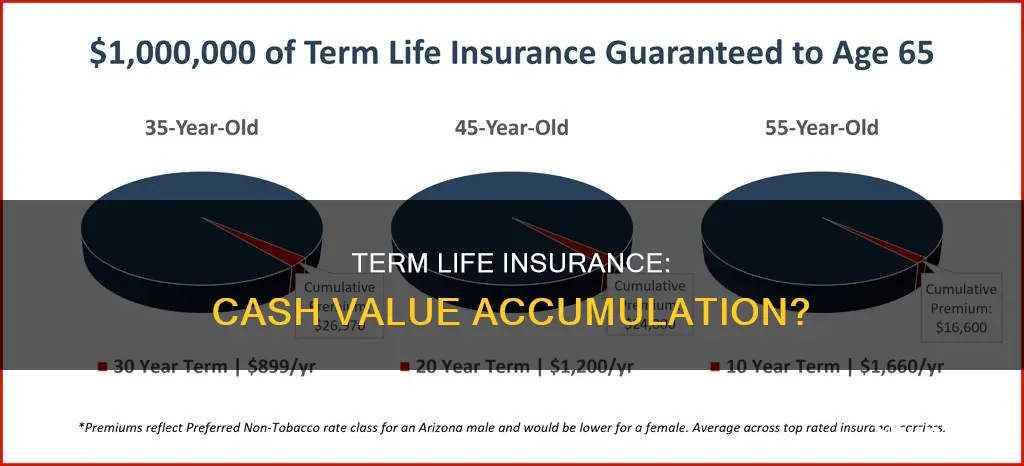

Term life insurance is a type of insurance that covers an individual for a set number of years, such as 10, 20, or 30 years. It tends to be cheaper than whole life insurance, which offers coverage for an entire lifetime. While term life insurance provides coverage for a fixed period, it does not accumulate cash value over time. On the other hand, whole life insurance policies have a cash value component that grows over the years, allowing policyholders to borrow against it or surrender the policy for cash. This makes whole life insurance a more complex and expensive option compared to term life insurance.

| Characteristics | Values |

|---|---|

| Cost | Term life insurance is cheaper than whole life insurance |

| Coverage | Term life insurance covers a set period of time, whereas whole life insurance covers the entire life |

| Cash value | Term life insurance does not have a cash value, whereas whole life insurance does |

| Premium | Term life insurance premiums are level throughout the length of the policy |

| Death benefit | Term life insurance pays out a death benefit if the policyholder dies during the term |

| Complexity | Whole life insurance is more complex than term life insurance |

| Conversion | It may be possible to convert term life insurance to whole life insurance |

What You'll Learn

- Term life insurance is cheaper than whole life insurance but offers temporary coverage

- Whole life insurance is more expensive but offers lifelong coverage and builds cash value

- Term life insurance does not have a cash value component

- Whole life insurance policies have a cash value that grows at a guaranteed fixed rate

- Whole life insurance can be a good investment strategy

Term life insurance is cheaper than whole life insurance but offers temporary coverage

Term life insurance is a cheaper option than whole life insurance, but it only offers temporary coverage. This means that term life insurance covers you for a set number of years, usually 10, 20, or 30 years. During this period, if you pass away, your beneficiaries will receive a payout. However, if you outlive the term, your coverage ends, and your beneficiaries won't receive anything. On the other hand, whole life insurance tends to be more expensive but offers lifelong coverage.

The difference in cost between term and whole life insurance is significant. Term life insurance is much more affordable because it provides temporary coverage and doesn't build up any cash value. In contrast, whole life insurance premiums are much higher due to the lifelong coverage and the potential for the policy to accumulate cash value over time. This cash value component makes whole life insurance a more complex and costly product.

With term life insurance, you can choose a policy length that typically ranges from 1 to 30 years. This type of insurance is ideal if you only want coverage for a specific period, such as during the years you are raising children or paying off a mortgage. It is also a good option if you want affordable coverage, especially if you are young and healthy. Additionally, some term life policies can be converted to permanent coverage later on, which is useful if you anticipate needing lifelong insurance but cannot afford it at the moment.

Whole life insurance, on the other hand, is suitable for those who can comfortably afford the higher premiums and want coverage that lasts their entire life. It is also a good choice if you have lifelong dependents, such as children with special needs, as it ensures they will be provided for even after you're gone. The cash value component of whole life insurance is another advantage, as it grows at a guaranteed rate set by the insurer, and you can borrow against it or surrender the policy for cash.

While term life insurance doesn't typically build cash value, there may be some insurers that offer this option for an additional cost. If having cash value is important to you, it's best to inquire with your insurer about the possibility of adding this feature to your term life policy.

Civil Service Life Insurance: Cash Value and Benefits Explained

You may want to see also

Whole life insurance is more expensive but offers lifelong coverage and builds cash value

Term life insurance is a type of life insurance that offers coverage for a fixed period, such as 10, 20, or 30 years. It is a temporary form of insurance that provides coverage for a set number of years, after which the policy ends, and beneficiaries will not receive any payout. Term life insurance is generally the most affordable option and is suitable for those who only want coverage for a specific period.

On the other hand, whole life insurance is a type of permanent life insurance that offers coverage for the entire life of the insured. It tends to be more expensive than term life insurance due to its lifelong coverage and additional features. One of its key features is the cash value component, which allows the policy to build cash value over time. This cash value can grow at a guaranteed fixed rate set by the insurer or be invested to earn variable returns. The policyholder can borrow against this cash value or withdraw it, providing flexibility and access to funds during their lifetime.

