Considering enrolling in the mature defensive driver course can significantly impact your Geico insurance rates. This course equips drivers with valuable skills to enhance their safety on the road, potentially reducing the likelihood of accidents and claims. As a result, insurance companies often view these drivers as lower-risk, which can lead to lower premiums. This introduction sets the stage for a discussion on the potential benefits of the course for insurance savings.

| Characteristics | Values |

|---|---|

| Policy Impact | Taking the mature defensive driver course can lead to lower insurance premiums with Geico, as it demonstrates a commitment to safe driving. |

| Discount Amount | The discount varies, but it can range from 5% to 15% or more, depending on the state and Geico's policies. |

| Eligibility Criteria | Drivers must be at least 50 years old and have a clean driving record to be eligible for the mature driver discount. |

| Course Requirements | The course typically involves a combination of classroom instruction and behind-the-wheel training, covering topics like hazard recognition, vehicle control, and safe driving techniques. |

| State Variations | Discount availability and eligibility may vary by state, as Geico's policies and requirements can differ across regions. |

| Documentation | Proof of completion of the mature defensive driver course is usually required to claim the discount. |

| Renewal Benefits | The discount may be applied to both new and existing policies, and it can be renewed annually if the driver continues to meet the criteria. |

| Additional Perks | Some states offer additional benefits, such as reduced liability coverage or accident forgiveness, for mature drivers who complete the course. |

What You'll Learn

- Discount Structure: The course may offer specific discounts for its completion

- Claims Experience: Improved driving skills can lead to fewer claims and lower premiums

- Safety Training: Focus on defensive driving techniques to enhance road safety

- Insurance Rates: Geico's pricing policies and discounts for safe drivers

- Policy Adjustments: Completing the course might result in policy adjustments and savings

Discount Structure: The course may offer specific discounts for its completion

The Mature Defensive Driver Course can indeed provide a significant advantage for drivers seeking to lower their insurance premiums, particularly with companies like Geico. One of the key benefits is the potential for substantial discounts on insurance rates. When you complete this course, you demonstrate a commitment to safe driving practices and a proactive approach to improving your skills. This can be highly attractive to insurance providers, as it indicates a reduced risk of accidents and, consequently, lower insurance costs.

The discount structure varies by insurance company and policy, but it often includes a percentage reduction on the premium. For instance, completing the Mature Defensive Driver Course might earn you a 10-15% discount on your auto insurance with Geico. This discount can be applied to the overall policy or specific coverage, such as collision or comprehensive insurance. The more comprehensive the course and the better the driving record improvement, the higher the potential savings.

Additionally, some insurance companies offer loyalty rewards or additional discounts for completing driver education programs. These incentives can further reduce your insurance expenses. It's important to review the specific terms and conditions of your insurance policy and the course provider's guidelines to understand the exact discount structure and any eligibility criteria.

To maximize the benefits, consider the following: ensure you meet the course requirements, which may include a minimum age and a clean driving record. Also, maintain a consistent driving record post-course completion to avoid any increases in premiums due to accidents or violations. Regularly reviewing your policy and discussing any changes with your insurance agent can help you take full advantage of the discounts you've earned.

In summary, the Mature Defensive Driver Course can be a powerful tool for reducing insurance costs, especially with companies like Geico, through specific discount structures. Understanding these discounts and maintaining a safe driving record can lead to significant savings on your insurance premiums.

Understanding the Ins and Outs of Auto Insurance Supplements

You may want to see also

Claims Experience: Improved driving skills can lead to fewer claims and lower premiums

Improved driving skills can significantly impact your insurance premiums, especially when it comes to claims experience. By taking a mature defensive driver course, you're not only enhancing your knowledge of the road but also demonstrating a commitment to safe driving practices. This can result in a reduced number of insurance claims, which is a crucial factor in determining your premiums.

