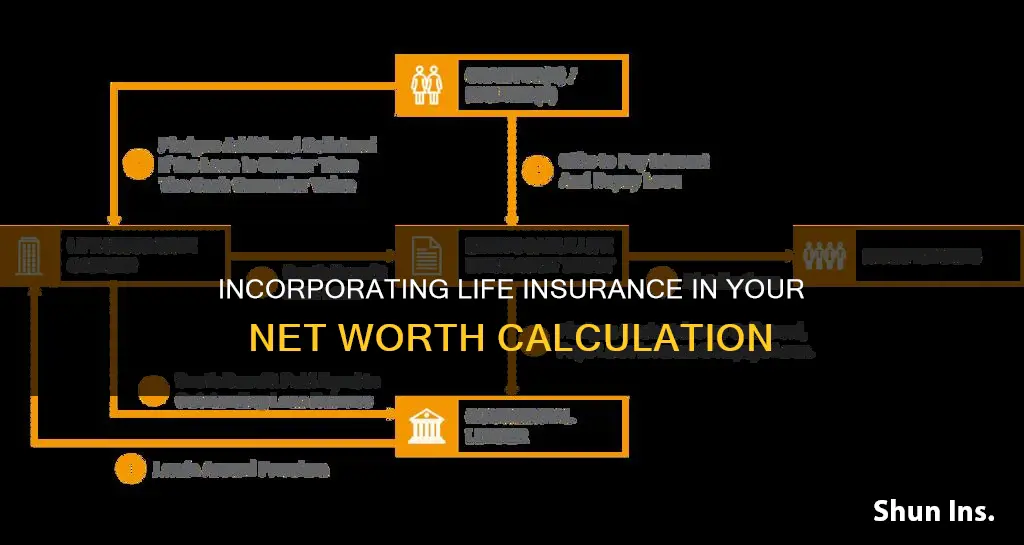

Net worth is the value of all assets minus the total of all liabilities. In other words, it is what you own minus what you owe. When calculating your net worth, you need to properly account for the value of your life insurance. The face amount of current life insurance policies does not count toward your net worth, but the cash value of policies and all inherited death benefits do.

| Characteristics | Values |

|---|---|

| Definition | Net worth is the value of all assets minus the total of all liabilities. |

| Formula | Assets – Liabilities = Net worth |

| Assets | Everything a person owns that has monetary value, such as cash, investments, retirement accounts, savings accounts, life insurance policies, and real estate. |

| Liabilities | Debts or financial obligations, such as mortgages, loans, and credit card debt. |

| Calculation | Start by making a list of all your assets and liabilities, including investment portfolios, credit card balances, mortgages, and other debts. Then, use the formula to calculate your net worth. |

What You'll Learn

Face amount of life insurance

The face amount, or face value, of a life insurance policy is the sum of money that an insurance provider guarantees as a payout to the policy's beneficiaries upon the death of the insured person. It is also known as the death benefit. The face amount is influenced by factors such as income, family size, location, and financial goals. It is important to note that the face amount does not include additional benefits, often called riders, that the policyholder may include in the original contract.

There are several methods to calculate the face amount of a life insurance policy:

- The 10x method: This is the most common method, where the policy is equal to 10 times the insured person's salary. However, this may not take into account all financial needs, such as college tuition for children.

- The DIME method: This method considers debt, income, mortgage, and education expenses to determine an appropriate face amount.

- The human value method: This method calculates the lifetime income potential of the insured person, based on their current and expected future earnings.

The face amount of a life insurance policy is a crucial component as it influences the cost of the policy. As the face amount increases, so does the cost of the policy. Additionally, the face amount can change over time, depending on how the policy is managed. For example, the face amount can increase if additional insurance is purchased or dividends are accumulated within the policy. On the other hand, withdrawals from the policy or unpaid loans will reduce the face amount.

Life Insurance at 71: Is It Worth It?

You may want to see also

Cash value of life insurance

Net worth is the value of all assets minus the total of all liabilities. Assets are everything a person owns that has monetary value, such as cash, investments, retirement accounts, savings accounts, life insurance policies, and real estate. Liabilities, on the other hand, include debts or financial obligations like mortgages, loans, and credit card debt.

Life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component. The two main components that make up a life insurance policy are the death benefit and the cash value. The death benefit is the part of the plan that the beneficiaries receive later on, and the cash value portion can be particularly appealing because you may be able to access the money early.

There are a few different ways to access the cash value of a life insurance policy. One way is by taking out a loan against the policy, which allows you to borrow the expected cash value without surrendering the plan. Another way is to surrender the policy, which means giving up the life insurance benefit in exchange for the cash value. A third option is to make a withdrawal, which can be done if the policy is structured properly. However, it's important to note that accessing the cash value early may reduce the death benefit.

Some types of life insurance policies that may have a cash value portion include whole life insurance, universal life insurance, variable life insurance, and indexed life insurance. When deciding whether to choose a life insurance policy with cash value, it's important to consider your financial situation and goals. If you want to grow funds over time that you can access while you're still alive and are willing to pay higher premiums, a policy with cash value may be a good option.

