When considering life insurance, it's important to understand that not all policies are created equal. One type of life insurance that stands out for its unique feature is level term life insurance. Unlike other policies that increase in cost as you age, level term life insurance provides a fixed death benefit for a specified term, typically 10, 15, or 20 years. This means your premium remains the same throughout the policy period, offering consistent coverage without the worry of increasing premiums due to age-related factors. This type of insurance is an attractive option for those seeking long-term protection without the financial burden of rising costs as they get older.

| Characteristics | Values |

|---|---|

| Term Life Insurance | This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a fixed death benefit, which remains the same throughout the term. |

| Level Term Life Insurance | A variation of term life, where the death benefit and premium remain constant for the entire policy term. |

| Decreasing Term Life Insurance | Similar to term life but with a decreasing death benefit over time. Premiums may also decrease as the insured person ages. |

| Fixed Universal Life Insurance | A permanent life insurance policy with a fixed death benefit and an investment component. Premiums can be adjusted annually, but the death benefit stays the same. |

| Variable Universal Life Insurance | Offers flexibility in premium payments and death benefit adjustments. The investment component allows for potential growth, but it can also decrease in value. |

| Whole Life Insurance | Provides lifelong coverage with a fixed death benefit and premiums. The premiums are typically higher than term life but remain constant for the entire policy. |

| No-Lapse Universal Life Insurance | Designed to avoid premium increases due to age, ensuring consistent premiums and a fixed death benefit. |

| Guaranteed Issue Life Insurance | Issued without medical exams, often with a fixed premium and death benefit, making it suitable for those with pre-existing conditions. |

| Final Expense Insurance | Specifically designed to cover funeral and burial expenses, typically with a fixed benefit and premiums that may not increase with age. |

What You'll Learn

- Term Life Insurance: Fixed coverage for a set period, no age adjustments

- Whole Life with Fixed Benefits: Accumulates cash value, but benefits remain constant

- Guaranteed Issue: No medical exam, rates don't change with age

- Final Expense: Covers funeral costs, often with no age-based increases

- Riders: Additional coverage, not tied to age adjustments

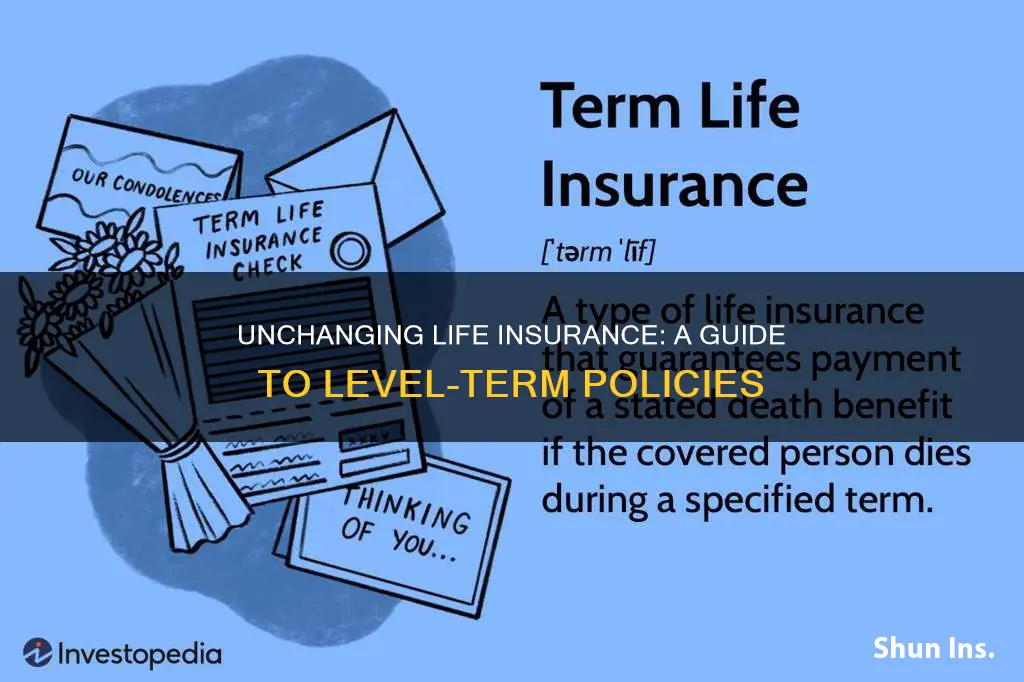

Term Life Insurance: Fixed coverage for a set period, no age adjustments

Term life insurance is a straightforward and cost-effective way to secure financial protection for a specific period, typically 10, 15, or 20 years. Unlike permanent life insurance, which offers lifelong coverage and can increase in value over time, term life insurance provides fixed coverage for the chosen duration without any adjustments based on age. This type of policy is an excellent choice for individuals who want a simple and affordable solution to meet their short-term financial obligations, such as supporting a family, paying off a mortgage, or covering educational expenses.

