When it comes to renting out your car through Turo, understanding the insurance requirements is crucial. While Turo provides insurance coverage for its hosts, it's essential to know that this insurance might not always be sufficient or cover all potential risks. This means that having your own car insurance is often a wise choice to ensure you're fully protected in case of any unforeseen events during the rental period. In this paragraph, we'll explore the insurance considerations for Turo hosts and why having your own policy can provide added peace of mind.

| Characteristics | Values |

|---|---|

| Legal Requirement | Turo requires drivers to have a valid driver's license and proof of insurance. However, Turo's insurance policy covers the vehicle and driver, so you don't need to provide your own insurance. |

| Coverage | Turo's insurance covers the vehicle, driver, and any passengers. It includes liability coverage, collision damage waiver, and personal injury protection. |

| Additional Benefits | Drivers can choose to purchase additional coverage options, such as rental car insurance or roadside assistance, through Turo. |

| Driver Eligibility | Drivers must be at least 21 years old and have a clean driving record. Turo also has a points-based system to assess driving risk. |

| Insurance Provider | Turo partners with various insurance companies to provide coverage. The specific provider may vary depending on the vehicle and location. |

| Cancellation Policy | If a driver cancels their Turo reservation, Turo's insurance coverage may continue for the duration of the reservation, depending on the terms and conditions. |

What You'll Learn

- Legal Requirements: Understanding mandatory insurance laws for Turo rentals

- Turo's Insurance Policy: Overview of Turo's insurance coverage and requirements

- Driver's Insurance: How personal insurance interacts with Turo rentals

- Coverage Gaps: Identifying potential gaps in insurance when using Turo

- Financial Protection: Turo's insurance ensures financial security for drivers and owners

Legal Requirements: Understanding mandatory insurance laws for Turo rentals

When it comes to renting a car through Turo, understanding the legal requirements regarding insurance is crucial for both drivers and hosts. The insurance landscape can vary depending on your location and the specific regulations set by each state or country. Here's a breakdown of the key points to consider:

Mandatory Insurance for Drivers:

In most regions, having car insurance is a legal obligation for drivers. When renting a car through Turo, it is essential to ensure that you have the necessary coverage. Turo provides a liability insurance policy for its rentals, which typically covers damage to the vehicle and third-party liability. However, it's important to note that this insurance might not be sufficient for all situations. Drivers should review their own insurance policies to understand their coverage and any potential gaps. For instance, if you have comprehensive or collision coverage on your personal vehicle, you might want to ensure that Turo's insurance doesn't interfere with these existing policies.

Insurance for Hosts (Car Owners):

Turo hosts, who list their vehicles for rent, also have specific insurance considerations. Hosts are typically required to have a personal auto insurance policy that covers rental usage. This means that the host's insurance should be adjusted to include rental coverage. It is advisable for hosts to inform their insurance provider about their Turo activities to ensure they have the appropriate coverage. Additionally, hosts might need to consider additional insurance options, such as damage waiver or liability insurance, to protect themselves from potential financial losses in case of accidents or damage to the rented vehicle.

Local Regulations and Variations:

Insurance laws can vary significantly from one jurisdiction to another. It is essential to research and understand the specific regulations in your area. Some regions might require additional insurance coverage, such as personal injury protection or medical payments coverage, which are not typically included in Turo's standard insurance. Local laws may also dictate the minimum liability coverage required, so drivers should ensure they meet these standards.

Turo's Insurance Options:

Turo offers various insurance add-ons that drivers can purchase to customize their coverage. These options can include damage waiver, liability insurance, and personal accident insurance. Understanding these add-ons and their costs is essential for drivers to make informed decisions, especially if they have existing insurance coverage.

In summary, while Turo provides a basic insurance layer, it is the responsibility of both drivers and hosts to ensure compliance with local insurance laws. Thorough research and consultation with insurance professionals can help individuals navigate the legal requirements, ensuring a smooth and legally compliant Turo rental experience.