Whole life insurance also offers the advantage of guaranteed premium payments that remain level throughout the policy. Additionally, it provides a guaranteed death benefit, ensuring that beneficiaries receive a payout regardless of when the insured person passes away. However, the high cost of whole life insurance makes it unaffordable for many individuals, and it may not be the best option for those who do not require lifelong coverage.

In summary, while whole life insurance offers lifelong coverage and builds cash value, it comes at a higher cost compared to term life insurance. The choice between the two depends on individual needs, with term life insurance being sufficient for most people seeking temporary coverage, while whole life insurance may be more suitable for those seeking permanent coverage, investment opportunities, and additional features.

Living with Psoriasis: Life Insurance and You

You may want to see also

Term life insurance does not have a cash value component

Term life insurance is a type of life insurance that covers you for a set number of years, such as 10, 20 or 30 years. It tends to be cheaper than whole life insurance, but it does not usually last your entire life and does not build cash value. This means that if you outlive the term, your beneficiaries will not receive any money.

Whole life insurance, on the other hand, tends to be more expensive as it covers you for your entire life and has a cash value component. This means that a portion of your premium goes towards the cash value, which can grow over time. This cash value can be borrowed against or surrendered for cash.

Term life insurance is a good option for those who only want coverage for a specific period of time, such as when they have major financial obligations like raising children or paying off a mortgage. It is also a good choice for those who want affordable coverage, as it is the least expensive option, especially for young and healthy individuals.

In contrast, whole life insurance is suitable for those who want coverage that lasts their entire life and are comfortable with the higher premiums. It is also a good option for those who want life insurance that builds guaranteed cash value.

While term life insurance does not typically have a cash value component, there may be some insurers that offer this feature. If having cash value is important to you, it is worth asking your insurer if it is possible to add this feature to your term life policy. Alternatively, you may be able to convert your term life insurance policy to whole life insurance, which would give you the benefit of lifelong coverage and the opportunity to build cash value.

Life Insurance Stacking: MetLife's Benefits and Drawbacks

You may want to see also

Whole life insurance policies have a cash value that grows at a guaranteed fixed rate

Term life insurance is cheaper than whole life insurance but only covers the policyholder for a set number of years. Whole life insurance, on the other hand, tends to cost more but can last the policyholder's entire life and build cash value that can be borrowed against. Whole life insurance is, therefore, a more complex and expensive product.

Whole life insurance policies are a type of permanent life insurance that covers the insured person for their entire life. They are distinguished by their cash value component, which functions similarly to a retirement savings account. This means that the cash value of a whole life insurance policy can be withdrawn or borrowed against.

The cash value of a whole life insurance policy grows at a guaranteed fixed rate. This means that even if the policyholder withdraws or borrows from the cash value, causing the balance to decrease, it will continue to grow at the predetermined rate. The cash value of a whole life insurance policy is also tax-deferred, meaning that taxes on gains are only paid when the gains are withdrawn from the policy.

The cash value of a whole life insurance policy is influenced by several factors, including premiums paid, dividends received, and interest earnings. The growth of the cash value is also determined by whether the policy is "participating" or "non-participating". A participating policy redistributes any excess of premiums as dividends to the insured, which can then be reinvested into the policy. A non-participating policy, on the other hand, keeps any excess of premiums as profit for the insurer.

In summary, whole life insurance policies offer a guaranteed death benefit and a cash value component that grows at a guaranteed fixed rate. This allows policyholders to borrow or withdraw from their cash value, providing a source of financial security during their lifetime.

Geico's Life Insurance: What You Need to Know

You may want to see also

Whole life insurance can be a good investment strategy

Term life insurance is cheaper than whole life insurance but covers the policyholder for only a set number of years. Whole life insurance, on the other hand, tends to be more expensive but lasts the policyholder's entire life and builds cash value that can be borrowed against. Whole life insurance can be a good investment strategy for several reasons.

Firstly, whole life insurance can be used as a financial asset during the policyholder's life, similar to an IRA or mutual fund. The cash value of a whole life insurance policy grows over time, and the policyholder can borrow against it, use it as collateral for a loan, or withdraw funds. This provides flexibility and can be especially useful in case of an emergency or for major expenses.

Secondly, whole life insurance offers guaranteed returns and can supplement retirement income. The cash value grows at a fixed rate guaranteed by the insurer and is tax-deferred, meaning any interest earned is not taxed as long as the funds remain in the policy. This makes whole life insurance a form of "forced savings," providing financial stability and peace of mind.

Thirdly, whole life insurance can be beneficial for individuals who have maxed out their retirement accounts and are looking for additional tax-deferred savings options. The cash value of a whole life insurance policy can grow over time through dividends or interest, and the policy can be surrendered for cash when the policyholder retires.

Additionally, whole life insurance can be useful for individuals with lifelong financial dependents, such as children with disabilities. It provides lifelong coverage and helps ensure financial stability for the dependent. Whole life insurance can also help create generational wealth by allowing the policyholder to leave the full value of assets to their heirs, which can be used to pay estate taxes and continue building wealth.

Lastly, whole life insurance can be a good investment strategy for diversifying an investment portfolio. The cash value grows at a set rate, and the returns are dependable and not subject to market conditions. This makes whole life insurance a relatively low-risk investment option compared to other investments such as stocks, bonds, or real estate.

Kroger Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Term life insurance does not typically develop cash value. Term life insurance is designed to last for a limited period and is usually cheaper than whole life insurance.

If you want to add cash value to a new term life insurance policy, ask your insurer if it's possible. If you already have a term life insurance policy and want to add cash value, it may be possible to convert it to whole life insurance.

Term life insurance covers you for a set number of years, such as 10, 20 or 30 years, and is usually more affordable. Whole life insurance tends to be more expensive but covers you for your entire life and builds cash value that you can borrow against.