U.S. life insurance is a financial protection tool that provides a financial safety net for individuals and their families. It offers a way to ensure that loved ones are financially secure in the event of the insured's death. This type of insurance policy typically pays out a death benefit to the designated beneficiaries, which can be used to cover various expenses, such as mortgage payments, education costs, or daily living expenses. The policyholder pays regular premiums to the insurance company, and in return, the insurer promises to provide financial support to the policyholder's family upon their passing. Understanding the different types of life insurance, such as term life, whole life, and universal life, is essential for individuals to choose the best coverage that aligns with their financial goals and needs.

What You'll Learn

- Definition: US life insurance provides financial protection for beneficiaries in the event of the insured's death

- Types: Term, whole life, universal life, and variable life are common types

- Benefits: Covers final expenses, provides income, and ensures financial security for loved ones

- Cost: Premiums vary based on age, health, coverage amount, and type of policy

- Regulation: Insured in the US are regulated by state and federal laws

Definition: US life insurance provides financial protection for beneficiaries in the event of the insured's death

US life insurance is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. It is a contract between an individual (the insured) and an insurance company, where the insurer promises to pay a designated sum of money (the death benefit) to one or more beneficiaries upon the insured's death. This insurance policy is a crucial tool for managing risks and ensuring financial stability for families and dependents.

The primary purpose of US life insurance is to offer financial protection and support to the beneficiaries in the event of the insured's passing. When an individual purchases a life insurance policy, they essentially make a promise to the insurance company that they will pay regular premiums in exchange for the insurer's commitment to provide financial assistance to their beneficiaries. This arrangement provides a safety net for the insured's family, covering various expenses and ensuring their financial well-being during a challenging time.

In the context of the US, life insurance policies can be categorized into different types, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is typically chosen for its affordability and straightforward coverage. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time.

When the insured individual passes away, the life insurance policy comes into effect. The insurance company pays out the death benefit, which can be a lump sum or in regular installments, depending on the policy terms. This financial support can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses for the beneficiaries, ensuring that the family's financial obligations are met and their long-term goals remain on track.

It is essential to understand that US life insurance policies can vary significantly in terms of coverage, benefits, and costs. Factors such as age, health, lifestyle, and the amount of coverage desired influence the premium rates and overall policy structure. Therefore, individuals should carefully evaluate their insurance needs, compare different policies, and seek professional advice to ensure they choose the most suitable life insurance plan for their specific circumstances.