Auto Insurance Deductibles: When to Increase and Manage Risks

You may want to see also

Turo's Insurance Policy: Overview of Turo's insurance coverage and requirements

Turo, a popular car-sharing platform, offers a unique way for individuals to rent and drive vehicles. When participating in the Turo marketplace, understanding the insurance coverage and requirements is essential for both hosts and renters. Here's an overview of Turo's insurance policy and the coverage it provides:

Insurance Coverage for Hosts:

Turo provides insurance coverage for hosts, which is a crucial aspect of the platform's safety net. When a host lists their vehicle on Turo, they are automatically covered by the platform's insurance policy. This coverage typically includes liability insurance, which protects the host against claims related to bodily injury or property damage to third parties. The liability coverage is designed to cover the host's legal and medical expenses in the event of an accident. Additionally, Turo's insurance may also include collision damage waiver (CDW) and personal injury protection (PIP), offering further protection for the host's vehicle and the renter.

Insurance for Renters:

Renters using Turo also benefit from comprehensive insurance coverage. When a renter books a car, Turo's insurance policy automatically applies, providing a layer of protection during the rental period. This coverage often includes liability insurance, which safeguards the renter against financial losses if they cause damage to another person's property or vehicle. In some cases, Turo's insurance might also cover personal belongings left in the rented car, providing peace of mind for renters. It is important to note that the specific coverage details can vary, so renters should review the policy carefully before accepting the rental agreement.

Requirements and Exclusions:

Turo's insurance policy has certain requirements and exclusions that both hosts and renters should be aware of. For hosts, it is mandatory to have a valid driver's license and a clean driving record. The vehicle must also be in good condition, with regular maintenance and proper documentation. As for renters, they need to meet Turo's eligibility criteria, which may include a minimum age and a valid driver's license. Renters should also be aware of any additional insurance requirements or restrictions imposed by their personal insurance providers.

Understanding the insurance coverage and requirements is vital to ensure a smooth and protected experience on the Turo platform. Both hosts and renters should familiarize themselves with the policy details, including any specific conditions or limitations, to make informed decisions and manage potential risks effectively.

Insuring Mom: Adding a Parent to Your Auto Policy

You may want to see also

Driver's Insurance: How personal insurance interacts with Turo rentals

The relationship between personal insurance and Turo rentals is an important consideration for drivers who choose to rent out their vehicles through the Turo platform. When you list your car on Turo, you are essentially renting it to other drivers, and understanding the insurance dynamics is crucial to ensure both your protection and that of your renters.

In most cases, your personal insurance policy will not cover Turo rentals. Standard auto insurance policies typically only provide coverage for the policyholder and their authorized drivers. When you rent your car to others through Turo, you are essentially extending the use of your vehicle to a third party, which falls outside the scope of your personal insurance coverage. This means that if an accident occurs while your car is rented, your personal insurance might not be sufficient to cover the damages or injuries.

To address this, Turo provides its own insurance coverage for both the host (the car owner) and the renter. As a host, you are automatically covered by Turo's Host Protection Plan, which includes liability coverage and collision damage waiver (CDW) for your vehicle while it is listed on the platform. This coverage ensures that you are protected financially in case of accidents, theft, or other covered incidents. The CDW, in particular, is a valuable feature as it covers the deductible amount if your car is damaged in an accident, saving you from potential out-of-pocket expenses.

However, it's essential to review the terms and conditions of Turo's insurance policies carefully. Different rental periods and coverage options may apply, and understanding these details will help you make informed decisions when renting out your car. Additionally, some personal insurance companies may offer additional coverage or endorsements specifically for vehicle-sharing platforms like Turo. Checking with your insurance provider can help you determine if you have any additional coverage that could be relevant to your Turo rentals.

In summary, while your personal insurance may not cover Turo rentals, Turo's insurance programs provide the necessary protection for both hosts and renters. Understanding these insurance interactions is vital to ensure a smooth and secure experience when using Turo, allowing you to rent your car with confidence.

Lemonade: Auto Insurance Available?

You may want to see also

Coverage Gaps: Identifying potential gaps in insurance when using Turo

When considering using Turo, a car-sharing platform, it's crucial to understand the insurance landscape to avoid potential coverage gaps. Many car owners might assume that their existing auto insurance policy covers them when they list their vehicle on Turo. However, this is not always the case, and there are several gaps in coverage that drivers should be aware of.

