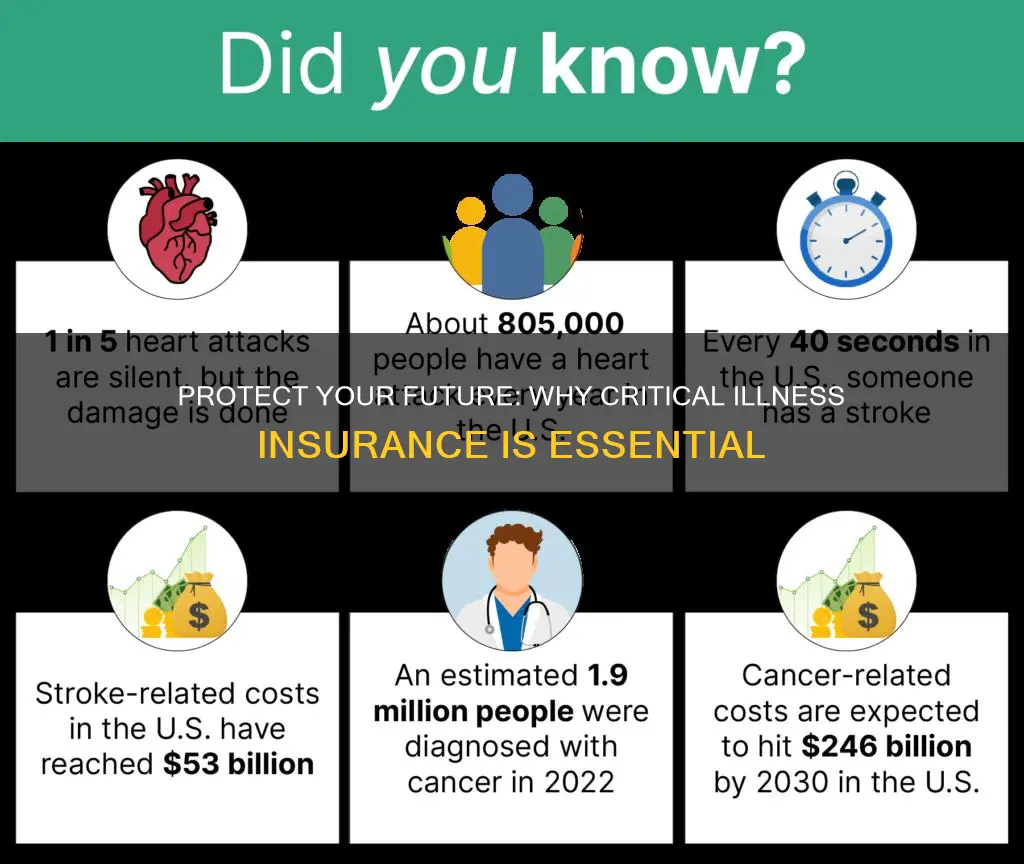

Critical illness insurance is a specialized type of life insurance designed to provide financial support when an individual is diagnosed with a critical illness, such as cancer, heart attack, or stroke. Unlike traditional life insurance, which primarily offers financial protection in the event of death, critical illness insurance focuses on the financial impact of a serious illness that can significantly alter one's ability to work and earn an income. This type of insurance can help cover medical expenses, replace lost income, and provide financial security during a challenging period, ensuring that the policyholder and their family can maintain their standard of living and access necessary treatments.

What You'll Learn

- Financial Security: Protects loved ones financially if you're unable to work due to critical illness

- Peace of Mind: Provides reassurance knowing your family is financially secure in case of a serious health event

- Medical Expenses: Covers the high costs of treatment, hospitalization, and follow-up care

- Income Replacement: Replaces lost income to maintain lifestyle and cover daily expenses

- Long-Term Care: Ensures access to quality long-term care facilities if needed post-recovery

Financial Security: Protects loved ones financially if you're unable to work due to critical illness

Critical illness insurance is a vital financial tool that provides a safety net for individuals and their families during challenging times. When someone is diagnosed with a critical illness, such as cancer, heart attack, or stroke, it can be a life-altering event. The impact of such a diagnosis goes beyond the physical and emotional toll; it can also lead to significant financial strain. This is where critical illness insurance steps in as a crucial safeguard.

The primary purpose of this insurance is to offer financial security and peace of mind. It ensures that if an individual falls ill and is unable to work, their loved ones are protected financially. The insurance policy typically provides a lump sum payment or regular income to cover various expenses that arise when dealing with a critical illness. These expenses may include medical bills, home modifications for accessibility, loss of income due to time off work, and even daily living costs. By having this insurance, individuals can focus on their recovery without the added worry of financial instability.

One of the key advantages is its ability to provide immediate financial support when it is needed most. Critical illnesses often require extensive treatment, which can be a lengthy process. During this time, the insured person may not be able to work, leading to a loss of income. The insurance payout can bridge this gap, ensuring that essential financial commitments are met. This financial security allows individuals to access the best available treatment options and potentially improve their chances of recovery.

