75 per year.

- Your ethnicity, race, and sexual orientation: While insurers assess your age and gender, they cannot discriminate based on these elements of diversity.

- Your credit score: Although your insurer will look at your credit history, your credit score won't affect your premium.

- Your marital status: Life insurers don't have different rates for married applicants, unlike many auto insurance companies.

- The number of life insurance policies you have: You will, however, need to justify purchasing large amounts of coverage across multiple policies.

- The number of beneficiaries you name: Whether you have one or five beneficiaries will not impact your rate.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

How are life insurance rates determined?

Life insurance rates are determined by assessing the risk of insuring an individual. Life insurance companies are careful not to insure people who, due to medical conditions or risky behaviour, may die prematurely. If they did, this would eventually raise rates for others who are healthy.

- Age: The younger you are, the lower your premium will be. This is because your life insurance company calculates your rates largely based on life expectancy.

- Gender: Women tend to pay lower life insurance premiums than men because they generally have a longer life expectancy.

- Weight: Your height and weight are factors that life insurance companies consider when assessing your application. Insurers often use the Body Mass Index (BMI) as a tool to gauge your overall health in relation to your weight and height.

- Health: The healthier you are, the less you’ll likely pay for your life insurance policy. Most life insurance policies require a medical exam and will request your medical records to ensure that you don't have a pre-existing condition that would drastically shorten your life expectancy.

- Lifestyle: The way you live impacts your risk level in the eyes of insurers. Life insurance providers typically raise your rates to compensate for the risks associated with a dangerous lifestyle, such as a risky occupation or extreme hobbies.

- Driving record: Life insurance companies look at your driving history to gauge your overall risk profile. Frequent speeding tickets, DUIs or license suspensions suggest higher risk, potentially leading to increased premiums or even declined coverage.

- Tobacco use: Tobacco use is a significant factor in premium calculations due to its health risks.

- Family medical history: A history of serious health conditions in your family may lead to higher life insurance premium rates because it increases your chances of developing similar issues.

- Type of policy: Term policies typically cost less than permanent policies since an eventual payout is less likely.

Life Insurance and Food Stamps: Is There a Link?

You may want to see also

What factors don't impact your life insurance premium?

When it comes to determining life insurance premiums, there are several factors that insurance companies take into account, such as age, gender, smoking status, health, family medical history, driving record, and occupation. However, there are also certain factors that do not impact the premium. Here are four paragraphs detailing what factors do not affect life insurance premiums:

Ethnicity, Race, and Sexual Orientation: Insurance companies are not allowed to discriminate based on ethnicity, race, or sexual orientation when setting life insurance premiums. While they may consider age and gender, these elements of diversity do not influence the rates offered. This ensures that individuals from diverse backgrounds are not unfairly targeted or charged higher premiums.

Credit Score: Although credit history is considered, your credit score itself does not affect your life insurance premium. Insurance companies typically review your credit history for the past seven years. However, if you have a bankruptcy on record, it may be deemed as a higher risk of mortality, which could impact your premium. It's important to note that a poor credit score won't directly increase your premium, but it may be considered alongside other factors.

Marital Status: Unlike auto insurance providers, life insurance companies do not offer different rates based on marital status. Whether you are single, married, divorced, or widowed, it will not have an impact on the premium you are offered. This means that your life insurance premium remains consistent regardless of your marital status or any changes to it over time.

Number of Policies and Beneficiaries: The number of life insurance policies you have does not affect your premium. You can have multiple policies without seeing an increase in rates. Similarly, the number of beneficiaries you name on your policy also has no impact on the premium. Whether you have one or several beneficiaries, the rate remains the same. This allows you to have greater flexibility in planning your financial protection without worrying about increased costs.

Basic Life Insurance: What Employers Provide and Why

You may want to see also

What is reduced paid-up life insurance?

Reduced paid-up life insurance is an option for some life insurance policies that allows you to retain a death benefit without paying anything towards premiums. This option is only available for some permanent life insurance policies, as term life insurance policies do not have a cash value.

When you buy whole life insurance, part of the money you pay in premiums is allocated to a cash value account, which can earn interest. If you can no longer afford the premiums, you could surrender the policy and withdraw this cash value. However, this would eliminate the death benefit. Reduced paid-up insurance offers an alternative to this, allowing you to use the cash value to convert to a paid-up policy with a smaller death benefit. Insurers base their cash value calculations on how much cash value you've accumulated and what you've paid in premiums.

The main benefit of reduced paid-up life insurance is that it eliminates premium payments, which may be appealing if you're trying to cut expenses but retain life insurance coverage. However, the death benefit amount is much lower, which may negatively impact your beneficiaries if you're leaving behind significant debt.

Suitability Requirements: A Must for Life Insurance Products?

You may want to see also

How does reduced paid-up life insurance work?

Reduced paid-up life insurance is a non-forfeiture option that allows policyholders to retain a death benefit from their life insurance policy without paying premiums. This option is typically available for whole life insurance policies, where a cash value account is built up over time from the premiums paid. When the premiums become unaffordable, instead of surrendering the policy and withdrawing the cash value, the reduced paid-up option allows the policyholder to use the cash value to convert to a paid-up policy with a smaller death benefit.

Here's how it works:

Surrendering the Policy

If you surrender a whole life policy, you can withdraw its cash value, usually minus any surrender fees. There would be no death benefit left for your beneficiaries, and no more premiums to pay as the policy would end.

Reduced Paid-Up Option

The reduced paid-up option allows you to retain your policy without paying any additional premiums. The insurance company adjusts the death benefit to match the accumulated cash value. The new death benefit amount is calculated based on the cash value, the number of years you've had the policy, and the amount you've paid in premiums. For example, if you've built up a cash value of $50,000 on a $500,000 policy, your new death benefit would likely be around $50,000, and you wouldn't have to pay any more premiums.

The reduced paid-up option is particularly useful if you're experiencing financial hardship and can no longer afford the premiums, but still want to maintain some level of life insurance coverage for your beneficiaries. It's important to note that this option may not be available if your policy is relatively new or if you haven't built up enough cash value. Additionally, any riders included in your original policy, such as a disability rider, would be cancelled upon conversion to a reduced paid-up policy.

Life Insurance and Lung Cancer: What Coverage is Offered?

You may want to see also

Frequently asked questions

The cost of life insurance is influenced by various factors, including age, gender, health, lifestyle choices, and occupation. Younger and healthier individuals generally pay lower premiums. Additionally, factors like smoking status, driving record, and hazardous jobs can increase the cost.

Life insurance provides financial protection for your loved ones after your death. It offers a death benefit that can be used for burial expenses, replacing lost income, or other financial needs. The beneficiary can use the payout as they see fit, without any restrictions.

There are two main types of life insurance: permanent and term life insurance. Permanent life insurance, including whole and universal life, offers lifelong coverage with a death benefit and a savings component. Term life insurance, on the other hand, provides temporary coverage for a specified term, such as 5 to 30 years, and is generally more affordable.