Cholesterol's Impact on Life Insurance: What You Need to Know

You may want to see also

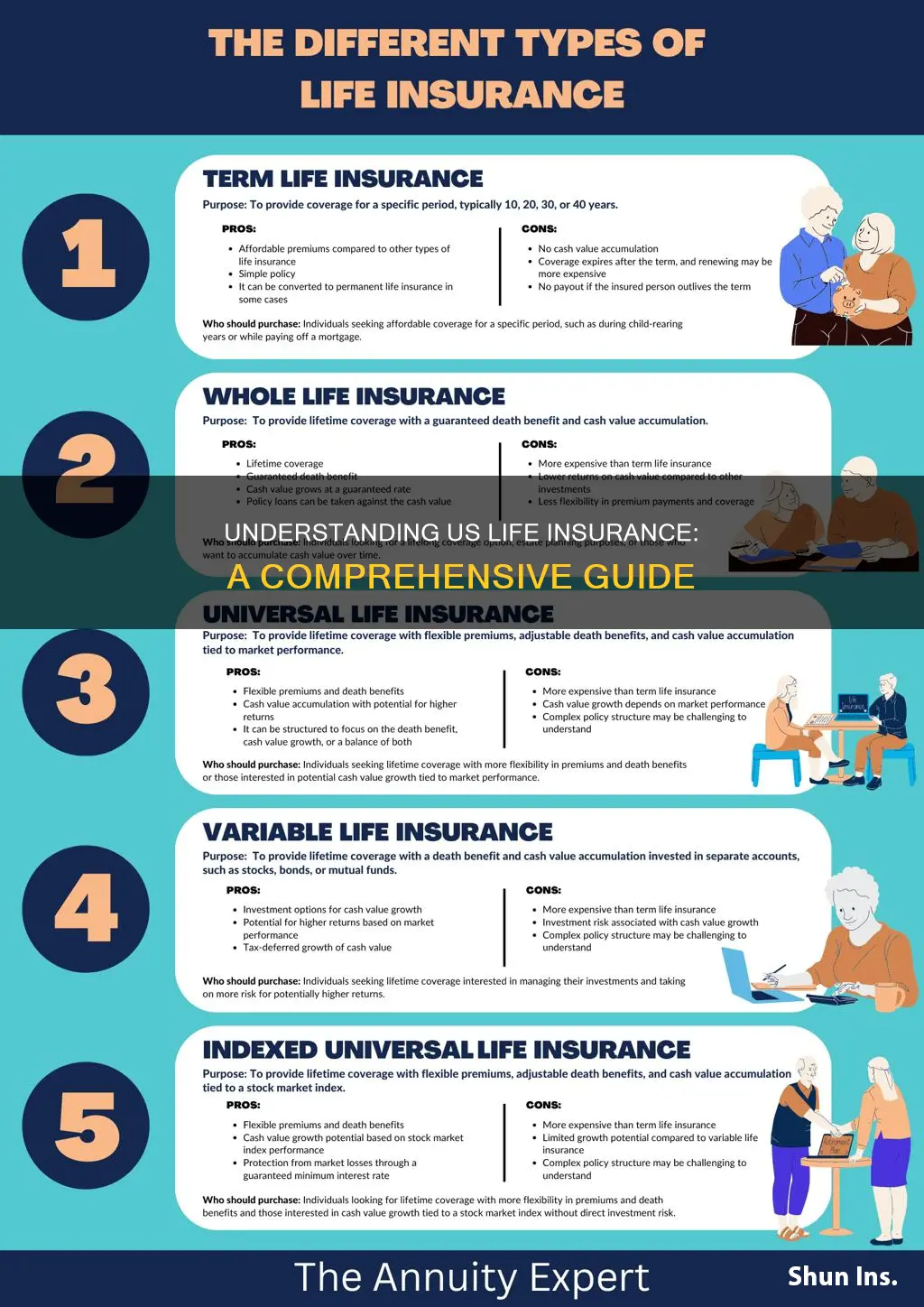

Types: Term, whole life, universal life, and variable life are common types

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It is a crucial aspect of financial planning, offering peace of mind and financial security to individuals and their families. In the United States, various types of life insurance policies are available, each with unique features and benefits. Understanding these types is essential for individuals to choose the right coverage that aligns with their needs and financial goals.

Term Life Insurance: This is a straightforward and affordable type of life insurance. It provides coverage for a specified term, typically 10, 20, or 30 years. During this period, the policyholder pays premiums, and in return, the insurer promises to pay a death benefit to the beneficiaries if the insured person dies during the term. Term life insurance is ideal for individuals who want temporary coverage, often used to cover debts or provide financial support for a specific period, such as mortgage payments or children's education. It offers a fixed premium, making it predictable and budget-friendly.

Whole Life Insurance: In contrast to term life, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a combination of death benefit coverage and a savings component. With whole life, the policyholder pays premiums, and a portion of each premium goes into a cash value account, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is suitable for those seeking long-term financial security and a consistent premium, as the rate remains the same throughout the policy's life.

Universal Life Insurance: This type of policy offers flexible coverage and a permanent death benefit. Universal life insurance provides a guaranteed death benefit and allows policyholders to adjust their premiums and death benefit amounts over time. The premiums are typically higher than term life but lower than whole life. Policyholders can choose to pay the minimum required premium, and any additional amount can be invested, potentially growing the cash value. Universal life is suitable for those who want the flexibility to customize their policy and potentially build a substantial cash value over time.

Variable Life Insurance: Variable life insurance combines death benefit coverage with an investment component. It offers more investment options compared to traditional life insurance. Policyholders can allocate a portion of their premiums to various investment accounts, which can include stocks, bonds, or mutual funds. The performance of these investments directly impacts the cash value of the policy. Variable life insurance provides more control over the investment strategy, making it attractive to those who want to actively manage their investments. However, it is important to note that the investment component adds complexity and potential risk.

Fixed Life Insurance: What You Need to Know

You may want to see also

Benefits: Covers final expenses, provides income, and ensures financial security for loved ones

Life insurance is a financial tool that provides a safety net for individuals and their families, offering a range of benefits that can be life-changing. One of the primary advantages of US life insurance is its ability to cover final expenses, which are often significant and unexpected costs associated with end-of-life matters. These expenses can include funeral and burial costs, medical bills, and outstanding debts, ensuring that the deceased's loved ones are not burdened with financial strain during an already difficult time. By having a life insurance policy in place, individuals can provide peace of mind, knowing that their final wishes will be honored and their loved ones will be financially supported.

Moreover, life insurance serves as a reliable source of income replacement. When an individual passes away, their family may experience a sudden loss of financial support. Life insurance policies typically provide a lump sum payment or regular income payments to beneficiaries, helping to replace the deceased's income and maintain the family's standard of living. This financial security can be crucial for covering daily expenses, paying for children's education, or even starting a new business venture, ensuring that the family's long-term goals and dreams remain achievable.

