Disintermediation is a financial term that refers to a situation where only two parties are involved in a transaction, with no intermediaries participating. In the context of life insurance, disintermediation risk refers to the possibility that policyholders may give up their policies due to rising interest rates. This can result in cash flow obligations that exceed returns on investment assets. For example, if interest rates rise too quickly, policyholders may cancel their policies faster than expected, leading to a shrinking asset base for insurance companies.

| Characteristics | Values |

|---|---|

| Definition | Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating |

| Reasons | To reduce costs or increase delivery speed |

| Example | A real estate agent’s commission may motivate a buyer to purchase directly from the seller to avoid additional costs |

| Disintermediation risk | The risk of rising interest rates causing policyholders to take the cash value of their policy and invest in higher-yielding securities |

What You'll Learn

Disintermediation risk

Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating. In financial terms, this involves the removal of banks, brokers, or other third parties, allowing individuals to transact or invest directly. The usual reasons for disintermediation are to reduce costs or increase delivery speed.

In the context of life insurance, rising interest rates have generated the prospect of disintermediation risk. For example, a report from AM Best found that the value of surrendered annuity policies increased by 18% in the third quarter of 2023 compared to the same time in 2022. This trend suggests that policyholders are opting to surrender their policies in favour of higher-yielding investments.

Runoff annuity insurance companies or those that focus on block acquisitions rather than organic growth are particularly vulnerable to disintermediation risk. These companies may experience a shrinking asset base as policyholders choose to invest elsewhere.

Cancel Your Reliance Nippon Life Insurance: A Step-by-Step Guide

You may want to see also

The involvement of a mediator

Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating. In the context of life insurance, disintermediation risk refers to the potential that policyholders may relinquish their policies due to rising interest rates. This can occur when policyholders take the cash value of their policy and invest in higher-yielding securities. The involvement of a mediator, such as a bank or broker, in a business transaction can reduce the potential gains for each party. For example, a buyer may be motivated to purchase directly from the seller to avoid additional costs, such as a real estate agent's commission.

The decision to disintermediate may be driven by the desire to reduce costs or increase delivery speed. In financial transactions, disintermediation involves the removal of banks, brokers, or other third parties, allowing individuals to transact or invest directly. While disintermediation can have benefits, it is important to consider the potential risks. In the case of life insurance, disintermediation can lead to policyholders surrendering their policies faster than expected, resulting in cash flow obligations that exceed returns on investment assets.

Additionally, mediators can provide access to a wider range of options and resources. They often have established relationships with multiple insurance providers, allowing policyholders to compare and contrast different offerings. This can result in more informed decision-making and potentially better rates or coverage. Furthermore, mediators can offer ongoing support and assistance throughout the life of the policy. They can help with administrative tasks, claims processing, and policy adjustments, ensuring a smoother experience for policyholders.

However, it is important to acknowledge that the involvement of a mediator also comes with potential drawbacks. As mentioned earlier, the inclusion of a middleman can increase costs for both parties. These additional costs may outweigh the benefits, especially in transactions where speed and efficiency are prioritised. Additionally, the presence of a mediator can introduce an extra layer of complexity and potential delays in decision-making.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Rising interest rates

Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating. In the context of life insurance, disintermediation risk refers to the potential that policyholders may relinquish their policies due to rising interest rates.

When interest rates rise, policyholders may be incentivised to take the cash value of their policy and invest in higher-yielding securities. This can result in cash flow obligations that exceed returns on investment assets for insurance companies. For example, if interest rates rise too rapidly, policyholders may surrender their policies faster than expected. This can lead to a shrinking asset base for insurance companies, particularly those that focus on block acquisitions rather than organic growth.

The involvement of a mediator, such as a bank or broker, in a business transaction can reduce the potential gains for each party. In the case of life insurance, disintermediation can occur when policyholders choose to invest their money elsewhere due to rising interest rates, bypassing the insurance company and potentially impacting their cash flow and ability to service ongoing liabilities.

Overall, rising interest rates can create a disintermediation risk in the life insurance industry by motivating policyholders to seek higher returns on their investments, leading to a potential exodus of policies and cash flow challenges for insurers.

