Whole life insurance is a form of permanent life insurance that stays in place for the duration of a person's life as long as premiums are paid. Whole life insurance policies offer a guaranteed death benefit, predictable premiums over time, and even dividends that can provide cash or help offset the cost of life insurance over time. Dividends are not guaranteed but are paid on an annual basis with most companies.

What You'll Learn

Dividends are not guaranteed

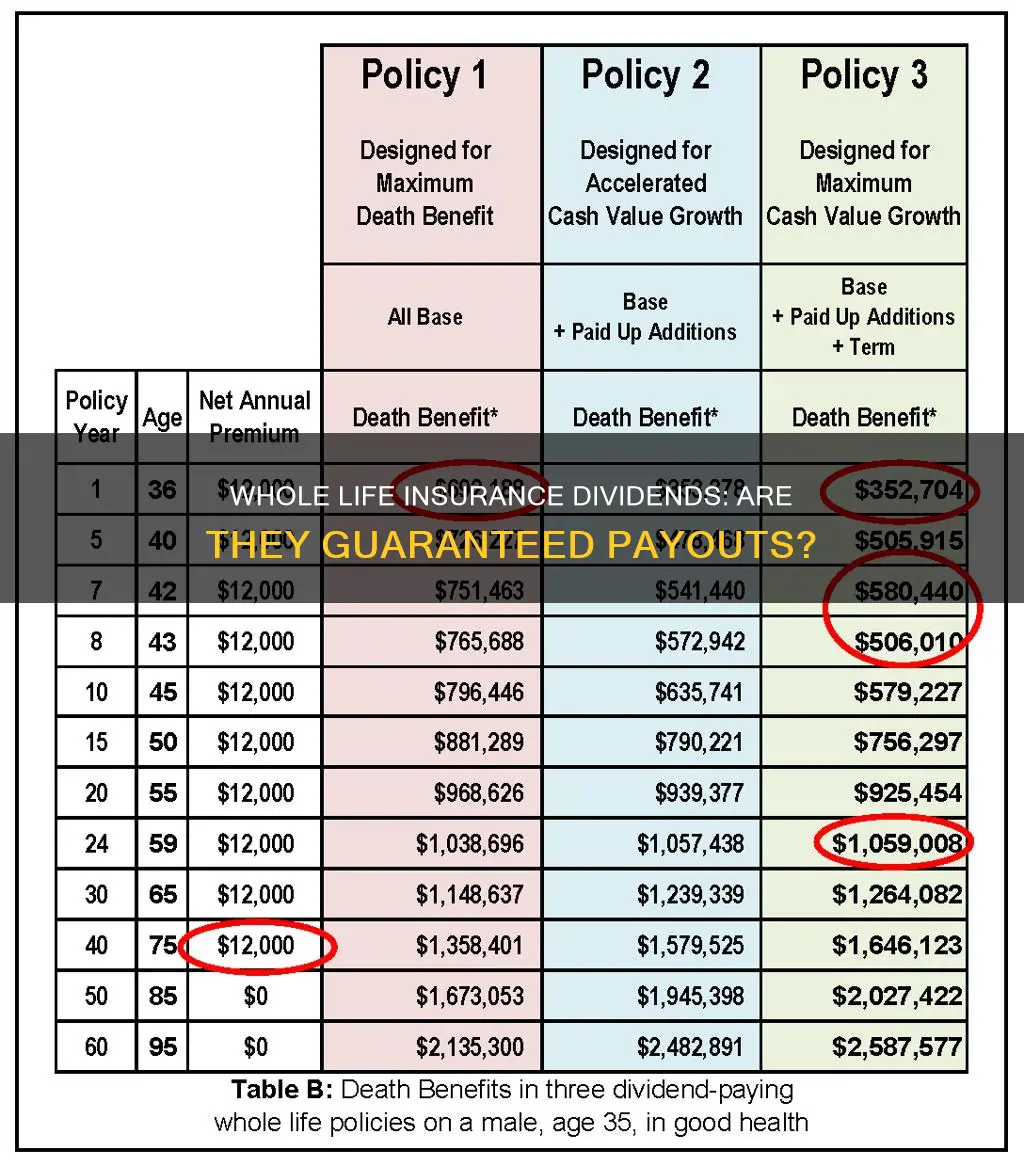

Dividends are an optional payment from the insurer and are based on the policy's amount of insurance in force. The more coverage your policy has, the more you could potentially receive in dividends. Dividends can be used in several ways, such as purchasing additional coverage, increasing the cash value and death benefits, or building assets. However, dividends should be seen as a bonus rather than a guaranteed feature.

When deciding between a participating (dividend-eligible) or non-participating policy, consumers must consider if potential dividends are worth the increased monthly premium. A participating policy can be worth it if you want to offset future premium costs or increase the cash value of the policy by putting the dividend towards paid-up additions.

Whole life insurance policies that pay dividends are often referred to as "participating" policies because customers can participate in the insurer's success. These policies are issued by mutual companies, which are owned by their policyholders. It is customary for mutual insurers to pay dividends annually back to their policyholders.

While dividends are not guaranteed, every mutual company still in existence has found a way to pay a dividend every year for the last 150+ years. This track record of consistent dividend payments can provide peace of mind to policyholders. However, it's important to remember that past performance does not guarantee future results.

