Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. When considering which type of life insurance is better, it's important to understand the different options available and their unique features. Term life insurance offers a straightforward and cost-effective solution for a specific period, while whole life insurance provides permanent coverage with a cash value component. Universal life insurance offers flexibility in premium payments and death benefits, and variable life insurance allows for investment growth. Each type has its advantages, and the choice depends on individual needs, financial goals, and risk tolerance.

What You'll Learn

- Cost-Effectiveness: Compare premiums, coverage limits, and policy terms

- Coverage Options: Evaluate term life, whole life, and universal life

- Financial Strength: Assess the insurer's financial stability and ratings

- Customer Service: Review customer satisfaction and support availability

- Flexibility: Consider policy customization and rider options

Cost-Effectiveness: Compare premiums, coverage limits, and policy terms

When evaluating life insurance options, cost-effectiveness is a critical factor to consider. It involves a comprehensive assessment of various aspects of the policy to ensure you get the best value for your money. Here's a detailed breakdown of how to compare different life insurance policies in terms of cost-effectiveness:

- Premiums: The premium is the amount you pay regularly (monthly, quarterly, or annually) to maintain your life insurance policy. Lower premiums are generally more cost-effective, but it's essential to strike a balance. Cheaper premiums might indicate lower coverage or a less stable insurance company. Look for policies that offer competitive rates without compromising on the quality of coverage. Compare the premiums of different insurers and consider the payment frequency. Annual or multi-year payments often result in lower overall costs compared to monthly payments.

- Coverage Limits: The coverage limit refers to the amount of financial protection provided by the policy. It's crucial to ensure that the coverage limit is sufficient to meet your financial goals and obligations. A higher coverage limit typically means higher premiums, so finding the right balance is key. Assess your financial needs, including mortgage payments, children's education costs, outstanding debts, and future expenses. Multiply these by a safety factor to determine the appropriate coverage limit. Remember, a higher coverage limit doesn't always translate to better value; it should be proportional to your needs.

- Policy Terms: Life insurance policies can have varying terms, such as 10-year, 20-year, or permanent (whole life) policies. Term life insurance is generally more cost-effective for shorter-term needs, while permanent policies offer lifelong coverage but at a higher cost. Evaluate your long-term financial goals and choose a policy term that aligns with your needs. For instance, if you have a mortgage that will be paid off in 15 years, a 20-year term policy might be sufficient and cost-effective.

- Additional Benefits and Fees: Some life insurance policies offer additional benefits, such as an investment component or critical illness coverage, which can increase the overall cost. Carefully review the policy details to understand any additional fees or charges. Ensure that any extra benefits provide genuine value and are not just adding to the premium without significant advantage.

By comparing premiums, coverage limits, and policy terms, you can make an informed decision about the cost-effectiveness of different life insurance policies. It's essential to strike a balance between affordability and the level of protection you require. Regularly reviewing and adjusting your policy as your circumstances change can also help ensure that you maintain cost-effective coverage throughout your life.

Becoming a Non-Life Insurance Agent in the Philippines

You may want to see also

Coverage Options: Evaluate term life, whole life, and universal life

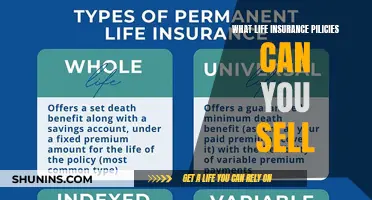

When considering life insurance, one of the primary decisions you'll make is choosing the type of policy that best suits your needs. The market offers several options, each with its own advantages and considerations. Here, we delve into the coverage options available, specifically exploring term life, whole life, and universal life insurance.

Term Life Insurance:

