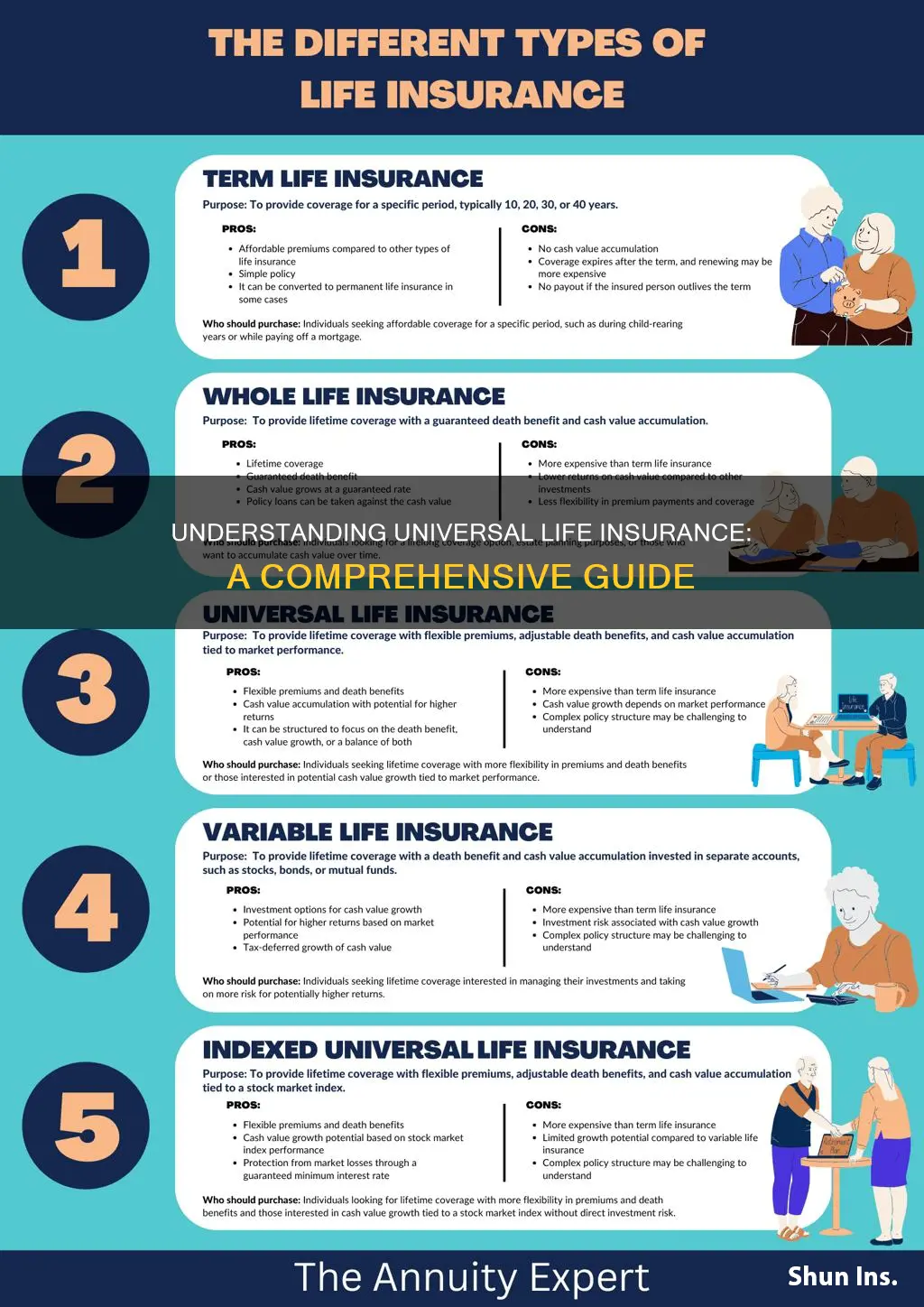

Universal life insurance is a type of permanent life insurance that offers both death benefit coverage and an investment component. Unlike term life insurance, which provides coverage for a specific period, universal life insurance allows policyholders to adjust their premiums and death benefits over time. This flexibility enables individuals to tailor their insurance to their changing needs and financial goals. The investment portion of the policy grows tax-deferred, and policyholders can access their cash value through loans or withdrawals, providing a source of emergency funds or a way to build wealth. Understanding the features and benefits of universal life insurance can help individuals make informed decisions about their long-term financial security and risk management.

