Cancer patients may not be eligible for traditional life insurance policies, but there are non-traditional options available. Cancer survivors who have been in remission for at least five years can obtain a traditional term or permanent life insurance policy, depending on the severity of their diagnosis. The type of policy, face amount, and cost are determined by seven critical factors relating to the patient's diagnosis and overall health. Critical illness insurance, which pays a lump sum upon diagnosis of a severe illness, also covers lung cancer.

| Characteristics | Values |

|---|---|

| Cancer patients' life insurance options | Guaranteed life insurance, group life insurance |

| Cancer survivors' life insurance options | Traditional term or permanent life insurance policy |

| Cancer patients' life insurance eligibility | Depends on the type and stage of cancer, treatment history, and date of diagnosis |

| Cancer survivors' life insurance eligibility | Depends on the type and stage of cancer, treatment history, date of diagnosis, and length of time post-cancer |

| Waiting period for life insurance after cancer | Varies depending on the type of cancer and the insurer; typically 2-5 years |

| Cost of life insurance after cancer | 2-4 times higher than for a healthy individual without cancer |

What You'll Learn

Life insurance for lung cancer patients

If you have lung cancer, you may be able to obtain life insurance, but your options will be limited. Typically, cancer patients can only qualify for guaranteed issue policies with restricted payouts and limited coverage. This type of insurance is often more expensive than traditional life insurance.

What Life Insurance Companies Look For

Life insurance companies will want to see that lung cancer patients have:

- Received full treatment

- Completed regular follow-up visits as recommended by their doctor

- No longer be in treatment

Preparing for Your Application

To give yourself the best chance of being approved for life insurance, it is important to:

- Have all doctors' names, addresses, and phone numbers available

- Ensure your doctor(s) have copies of all records regarding cancer treatment, pathology reports, and follow-up reports

- Have a list of all medications and their dosages available

- Not skip any follow-up visits with your doctor

- Always follow your doctor's advice, orders, and medical opinions

Case Studies

Jackson

Jackson, a 56-year-old individual, applied for term life insurance after being diagnosed with early-stage lung cancer. Due to the early detection and prompt treatment, Jackson had a favorable prognosis. He had no other medical conditions and diligently followed up with his doctor. Jackson was approved at a Standard rating class with an annual premium of $509.

Joan

Joan, a 45-year-old woman, applied for term life insurance while undergoing treatment for lung cancer. Although Joan had no other health issues and adhered to her doctor's recommendations, her application was postponed for ten years from the end of her treatment.

Roger

Roger, a 38-year-old individual, sought term life insurance after being diagnosed with lung cancer. However, his lack of routine follow-up appointments and tobacco use resulted in his application being declined. The insurance company deemed the risk too high to offer coverage.

What This All Means for You

The good news is that you can qualify for coverage if you have a history of lung cancer. Your outcome and premium cost will depend on factors such as your age, stage of cancer, treatment, follow-up, and medical history. While you can control the outcome to some extent through good follow-up and lifestyle habits, other uncontrollable factors will also come into play when the life insurance company reviews your application.

Flight Emergencies: Insurance Coverage for Flight-for-Life Services

You may want to see also

Life insurance for lung cancer survivors

Being diagnosed with cancer can be a scary experience, and you may be concerned about how it will impact your future and your loved ones. One common question that arises is whether life insurance will cover lung cancer and what options are available for survivors. Here is some information to guide you through the process and help you secure the coverage you need.

Obtaining Life Insurance After Cancer

The good news is that having cancer does not automatically disqualify you from obtaining life insurance. Many life insurance companies are willing to insure cancer patients and survivors, although the specific terms and premiums may vary. The key factors influencing your eligibility and rates include the type and stage of cancer, your treatment status, and your overall health.

Types of Life Insurance for Cancer Survivors

There are several types of life insurance available to cancer survivors:

- Guaranteed issue life insurance: This option typically has no medical exam or health questions, and you cannot be turned down. However, the coverage amounts are usually low, and the policy often includes graded death benefits, meaning your beneficiaries may not receive the full payout if you pass away within the first few years of the policy.

- Group life insurance: Group life insurance is often available through employers or certain organizations and can provide guaranteed coverage up to a certain amount. Higher levels of coverage may require medical underwriting.

- Traditional term or whole life insurance: Cancer survivors in remission for two to five years may qualify for traditional term or whole life insurance policies. However, the rates are typically higher, and certain types of cancer may prevent you from obtaining coverage.

Factors Affecting Your Life Insurance Rates

When determining your life insurance rates, companies will consider various factors, including your age, cancer history, and overall health. Different types of cancer carry different risks, and those that spread to other parts of the body may result in higher premiums or disqualification from certain policies.