When you have fewer claims, insurance companies view you as a lower-risk driver. This is because a history of claims often indicates a pattern of accidents or incidents, which can be costly for the insurance provider. By improving your driving skills, you're less likely to be involved in accidents, and thus, the likelihood of making a claim decreases. As a result, insurance companies are more inclined to offer you lower premiums, as they perceive you as a safer and more responsible driver.

The mature defensive driver course equips you with valuable skills and knowledge. You'll learn about various driving techniques, such as maintaining a safe distance from other vehicles, anticipating potential hazards, and adapting to different road conditions. These skills not only improve your overall driving ability but also contribute to a more cautious and defensive mindset on the road. By practicing these techniques, you're less likely to make errors that could lead to accidents, further reducing the chances of insurance claims.

Additionally, completing the course can showcase your dedication to safe driving to insurance companies. Many insurers offer discounts or incentives for drivers who have completed defensive driving courses. This is because it demonstrates a proactive approach to safety, which can be appealing to insurance providers. As a result, you may be eligible for reduced premiums, making it a beneficial investment in both your driving skills and your insurance costs.

In summary, taking a mature defensive driver course can have a direct impact on your insurance premiums by improving your driving skills and reducing the likelihood of claims. This not only benefits you by potentially saving money on insurance but also contributes to safer roads and a more responsible driving community. It's a win-win situation, as you gain valuable skills and knowledge while also enjoying the financial advantages of lower insurance costs.

Disputing Auto Insurance Claims: Your Rights

You may want to see also

Safety Training: Focus on defensive driving techniques to enhance road safety

Defensive driving is a crucial skill for all drivers, especially those who want to improve their road safety and potentially lower their insurance premiums. The mature defensive driver course is an excellent initiative that equips drivers with the knowledge and techniques to handle various driving scenarios effectively. This training program focuses on proactive and responsive driving strategies, which can significantly reduce the risk of accidents and promote a safer driving environment.

The course typically covers a range of topics, including hazard perception, risk assessment, and the ability to anticipate potential dangers on the road. Drivers learn to maintain a safe following distance, recognize and respond to dangerous situations, and make informed decisions while driving. By mastering these skills, mature drivers can become more aware of their surroundings and take preventive measures to avoid accidents.

One of the key benefits of this training is its emphasis on hazard perception. Defensive drivers are taught to identify and react to potential hazards quickly. This includes recognizing sudden stops, lane changes, and other drivers' erratic behavior. By improving hazard perception, drivers can anticipate and respond to changing road conditions, reducing the likelihood of collisions.

Additionally, the course encourages drivers to adopt a proactive approach to driving. This involves maintaining a calm and focused mindset, which is essential for making sound decisions in stressful situations. Mature drivers are trained to anticipate other drivers' actions, plan their routes, and stay alert even in heavy traffic. These skills contribute to a more defensive and cautious driving style, ultimately improving overall road safety.

Taking the mature defensive driver course can have a positive impact on insurance premiums, especially with companies like Geico. Insurance providers often offer discounts to drivers who have completed such courses, as it demonstrates a commitment to safe driving practices. Lower insurance rates are a direct result of reduced accident risks, which can be significantly improved through defensive driving training. This initiative not only benefits individual drivers but also contributes to a safer and more responsible driving culture on the roads.

Consumer Insights: Auto Insurance for Households

You may want to see also

Insurance Rates: Geico's pricing policies and discounts for safe drivers

The mature defensive driver course can indeed have a positive impact on your Geico insurance rates, and understanding how this works is essential for any driver looking to save money on their premiums. Geico, a well-known insurance provider, offers various discounts to encourage safe driving habits and reward customers for their commitment to road safety. One such discount is specifically tailored to mature and experienced drivers who have completed a defensive driving course.

