Group term life insurance often includes age reductions in its pricing structure due to the statistical relationship between age and mortality risk. Younger individuals generally have a higher risk of death compared to older individuals, and insurance companies use age-based reductions to account for this. By applying these reductions, the insurance provider ensures that the premiums are fair and reflective of the policyholder's age, allowing for more accurate risk assessment and pricing. This practice is common in group insurance plans, where multiple individuals are covered under a single policy, and it helps to maintain the financial stability of the insurance company while offering affordable coverage to the group members.

| Characteristics | Values |

|---|---|

| Reduced Premiums | Younger individuals typically pay lower premiums for group term life insurance. This is because the risk of death is generally lower for younger people, and insurance companies can offer more competitive rates. |

| Longer Coverage Periods | Age reductions allow for longer coverage periods for younger individuals. This means that younger policyholders can benefit from extended protection without paying higher premiums. |

| Health and Lifestyle Factors | Insurance companies consider health and lifestyle factors, which can vary with age. Younger individuals may have fewer health concerns, and their lifestyle choices (e.g., smoking, alcohol consumption) can also impact premium costs. |

| Statistical Analysis | Age reductions are based on statistical data and research. Insurance providers analyze mortality rates and other risk factors across different age groups to determine appropriate premium adjustments. |

| Flexibility | Group term life insurance with age reductions offers flexibility for employers and employees. It allows for customized coverage options tailored to the specific needs of different age groups within a workforce. |

| Cost-Effectiveness | For younger employees, this type of insurance can be more cost-effective, providing a higher death benefit relative to the premium paid. This is especially beneficial for those with families or financial dependents. |

| Age-Specific Benefits | Age reductions ensure that younger individuals receive the full death benefit without any age-based reductions, providing comprehensive coverage during their most productive years. |

What You'll Learn

- Age-Based Premiums: Younger individuals pay less due to lower mortality risk

- Statistical Advantage: Younger policyholders provide better statistical data for risk assessment

- Longer Coverage Period: Age reductions allow for longer-term insurance at lower rates

- Health and Lifestyle: Younger groups often have healthier habits, reducing insurance costs

- Market Demand: Age-reduced rates cater to younger consumers seeking affordable insurance

Age-Based Premiums: Younger individuals pay less due to lower mortality risk

The concept of age-based premiums in group term life insurance is a fundamental aspect of insurance design, and it directly impacts the cost of coverage for individuals. Younger individuals often benefit from lower premiums due to a critical factor: reduced mortality risk. This principle is at the heart of why age is a significant determinant in insurance pricing.

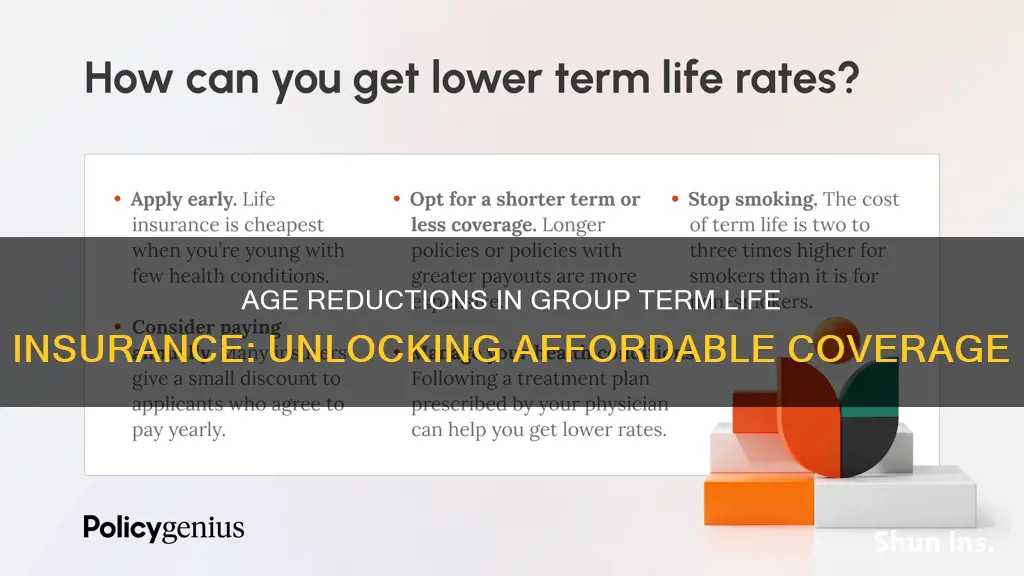

As individuals age, the likelihood of facing a life-threatening event, such as an accident or a critical illness, increases. This higher risk is a primary reason why older individuals typically pay more for life insurance. Insurance companies use age as a predictor of future health and longevity, and this prediction is a key factor in setting premiums. Younger people, on the other hand, have a lower risk profile because they have more years of life ahead, and their chances of developing critical health issues or meeting with accidents are relatively lower.