Insurance companies often categorize applicants into risk groups, such as preferred plus, preferred, standard plus, and standard, with corresponding premium rates. The longer you have been in remission and the healthier you are, the better your chances of obtaining more favourable rates.

Tips for Improving Your Chances

To increase your chances of obtaining life insurance after cancer, consider working with an experienced independent agent who specializes in impaired risk underwriting. Additionally, focus on improving your overall health by adopting healthy habits, avoiding tobacco, and minimizing risky hobbies or behaviours.

Remember, each person's situation is unique, and the best approach is to be honest and detailed about your cancer history when applying for life insurance. By providing comprehensive information and working with knowledgeable professionals, you can secure the coverage you need to protect your loved ones.

Hartford's Life Insurance Offerings: What You Need to Know

You may want to see also

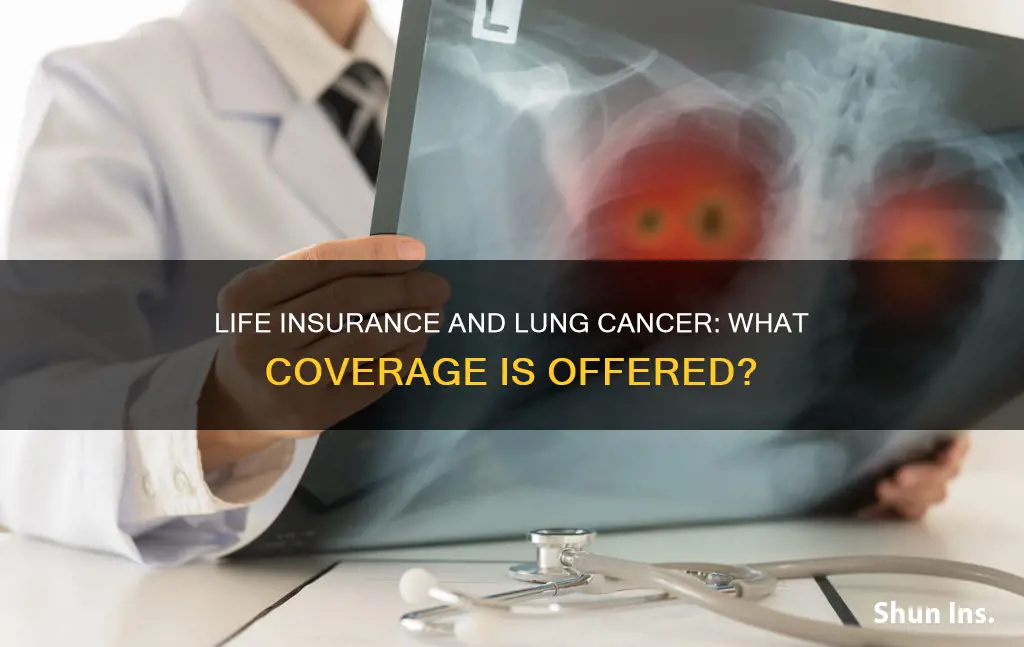

Critical illness insurance for lung cancer

Critical illness insurance is a supplemental health insurance policy that pays out a fixed, lump sum if you are diagnosed with a severe illness. It covers a wide range of diseases, including lung cancer. The benefit payment can be used for any purpose, including medical bills, daily living expenses, and mortgage payments. It is designed to protect individuals and their families from financial hardship in the event of a serious diagnosis.

The stipulations for critical illness coverage vary across different plans. While some plans cover certain diseases or medical emergencies, others do not. It is important to carefully review the details of each plan before purchasing critical illness insurance. The cost of critical illness insurance depends on several factors, such as age, sex, health status, family medical history, and the desired amount and extent of coverage.

For individuals with a history of lung cancer or other severe cancers, obtaining critical illness insurance can be challenging. Insurers typically assess these cases on an individual basis, considering factors such as the type and stage of cancer, treatment history, and length of time since the last treatment. Some insurers may offer coverage with specific exclusions, such as a full exclusion for any future cancer diagnosis or a tailored exclusion based on the individual's circumstances.

It is important to note that critical illness insurance does not cover pre-existing conditions. Individuals with an existing diagnosis of lung cancer or other severe illnesses are generally ineligible to purchase a critical illness plan. However, some plans may provide coverage for pre-existing conditions if they have been treated prior to the effective date of the critical illness coverage and the individual has maintained the policy for a specified period.

