BIA life insurance, or Business Interruption Analysis (BIA) life insurance, is a specialized type of insurance that provides coverage for the financial losses a business might face due to the interruption of its normal operations. This insurance is designed to protect businesses from the financial impact of unexpected events, such as natural disasters, accidents, or other disruptions, that could halt their regular business activities. It covers the costs associated with resuming operations, including expenses for temporary facilities, employee salaries, and other operational costs, until the business can return to its normal state. BIA life insurance is crucial for businesses to ensure their long-term sustainability and financial stability in the face of unforeseen circumstances.

What You'll Learn

- Definition: Bia Life Insurance is a type of policy that provides financial protection for beneficiaries in the event of the insured's death

- Key Features: It offers coverage for a specific period, often with a guaranteed death benefit and potential cash value accumulation

- Benefits: Provides financial security, tax advantages, and potential investment growth for the insured's beneficiaries

- Comparison: Bia Life Insurance differs from term life by offering more flexibility and potential long-term value

- Considerations: Factors like age, health, and desired coverage period influence the cost and suitability of this insurance

Definition: Bia Life Insurance is a type of policy that provides financial protection for beneficiaries in the event of the insured's death

BIA Life Insurance, or Business Interruption Analysis, is a critical tool for assessing the financial impact of disruptions to a business. It is a comprehensive process that evaluates the potential losses a company might face due to various unforeseen events, such as natural disasters, accidents, or even the death of a key employee. This type of insurance is designed to provide financial protection and stability to a business during challenging times, ensuring its long-term survival and continuity.

When it comes to the definition of BIA Life Insurance in the context of personal insurance, it refers to a specific type of life insurance policy. This policy is tailored to provide financial security to the beneficiaries in the event of the insured's death. Unlike traditional life insurance, BIA Life Insurance focuses on the financial implications of the insured's passing, especially in the context of a business or a family's financial well-being.

The primary purpose of this insurance is to offer a financial safety net for the beneficiaries, ensuring they have the necessary resources to maintain their standard of living and cover essential expenses. It provides a lump sum payment or regular income to the designated beneficiaries, who can then use these funds to cover various costs, such as mortgage payments, living expenses, education fees, or even to start a new business venture.

BIA Life Insurance is particularly valuable for individuals who are primary breadwinners or have significant financial responsibilities. It ensures that their family or business partners are financially protected in the event of their untimely demise. This type of insurance is often used as a strategic tool to secure a business's future, especially for small businesses, as it provides a means to continue operations and maintain the company's value even in the face of unexpected losses.

In summary, BIA Life Insurance is a specialized form of life insurance that focuses on providing financial protection and stability to beneficiaries in the event of the insured's death. It is a crucial aspect of personal and business financial planning, offering peace of mind and ensuring the long-term security of individuals and their loved ones.

Haven Life Insurance: BBB Ratings and Reviews Explained

You may want to see also

Key Features: It offers coverage for a specific period, often with a guaranteed death benefit and potential cash value accumulation

Term BI (Business Interruption) insurance is a critical component of risk management for businesses, especially those in the service industry. It provides financial protection during the period when a business is unable to operate due to unforeseen events such as natural disasters, equipment failures, or other disruptions. This type of insurance is designed to cover the income loss and additional expenses a business incurs when it cannot carry out its normal operations.

One of the key features of term BI insurance is its coverage for a specific period. This duration is typically determined based on the nature of the business and the potential risks it faces. For instance, a restaurant might need coverage for a shorter period compared to a manufacturing plant, which may require longer-term coverage due to the extensive setup and specialized equipment involved. The insurance policy is structured to provide financial support for the business during this defined period, ensuring that the company can meet its financial obligations and maintain its operations until it can resume normal activities.

Another important aspect is the guaranteed death benefit, which is a fixed amount paid to the policyholder or their beneficiaries upon the occurrence of a specified event, such as the death of the insured individual. This feature ensures that the business and its stakeholders are financially protected in the event of a key person's passing. The death benefit can be used to cover various expenses, including payroll, rent, and other operational costs, ensuring the business's financial stability and continuity.

Additionally, term BI policies often include the potential for cash value accumulation. This means that over time, a portion of the premiums paid may accumulate as cash value within the policy. This cash value can be borrowed against or withdrawn, providing the business owner with a source of funds that can be used for various purposes, such as expanding the business, investing in new projects, or simply as a financial safety net. The accumulation of cash value is particularly beneficial for long-term policies, as it allows the business to build a financial reserve that can be utilized when needed.

In summary, term BI life insurance is a specialized form of coverage that provides financial protection for businesses during periods of disruption. Its key features include coverage for a specific period, a guaranteed death benefit, and the potential for cash value accumulation. These features collectively ensure that businesses can manage financial risks, maintain operations, and protect their interests in the face of unforeseen events. Understanding these aspects is crucial for business owners to make informed decisions about their insurance needs and ensure the long-term sustainability of their enterprises.

Life Insurance Beneficiary: Can a Corporation Benefit?

