Permanent life insurance is a type of insurance policy that provides coverage for the entire life of the policyholder, as long as premiums are paid. Unlike term life insurance, which only covers a specific period, permanent life insurance offers lifelong protection. It typically includes a death benefit and a savings element, allowing policyholders to build cash value within their policy. This cash value can be accessed during the policyholder's lifetime, providing financial flexibility. Permanent life insurance is ideal for individuals seeking long-term protection and is often utilized by families, business owners, and high-net-worth individuals. It offers peace of mind, knowing that loved ones will be financially secure even after the policyholder's passing.

What You'll Learn

- Permanent life insurance lasts the entire life of the policyholder

- It combines a death benefit with a savings component

- Whole life insurance is a common type of permanent life insurance

- Permanent life insurance is more expensive than term life insurance

- Permanent life insurance policies have tax advantages

Permanent life insurance lasts the entire life of the policyholder

Permanent life insurance is a type of insurance policy that provides coverage for the entire life of the insured person, as long as premiums are paid. It is designed to offer long-term or lifelong protection and typically includes a death benefit along with a savings component. This means that permanent life insurance policies will last the entire life of the policyholder, providing coverage until they pass away, regardless of their age.

The key advantage of permanent life insurance is that it offers indefinite coverage, whereas term life insurance only covers a specific period. Permanent life insurance policies guarantee a death benefit payout, ensuring financial protection for loved ones, regardless of when the policyholder passes away. This makes it ideal for those seeking long-term financial protection and looking to create an inheritance for their heirs.

Permanent life insurance also offers the ability to accumulate cash value. The savings component allows the policy to build cash value over time, which can be accessed by the policyholder during their lifetime. This feature provides financial flexibility and can be used for various purposes, such as unexpected emergencies, milestone events, or investment opportunities. However, withdrawing or borrowing against the cash value will reduce the future death benefit for beneficiaries.

It's important to note that permanent life insurance policies have higher premiums compared to term life insurance. The cost of permanent coverage is typically more expensive due to the lifelong duration and the inclusion of a savings component. As a result, permanent life insurance may be more suitable for individuals who can afford the higher premiums and are seeking indefinite coverage and savings opportunities.

Overall, permanent life insurance lasting the entire life of the policyholder provides peace of mind and financial security for both the insured person and their loved ones. It removes the limitations of term life insurance and allows individuals to plan for their future and that of their beneficiaries.

Life Insurance Disqualifiers: Health, Age, and Lifestyle Factors

You may want to see also

It combines a death benefit with a savings component

Permanent life insurance is a type of insurance policy that provides coverage for the full lifetime of the insured person. It is designed to offer long-term protection and typically combines a death benefit with a savings component. This means that if the policy is active when the policyholder dies, their beneficiaries will receive a death benefit payout, and the policy can also be used as a savings tool.

The savings component of permanent life insurance allows the policy to build cash value over time. This cash value can be accessed by the policyholder during their lifetime, for example, to help pay for unexpected emergencies or significant expenses such as college tuition or retirement. The cash value generally grows on a tax-deferred basis, meaning the policyholder pays no taxes on earnings as long as the money stays in the policy.

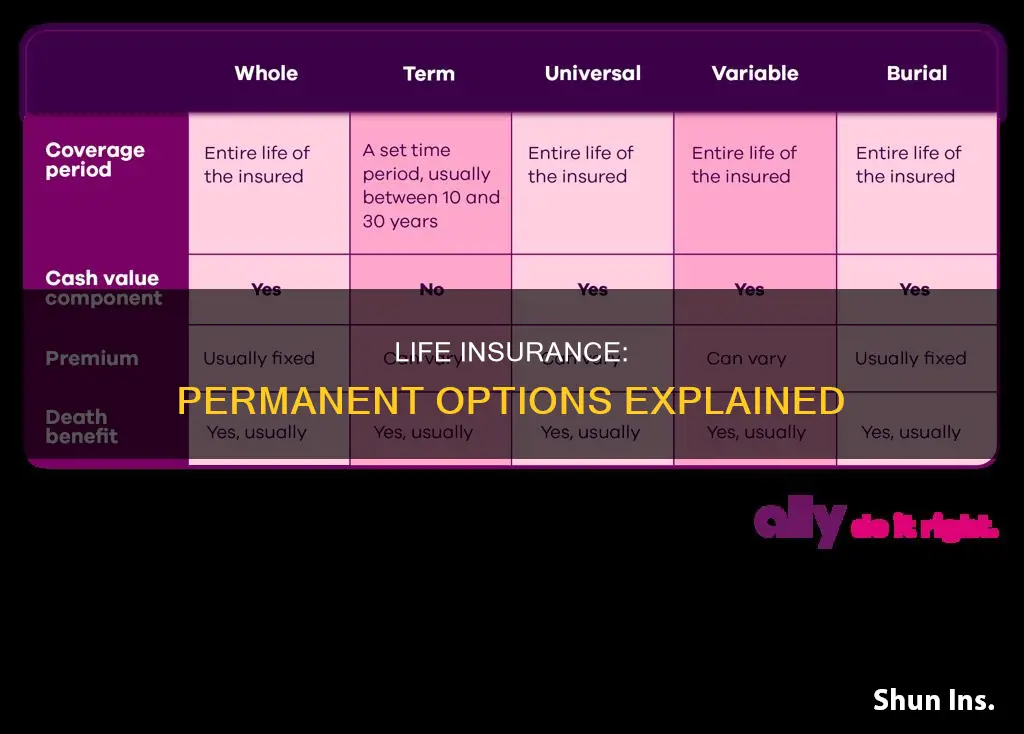

There are different types of permanent life insurance policies, including whole life and universal life. Whole life insurance policies have fixed premiums that do not change over time, even as the policyholder's age and health status change. These policies offer stable and predictable coverage. On the other hand, universal life insurance provides more flexibility, allowing the policyholder to adjust their premiums and, to some extent, the death benefit amount.