Esurance Life Insurance: What You Need to Know

You may want to see also

Death benefits

When calculating your net worth, you must consider your assets and your liabilities. Assets are everything a person owns that has monetary value, such as cash, investments, and real estate. Liabilities, on the other hand, are debts or financial obligations, such as mortgages and loans. Net worth is calculated by subtracting your liabilities from your assets.

Life insurance policies are considered an asset when calculating your net worth. However, it is important to note that the way you choose to structure your life insurance policy can affect your net worth. For example, if you have a life insurance policy with a cash value account and take out a loan without paying it back, this amount will be subtracted from the death benefit. Additionally, if you don't use the money in your cash value account before you pass away, the cash value typically reverts to the life insurance company.

Now, let's discuss death benefits in detail. A death benefit is a payout to the beneficiary of a life insurance policy when the insured person dies. It provides financial support to loved ones after the insured person's death. The amount of the death benefit is set in the terms of the contract and is chosen by the policyholder, who makes regular premium payments. The policyholder can add or remove beneficiaries at any time and can also decide how much of the death benefit each beneficiary will receive.

There are several types of death benefits:

- All-cause death benefit: This is a standard death benefit that covers all causes of death except those specifically excluded in the policy.

- Accidental death benefit (ADB): This is typically paid as a result of a death included in a rider added to an insurance policy.

- Accidental death and dismemberment benefit (ADDB): This covers deaths from covered accidents and also includes accidental dismemberment or the loss of body parts or functions.

- Lump-sum payout: This type of death benefit is paid out all at once and is generally not counted as taxable income.

- Retained asset account: Beneficiaries can keep the death benefit with the insurance company in an interest-bearing account and withdraw funds at any time. Any interest earned is taxable.

- Life income payout: The beneficiary receives the death benefit in guaranteed payments for their lifetime. The amount received in each payment is based on their age when filing the life insurance claim.

- Life income with period certain: This option allows the beneficiary to receive payments for a certain period, and if they die before the period ends, their beneficiaries will receive the remaining payments.

- Specific income payout: The death benefit is paid out in installments over time, with the unpaid portion generally earning interest for the beneficiary. Any interest earned is taxable.

To receive a death benefit, beneficiaries must submit a death claim form, provide the insured's policy number, name, Social Security number, date of death, and payment preferences. They also need to submit a certified copy of the death certificate along with the claim form. Most insurers require additional documentation, such as police reports or autopsy reports, if the insured dies during the contestable period or from accidental or unusual means.

Whole Life Insurance Dividends: Are They Guaranteed Payouts?

You may want to see also

Net worth calculation

Net worth is a valuable way to understand your financial health. It is the value of your assets minus your loans and financial obligations (otherwise known as liabilities). In other words, it is what you own minus what you owe.

Assets are everything a person owns that has monetary value. This includes cash, investments, retirement accounts, savings accounts, life insurance policies, and real estate. Liabilities, on the other hand, include debts or financial obligations such as mortgages, loans, and credit card debt.

To calculate your net worth, start by making a list of all your assets and liabilities, including investment portfolios, credit card balances, mortgages, and other debts. Then, use the following formula:

Assets - Liabilities = Net worth

For example, if you own a house with a market value of $200,000 and you have a mortgage of $150,000, you can add $50,000 to your net worth.

It's important to note that when calculating net worth, your income is not included. A person can have a large income but a low net worth if they spend most of their money. On the other hand, even people with modest incomes can accumulate significant wealth and a high net worth if they invest wisely and save.

Liquidity in Life Insurance: Understanding Cash Value and Options

You may want to see also

Liabilities

When calculating your net worth, it's important to understand the role of liabilities, which are essentially the opposite of assets. Liabilities represent the debts or financial obligations that you owe. In simple terms, they are the money you don't have.

Common examples of liabilities include mortgages, credit card debt, loans, and other outstanding payments. These are all considered financial commitments that you are liable for and need to be factored into your net worth calculation.

Let's consider an example to illustrate this further. Imagine you have a mortgage on your home, an outstanding balance on your credit card, and a personal loan you're repaying. These would all be classified as liabilities. To calculate your net worth accurately, you would need to subtract these liabilities from your total assets.

It's worth noting that liabilities can also include future financial commitments or potential debts. For instance, if you're planning to take out a loan for a new car or have upcoming education expenses, these future liabilities should be considered when assessing your overall financial health.

By regularly reviewing and managing your liabilities, you can make more informed financial decisions. This might include finding ways to reduce your debt, such as by paying off credit cards or consolidating loans, or it could involve seeking opportunities to increase your assets, such as through investments or savings. Ultimately, effectively managing your liabilities is a crucial aspect of financial planning and can help you achieve your long-term goals.

How Children Receive Money from Term Life Insurance

You may want to see also

Frequently asked questions

Your net worth is the total value of your assets minus your liabilities. Assets include cash, investments, retirement accounts, savings accounts, life insurance policies, and real estate. Liabilities include mortgages, loans, and credit card debt.

Calculating your net worth lets you better understand your financial position. It is a valuable way to track your financial health and make informed decisions about the future.

The face amount of current life insurance policies does not count toward your net worth as you do not have access to the benefit while you are alive. However, the cash value of policies and all inherited death benefits do count toward your net worth as they increase your liquid assets.