Life Insurance: A Global Perspective on Coverage

You may want to see also

Policyholders relinquishing policies

Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating. In the context of life insurance, disintermediation risk refers to the potential that policyholders may relinquish their policies due to rising interest rates.

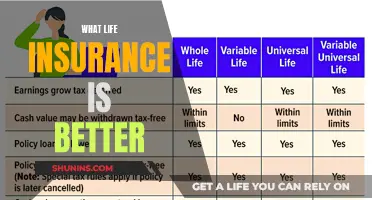

When interest rates rise, policyholders may be motivated to take the cash value of their policy and invest it in higher-yielding securities. This can result in a rapid increase in policy surrender rates, which can lead to cash flow obligations that exceed returns on investment assets for insurers. For example, if a policyholder has a whole life insurance policy, they may choose to surrender the policy and receive the cash value if they believe they can get a higher return by investing the money elsewhere.

During periods of persistently low interest rates, policy surrender rates tend to decrease. However, insurers still face risks. If investment returns decline, insurers may struggle to service ongoing liabilities. This can be particularly challenging for runoff annuity insurance companies, which focus on block acquisitions rather than organic growth and cannot replace the business being surrendered.

Policyholders may also choose to relinquish their policies for reasons other than interest rates. For example, they may no longer need or want the coverage, or they may be unable to afford the premiums. Additionally, policyholders may decide to switch to a different insurance provider that offers more competitive rates or better coverage options.

In summary, disintermediation in life insurance refers to the potential for policyholders to surrender their policies due to rising interest rates. This can create challenges for insurers, as they may face cash flow obligations that exceed returns on investment assets. Policyholders may also relinquish their policies for various other reasons, such as changing needs or preferences or seeking more competitive rates.

Finding VCU Life Insurance: A Comprehensive Guide

You may want to see also

Reducing costs or increasing delivery speed

Disintermediation is a financial term that describes a situation where only two parties are involved in a transaction, with no intermediaries participating. In the context of life insurance, disintermediation can help reduce costs or increase delivery speed by cutting out middlemen such as banks, brokers, or other third parties. This allows individuals to transact or invest directly with the insurance provider.

The involvement of a mediator in a business transaction can reduce the potential gains for each party. For example, a buyer may be motivated to purchase directly from the seller to avoid additional costs such as a real estate agent's commission. Similarly, in the life insurance industry, policyholders may choose to relinquish their policies and invest in higher-yielding securities if interest rates rise too rapidly. This can result in cash flow obligations that exceed returns on investment assets for insurance providers.

Runoff annuity insurance companies or those that focus on block acquisitions rather than organic growth are most likely to experience a shrinking asset base due to disintermediation. This is because they cannot replace the business being surrendered as quickly as companies focused on growth.

By removing intermediaries from the transaction process, life insurance providers can reduce costs associated with broker commissions or other fees. This can lead to more competitive pricing and potentially attract more customers. Additionally, disintermediation can increase delivery speed by streamlining the decision-making process and reducing the time required for coordination between multiple parties.

Overall, disintermediation in life insurance can help reduce costs and increase delivery speed by cutting out middlemen and allowing for more direct transactions between the provider and the customer. This can lead to improved efficiency, competitiveness, and customer satisfaction.

Life Insurance for 23-Year-Olds: Necessary or Not?

You may want to see also

Frequently asked questions

Disintermediation is a financial term that describes a transaction between two parties with no intermediaries. In life insurance, this could mean removing banks, brokers or other third parties to allow individuals to invest directly.

The usual reasons for disintermediation are to reduce costs or increase delivery speed.

Disintermediation risk refers to the potential that policyholders may relinquish policies due to rising interest rates. If interest rates rise too rapidly, policyholders may surrender policies faster than expected, resulting in cash flow obligations that exceed returns on investment assets.

A report from AM Best found that rising interest rates in the life insurance segment have generated the prospect of disintermediation risk. The value of surrendered annuity policies increased by 18% in the third quarter of 2023 compared to 2022.