Firstly, standard auto insurance policies typically cover the policyholder's vehicle, but they often exclude coverage for vehicles owned by others. When you list your car on Turo, you are essentially renting it out to others, which falls outside the scope of your regular insurance policy. This means that if an accident occurs while your car is being used by a Turo driver, your insurance might not provide the necessary coverage.

Secondly, Turo provides its own insurance coverage, but it may not be comprehensive enough. Turo's insurance policy typically covers damage to the listed vehicle, but it might not extend to other vehicles involved in an accident. Additionally, the coverage limits and exclusions can vary, leaving gaps in protection. For instance, Turo's insurance might not cover comprehensive damage, such as theft or natural disasters, which are often part of standard auto insurance policies.

To address these coverage gaps, drivers should carefully review their insurance policies and consider the following:

- Contact Your Insurer: Inform your insurance company about your Turo activities and inquire about any specific coverage options or endorsements they offer for rental or sharing purposes. They might provide additional coverage or guide you on how to ensure adequate protection.

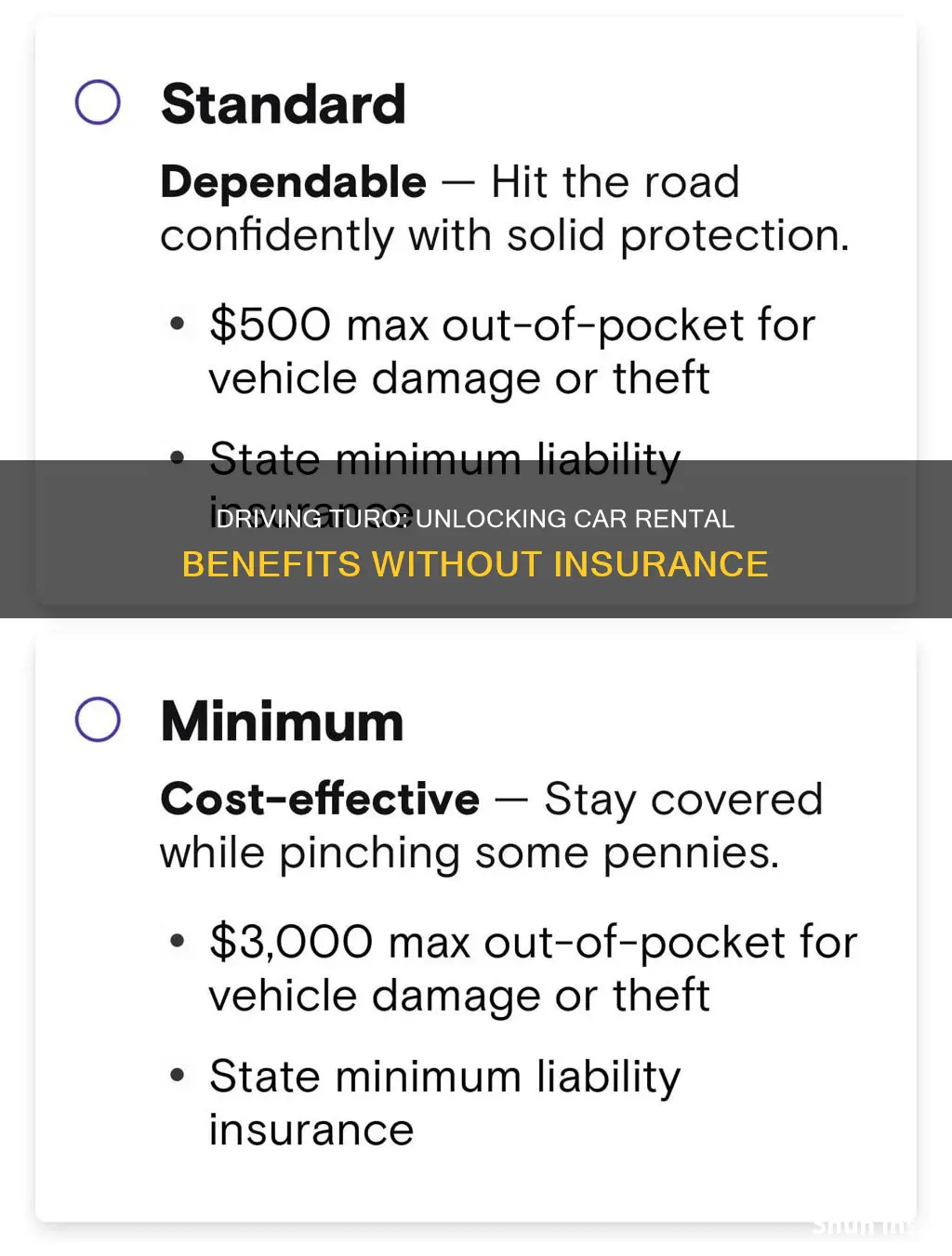

- Turo's Insurance Options: Turo offers different insurance plans, including primary and secondary coverage. Understand the terms and conditions of these plans to ensure you have the appropriate level of protection.

- Consider Additional Coverage: Depending on your circumstances, you may need to obtain additional insurance specifically for Turo. This could include liability coverage for any accidents or damage caused by the Turo drivers.

Identifying and addressing these coverage gaps is essential to ensure that you and your vehicle are adequately protected when using Turo. By taking the necessary steps, you can minimize the risks and have peace of mind while sharing your car with others.

Lost Wages and Auto Insurance Tax

You may want to see also

Financial Protection: Turo's insurance ensures financial security for drivers and owners

When it comes to using Turo, a car-sharing platform, understanding the insurance requirements is crucial for both drivers and vehicle owners. One common question that arises is whether you need car insurance to drive a car listed on Turo. The answer is yes, having car insurance is essential, and it provides financial protection for all parties involved in the car-sharing process.

Turo's insurance policy is designed to offer comprehensive coverage, ensuring that drivers and vehicle owners are protected financially in various scenarios. This insurance coverage is an integral part of the Turo experience, providing peace of mind and security. For drivers, having insurance is mandatory to drive any car listed on the platform. This requirement is in place to protect both the driver and the vehicle owner. In the event of an accident, theft, or damage, the insurance coverage ensures that financial responsibility is met, covering potential costs and liabilities.

