Employers can offer their employees a valuable benefit by providing life insurance through a trusted provider like MetLife. This insurance plan can provide financial security for employees and their families in the event of the employee's untimely passing. The employer-sponsored life insurance benefit from MetLife typically offers a fixed amount of coverage, often a percentage of the employee's salary, which can be a significant financial safety net for the employee's loved ones. This benefit is an attractive addition to any employee benefits package, demonstrating the employer's commitment to the well-being of their workforce.

What You'll Learn

- Cost Structure: Employers pay a premium to MetLife for group life insurance coverage

- Coverage Options: Customizable plans offer varying death benefits and riders

- Administration: MetLife handles claims, enrollment, and policy management for the employer

- Employee Benefits: Employees receive life insurance as a valuable perk

- Tax Advantages: Group life insurance may offer tax benefits for both employer and employee

Cost Structure: Employers pay a premium to MetLife for group life insurance coverage

Employers often provide group life insurance as a valuable benefit to their employees, and MetLife is a well-known provider of such coverage. When an employer offers group life insurance through MetLife, they are essentially purchasing a policy on behalf of their workforce. This arrangement provides financial protection for the employees' families in the event of their passing. The cost structure of this benefit is primarily centered around the premiums paid by the employer to MetLife.

The premium rate is determined by various factors, including the number of employees enrolled, their age distribution, and the level of coverage selected. MetLife calculates the premium based on these factors to ensure the policy remains financially viable and sustainable. Employers typically pay a fixed amount per employee, which may be included in the overall compensation package or deducted from the employees' wages. This premium payment is a significant consideration for businesses, as it directly impacts their operational costs.

Group life insurance offers a cost-effective way to provide a critical benefit to employees. The group policy often has lower administrative costs compared to individual policies, making it an efficient choice for employers. Additionally, the collective risk pool of a group policy can result in more favorable premium rates, benefiting both the employer and the employees.

Employers should carefully review the premium structure and any associated fees with MetLife to ensure they understand the financial commitment involved. It is essential to consider the company's budget and the value of the life insurance benefit to the workforce when making decisions regarding group insurance coverage.

In summary, the cost structure of employers' life insurance benefits from MetLife involves premium payments, which are influenced by various factors. This arrangement provides a valuable financial safety net for employees' families while also requiring careful consideration of the employer's financial resources.

Life Insurance Certificate: Understanding Your Policy Proof

You may want to see also

Coverage Options: Customizable plans offer varying death benefits and riders

When it comes to employer-sponsored life insurance, MetLife offers a range of customizable plans that provide valuable coverage options for both employers and their employees. These plans are designed to be flexible, allowing businesses to tailor the benefits to their specific needs and the needs of their workforce. Here's an overview of the coverage options available:

Death Benefits: The core of any life insurance policy is the death benefit, which is the financial payout provided to the beneficiaries upon the insured individual's passing. With MetLife's customizable plans, employers can choose from various death benefit options. This includes fixed death benefits, where the payout amount is predetermined and remains constant throughout the policy term. Alternatively, variable death benefits can be selected, allowing the benefit amount to increase over time, providing higher coverage as the employee's salary or role evolves. This flexibility ensures that the insurance keeps pace with the changing needs of the workforce.

Riders and Add-Ons: MetLife's customizable plans also offer a variety of riders and add-ons, providing additional benefits and protection. For instance, the Accidental Death Benefit Rider can double the death benefit if the insured's death is a result of an accident. This rider offers extra peace of mind, especially for high-risk occupations. Other riders may include critical illness coverage, which provides a lump-sum payment if the insured is diagnosed with a critical illness, and waiver of premium rider, ensuring that the policy remains in force even if the insured is unable to make payments due to illness or injury. These riders allow employers to customize the plan to address specific concerns and provide comprehensive coverage.

By offering these customizable plans, MetLife empowers employers to make informed decisions about their employees' well-being. The ability to choose between different death benefits and add riders ensures that the life insurance policy aligns with the unique requirements of each business and its staff. This level of flexibility is a significant advantage, as it allows for a more personalized and effective approach to employee benefits.

In summary, MetLife's employer-sponsored life insurance plans provide a comprehensive and adaptable solution. With various death benefit options and a range of riders, employers can design a policy that suits their budget, risk tolerance, and the specific needs of their employees. This level of customization ensures that the life insurance benefit is a valuable and appreciated part of the overall compensation package.

Life Insurance and Veteran Suicide: What Families Need to Know

You may want to see also

Administration: MetLife handles claims, enrollment, and policy management for the employer

MetLife, a renowned insurance provider, offers a comprehensive range of benefits to employers, including life insurance coverage, which is a crucial aspect of employee welfare. When it comes to administration, MetLife takes on a pivotal role in ensuring a smooth and efficient process for employers. Here's how they handle the administrative responsibilities:

Claims Management: MetLife's expertise lies in efficiently managing claims, which is a critical part of the employer's life insurance benefit. When an employee's life is covered under this insurance, the claims process ensures that the designated beneficiaries receive the financial support they are entitled to. MetLife's claims team is well-equipped to handle these processes, providing guidance and support to both employers and beneficiaries. They streamline the claim settlement, ensuring a fair and timely resolution, which is essential during challenging times for the employer and their staff.