The beauty of term life insurance lies in its simplicity. When you purchase a term policy, you agree to pay a premium for a set period, and in return, you receive a death benefit if you pass away during that time. The premium remains consistent throughout the term, and there are no hidden age-related increases. This predictability allows individuals to plan their finances more effectively, as they know exactly how much they will pay and what they are entitled to.

One of the key advantages of term life insurance is its affordability. Since the coverage is fixed, the insurance company doesn't have to account for the increased risk associated with aging. As a result, younger individuals often benefit from lower premiums compared to other types of life insurance. This makes term life insurance an attractive option for those who want to secure coverage without breaking the bank, especially when they are in their prime earning years.

For those who prefer a more permanent solution, converting a term policy to a permanent life insurance plan after the initial term ends is an option. This transition allows individuals to continue having coverage without the age-based increases, providing long-term financial security. Additionally, term life insurance can be a strategic choice for those who want to build a financial cushion before committing to a more permanent policy, ensuring they have the necessary funds to support their loved ones in the event of an untimely passing.

In summary, term life insurance offers a fixed and affordable coverage option for a set period, making it an ideal choice for individuals seeking a straightforward and cost-effective way to protect their loved ones. With no age adjustments, this type of insurance provides peace of mind and financial security without the complexities often associated with other life insurance products. It is a valuable tool for anyone looking to secure their family's future during critical life stages.

MetLife's Employer-Provided Life Insurance: A Comprehensive Overview

You may want to see also

Whole Life with Fixed Benefits: Accumulates cash value, but benefits remain constant

Whole life insurance with fixed benefits is a type of permanent life insurance that offers a unique combination of features. Unlike term life insurance, which provides coverage for a specified period, whole life insurance is designed to provide coverage for the entire lifetime of the insured individual. One of the key advantages of this type of policy is that the death benefit remains constant throughout the life of the policyholder, regardless of age. This means that the financial protection offered by the policy does not decrease over time as the insured person ages.

The 'fixed benefits' aspect refers to the guaranteed payout that the policyholder or their beneficiaries will receive upon the insured's death. This benefit amount is predetermined and does not change, providing a sense of security and predictability. For example, if you purchase a whole life policy with a fixed death benefit of $500,000, that amount will be paid out to your beneficiaries when you pass away, regardless of your age at the time of death. This feature is particularly attractive to those seeking long-term financial security and a consistent level of coverage.

In addition to the fixed death benefit, whole life insurance policies also accumulate cash value over time. As premiums are paid, a portion of the premium goes towards building a cash reserve, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes, such as financing education, starting a business, or covering unexpected expenses. The growth of cash value is another advantage, allowing the policy to build equity over the years.

The combination of a fixed death benefit and cash value accumulation makes whole life insurance with fixed benefits an attractive option for individuals who want both long-term financial protection and an investment component. It provides a sense of stability and control, ensuring that the insured's loved ones receive a predetermined amount while also offering the potential for tax-advantaged growth. This type of policy is particularly suitable for those who prefer a more permanent and consistent approach to life insurance, as it does not change or decrease in value over time.

When considering whole life insurance with fixed benefits, it is essential to review the policy details, including the specific terms, conditions, and any associated fees. Understanding the policy's features, such as the fixed death benefit and cash value accumulation, will help individuals make an informed decision about their long-term financial planning and insurance needs. This type of policy can be a valuable tool for those seeking a reliable and consistent form of life insurance coverage.

Life Insurance and Your Rights as an Employee

You may want to see also

Guaranteed Issue: No medical exam, rates don't change with age

When it comes to life insurance, one of the most appealing options for those seeking simplicity and predictability is guaranteed issue life insurance. This type of policy is designed to provide coverage without the hassle of a medical exam, and it offers a unique advantage: rates that remain constant regardless of age.

Guaranteed issue life insurance is a type of policy that is issued without the need for a medical examination, making it accessible to individuals who may have health issues or are considered high-risk by traditional insurance companies. The primary focus is on providing coverage rather than assessing the individual's health status. This approach ensures that everyone has the opportunity to secure life insurance, especially those who might face challenges in obtaining standard coverage.

One of the most significant advantages of this policy is the stability of its rates. Unlike term life insurance, which can have premiums that increase with age, guaranteed issue policies offer a fixed rate that remains the same throughout the term of the policy. This predictability is particularly beneficial for individuals who want to plan their finances without the worry of increasing costs over time. For example, if you purchase a guaranteed issue policy at age 60, the premium will be the same for the entire duration of the policy, providing long-term financial security.

The no-medical-exam aspect also simplifies the application process. Traditional life insurance often requires extensive medical history and health assessments, which can be time-consuming and may deter some applicants. With guaranteed issue, the process is streamlined, allowing individuals to quickly obtain coverage without the need for extensive paperwork or medical checks. This accessibility is especially important for those who may have pre-existing conditions or are older, as it ensures they can secure insurance without the typical barriers.

In summary, guaranteed issue life insurance with no medical exam and fixed rates is an attractive option for individuals seeking simplicity and financial stability. It provides an accessible way to obtain life insurance, ensuring that everyone has the opportunity to protect their loved ones, regardless of their age or health status. This type of policy offers a unique blend of convenience and predictability, making it a valuable consideration for anyone looking to secure their financial future.