When considering critical illness insurance, it is essential to evaluate factors such as the comprehensiveness of your current health insurance plan, your out-of-pocket medical expenses, your risk for certain diseases, and your financial situation. Critical illness insurance can provide peace of mind and help alleviate financial concerns during a challenging time.

Life Insurance and Physicals: What's the Connection?

You may want to see also

Guaranteed issue life insurance for lung cancer

If you have been diagnosed with lung cancer, you may be concerned about securing life insurance. While a cancer diagnosis can impede your ability to purchase traditional life insurance, there are options available to you, including guaranteed issue life insurance.

Guaranteed issue life insurance is a type of life insurance that is guaranteed to be issued, regardless of your health status. This means that you cannot be turned down for this type of policy, even if you have a serious illness such as cancer. This form of life insurance does not require a medical exam, health questions, or a review of your medical history.

Benefits of Guaranteed Issue Life Insurance for Lung Cancer Patients

One of the biggest benefits of guaranteed issue life insurance for lung cancer patients is that it provides some coverage, which is better than having no life insurance at all. The application process is also simple and quick, and it does not require any needles, nurses, or liquid samples.

Drawbacks of Guaranteed Issue Life Insurance

There are a few drawbacks to guaranteed issue life insurance. Firstly, there are age restrictions, typically only available to individuals between 40 and 85 years old. Secondly, the death benefit is usually graded, meaning that for the first two years of the policy, your beneficiaries will not be eligible for the full death benefit. Instead, they will receive only the premiums paid, plus interest. Additionally, the face amount of these policies is typically modest, ranging from $5,000 to $40,000.

Obtaining Guaranteed Issue Life Insurance for Lung Cancer

If you are a lung cancer patient seeking guaranteed issue life insurance, you can look to companies such as AIG Life Insurance Company, Gerber Life Insurance Company, and Great Western Insurance Company, which offer coverage ranging from $5,000 to $25,000.

Alternatives to Guaranteed Issue Life Insurance

While guaranteed issue life insurance may be the most accessible option for lung cancer patients, there are a few alternatives to consider. Group life insurance, for example, is commonly available through employers and is often guaranteed issue up to a certain amount of coverage. Another option is burial life insurance, which is designed for individuals over 50 and can be purchased regardless of health issues, although it has a lower maximum death benefit.

Working with an Independent Agent

When seeking life insurance as a cancer patient, it is recommended to partner with an independent agent who can shop multiple carriers and policies to find the best option for your specific needs and budget. They will be able to guide you through the application process and increase your chances of obtaining coverage.

Life Insurance After Retirement: What You Need to Know

You may want to see also

Traditional life insurance for lung cancer survivors

If you have been diagnosed with lung cancer, your ability to purchase traditional life insurance will be impeded. However, this is not a permanent barrier to obtaining life insurance. While you may be able to buy some types of life insurance, they are likely to be limited and expensive.

Factors Affecting Life Insurance for Lung Cancer Patients

The type of cancer and whether it has spread to other parts of the body are crucial factors. Small cell lung cancer, for instance, is considered high-risk, and you will probably be unable to obtain traditional life insurance. On the other hand, basal cell carcinoma (skin cancer) usually does not affect insurance rates.

Waiting Periods for Lung Cancer Survivors

To qualify for traditional life insurance, lung cancer survivors typically need to be in remission for a minimum of three years. This waiting period can vary depending on the insurance company and the specifics of your cancer. Some insurers may require a longer remission period of up to ten years.

Types of Life Insurance Available to Lung Cancer Survivors

After being in remission for several years, lung cancer survivors may qualify for traditional term or whole life insurance policies. However, the rates for these policies will be higher than for someone without a history of cancer.

Steps to Take When Applying for Life Insurance After Lung Cancer

It is recommended to obtain quotes from multiple life insurance companies, as each company has its own underwriting guidelines. Additionally, consider applying for final expense life insurance, which is designed to cover funeral and medical expenses. This type of insurance does not require a medical exam or health questions, making it a viable option for individuals with pre-existing conditions like cancer.

Universal Life Insurance: Group Cash Value Explained

You may want to see also

Frequently asked questions

If you are currently undergoing treatment for lung cancer, you will likely only qualify for a guaranteed life insurance policy, which is more expensive and has a lower payout.

If you are in remission, you may be able to get a traditional term or permanent life insurance policy, depending on the specifics of your diagnosis and treatment.

The longer you've been in remission, the more likely you are to be offered life insurance. Companies may want to wait two to five years after your treatment ends before offering you coverage.

If you have a life insurance policy that covers any cause of death, and you die from lung cancer while the policy is active, your beneficiaries can claim the death benefit.