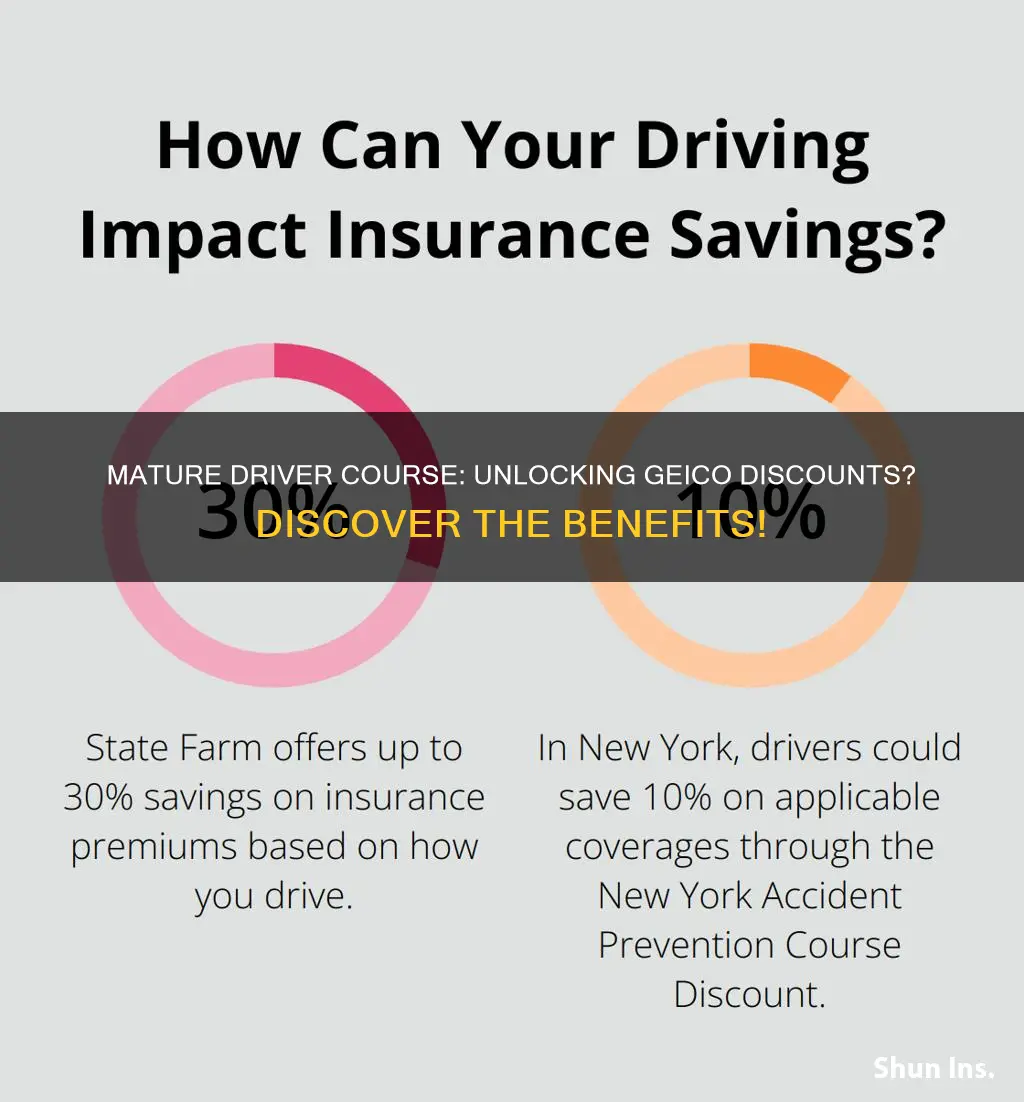

When you enroll in a mature defensive driver course, you demonstrate a proactive approach to improving your driving skills and understanding road safety. Geico recognizes this initiative and provides a discount as an incentive. The discount amount can vary, but it typically ranges from 5% to 10% off your insurance premiums. This reduction in cost is a direct result of your commitment to enhancing your driving abilities and reducing the likelihood of accidents.