Moreover, critical illness insurance offers a sense of reassurance and control. It empowers individuals to take charge of their financial future by providing a financial safety net. Knowing that their loved ones will be taken care of in the event of a critical illness can significantly reduce stress and anxiety. This peace of mind can be invaluable, allowing individuals to concentrate on their health and well-being during a difficult period.

In summary, critical illness insurance is a powerful tool for financial protection. It safeguards individuals and their families by providing financial security when facing a critical illness. With the right insurance policy, individuals can navigate the challenges of illness with the knowledge that their loved ones' financial stability is protected. This type of insurance is an essential consideration for anyone looking to secure their financial future and the well-being of their loved ones.

Best Life Insurance: Am Best Rankings Explained

You may want to see also

Peace of Mind: Provides reassurance knowing your family is financially secure in case of a serious health event

Critical illness insurance is a financial safety net that offers peace of mind to individuals and their families. It provides a comprehensive solution to address the potential financial burdens associated with critical illnesses, ensuring that your loved ones are protected during challenging times. This type of insurance is designed to provide a lump sum payment or regular income if you are diagnosed with a critical illness, allowing you to focus on recovery and your family's well-being.

The primary benefit of critical illness insurance is the reassurance it brings. Knowing that your family's financial stability is protected can significantly reduce stress and anxiety. Serious health events, such as heart attacks, strokes, cancer, or other critical illnesses, can be life-altering and financially devastating. Without proper insurance, the medical expenses, loss of income, and additional costs associated with recovery can quickly accumulate, putting a strain on your family's financial resources.

By having critical illness insurance, you can ensure that your family has the financial means to cover essential expenses during your recovery. This includes medical bills, home care, rehabilitation costs, and even daily living expenses. The insurance payout can provide the necessary support to cover these costs, allowing you to concentrate on your health and recovery without the added worry of financial burdens. It empowers you to make informed decisions about your treatment options, ensuring that you receive the best care without being limited by financial constraints.

Furthermore, critical illness insurance provides a sense of security and control. It enables individuals to take proactive steps towards financial planning. With this insurance, you can have the confidence to make long-term financial decisions, knowing that your family's future is protected. It allows you to focus on your health and well-being, make necessary lifestyle changes, and plan for the future without the constant fear of financial instability.

In summary, critical illness insurance offers peace of mind by providing financial security for your family in the event of a serious health event. It empowers individuals to take control of their financial future, ensuring that their loved ones are protected and able to cope with the challenges that critical illnesses may bring. This type of insurance is a valuable tool for anyone seeking to safeguard their family's financial well-being and focus on their health and recovery.

Sanitation Workers' Life Insurance: Are AZ CTY Employees Covered?

You may want to see also

Medical Expenses: Covers the high costs of treatment, hospitalization, and follow-up care

Critical illness insurance is a financial safety net designed to provide individuals with a critical illness a much-needed source of financial support during a challenging time. One of the most significant benefits of this type of insurance is its ability to cover the high and often unexpected costs associated with critical illnesses. When someone is diagnosed with a critical illness, they often face a multitude of medical expenses that can quickly accumulate. These expenses include the cost of treatment, which can vary widely depending on the severity of the illness and the specific medical interventions required. For instance, treatments for conditions like cancer, heart attacks, or strokes can involve expensive surgeries, medications, and specialized therapies.

Hospitalization is another significant expense that critical illness insurance aims to address. Hospital stays can be lengthy and costly, especially in intensive care units or specialized wards. The insurance policy can help cover the fees for accommodation, medical procedures, and the extensive monitoring and care that often accompany critical illnesses. Moreover, the insurance can extend its coverage to include the expenses related to follow-up care, which is crucial for many critical illnesses. This phase of treatment often involves regular check-ups, rehabilitation, and long-term management to ensure the best possible recovery and quality of life. The costs of these follow-up treatments can be substantial, and having insurance coverage can provide much-needed financial relief.

The financial burden of medical expenses can be overwhelming for individuals and their families, especially when dealing with a critical illness. It can lead to significant debt and strain on personal finances. Critical illness insurance steps in to alleviate this burden by providing a lump-sum payment or regular income to cover these expenses. This financial support allows policyholders to focus on their recovery and well-being without the added stress of financial worries. With the insurance coverage, individuals can afford the necessary treatments, ensure they receive the best medical care, and potentially improve their chances of recovery.

Furthermore, the insurance policy can also cover other related costs, such as transportation to and from medical facilities, especially for those in remote areas, and even provide assistance with home modifications or adaptations required due to the illness. The comprehensive nature of critical illness insurance ensures that policyholders are protected from the financial impact of a critical illness, allowing them to concentrate on their health and recovery. It provides a sense of security and peace of mind, knowing that their financial future is at least partially protected during a difficult period.

In summary, critical illness life insurance is a vital financial tool that specifically targets the high medical expenses associated with critical illnesses. It ensures that individuals can access the necessary treatments, receive adequate hospitalization care, and manage the costs of long-term follow-up care without incurring substantial debt. This type of insurance is a proactive approach to financial planning, offering a safety net that can significantly improve the quality of life for those affected by critical illnesses.