Enrollment Assistance: Enrolling employees in the life insurance plan is a seamless process facilitated by MetLife. They provide comprehensive support to employers, helping them understand the various coverage options available. During enrollment periods, MetLife offers dedicated assistance, ensuring that employees can make informed decisions about their insurance coverage. This includes providing detailed information about different policy types, coverage amounts, and any additional benefits, allowing employers to offer a tailored and competitive package to their workforce.

Policy Management: MetLife takes care of the intricate task of policy management, ensuring that the employer's life insurance benefit remains active and effective. This involves regular policy reviews, updates, and adjustments as per the employer's needs. MetLife's administration team keeps track of policy changes, ensuring that the coverage remains relevant and beneficial to the employees. They also handle premium payments, policy documentation, and any necessary adjustments to accommodate changes in the workforce, providing a hassle-free experience for the employer.

By offering these administrative services, MetLife empowers employers to provide a valuable and well-managed life insurance benefit to their employees. This not only demonstrates the employer's commitment to employee welfare but also contributes to a positive and supportive work environment. MetLife's expertise in claims, enrollment, and policy management ensures that the employer's investment in employee benefits is well-organized and effective.

Cashing Out Northwestern Mutual Life Insurance: A Step-by-Step Guide

You may want to see also

Employee Benefits: Employees receive life insurance as a valuable perk

Employee life insurance is a crucial benefit that employers offer to their staff, providing a safety net and peace of mind for both the employees and their families. When it comes to choosing a life insurance provider, many companies opt for reputable and trusted names in the industry, such as MetLife. MetLife offers a comprehensive range of life insurance products tailored to meet the diverse needs of employees, ensuring that they and their loved ones are protected financially in the event of unforeseen circumstances.

As an employer, offering life insurance as a benefit can significantly enhance employee satisfaction and retention. It demonstrates a commitment to the well-being of the workforce, which can boost morale and foster a positive company culture. Employees often view this benefit as a valuable addition to their overall compensation package, especially since life insurance can provide financial security for their families during challenging times.

MetLife's employer-sponsored life insurance plans typically include various coverage options. These may include term life insurance, which provides coverage for a specified period, and permanent life insurance, offering lifelong protection. Employers can customize the plans to fit their budget and the preferences of their employees, ensuring that the benefit is accessible and beneficial to all. For instance, they might offer a basic level of coverage for all employees or provide higher coverage amounts for key positions or long-serving staff.

Enrolling in MetLife's life insurance program is usually straightforward. Employees can complete an application, providing personal and medical information, and choose the level of coverage they desire. The process is designed to be efficient, allowing employees to quickly secure a policy and gain the financial protection they need. Additionally, MetLife's customer service and support can assist employees in understanding their coverage and making any necessary adjustments to their policies over time.

In summary, offering life insurance as an employee benefit is a strategic decision that employers can make to show their dedication to the workforce's welfare. MetLife's expertise and range of products make it an ideal partner for providing this essential benefit. By choosing MetLife, employers can ensure that their staff members and their families are protected, contributing to a more secure and satisfied workforce. This, in turn, can lead to improved productivity and a more positive work environment.

Unraveling the Mystery: Life Insurance Enricher Explained

You may want to see also

Tax Advantages: Group life insurance may offer tax benefits for both employer and employee