To take advantage of this discount, you'll need to provide proof of completion for the mature defensive driver course. This proof could be in the form of a certificate or a letter from the course provider. Geico's customer service team can guide you through the process and ensure that your policy reflects the discount. It's important to note that this discount is often applied to the non-comprehensive portion of your policy, which covers liability, collision, and comprehensive insurance.

Additionally, Geico's pricing policies consider various factors when determining insurance rates. Safe driving habits, such as maintaining a clean driving record, are highly valued. A history of safe driving can lead to lower premiums over time. Geico also offers other discounts for safe drivers, such as the 'Safe Driver Bonus' and the 'Multi-Policy Discount,' further emphasizing their commitment to rewarding responsible driving.

In summary, taking the mature defensive driver course can significantly impact your Geico insurance rates. It demonstrates your dedication to road safety and can result in substantial savings. Geico's pricing policies encourage safe driving and provide discounts to reward customers who actively contribute to a safer driving environment. By enrolling in these courses and maintaining a safe driving record, you can enjoy the benefits of lower insurance premiums and contribute to a more secure driving experience.

Understanding Medical Coverage in Your Auto Insurance Bill

You may want to see also

Policy Adjustments: Completing the course might result in policy adjustments and savings

Completing the mature defensive driver course can indeed lead to significant policy adjustments and potential savings when it comes to your insurance premiums, particularly with companies like Geico. This course is designed to enhance your driving skills and promote safer driving habits, which can directly impact your insurance rates. Here's a detailed breakdown of how this might work:

Reduced Risk Assessment: Insurance companies, including Geico, often use risk-based pricing models. This means they assess the likelihood of a policyholder making a claim and adjust premiums accordingly. By completing a defensive driving course, you demonstrate a commitment to improving your driving skills and reducing the risk of accidents. This proactive approach can lead to a more favorable risk assessment from the insurance company, resulting in lower premiums.

Discounts and Incentives: Many insurance providers offer discounts to policyholders who have completed defensive driving courses. These discounts can vary, but they often amount to a percentage off your premium or a flat rate reduction. For instance, Geico might offer a discount of 10% or more for completing a certified defensive driving program. This direct savings can significantly lower your insurance costs over time.

Improved Driving Record: The course equips you with valuable skills and knowledge to handle various driving scenarios safely. As a result, you are less likely to be involved in accidents or traffic violations. A clean driving record is crucial for insurance companies as it indicates a lower risk of claims. With a reduced risk profile, insurance providers may offer more competitive rates or even remove certain coverage restrictions, further lowering your overall insurance expenses.

Enhanced Customer Profile: Insurance companies often view policyholders who actively engage in safety programs as more responsible and proactive. This can lead to a more positive perception of your driving habits and overall risk profile. As a result, you may be considered for additional benefits or loyalty programs offered by Geico, further enhancing your savings potential.

In summary, taking the mature defensive driver course can be a strategic move to lower your Geico insurance premiums. It not only improves your driving skills but also demonstrates a proactive approach to safety, which is highly valued by insurance companies. By understanding the potential policy adjustments and savings, you can make an informed decision about enrolling in such programs.

Infinity's Gap Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, taking the Mature Defensive Driver Course can lead to lower insurance premiums with Geico. This course demonstrates a commitment to safe driving and can result in a discount on your policy.

Savings vary, but Geico often offers a 10-15% discount for completing the Mature Defensive Driver Course. Some drivers may even qualify for additional discounts, making it a valuable investment in your insurance.

While not always mandatory, completing the course can enhance your chances of receiving discounts. Geico may consider it as a positive factor in your driving history and risk assessment.

Yes, many insurance providers recognize the Mature Defensive Driver Course and its benefits. You can typically use the certificate to negotiate lower rates with various insurers, not just Geico.

The course is generally available to drivers of all ages, but it is particularly beneficial for mature drivers who want to improve their driving skills and potentially lower their insurance costs.