Life Insurance Physicals: Are They Necessary?

You may want to see also

Final Expense: Covers funeral costs, often with no age-based increases

When considering life insurance, it's important to understand the various types available and their unique features. One type of life insurance that stands out for its specific purpose and structure is "Final Expense" insurance. This type of coverage is designed to provide financial assistance to beneficiaries in the event of the insured's death, specifically covering the costs associated with funeral and burial expenses. What sets Final Expense insurance apart is its approach to pricing, which often differs from traditional life insurance policies.

Traditional life insurance policies typically increase in cost as the insured individual gets older due to the higher risk associated with longevity. However, Final Expense insurance takes a different approach. It is designed to provide a fixed amount of coverage, often with no age-based increases. This means that the premium remains consistent throughout the policy's duration, regardless of the insured's age. For individuals who want to secure funeral and burial costs without the worry of increasing premiums, this type of insurance can be a valuable option.

The primary purpose of Final Expense insurance is to ensure that the financial burden of funeral and burial arrangements is alleviated from the loved ones of the deceased. By providing a predetermined amount of coverage, the policy ensures that the insured's family can focus on grieving and honoring their loved one without the added stress of financial concerns. This type of insurance is particularly attractive to those who want to plan ahead and provide peace of mind for their families.

One of the key advantages of Final Expense insurance is its simplicity. The policy is straightforward, with no complex medical exams or extensive health history inquiries. This makes the application process more accessible and efficient, allowing individuals to secure coverage quickly. Additionally, the fixed premiums make budgeting easier, as policyholders know exactly how much they will pay annually without any unexpected increases.

In summary, Final Expense insurance is a specialized form of life insurance that focuses on covering funeral and burial costs. Its unique feature is the lack of age-based premium increases, providing a fixed amount of coverage throughout the policy's term. This type of insurance offers a practical solution for individuals seeking to secure their loved ones' financial future during their passing, ensuring a more peaceful and stress-free experience for the entire family.

Depression's Impact: Life Insurance Complications

You may want to see also

Riders: Additional coverage, not tied to age adjustments

When considering life insurance, it's important to understand the various options available, especially when it comes to riders that offer additional coverage without the typical age-related adjustments. These riders can provide valuable benefits while keeping the policy more stable and predictable over time. Here's an overview of what you need to know:

Riders, in the context of life insurance, are optional add-ons that enhance your base policy. They offer specific benefits that can be tailored to your needs, providing extra protection without the need for frequent adjustments based on age. One of the key advantages of these riders is their ability to provide additional coverage without the complexities and potential drawbacks of age-based adjustments. Age-based adjustments in traditional life insurance policies often lead to higher premiums as you get older, which can be a significant concern for those seeking long-term financial security.

For instance, let's consider a rider that provides an additional death benefit. This rider can offer a fixed amount of coverage that remains constant throughout the policy term, regardless of your age. This is particularly beneficial for individuals who want a stable and predictable insurance plan, especially if they have specific financial goals or obligations that require a consistent level of coverage. By choosing this rider, you ensure that your loved ones receive the intended financial support without the worry of increasing costs due to age-related factors.

Another type of rider worth exploring is the "Accidental Death Benefit" rider. This rider provides an additional payout if the insured person's death is a result of an accident. The beauty of this rider is that it doesn't change with age, ensuring that the accidental death benefit remains the same throughout the policy's duration. This is especially useful for those with active lifestyles or professions that may carry a higher risk of accidents.

Furthermore, riders can also offer benefits like critical illness coverage or disability income insurance. These riders provide financial support during critical health events or when the insured individual becomes unable to work due to an illness or injury. The advantage here is that the coverage amount remains fixed, providing a consistent safety net without the need for adjustments based on age-related health changes.

In summary, riders that offer additional coverage without age-related adjustments provide a flexible and tailored approach to life insurance. They ensure that your policy remains relevant and beneficial as your circumstances change over time. By carefully selecting the appropriate riders, you can create a comprehensive and stable insurance plan that meets your specific needs and provides peace of mind.

Universal Life Insurance: Index-Linked Benefits and Features

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a fixed death benefit and premiums remain the same throughout the term. This type of insurance does not increase with age, making it a cost-effective option for those who need coverage for a defined period.

Whole life insurance is a form of permanent life insurance that guarantees a death benefit and has an investment component. Unlike term life, the premiums in whole life increase over time, but they are typically lower in the early years. This type of policy accumulates cash value, which can be borrowed against or withdrawn, providing financial flexibility.

Yes, some life insurance companies offer level term life insurance, which provides a fixed death benefit and premiums that do not increase with age. This type of policy is ideal for individuals who want coverage for a specific duration without the premium adjustments that come with age-based policies.

Yes, there are no-exam or simplified issue life insurance policies available. These policies typically have lower death benefits and may not offer as much coverage as traditional life insurance. They are designed for individuals who may have difficulty passing a medical exam or prefer a quicker and simpler application process.