Kentucky Farm Bureau: Offering Life Insurance and More

You may want to see also

Dividends are based on the insurer's financial performance

The amount of a dividend is tied to the price of the premiums paid by the policyholder. The higher the dividend, the more expensive the policy. Dividends are distributed as a percentage of the policy value. For example, a policy with a death benefit of $100,000 that offers a 0.5% dividend will pay out $500.

The dividend amount often depends on the amount paid into the policy. For instance, a policy worth $50,000 that offers a 3% dividend will pay out $1,500 for the year. If the policyholder contributes an additional $2,000 in value during the subsequent year, they will receive $60 more for a total of $1,560. These amounts can increase over time and may eventually be large enough to offset some of the costs associated with premium payments.

The dividend amount is determined by the insurer's board of directors, who decide whether to pay a dividend and how much based on the company's financial performance in the past fiscal year, its expenses, and its cash reserves.

Dividends are usually based on three components: the dividend interest rate credit, mortality credits, and company expense debits. The dividend interest rate credit represents the yield from the insurance company's investment portfolio. The mortality component, or mortality credits, reflects the number of insurance claims paid out compared to the number of claims the company anticipated when it underwrote the policies. Company expense debits reflect the policyholder's share of the company's operational expenses.

When selecting an insurer, it is important to consider their financial performance and history of dividend payments to maximize the likelihood of receiving dividends.

Hawaii Life Insurance: Tax-Free or Not?

You may want to see also

Dividends can be used to purchase additional coverage

Purchasing additional coverage with dividends is a good way to reduce the impact of inflation or increase the death benefit if financial circumstances necessitate it. This option can be particularly useful for those with growing financial responsibilities, such as a family.

It is important to note that dividends are not guaranteed and depend on the insurer's financial performance. Therefore, while dividends can be used to purchase additional coverage, it is not a sure thing. Policyholders should carefully review the details of their policy to understand if and how dividends may be paid out, and how they can be used.

Additionally, policies that provide guaranteed dividends typically have higher premiums to make up for the added risk to the insurance company. On the other hand, policies that offer non-guaranteed dividends may have lower premiums, but there is a risk that no dividends will be paid out in a given year.

Life Insurance Policy Options: Control and Flexibility

You may want to see also

Dividends are not taxable

Dividends from whole life insurance policies are generally not subject to income tax. This is because the Internal Revenue Service (IRS) considers dividend payouts to be a return of insurance premiums that the policyholder has already paid taxes on. In other words, the dividends are treated as refunds for overpayment of the premium.

The best option is usually to take the cash or check from dividends and reinvest the proceeds in an investment vehicle that could earn more income. This is because, in most cases, the gains earned as interest on dividends left in the policy to accumulate interest may be taxable.

There are some instances where life insurance dividends may be taxable:

- If your dividend returns exceed the amount of premiums you have paid, there may be income tax implications. This is because any dividends over the amount you paid are considered income, not a return of premium.

- If you earn interest on dividends left in your policy, this interest income may be taxable if it earns you more than you have paid in premiums.

VGLI Whole Life Insurance: Is It Worth the Cost?

You may want to see also

Dividends can be used in several ways

- Receiving dividends as cash: The insurance company can send you a check or make an ACH payment to your bank account. This option provides flexibility, as you can use the funds for anything you like, such as discretionary spending.

- Keeping funds in a savings account with the insurer: Some insurers allow policyholders to leave their dividends in a separate savings account, where they can earn interest at a specified rate. This option offers liquidity and convenience, as you can withdraw the funds at any time without having to manage the money yourself.

- Using dividends to pay for the policy: You can request that the insurer put your dividends toward future premiums, reducing the amount you owe. This can be helpful in years when your insurer has strong financial performance.

- Purchasing additional insurance: Instead of reducing your premiums, you can use your dividends to get additional coverage. This is known as purchasing "paid-up coverage," as you can increase your death benefit without a corresponding increase in premiums. This option may help combat the effects of inflation or increase your death benefit if your financial circumstances change.

- Paying down policy loans: If you have borrowed against your cash value, you can ask the insurer to use your dividends to pay down your policy loan balance. This allows you to pay off your loan without dipping into your regular income.

It's important to note that the availability and specifics of these options may vary depending on the insurance company and the policy details. Be sure to carefully review the terms of your policy to understand how you can use your dividends.

Hep C Screening: Life Insurance's Impact on Your Health

You may want to see also

Frequently asked questions

No, whole life insurance dividends are not guaranteed.

Dividends are paid out if the insurer has strong financial performance, including investment performance, the number of claims paid out compared to premiums paid in, and operational costs.

In most cases, whole life insurance dividends are not subject to income tax because they are considered a return of insurance premiums. However, if the dividend amount exceeds the total amount of premiums paid, there may be tax implications.

There are several options for using whole life insurance dividends, including receiving the dividend as a cash payment, using the dividend to reduce future premiums, purchasing additional insurance coverage, or leaving the dividend with the insurance company to earn interest.

A participating whole life insurance policy is one in which the policyholder is considered a stakeholder in the insurance company and may receive dividends based on the company's financial performance. A non-participating policy does not pay dividends and typically has lower premiums.