You may want to see also

Benefits: Provides financial security, tax advantages, and potential investment growth for the insured's beneficiaries

Term BI (or 'term life insurance with an investment component') is a type of life insurance that offers both a death benefit and an investment component. It provides a financial safety net for your loved ones in the event of your passing, ensuring they have the financial resources to cover essential expenses and maintain their standard of living. This type of policy is particularly attractive to those seeking a straightforward and cost-effective way to secure their family's financial future.

One of the key advantages of term BI is the financial security it offers. When you purchase this policy, you agree to pay a fixed premium for a specified term, typically 10, 15, or 20 years. During this period, if you pass away, the policy's death benefit is paid out to your designated beneficiaries, providing them with a lump sum or regular income to cover various expenses, such as mortgage payments, children's education, and daily living costs. This financial cushion ensures that your family can maintain their financial stability and avoid the burden of unexpected debt.

In addition to financial security, term BI also provides tax advantages. The death benefit paid out upon your passing is generally not subject to income tax, meaning the full amount goes directly to your beneficiaries. This is in contrast to other forms of insurance payouts, which may be taxed as ordinary income. Furthermore, the premiums paid for term BI are typically tax-deductible, providing an additional financial benefit to policyholders.

The investment component of term BI is another significant advantage. A portion of your premium is allocated to an investment fund, which can grow over time. This investment growth can provide an additional financial benefit to your beneficiaries. The investment returns are not guaranteed and may fluctuate, but they offer the potential for long-term growth, which can be particularly valuable for long-term financial planning. This aspect of term BI allows you to potentially build a substantial fund that can be used for various purposes, such as funding your child's education or providing a financial cushion for your beneficiaries.

Term BI life insurance is an excellent choice for individuals who want to provide financial security and peace of mind for their loved ones. With its combination of death benefits, tax advantages, and potential investment growth, this type of policy offers a comprehensive solution for long-term financial planning. It ensures that your family can maintain their financial stability and make informed decisions about their future, even in the face of unexpected circumstances.

Cashing in on Life Insurance: Redeeming Your Policy

You may want to see also

Comparison: Bia Life Insurance differs from term life by offering more flexibility and potential long-term value

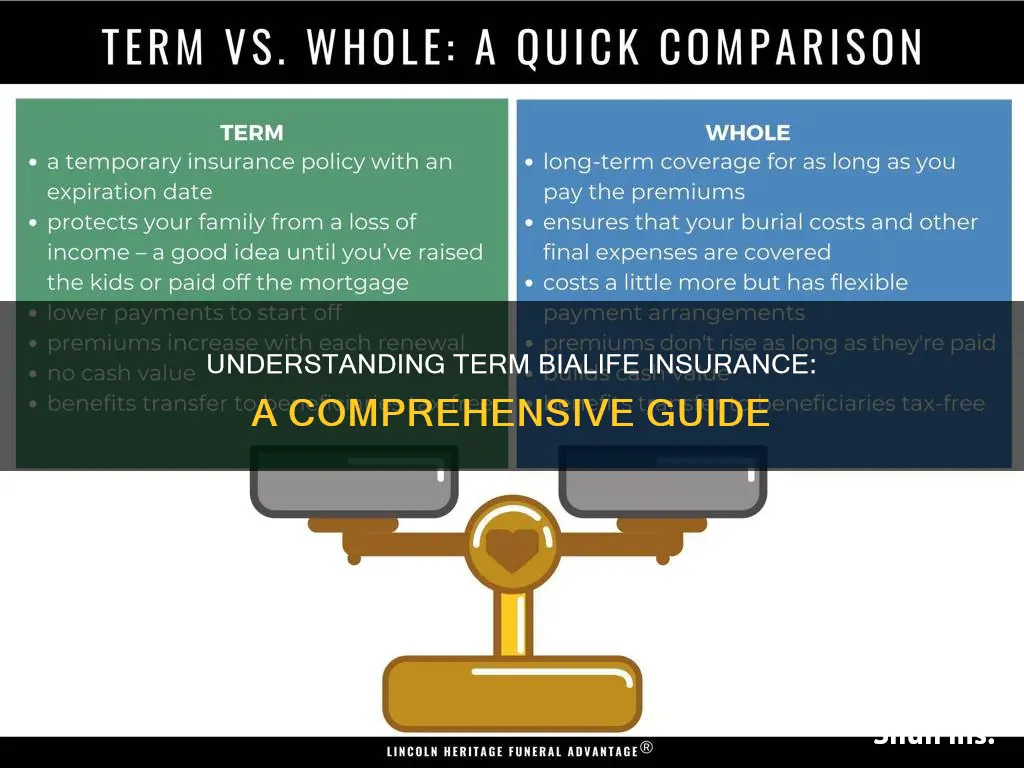

Bia Life Insurance, a relatively new player in the insurance market, offers an alternative to traditional term life insurance, providing policyholders with a unique set of features and benefits. While term life insurance is a straightforward and cost-effective way to secure financial protection for a specified period, Bia Life Insurance takes a different approach, focusing on flexibility and long-term value. This comparison aims to highlight the key differences and advantages of choosing Bia Life Insurance over term life.