What You'll Learn

- Definition: Universal life insurance is a type of permanent life insurance with a flexible premium and investment component

- Features: It offers a combination of death benefit, cash value accumulation, and investment options

- Flexibility: Policyholders can adjust premium payments and investment allocations over time

- Tax Advantages: Proceeds are generally tax-free, and cash value grows tax-deferred

- Longevity: Provides coverage for a lifetime, ensuring financial security for beneficiaries

Definition: Universal life insurance is a type of permanent life insurance with a flexible premium and investment component

Universal life insurance is a comprehensive and flexible form of permanent life insurance. It offers a unique combination of features that set it apart from other life insurance policies. At its core, universal life insurance provides long-term coverage, ensuring financial security for the policyholder's beneficiaries. One of its key attributes is the flexibility it offers in terms of premium payments and investment options.

In this type of insurance, policyholders have the freedom to choose how much they want to pay in premiums, allowing for customization based on their financial situation and goals. This flexibility is particularly advantageous for those who may experience fluctuations in income or prefer a more tailored approach to their insurance needs. Additionally, universal life insurance incorporates an investment component, where a portion of the premium payments is allocated to an investment account. This investment aspect is designed to grow over time, providing potential for accumulation of wealth.

The investment portion of universal life insurance is strategically managed to offer both growth and stability. It is typically invested in a diverse range of assets, such as stocks, bonds, and mutual funds, to optimize returns while also mitigating risk. This investment strategy allows the policyholder's money to work harder, potentially accumulating a substantial sum over the policy's lifetime. As the investment grows, so does the cash value of the policy, providing a financial reserve that can be utilized for various purposes.

Furthermore, universal life insurance offers a permanent coverage option, ensuring that the policy remains in force for the policyholder's lifetime. This is in contrast to term life insurance, which provides coverage for a specified period. With universal life, the death benefit is guaranteed, providing financial security to the policyholder's designated beneficiaries. This permanent nature of the policy makes it an attractive choice for those seeking long-term financial protection.

In summary, universal life insurance is a powerful financial tool that combines the benefits of permanent coverage, flexible premium payments, and a strategic investment component. It empowers individuals to take control of their financial future, offering both security and the potential for wealth accumulation. Understanding the features and advantages of universal life insurance can help individuals make informed decisions about their insurance needs and long-term financial planning.

Life Insurance Paid Add-ons: Taxable or Not?

You may want to see also

Features: It offers a combination of death benefit, cash value accumulation, and investment options

Universal life insurance is a type of permanent life insurance that offers a unique blend of features, providing both financial security and investment opportunities. One of its key attributes is the combination of a death benefit, which ensures financial protection for your loved ones in the event of your passing, and cash value accumulation, which allows the policy to grow over time. This dual benefit is a significant advantage, as it provides immediate financial support while also building a long-term asset.

The death benefit is a guaranteed amount paid out upon the insured's death, ensuring that your family receives the intended financial support. This aspect is particularly valuable for those who want to provide for their loved ones' long-term needs, such as education expenses, mortgage payments, or living expenses. Universal life insurance offers flexibility in determining the death benefit, allowing policyholders to adjust it as their financial situation changes.

Cash value accumulation is a powerful feature that sets universal life insurance apart. As premiums are paid, a portion is allocated to build cash value, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing access to funds for various purposes, such as funding education, starting a business, or covering unexpected expenses. Over time, the cash value can accumulate significantly, becoming a substantial financial asset.

