Life insurance is a crucial aspect of financial planning, providing financial security and peace of mind to individuals and their loved ones. When considering which insurance policies actively participate in life coverage, it's important to understand the different types available. Term life insurance offers coverage for a specified period, providing a death benefit if the insured passes away during that time. Whole life insurance, on the other hand, provides lifelong coverage and includes an investment component, allowing policyholders to build cash value over time. Additionally, universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust their coverage as their needs change. Understanding these options can help individuals choose the best insurance policy to suit their specific needs and ensure their financial well-being.

What You'll Learn

- Health Insurance: Covers medical expenses and promotes active, healthy living

- Life Insurance: Provides financial protection for dependents in the event of death

- Disability Insurance: Offers income replacement when an individual cannot work due to illness or injury

- Long-Term Care Insurance: Helps cover costs of long-term care services and support

- Critical Illness Insurance: Provides financial assistance for serious illnesses, aiding in recovery and treatment

Health Insurance: Covers medical expenses and promotes active, healthy living

Health insurance is a vital component of a healthy and active lifestyle, offering financial protection and peace of mind. This type of insurance is designed to cover medical expenses, ensuring that individuals can access the necessary healthcare services without incurring significant financial burdens. By having health insurance, you gain the freedom to focus on your well-being and make choices that promote an active and healthy life.

When it comes to medical expenses, health insurance acts as a safety net. It covers a wide range of healthcare costs, including doctor visits, hospital stays, emergency room treatments, prescription medications, and even preventive care. With insurance, you can seek medical attention promptly without worrying about the financial implications. This encourages individuals to take a proactive approach to their health, seeking regular check-ups and early interventions, which are essential for maintaining an active lifestyle.

The benefits of health insurance extend beyond financial coverage. Many insurance plans also offer additional features that promote a healthy and active life. These may include incentives for regular exercise, such as discounted gym memberships or rewards for completing fitness challenges. Some plans provide access to wellness programs, offering guidance on nutrition, stress management, and overall healthy living. These programs empower individuals to make informed choices and adopt habits that contribute to their long-term well-being.

Furthermore, health insurance can provide coverage for various activities and sports that promote an active lifestyle. Whether it's participating in team sports, cycling, hiking, or simply enjoying outdoor activities, having insurance can offer peace of mind. In the event of injuries or accidents, health insurance ensures that individuals can receive the necessary medical treatment without financial constraints. This encourages people to engage in physical activities and explore their passions, knowing that their health is protected.

In summary, health insurance plays a crucial role in covering medical expenses and promoting an active, healthy lifestyle. It enables individuals to access healthcare services, make informed choices about their well-being, and engage in activities that contribute to their overall fitness. With the right insurance plan, you can focus on living an active life, knowing that your health is protected and that you have the resources to make positive choices.

Symetra Life Insurance: A Comprehensive Guide to Understanding Your Coverage

You may want to see also

Life Insurance: Provides financial protection for dependents in the event of death

Life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones. It provides a financial safety net for dependents in the event of the policyholder's death, ensuring that their financial obligations and future needs are met. This type of insurance is designed to offer peace of mind and financial security, knowing that your family will be taken care of even if you are no longer around.