Military Spouses: Life Insurance Options and Entitlements

You may want to see also

Income Replacement: Replaces lost income to maintain lifestyle and cover daily expenses

Critical illness insurance is a type of life insurance policy that provides a lump sum payment if the insured individual is diagnosed with a critical illness, such as cancer, heart attack, or stroke. While the primary purpose of this insurance is to offer financial support during a critical illness, it also plays a crucial role in replacing lost income and maintaining one's lifestyle.

When an individual is diagnosed with a critical illness, they often face a sudden and significant loss of income. This is because the illness may require extended periods of treatment, rehabilitation, or even long-term care, during which the individual cannot work. As a result, their primary source of income is disrupted, leading to financial strain and potential debt. Critical illness insurance steps in to bridge this gap by providing a tax-free lump sum payment, which can be used to cover various expenses.

The primary benefit of income replacement through critical illness insurance is the ability to maintain one's standard of living. This insurance policy ensures that the insured individual can continue to meet their daily financial obligations, such as mortgage or rent payments, utility bills, groceries, and other essential expenses. By providing a substantial financial cushion, the policyholder can avoid the stress and anxiety associated with financial instability and focus on their recovery and long-term health management.

Moreover, the income replacement aspect of critical illness insurance offers peace of mind. It allows individuals to plan for the future and ensure that their loved ones are financially secure in the event of a critical illness. The lump sum payment can be used to cover living expenses for the policyholder and their family, ensuring that their basic needs are met during a challenging time. This financial security can significantly reduce the emotional burden associated with a critical illness, allowing individuals to concentrate on their health and recovery.

In summary, critical illness life insurance is a valuable tool for income replacement, providing financial stability and peace of mind during a critical illness. It enables individuals to maintain their lifestyle, cover daily expenses, and focus on their health without the added worry of financial hardship. Understanding the income replacement aspect of this insurance is essential for anyone considering this type of coverage, as it highlights the practical benefits of having a critical illness policy in place.

Vitality Life Insurance: Is It Worth the Hype?

You may want to see also

Long-Term Care: Ensures access to quality long-term care facilities if needed post-recovery

Critical illness insurance is a financial safety net that provides a lump sum payment upon the diagnosis of a critical illness, offering individuals a chance to focus on recovery and healing without the added stress of financial burdens. This type of insurance is designed to cover the potentially high costs associated with severe illnesses, such as cancer, heart attacks, strokes, and organ failures, which can be financially devastating without adequate coverage. The primary goal is to ensure that policyholders can access the best medical care and treatment options available, improving their chances of a successful recovery.

One of the key benefits of critical illness insurance is its ability to provide financial security and peace of mind. When someone is diagnosed with a critical illness, the last thing they need to worry about is the financial implications. The insurance payout can cover various expenses, including medical bills, hospital stays, rehabilitation, and even daily living costs during the recovery period. This financial support allows individuals to prioritize their health and well-being, potentially leading to better recovery outcomes.

Furthermore, critical illness insurance can be a powerful tool for long-term financial planning. The lump sum payment received can be used to cover any outstanding medical debts, ensuring that the individual and their family are not burdened with significant financial obligations. It can also provide the means to access specialized care and treatments that might not be covered by standard health insurance, potentially improving recovery prospects.

In addition to the immediate financial benefits, critical illness insurance also ensures access to quality long-term care facilities if needed post-recovery. Many critical illnesses require ongoing care and support even after the initial treatment. This can include rehabilitation, physical therapy, and ongoing medical supervision. With critical illness insurance, individuals can have the financial means to choose the best long-term care facilities, ensuring they receive the highest quality of care and support during their recovery journey.

Having access to quality long-term care facilities is crucial for a successful recovery and improved quality of life. These facilities often provide specialized care, rehabilitation services, and ongoing support to help individuals regain their independence and manage any long-term health issues. By ensuring access to such facilities, critical illness insurance empowers individuals to take control of their health and make informed decisions about their long-term care, ultimately enhancing their overall recovery experience.

Life Insurance: Is LTC Rider Worth the Cost?

You may want to see also

Frequently asked questions

Critical illness insurance is a type of life insurance that provides a lump-sum payment if the insured person is diagnosed with a critical illness, such as cancer, heart attack, stroke, or other specified conditions. It is important because it offers financial protection and peace of mind, ensuring that you or your loved ones are financially secure during a challenging time.

Critical illness insurance is specifically designed to provide financial support when an individual is diagnosed with a critical illness, whereas regular life insurance pays out upon the insured person's death. Critical illness insurance focuses on the treatment and recovery process, offering financial assistance to cover medical expenses, lifestyle adjustments, and potential loss of income.

The benefits include a guaranteed payout if you are diagnosed with a covered critical illness, which can help with medical bills, living expenses, and debt repayment. It also provides an opportunity to focus on recovery without financial worries. Additionally, some policies offer an enhanced payout if you survive the initial diagnosis, allowing for a better quality of life post-recovery.

While having pre-existing health conditions may impact your eligibility or premium rates, many insurance providers offer critical illness insurance to individuals with various health backgrounds. The underwriting process will consider your overall health, lifestyle, and medical history. It's best to consult with insurance professionals to understand the options available and find a policy that suits your specific needs.