In addition to the death benefit and cash value, universal life insurance often includes investment options. Policyholders can allocate a portion of their premiums to investment accounts, where the money can grow through various investment strategies. These investment options typically offer a higher potential return compared to traditional savings accounts, allowing the policy to grow faster. The investment aspect provides an opportunity to build wealth and potentially increase the overall value of the policy.

The combination of these features makes universal life insurance an attractive choice for individuals seeking both financial protection and investment growth. It offers a flexible and comprehensive solution, allowing policyholders to customize their coverage and take advantage of potential tax benefits. With its ability to provide a death benefit, accumulate cash value, and offer investment opportunities, universal life insurance can be a valuable tool for long-term financial planning and security.

Life Insurance: Permanent Options Explained

You may want to see also

Flexibility: Policyholders can adjust premium payments and investment allocations over time

Universal life insurance offers a unique level of flexibility to policyholders, allowing them to customize and adapt their insurance policies to their changing needs and financial goals. One of the key advantages of this type of insurance is the ability to adjust premium payments and investment allocations over time.

When purchasing a universal life policy, policyholders have the freedom to choose their initial premium payments, which can be tailored to their current financial situation. This flexibility enables individuals to start with lower premiums if they prefer, especially during their early years when they might have other financial priorities. As their financial circumstances improve, they can increase the premium payments to ensure a more substantial death benefit when the time comes. This adjustable nature of premium payments provides a safety net, allowing policyholders to manage their insurance costs effectively without compromising on coverage.

In addition to premium adjustments, universal life insurance also offers the option to modify investment allocations. Policyholders can allocate their policy's cash value between different investment options, such as stocks, bonds, or mutual funds. This investment flexibility allows individuals to align their insurance portfolio with their risk tolerance and financial objectives. For instance, someone with a higher risk tolerance might choose to allocate a larger portion of their cash value to stocks, aiming for potential higher returns. Conversely, a more conservative investor could opt for a balanced approach, distributing their investments across various asset classes.

Over time, as policyholders' financial goals and priorities evolve, they can further customize their universal life insurance. They can increase or decrease the amount allocated to investments, ensuring that their policy remains aligned with their changing needs. This level of control empowers individuals to make informed decisions about their insurance and investment strategies, adapting them as their life circumstances and market conditions change.

The flexibility provided by universal life insurance is particularly valuable for those who want to maximize their insurance benefits while maintaining financial control. It allows policyholders to make strategic adjustments, ensuring that their insurance coverage remains appropriate and cost-effective throughout their lives. With the ability to modify premium payments and investment allocations, universal life insurance offers a dynamic and personalized approach to long-term financial planning.

Mentioning Life Insurance for Tax Exemption: Can I?

You may want to see also

Tax Advantages: Proceeds are generally tax-free, and cash value grows tax-deferred

Universal life insurance offers a unique tax advantage that sets it apart from other insurance products. One of the key benefits is that the proceeds from a universal life insurance policy are generally tax-free. When the policyholder passes away, the death benefit is paid out to the designated beneficiaries, and this amount is typically not subject to income tax. This is a significant advantage, especially for those who want to ensure that their loved ones receive a substantial financial gift without the worry of tax implications. By avoiding taxation on the death benefit, universal life insurance can provide a more substantial financial legacy, allowing beneficiaries to use the funds for various purposes, such as education, business ventures, or retirement.

In addition to the tax-free proceeds, universal life insurance also allows for tax-deferred growth of cash value. As the policyholder makes regular premium payments, a portion of these payments is allocated towards building cash value. This cash value grows tax-free, meaning that any earnings or interest accrued on the policy's investment account are not subject to annual income tax. Over time, this tax-deferred growth can accumulate, providing a substantial amount of cash value that can be borrowed against or withdrawn, offering financial flexibility.

The tax advantages of universal life insurance are particularly beneficial for long-term financial planning. As the cash value grows, it can be used to pay for future expenses, such as college tuition or business investments, without triggering immediate tax consequences. This feature is especially valuable for those who want to maximize their savings and investments while also ensuring a stable financial future for their beneficiaries. By taking advantage of the tax-deferred nature of the cash value, policyholders can build a substantial financial reserve that can be utilized according to their specific needs and goals.