The benefits of life insurance extend beyond financial support. It plays a vital role in ensuring the financial security of loved ones. A life insurance policy can provide a safety net during challenging times, such as the loss of a primary income earner. It allows families to maintain their lifestyle, cover unexpected costs, and plan for the future without the added stress of financial uncertainty. Additionally, life insurance can be a valuable tool for business owners, as it provides liquidity to settle business debts or buy out partners, ensuring the continuity of the business and protecting the interests of employees and customers.

In summary, US life insurance offers a comprehensive solution to various financial concerns. It provides a means to cover final expenses, ensuring a dignified farewell, and replaces lost income, allowing families to maintain their financial stability. Moreover, it acts as a safety net, offering financial security and peace of mind to loved ones during difficult times. Understanding the benefits of life insurance is essential for making informed decisions about one's financial future and the well-being of those who depend on them.

Understanding Subrogation: A Key to Unlocking Insurance Benefits

You may want to see also

Cost: Premiums vary based on age, health, coverage amount, and type of policy

Understanding the cost structure of US life insurance is crucial for making informed decisions about your financial security. Life insurance premiums, which are the regular payments made to maintain a policy, can vary significantly depending on several key factors.

Age is a primary determinant of insurance rates. Younger individuals typically pay lower premiums because they are statistically less likely to require insurance payouts. As you age, especially after a certain threshold, premiums tend to increase due to the higher risk associated with older age. This is because the likelihood of health issues and mortality increases with age, and insurance companies adjust their rates accordingly.

Health status plays a critical role in determining premium costs. Insurers often assess your health through medical exams, health history, and lifestyle factors. A good health status, including a healthy weight, non-smoking status, and regular exercise, can lead to lower premiums. Conversely, pre-existing health conditions, chronic diseases, or a history of smoking may result in higher rates or even eligibility for coverage.

The coverage amount you choose also significantly impacts the premium. Higher coverage amounts mean a larger financial benefit in the event of the insured's death, and insurers charge more to cover this risk. The type of policy you select is another factor. Term life insurance, which provides coverage for a specified period, generally has lower premiums compared to permanent life insurance, which offers lifelong coverage and includes a cash value component.

In summary, US life insurance premiums are influenced by age, health, the desired coverage amount, and the type of policy. Understanding these factors can help you estimate the cost of different insurance plans and make a more informed decision about your life insurance coverage. It's essential to consider your personal circumstances and consult with insurance professionals to find the best policy that meets your needs and budget.

Whole Life Insurance Cash Values: Are They Flexible?

You may want to see also

Regulation: Insured in the US are regulated by state and federal laws

In the United States, life insurance is a highly regulated industry, ensuring that both insurers and policyholders are protected by a comprehensive legal framework. This regulation is a crucial aspect of the US life insurance market, providing a structured environment for the operation of insurance companies and the management of policyholder interests. The regulatory landscape is a complex interplay of state and federal laws, each contributing to the overall stability and fairness of the insurance sector.

At the federal level, the primary regulator is the National Association of Insurance Commissioners (NAIC). The NAIC is a non-governmental organization that develops and promotes standards for insurance regulation. It plays a pivotal role in setting guidelines and best practices for insurance companies across the country. One of its key responsibilities is the development and implementation of model regulations, which serve as a blueprint for state insurance departments. These models ensure a consistent approach to insurance regulation, allowing for a level playing field and facilitating interstate commerce. The NAIC's influence is significant, as it provides a unified voice for insurance regulators, enabling them to address industry-wide issues and promote consumer protection.

In addition to federal oversight, each state has its own insurance department or commission, which is responsible for regulating insurance companies operating within its jurisdiction. These state regulators enforce insurance laws and ensure that companies adhere to the established standards. They have the authority to examine and audit insurance practices, investigate complaints, and take legal action against non-compliant insurers. State regulations often go beyond the federal guidelines, providing additional consumer protections tailored to the specific needs and demographics of the state's population. This dual system of federal and state regulation ensures a comprehensive and localized approach to insurance oversight.

The regulation of insured individuals in the US is a critical aspect of this legal framework. Policyholders are protected by various laws that ensure transparency, fairness, and accountability in the insurance process. For instance, the Insurance Information Institute (III) provides valuable insights into the regulatory environment, offering resources and education to consumers. The III emphasizes the importance of understanding insurance policies and the rights of policyholders, including the right to file complaints and seek resolution through regulatory channels. Furthermore, state insurance departments often provide consumer guides and resources to help individuals navigate the complexities of their insurance policies and understand their rights.

The regulatory environment for US life insurance is designed to foster trust and confidence in the insurance market. It ensures that insurance companies operate with integrity and provide fair treatment to policyholders. The interplay between federal and state regulations creates a robust system that adapts to the diverse needs of different regions while maintaining a consistent standard of consumer protection. This regulatory structure is essential for the stability and growth of the US life insurance industry, ultimately benefiting both insurers and insured individuals.

Life Insurance and SNAP: Eligibility Impact and Considerations

You may want to see also