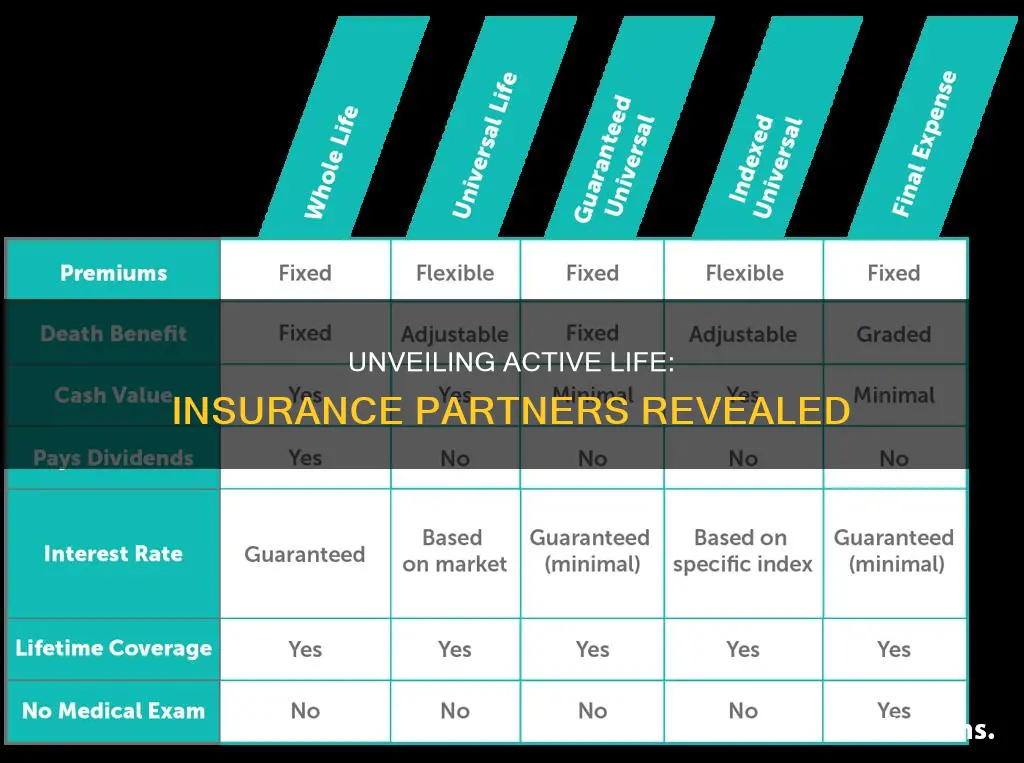

When considering life insurance, it's essential to understand the various types available. Term life insurance is a popular choice, offering coverage for a specified period, such as 10, 20, or 30 years. This term provides a fixed amount of financial protection during the agreed-upon period, ensuring that your dependents have the necessary funds to cover expenses and maintain their standard of living. On the other hand, permanent life insurance provides lifelong coverage, offering a combination of death benefit and a cash value component that can accumulate over time. This type of policy can be tailored to individual needs and may offer additional benefits like tax advantages and investment opportunities.

The primary purpose of life insurance is to provide financial security for your loved ones. It ensures that your dependents can cover essential expenses, such as mortgage payments, education costs, and daily living expenses, even if you are no longer able to provide for them. By having a life insurance policy, you can leave a lasting legacy and ensure that your family's financial future is protected. It allows your dependents to grieve without the added stress of financial worries, providing them with the freedom to make decisions regarding their future without the burden of financial constraints.

When purchasing life insurance, it is crucial to consider your specific circumstances and needs. Factors such as age, health, lifestyle, and financial obligations will influence the type and amount of coverage required. Younger individuals may opt for term life insurance, which is generally more affordable, while those seeking long-term financial protection might choose permanent life insurance. Additionally, it is essential to review and compare different insurance providers to find the best rates and coverage options that align with your budget and requirements.

In summary, life insurance is a vital component of financial planning, offering a safety net for your dependents in the event of your passing. It provides the necessary financial protection to ensure your family's well-being and peace of mind. By understanding the different types of life insurance and assessing your personal needs, you can make an informed decision to secure your loved ones' future. Remember, investing in life insurance is an act of love and responsibility, ensuring that your family can thrive even in your absence.

Get Your Ohio Life Insurance License: Quick Guide

You may want to see also

Disability Insurance: Offers income replacement when an individual cannot work due to illness or injury

Disability insurance is a crucial component of financial planning, providing a safety net for individuals who are unable to work due to illness or injury. This type of insurance offers a replacement income, ensuring that policyholders can maintain their standard of living and cover essential expenses during a period of disability. It is designed to provide financial security and peace of mind, knowing that one's income is protected in times of unexpected health issues.

When an individual becomes disabled and is unable to perform their regular duties, disability insurance steps in to fill the gap. The insurance company pays a regular benefit amount, typically a percentage of the policyholder's pre-disability income, to cover living expenses and other financial obligations. This income replacement can be a lifeline, allowing individuals to focus on their recovery and rehabilitation without the added stress of financial strain. The benefits can be adjusted to meet the policyholder's specific needs, ensuring a more personalized and comprehensive support system.

The process of claiming disability insurance benefits involves a thorough assessment of the policyholder's medical condition and its impact on their ability to work. Insurance companies often require medical evidence and may conduct interviews or assessments to determine the extent of the disability. This process ensures that the benefits are provided fairly and accurately, reflecting the individual's specific circumstances. It is essential for policyholders to understand their rights and responsibilities during this process to ensure a smooth and successful claim.

There are two main types of disability insurance: short-term and long-term. Short-term disability insurance provides coverage for a limited period, often up to a year, and is designed to bridge the gap until the individual can return to work. Long-term disability insurance, on the other hand, offers extended coverage, sometimes for the rest of the policyholder's life, if they are unable to return to work permanently. Both types of insurance can be tailored to suit individual needs, with various benefit options and waiting periods available.

In summary, disability insurance is a vital tool for managing the financial risks associated with illness or injury. It provides a reliable source of income replacement, ensuring that individuals can maintain their financial stability and focus on their health during challenging times. With the right coverage, policyholders can have the confidence to face unexpected disabilities, knowing they have a safety net in place.

Understanding Tax Implications of Group Term Life Insurance Proceeds

You may want to see also

Long-Term Care Insurance: Helps cover costs of long-term care services and support

Long-term care insurance is a crucial component of a comprehensive financial plan, especially for individuals who want to ensure they have the necessary support and coverage for their future care needs. This type of insurance is designed to provide financial assistance and peace of mind when facing the challenges of long-term care, which can be both physically and financially demanding. Here's a detailed look at how long-term care insurance can help:

Understanding Long-Term Care Needs: As people age, they may encounter situations where they require ongoing medical care, assistance with daily activities, or specialized services. This could include help with bathing, dressing, medication management, or even just companionship. Long-term care services are often provided in various settings, such as nursing homes, assisted living facilities, or even at home with the support of in-home care providers. The need for long-term care can arise unexpectedly and may last for months or even years, impacting an individual's financial resources and quality of life.