The financial protection offered by Turo's insurance extends to both drivers and vehicle owners. For drivers, it means that they can enjoy the flexibility of car-sharing without the constant worry of potential financial burdens. In the event of an incident, the insurance policy will cover the necessary expenses, including medical bills, property damage, and legal fees. This coverage is particularly important for drivers who may not have their own comprehensive insurance policy or who want additional protection for their Turo rentals.

For vehicle owners, Turo's insurance provides a safety net, ensuring that their investment is protected. If a driver causes damage to the vehicle while renting it, the insurance coverage will compensate the owner for the repairs. This aspect is crucial, as it safeguards the financial interests of vehicle owners, allowing them to rent their cars with confidence. The insurance policy also covers theft or total loss, providing financial security and peace of mind to both parties.

In summary, Turo's insurance is a vital component of the car-sharing experience, offering financial protection to both drivers and vehicle owners. It ensures that everyone involved can participate in the platform with confidence, knowing that they are covered in various situations. Understanding the insurance requirements and coverage is essential to fully utilize Turo's services and drive with peace of mind.

Auto Insurance Claims: Small Court, Big Impact?

You may want to see also

Frequently asked questions

Yes, you must have valid car insurance to drive with Turo. Turo requires all drivers to provide proof of insurance coverage that meets their minimum requirements. This ensures that you are protected in case of any accidents or damages during your rental period.

Turo accepts both personal auto insurance and commercial auto insurance, provided it meets the minimum liability coverage requirements. The insurance must be active and valid for the duration of the rental. Make sure to check Turo's website for the specific coverage limits they accept.

Absolutely! You can use your personal auto insurance policy as long as it covers the vehicle you're renting and meets Turo's requirements. Turo provides a list of recommended insurance providers, but you can also use your own insurance company if it complies with their guidelines.

If you don't have car insurance, you won't be able to drive with Turo. Turo's insurance requirements are in place to protect both the drivers and the vehicle owners. It's essential to have insurance coverage to ensure financial protection and legal compliance.

Turo offers optional insurance add-ons that you can purchase for added protection. These may include damage waiver, liability coverage, or personal accident insurance. These add-ons can provide extra peace of mind, especially for high-value vehicles or if you have specific concerns.