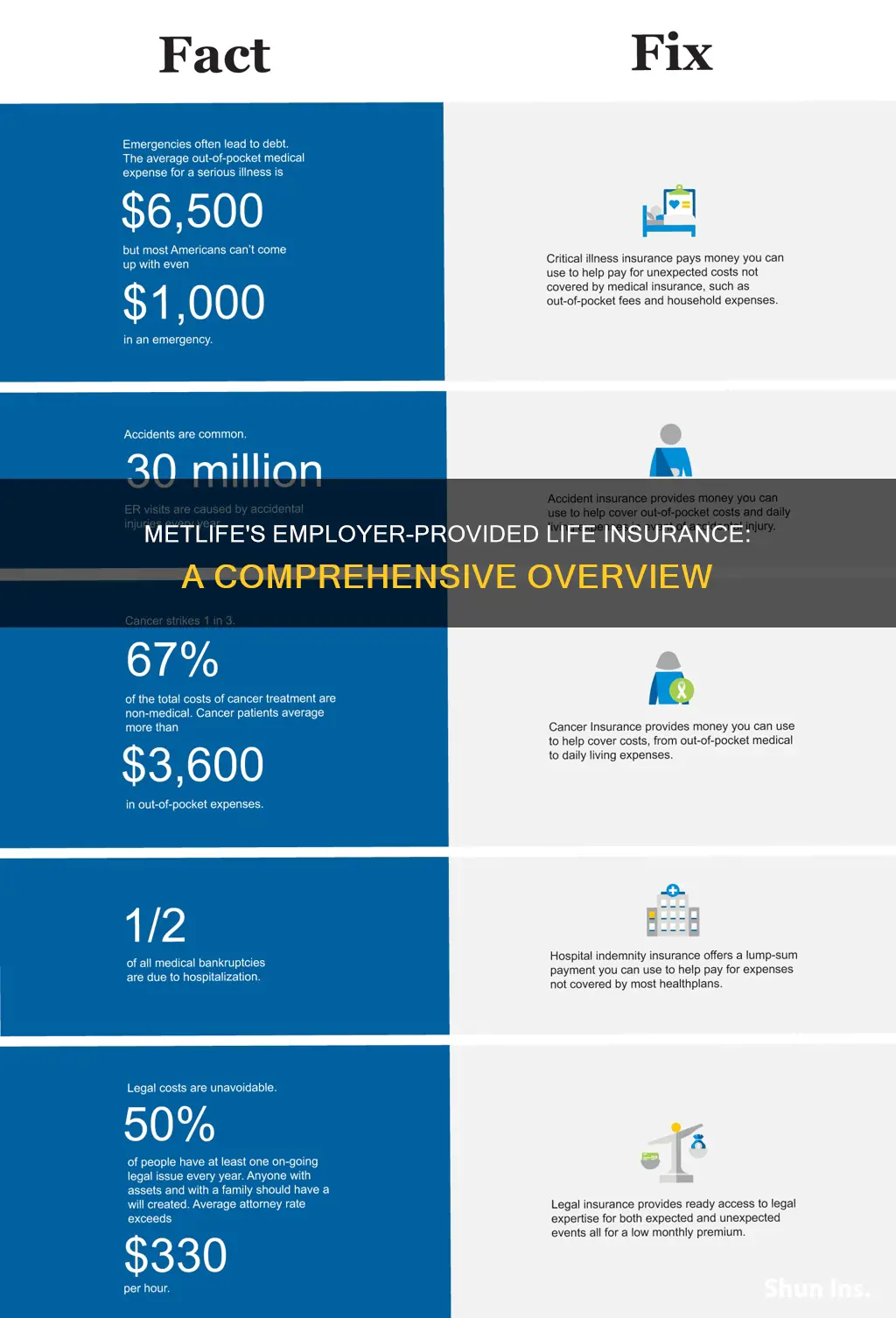

Group life insurance plans often provide tax advantages for both the employer and the employees enrolled in the program. For employees, the primary tax benefit is that the premiums for group life insurance are typically considered a qualified expense, which means they are tax-deductible. This is particularly advantageous for employees who are in higher tax brackets, as it can help reduce their taxable income and, consequently, their tax liability. By offering group life insurance, employers can provide a valuable benefit to their workforce while also potentially reducing their own tax obligations.

The tax advantages for employers are twofold. Firstly, the cost of providing group life insurance can be a tax-deductible business expense. This is because the employer's contribution to the insurance premiums is considered a necessary business expense, especially when it comes to insuring the lives of employees who are integral to the company's operations. Secondly, employers may also benefit from the tax-free status of the death benefit. When an employee's life is insured, and a death claim is paid out, the beneficiary receives the proceeds tax-free. This is a significant advantage for the employer, as it ensures that the financial benefit of the insurance goes directly to the intended recipient without any tax implications.

Additionally, the tax-free nature of group life insurance can also extend to the employees. When an employee receives a death benefit, it is generally not subject to income tax. This is because the insurance proceeds are considered a form of compensation for the risk taken by the insured individual, and in the event of their death, it is treated as a tax-free benefit. This tax advantage can provide financial security for the employee's beneficiaries, ensuring that the entire death benefit is available to them without any tax deductions.

Furthermore, the tax benefits of group life insurance can have a positive impact on the overall financial health of the business. By offering a tax-deductible benefit, employers can potentially reduce their taxable income, which may lead to lower tax payments and increased financial flexibility. This can be especially beneficial for small businesses or startups, as it allows them to allocate resources more efficiently and potentially reinvest savings into the business.

In summary, group life insurance provides a range of tax advantages for both employers and employees. For employees, it offers tax-deductible premiums, reducing taxable income. Employers benefit from tax-deductible expenses and the tax-free status of death benefits. This tax-efficient nature of group life insurance can contribute to a more financially stable and secure work environment, benefiting both the workforce and the business as a whole.

Risk Transference: How Life Insurance Shifts Financial Burdens

You may want to see also

Frequently asked questions

The employer's life insurance benefit is a group life insurance policy provided by MetLife to employees. It offers financial protection to the employer and their beneficiaries in the event of the employee's death.

The amount of coverage varies depending on the employer's plan and the employee's position. Typically, employers offer a set amount of insurance, often ranging from $50,000 to $100,000 or more, per employee.

Eligibility is usually based on the employee's employment status and may have specific criteria. Generally, full-time employees are eligible, and the coverage might start immediately or after a waiting period.

Enrollments for group life insurance are often done during open enrollment periods, which may be annual or semi-annual. Employees can typically choose their preferred coverage amount within the offered range during these enrollment windows.

The premium is determined by various factors, including the employee's age, gender, smoking status, occupation, and the chosen coverage amount. Employers often pay a portion or all of the premium, and the remaining amount might be deducted from the employee's paycheck.