The Role of Long-Term Care Insurance: Long-term care insurance is specifically tailored to address these potential future needs. It provides financial protection by covering the costs associated with long-term care services. When an individual purchases this insurance, they agree to pay regular premiums, and in return, the insurance company promises to pay for eligible long-term care expenses. This coverage can include a range of services, from skilled nursing care to home health aides and even adult day care services. The goal is to ensure that policyholders can access the care they need without incurring substantial out-of-pocket expenses.

Benefits of Long-Term Care Insurance: One of the key advantages of having long-term care insurance is the ability to maintain financial independence and control over one's care. Without insurance, the costs of long-term care can be overwhelming, often leading to the depletion of savings and even the sale of assets. Long-term care insurance helps individuals and their families by providing a steady stream of financial support, allowing them to focus on recovery, rehabilitation, or simply enjoying their later years without the added stress of financial burdens. Moreover, this insurance can be customized to fit individual needs, with various coverage options and benefit amounts available.

Eligibility and Participation: Long-term care insurance is available to individuals of various ages and health conditions, making it an inclusive option for active life insurance participation. It is often recommended to consider this insurance as part of a comprehensive financial strategy, especially for those approaching retirement age. Many insurance companies offer long-term care policies, and the terms and conditions may vary. It is essential to review and compare different plans to find the one that best suits your needs and budget. Additionally, some employers may offer long-term care insurance as a benefit, providing an opportunity to secure coverage through your workplace.

In summary, long-term care insurance is a vital consideration for anyone looking to protect their financial well-being and ensure they have access to the care they may need in the future. By understanding the potential costs and benefits, individuals can make informed decisions about their insurance options, ultimately leading to a more secure and comfortable retirement.

Universal Life Insurance: Definition and Benefits Explained

You may want to see also

Critical Illness Insurance: Provides financial assistance for serious illnesses, aiding in recovery and treatment

Critical Illness Insurance is a specialized type of coverage designed to provide financial support during challenging times. This insurance is tailored to offer a lump sum payment or regular income if the policyholder is diagnosed with a critical illness, such as cancer, heart attack, stroke, or other specified conditions. The primary purpose is to ease the financial burden associated with the diagnosis and treatment of these serious illnesses, allowing individuals to focus on their health and recovery.

When an individual is diagnosed with a critical illness, the financial implications can be overwhelming. Medical expenses, loss of income, and the need for specialized care can strain personal finances. Critical Illness Insurance steps in to provide a safety net, ensuring that policyholders receive the necessary financial assistance to manage these challenges. It empowers individuals to access the best available treatment options without the added stress of financial constraints.

The benefits of this insurance extend beyond the immediate financial relief. It enables policyholders to take a proactive approach to their health. With the financial support, individuals can afford comprehensive treatment plans, including access to top medical professionals, advanced therapies, and personalized care. This can significantly improve recovery rates and long-term health outcomes. Moreover, the insurance can cover various expenses, such as hospital stays, medication, rehabilitation, and even home modifications required during the recovery process.

This type of insurance is a valuable addition to a comprehensive financial plan. It complements other insurance policies, such as life insurance or disability insurance, by providing targeted support for specific health concerns. By understanding the coverage and benefits, individuals can make informed decisions about their insurance choices, ensuring they are adequately prepared for potential critical illnesses.

In summary, Critical Illness Insurance offers a unique and essential layer of protection, providing financial assistance when it matters most. It empowers individuals to navigate the challenges of serious illnesses with the peace of mind that their financial well-being is secure. With the right insurance coverage, individuals can focus on their health and recovery, knowing they have the necessary support to manage the associated financial burdens.

Ameritas vs New York Life: Which Insurance is Better?

You may want to see also

Frequently asked questions

As of my last update, the following insurance providers are known to participate in the Active Life program: [List the names of the insurance companies]. It's always a good idea to check with the official Active Life website or contact their customer support for the most up-to-date list of participating insurers.

You can verify your insurance coverage by visiting the Active Life website and using their 'Insurance Finder' tool. Simply enter your insurance provider's name and policy details, and the tool will provide information on their participation in the Active Life network. Alternatively, you can contact Active Life's customer service team for assistance.

Active Life typically accepts a wide range of insurance policies, including health, life, disability, and critical illness insurance. However, there may be specific criteria or exclusions, so it's essential to review the terms and conditions of your chosen insurance plan to ensure it aligns with Active Life's requirements.

Yes, you can switch insurance companies as long as the new provider is also participating in the Active Life network. You'll need to notify Active Life of the change and provide the necessary documentation to update your records. It's recommended to review the terms of your new insurance policy to understand any potential impact on your Active Life coverage.

If your insurance company withdraws from the Active Life program, you will need to explore alternative insurance options that meet your coverage needs. Active Life may provide resources or recommendations to help you find suitable insurance alternatives. It's advisable to regularly review and update your insurance coverage to ensure it remains aligned with your evolving needs and the offerings of participating insurers.