Permanent life insurance is ideal for individuals seeking long-term protection without a specific endpoint. It can provide peace of mind that loved ones will be financially protected in the event of the policyholder's death, regardless of when it occurs. Additionally, the savings component offers financial benefits during the policyholder's lifetime, making permanent life insurance a versatile tool for financial planning.

Understanding Bank-Owned Life Insurance: An Intangible Asset?

You may want to see also

Whole life insurance is a common type of permanent life insurance

Permanent life insurance is a type of insurance that provides coverage for the full lifetime of the insured person. It combines a death benefit with a savings component that earns interest on a tax-deferred basis. Whole life insurance is the most common type of permanent life insurance.

Whole life insurance is characterized by level premiums and a savings component. It lasts the policyholder's entire life, with regularly scheduled premiums to keep the policy active. The premiums are predetermined and then fixed for the life of the policy, as long as the policy is kept current. Whole life insurance also has a guaranteed, fixed death benefit, as well as a guaranteed growth rate for the cash value. This growth rate is usually around 3-4%, which is far less than historic stock market returns of 7-10%.

The premiums for whole life insurance policies are generally quite high, and the death benefit is usually low. For example, a whole life policy typically costs 10 times what a term life policy would for the same amount of death benefit. Despite the high premiums, whole life insurance is a good option for those who need long-term financial protection, want to create an inheritance for their heirs, or prefer stable premiums.

In addition to the death benefit, whole life insurance policies offer the opportunity to build cash value. This cash value can be accessed to help pay for unexpected emergencies or milestone events, such as college tuition or retirement. The cash value generally grows tax-deferred, providing tax advantages while the balance remains in the policy. Withdrawals of up to the total of premiums paid are typically not taxed. However, taking out the policy's cash value will reduce the future death benefit for heirs.

Whole Life Insurance: Grow Your Money, Securely

You may want to see also

Permanent life insurance is more expensive than term life insurance

Permanent life insurance policies are designed to provide long-term or lifelong coverage, as long as the premiums are paid. Term life insurance, on the other hand, provides temporary protection for a set period, often up to 30 years. While term life insurance policies may be renewable, this is usually only up to a specific age, and the premiums will increase with each renewal. Permanent life insurance policies, on the other hand, have premiums that are locked in at the time of purchase and are guaranteed not to increase.

Permanent life insurance policies also offer a cash value component, which allows the policyholder to build up a cash value that can be accessed and used during their lifetime. This cash value grows over time and can be used for emergencies or milestone events like college and retirement. Term life insurance, on the other hand, does not offer a cash value component, which makes the premiums lower.

Another benefit of permanent life insurance is that it offers tax advantages. The cash value component of a whole life policy grows tax-deferred, and the death benefit paid to beneficiaries is typically tax-free. In contrast, term life insurance does not offer these tax benefits.

Finally, permanent life insurance policies offer more flexibility than term life insurance policies. For example, universal life insurance, a type of permanent life insurance, allows the policyholder to adjust their premium payments and death benefit within certain limits. This flexibility can be useful if the policyholder's circumstances change.

Life Insurance in Canada: Getting Covered

You may want to see also

Permanent life insurance policies have tax advantages

The two primary types of permanent life insurance are whole life and universal life. The cash value of whole life insurance grows at a guaranteed rate. Universal life insurance also contains savings and a death benefit, but it features more flexible premium options, and its earnings are based on market interest rates. Variable life and variable universal life also provide expanded options to invest the cash value in mutual funds and other financial instruments.

The cash value of permanent life insurance can be accessed through loans and withdrawals. In general, loans are charged interest but are usually not taxable. Withdrawals are only taxed when the amount withdrawn exceeds the total of the premiums paid. However, taking cash value out of a permanent policy through a withdrawal or loan will reduce the future death benefit for heirs.

Life Insurance and Bank Accounts: What's the Connection?

You may want to see also

Frequently asked questions

Permanent life insurance is a type of insurance policy that provides coverage for the full lifetime of the insured person. It is designed to be long-term protection and can last a lifetime as long as premiums are paid.

Permanent life insurance policies typically have a death benefit and a savings component. The savings element allows the policy to build cash value over time, which can be accessed for emergencies or milestone events. This cash value generally grows on a tax-deferred basis, meaning the policyholder pays no taxes on earnings as long as the money stays in the policy.

Permanent life insurance costs depend on a variety of factors such as age, medical history, family size, and location. While it can be more expensive than term life insurance, permanent life insurance may be more efficient in the long run as it never needs to be renewed and rates don't increase with age.

The two primary types of permanent life insurance are whole life and universal life. Whole life insurance policies have fixed premiums and a guaranteed growth rate for the cash value. Universal life insurance offers more flexibility with adjustable premiums and the cash value grows based on market interest rates.