The insurance industry's approach to age-based pricing is based on statistical analysis and historical data. Actuaries use these data to calculate the expected number of deaths in a given age group over a specific period. By doing so, they can determine the average cost of providing coverage for that age group. Younger individuals contribute to a lower expected death rate, which results in lower premiums for them. This is because the insurance company's primary concern is to ensure that the premiums collected are sufficient to cover the potential payouts in the future, and younger individuals are statistically less likely to require a payout.

Additionally, age-based premiums also consider the potential for long-term coverage. Younger individuals often opt for longer-term policies, such as 10- or 20-year terms, which provide coverage for a more extended period. The insurance company's risk is spread over a more extended duration, making the overall cost more manageable and justifiable. In contrast, older individuals might prefer shorter-term policies, which could result in higher premiums due to the shorter coverage period and the higher risk associated with their age.

In summary, the age-based premium structure in group term life insurance is a strategic approach to pricing that considers the mortality risk associated with different age groups. Younger individuals benefit from lower premiums due to their lower mortality risk, which is a critical factor in insurance pricing. This system ensures that insurance companies can offer coverage at a reasonable cost while providing individuals with the financial protection they need during their most vulnerable years.

Adding Minors to Life Insurance: Executors and You

You may want to see also

Statistical Advantage: Younger policyholders provide better statistical data for risk assessment

The concept of age reductions in group term life insurance is primarily driven by the statistical advantage that younger policyholders offer. When individuals are younger, they are generally considered to be in a lower-risk category for life insurance companies. This is because younger people have a longer life expectancy, and their risk of mortality is significantly lower compared to older individuals. As a result, insurance providers can offer more competitive rates to younger policyholders, as they statistically have a higher chance of outliving the policy term.

The statistical data used by insurance companies to assess risk is based on extensive research and analysis of various demographic factors. Younger individuals typically have a lower incidence of chronic diseases, accidents, and other health-related issues that can lead to premature death. This means that the risk of an insurance claim being made during the policy term is reduced, allowing insurers to offer more affordable premiums.

Furthermore, the accumulation of data over time provides insurance companies with a more comprehensive understanding of risk factors. As younger policyholders age, their risk profiles can be continuously monitored and analyzed. This long-term data collection allows insurers to refine their risk assessment models, ensuring that the premiums charged are accurate and fair. Over time, as younger individuals age, their premiums may increase to reflect the changing risk assessment, but for now, they provide a statistical advantage.

The statistical advantage of younger policyholders is a critical factor in the pricing and structuring of group term life insurance policies. It enables insurance companies to offer coverage at more affordable rates, making it more accessible to a wider range of individuals. This accessibility is particularly beneficial for group insurance programs, where employers can provide life insurance to their employees at a lower cost, thus providing an essential benefit to their workforce.

In summary, the age reductions in group term life insurance are a strategic approach to leveraging the statistical advantage of younger policyholders. This approach allows insurance companies to offer competitive rates, improve accessibility, and build a robust risk assessment framework. As a result, younger individuals can secure valuable life insurance coverage without incurring excessive costs, ensuring they are adequately protected during their most productive years.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Longer Coverage Period: Age reductions allow for longer-term insurance at lower rates

The concept of age reductions in group term life insurance is a strategic approach to providing longer-term coverage at more affordable rates. This method is particularly beneficial for individuals who want to secure their loved ones' financial future for an extended period without incurring excessive costs. By understanding how age reductions work, you can make informed decisions about your insurance coverage and ensure that you and your family are adequately protected.

When it comes to life insurance, the term 'age reductions' refers to the practice of adjusting the insurance premium based on the age of the insured individual. Younger policyholders are typically offered lower premiums because they are considered less risky by insurance companies. This is because younger individuals have a longer life expectancy, and the likelihood of them outliving the policy term is lower compared to older individuals. As a result, the insurance provider can offer more extended coverage periods at reduced rates.

The primary advantage of age reductions is the ability to provide longer-term insurance coverage at a lower cost. For instance, a 30-year-old purchasing a 20-year term life insurance policy with age reductions will likely pay lower premiums compared to someone who is 40 years old buying the same policy. This is because the younger individual has a higher chance of outliving the policy, and the insurance company can spread the risk over a more extended period. Over time, this can result in significant savings for the policyholder.

This strategy is especially valuable for group term life insurance, where multiple individuals are covered under a single policy. By applying age reductions, the insurance company can offer competitive rates to a broader range of individuals, making group life insurance more accessible and affordable. This approach ensures that a larger group of people can benefit from life insurance protection, providing financial security for their families in the event of unforeseen circumstances.

In summary, age reductions in group term life insurance allow for longer-term coverage at lower rates by considering the age-related risk factors. Younger individuals can secure extended insurance periods at more affordable prices, ensuring that their loved ones are protected for a more extended duration. This strategy not only benefits the individual but also contributes to the overall accessibility and cost-effectiveness of group life insurance.