One of the primary distinctions is the level of customization it provides. Term life insurance typically offers a fixed coverage period, such as 10, 20, or 30 years, with a predetermined death benefit. In contrast, Bia Life Insurance allows policyholders to tailor their coverage to their specific needs. This flexibility enables individuals to choose the duration of coverage, ensuring that their insurance aligns with their evolving life circumstances. For instance, a young professional might opt for a longer coverage period to secure their family's financial future, while a retiree may prefer a shorter-term policy to cover any remaining debts or expenses.

The potential for long-term value is another significant advantage of Bia Life Insurance. Traditional term life insurance generally does not accumulate cash value, meaning the policy's value remains constant throughout the term. Bia Life Insurance, however, often incorporates an investment component, allowing policyholders to build up cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. For example, a policyholder could use the accumulated cash value to fund their child's education or as an emergency fund, ensuring that the insurance policy becomes a valuable financial asset rather than a mere liability.

Furthermore, Bia Life Insurance policies often offer the option to convert the term coverage into a permanent life insurance policy. This conversion feature provides long-term financial security, as it allows individuals to continue their coverage without interruption. Unlike term life, which expires at the end of the specified period, permanent life insurance provides lifelong coverage, ensuring that the insured individual's loved ones are protected even after the initial term has ended. This feature is particularly beneficial for those who desire long-term financial protection and want to avoid the potential gaps in coverage that can occur with term life.

In summary, Bia Life Insurance stands out from traditional term life insurance by offering enhanced flexibility and the potential for long-term value. The ability to customize coverage, build cash value, and convert to permanent insurance provides policyholders with a more comprehensive and adaptable financial solution. While term life insurance is suitable for short-term needs, Bia Life Insurance caters to those seeking a more flexible and potentially rewarding insurance experience, ensuring that their financial protection evolves with their changing lives.

Life Insurance and Death: A Guide to Checking Policies in Singapore

You may want to see also

Considerations: Factors like age, health, and desired coverage period influence the cost and suitability of this insurance

Term BI (Business Interruption) insurance is a critical component of risk management for businesses, especially those in industries where operations can be disrupted by unforeseen events. This type of insurance provides financial protection during the period a business is unable to operate due to covered losses, such as natural disasters, theft, or damage to property. Understanding the factors that influence the cost and suitability of term BI insurance is essential for business owners to make informed decisions.

Age is a significant consideration when evaluating term BI insurance. Younger businesses often face different risks compared to established companies. For instance, a newly launched tech startup might be more susceptible to cyber threats, while a long-standing restaurant business could be at risk from severe weather events. The age of the business can impact the insurance premium, as younger companies may be considered higher-risk due to their limited track record. Additionally, the age of the business's assets and infrastructure plays a role, as older buildings or equipment might require more extensive coverage.

Health, in the context of business insurance, refers to the overall financial health and stability of the company. Insurance providers assess the financial strength and creditworthiness of the business to determine the likelihood of a successful claim. A business with a strong financial position and a solid customer base is more likely to receive favorable terms and lower premiums. On the other hand, a business facing financial difficulties or with a history of losses may be considered higher-risk, leading to higher insurance costs or even difficulty in obtaining coverage.

The desired coverage period is another critical factor. Term BI insurance typically provides coverage for a specific period, often ranging from one to five years. The duration of coverage should align with the business's specific needs and the nature of the risks it faces. For instance, a business recovering from a natural disaster might require extended coverage to ensure it has sufficient time to rebuild and resume operations. Conversely, a business with a stable and predictable risk profile might opt for a shorter coverage period, saving on insurance costs.

In conclusion, when considering term BI life insurance, business owners must carefully evaluate their specific circumstances. Age and health of the business, as well as the desired coverage period, all play a role in determining the cost and suitability of the insurance. By understanding these factors, business owners can make informed decisions to ensure their operations are protected against potential disruptions. It is advisable to consult with insurance professionals who can provide tailored advice based on individual business needs.

New York Life Insurance: Making Money, Explained

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It offers a straightforward way to protect your loved ones financially during a defined period.

Term bia life insurance provides a death benefit to your beneficiaries if you pass away during the term period. The benefit amount is predetermined and remains constant throughout the term. It's a pure insurance product without an investment component.

The primary difference is the duration of coverage. Term life insurance is temporary, offering protection for a specific term, while permanent life insurance provides lifelong coverage. Term plans are generally more affordable and offer a fixed premium for the term duration.

Term life insurance is ideal for individuals who want to provide financial security for their family during a specific period, such as covering mortgage payments, children's education, or other short-term financial obligations. It's a cost-effective way to ensure your loved ones are protected.

Yes, many term life insurance policies offer the option to convert to permanent life insurance, such as whole life or universal life, before the term ends. This allows you to continue lifelong coverage without interruption.