Furthermore, the tax-free proceeds of universal life insurance can be advantageous for estate planning. When the policyholder passes away, the death benefit is received tax-free, allowing the beneficiaries to inherit a larger sum. This can help in maintaining the family's standard of living, funding charitable causes, or even providing a substantial inheritance for the next generation. The tax-free nature of the proceeds ensures that the entire death benefit is available to the beneficiaries, free from any potential tax liabilities.

In summary, universal life insurance provides a powerful tax advantage by offering tax-free proceeds and tax-deferred growth of cash value. This feature allows policyholders to build a substantial financial legacy, providing financial security and flexibility for their loved ones. By understanding and utilizing these tax benefits, individuals can make informed decisions about their insurance and financial planning, ensuring a more prosperous and secure future.

How Donating a Kidney Impacts Life Insurance Policies

You may want to see also

Longevity: Provides coverage for a lifetime, ensuring financial security for beneficiaries

Universal life insurance is a type of permanent life insurance that offers a unique and flexible approach to financial security. It is designed to provide coverage for a lifetime, ensuring that beneficiaries are protected even in the face of unexpected events. This type of policy is particularly attractive to those seeking long-term financial planning and a reliable safety net for their loved ones.

The key feature of universal life insurance is its ability to adapt to the policyholder's needs over time. Unlike traditional term life insurance, which provides coverage for a specific period, universal life insurance offers a permanent solution. It combines the benefits of a whole life policy with the flexibility of adjustable premiums and cash values. Policyholders can choose to pay a fixed premium or adjust the payments based on their financial situation, allowing for customization and control.

As the name suggests, this insurance provides coverage for the entire lifetime of the insured individual. This means that as long as the policy is in force, the death benefit will be paid out to the designated beneficiaries upon the insured's passing. The coverage ensures that the financial obligations and goals of the policyholder are met, providing peace of mind and security for the future. For example, if someone purchases a universal life policy in their 30s and lives to an advanced age, the policy will continue to provide financial protection for their family or beneficiaries throughout their entire life.

One of the advantages of this insurance is the potential for cash value accumulation. Policyholders can build up a cash value over time, which can be borrowed against or withdrawn as needed. This feature provides a financial safety net and can be particularly useful for those who want to access funds for various purposes, such as education expenses, business ventures, or retirement planning. The cash value also grows tax-deferred, allowing it to accumulate and potentially outpace the growth of traditional savings accounts.

In summary, universal life insurance offers a comprehensive solution for long-term financial security. It provides lifetime coverage, ensuring that beneficiaries are protected, and its adjustable nature allows policyholders to adapt to changing circumstances. With the potential for cash value accumulation, this insurance product empowers individuals to take control of their financial future and provide a stable foundation for their loved ones. Understanding the features and benefits of universal life insurance can help individuals make informed decisions about their long-term financial planning and risk management.

Cashing in on Life Insurance: Strategies for Success

You may want to see also

Frequently asked questions

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. It provides coverage for your entire life and allows policyholders to build cash value over time, which can be used for various purposes, such as loaning against the policy or increasing the death benefit.

This insurance policy provides a death benefit to your beneficiaries when you pass away. The policyholder can choose to pay fixed premiums or variable premiums, which can be adjusted based on market performance. The cash value accumulation in the policy can be used to pay for premiums, providing financial security and flexibility.

Some key benefits include the ability to customize the policy, potential for cash value growth, and the option to increase or decrease the death benefit as needed. It also offers lifelong coverage, ensuring financial protection for your loved ones.

Yes, one of the unique features is the ability to withdraw cash value from the policy. Policyholders can take out loans or withdrawals, which can be useful for various financial needs. However, it's important to note that withdrawals may impact the policy's death benefit and overall value.

The death benefit is typically a function of the policy's cash value and the policyholder's age and health. It can be adjusted by the policyholder, allowing for flexibility in providing financial security to beneficiaries.