Life Insurance Payouts: Understanding the Percentage Breakdown

You may want to see also

Health and Lifestyle: Younger groups often have healthier habits, reducing insurance costs

The concept of age reductions in group term life insurance is primarily driven by the statistical reality that younger individuals generally have lower mortality rates compared to older individuals. This is a fundamental principle in the insurance industry, where risk assessment plays a critical role in determining premiums. Younger groups often exhibit healthier habits and lifestyles, which contribute to their lower likelihood of developing severe health conditions or dying prematurely.

One of the key reasons for this is that younger people typically have more energy and are more physically active. They are less likely to be affected by chronic diseases like heart disease, diabetes, or certain types of cancer, which are more prevalent in older age groups. Additionally, younger individuals often have fewer financial responsibilities, allowing them to maintain healthier diets and engage in fewer risky behaviors.

The impact of lifestyle choices on health is significant. Younger groups are more likely to adopt and maintain healthy habits such as regular exercise, balanced diets, and reduced exposure to harmful substances like tobacco and excessive alcohol. These habits contribute to lower blood pressure, improved cardiovascular health, and a reduced risk of developing chronic diseases. As a result, insurance providers can offer more competitive rates for group term life insurance policies to younger individuals.

Furthermore, younger people often have a longer life expectancy, which is another factor considered by insurance companies. The longer the policy term, the higher the potential risk for the insurer. By offering lower premiums for younger groups, insurance providers can attract more customers and ensure a steady flow of premiums over a more extended period.

In summary, the age reductions in group term life insurance are a direct result of the healthier habits and lower mortality rates associated with younger individuals. This demographic's lifestyle choices and overall health contribute to more favorable risk profiles, allowing insurance companies to offer competitive rates and attract a wider customer base. Understanding these factors can help individuals make informed decisions when choosing life insurance coverage.

Prudential Life Insurance: Check's in the Mail

You may want to see also

Market Demand: Age-reduced rates cater to younger consumers seeking affordable insurance

The insurance industry has long understood the importance of catering to the needs of younger consumers, and one of the key strategies to achieve this is by offering age-reduced rates for group term life insurance. This approach is particularly crucial in a market where younger individuals often seek affordable insurance options without compromising on coverage.

Younger consumers typically have different financial priorities compared to older adults. They are more likely to be focused on building their careers, saving for the future, and establishing financial independence. As a result, they often seek insurance products that provide comprehensive protection at a cost that aligns with their budget. Group term life insurance, with its age-reduced rates, becomes an attractive solution for this demographic.

Age reductions in group term life insurance policies are designed to reflect the lower risk associated with younger individuals. Insurers calculate premiums based on statistical data and risk assessment, and younger policyholders generally present a lower risk profile. This is because younger people have a longer life expectancy, and their risk of developing health issues or facing life-altering events is considered lower compared to older adults. By offering reduced rates, insurers can make group term life insurance more accessible and affordable for younger consumers.

The market demand for affordable insurance is particularly high among young professionals, students, and recent graduates. These individuals often have limited financial resources and are eager to secure their future without incurring excessive costs. Age-reduced rates in group term life insurance policies enable them to obtain the necessary coverage without straining their budgets. This approach not only encourages young people to purchase insurance but also ensures they have a safety net in place for themselves and their loved ones.

In summary, the market demand for affordable insurance among younger consumers drives the need for age-reduced rates in group term life insurance. By offering these reduced rates, insurers can attract and cater to a younger demographic, providing them with the financial security they seek while also contributing to a more sustainable and inclusive insurance market. This strategy ultimately benefits both the insurance industry and the younger consumers who can now access essential insurance coverage at a more manageable cost.

DNRs and Life Insurance: Can You Sign Both?

You may want to see also

Frequently asked questions

Age reductions are a fundamental aspect of term life insurance, including group policies, because they reflect the statistical reality that the risk of death decreases with age. Insurers use age-based premiums to ensure that the policy remains affordable and financially viable for the entire term. Younger individuals generally have a higher risk profile, and by applying age reductions, the insurance company can offer coverage at a lower cost while still providing adequate protection.

Age reductions directly influence the premium rates. For each year of age, the premium may decrease, making the policy more affordable for the insured. This reduction is more pronounced for younger individuals, as their risk of mortality is generally higher. As a result, younger policyholders can secure coverage at a lower monthly or annual cost, making group term life insurance an attractive option for employers to provide to their employees.

Yes, age reductions typically become more pronounced for younger individuals, especially those in their 20s and 30s. During these decades, the risk of death due to various causes, such as accidents, health issues, or lifestyle factors, is relatively high. As a result, insurers offer more substantial discounts to encourage younger people to take out long-term coverage. This strategy helps ensure that the policy remains cost-effective for both the employer and the employee, providing valuable financial protection for an extended period.