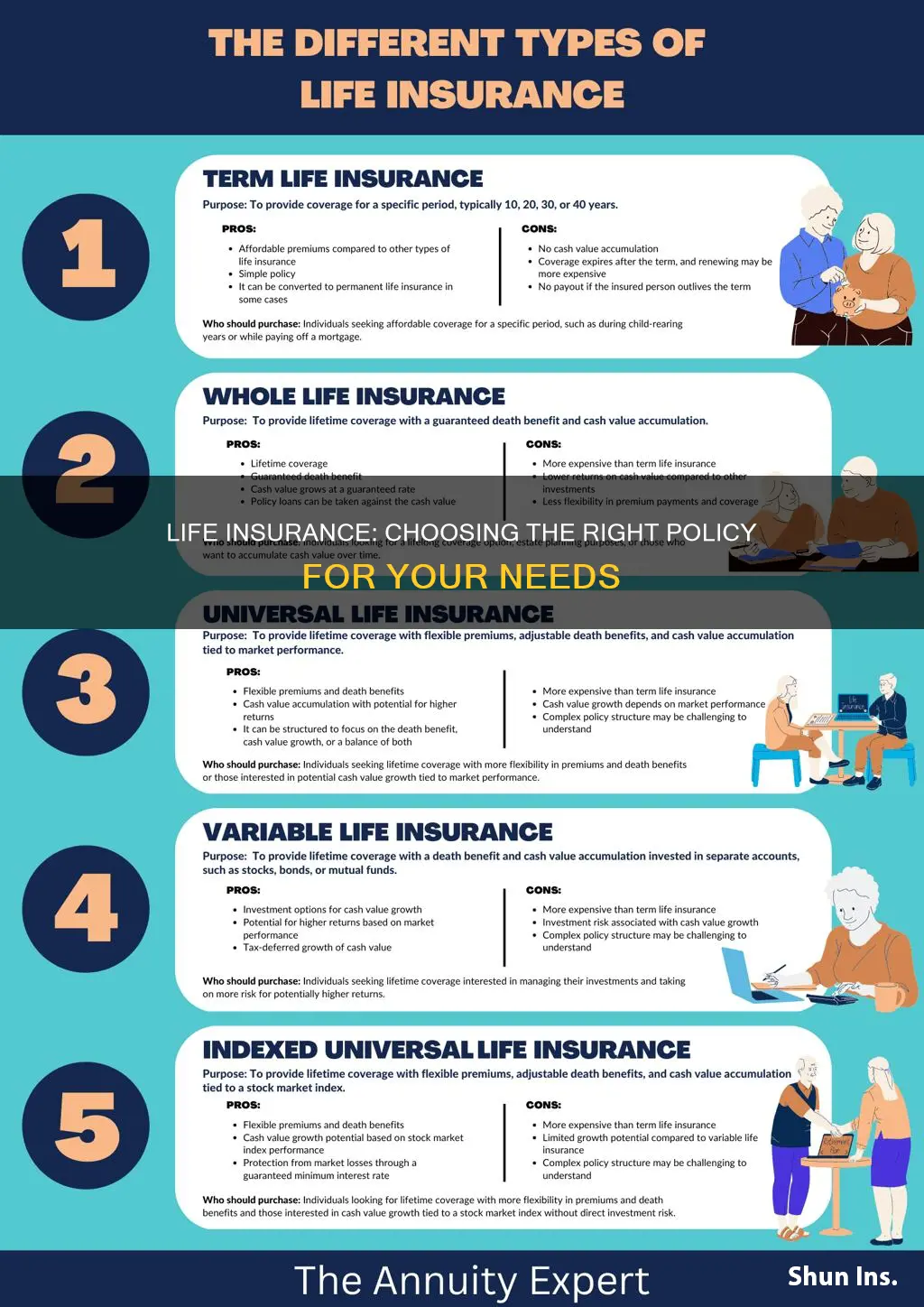

Term life insurance provides coverage for a specified period, often 10, 20, or 30 years. It is a straightforward and cost-effective solution for those seeking temporary coverage. During the term, the policy offers a death benefit if the insured individual passes away. This type of insurance is ideal for individuals who want coverage for a specific financial commitment, such as paying off a mortgage or covering children's education expenses. One of the key advantages is its simplicity; term life insurance has no investment component, making it a pure insurance product. Premiums are typically lower compared to permanent life insurance, making it an attractive option for those on a budget. However, it's important to note that term life insurance does not accumulate cash value, and the coverage ends at the end of the term, requiring renewal or purchase of a new policy if desired.

Whole Life Insurance:

Whole life insurance offers lifelong coverage, providing a sense of security that extends beyond the initial term. This type of policy builds cash value over time, which can be borrowed against or withdrawn. The death benefit is guaranteed and remains the same throughout the policy's duration. Whole life insurance is an excellent choice for those seeking long-term financial protection and a consistent death benefit. The cash value accumulation can be a valuable asset, allowing policyholders to build equity. Premiums are typically higher than term life, but they remain consistent over the life of the policy. This predictability in costs can be appealing to those who prefer financial stability. Additionally, whole life insurance provides a fixed interest rate, ensuring that the policy's value grows at a predictable rate.

Universal Life Insurance:

Universal life insurance offers flexibility and adaptability, combining permanent coverage with an investment component. Policyholders can adjust their premiums and death benefits over time, providing a level of customization. The cash value in universal life insurance grows at a variable rate, similar to an investment account. This feature allows for potential higher returns but also carries more risk. Universal life insurance is suitable for those who want both coverage and an investment vehicle. It provides the flexibility to increase or decrease coverage as needed, making it adaptable to changing financial circumstances. However, the investment aspect means that policyholders bear the risk of market fluctuations, and the cash value may not grow as expected.

When evaluating these coverage options, it's essential to consider your financial goals, risk tolerance, and the length of coverage needed. Term life is ideal for short-term needs, while whole life provides lifelong security. Universal life offers a balance between coverage and investment, allowing for flexibility. Assessing your unique situation will help you determine which type of life insurance is better suited to your requirements.

Free Life Insurance: Banks' Offerings and Their Caveats

You may want to see also

Financial Strength: Assess the insurer's financial stability and ratings

When evaluating life insurance options, understanding the financial stability and ratings of insurance companies is crucial. This aspect is often overlooked but can significantly impact your decision. Here's a detailed guide on how to assess the financial strength of insurers:

Understand the Importance of Financial Strength:

Financial stability is the backbone of any insurance company. It ensures that your policy will be honored in the event of a claim. A financially strong insurer can withstand financial losses, maintain its obligations, and provide long-term security to its policyholders. This is especially important for life insurance, where the insurer's ability to pay out death benefits is paramount.

Check Insurance Ratings:

Insurance companies are often rated by independent agencies like A.M. Best, Moody's, and Standard & Poor's. These ratings provide an assessment of the insurer's financial stability and ability to meet its financial obligations. Here's what these ratings typically indicate:

- A- or Higher: This rating signifies a strong financial position, indicating that the insurer is likely to maintain its obligations over the long term.

- B- to A-3: These ratings suggest a satisfactory financial strength, but the insurer may face some challenges in the event of a significant financial downturn.

- Lower Ratings: Insurers with lower ratings may struggle to meet their financial commitments, especially during economic downturns.

Review Financial Reports:

Insurance companies are required to disclose their financial information in annual reports and statements. These documents provide insights into the insurer's financial health, including assets, liabilities, and capital. Reviewing these reports can help you understand the insurer's financial position and its ability to pay claims. Look for consistent profitability, a strong asset base, and a healthy capital ratio.

Consider Market Presence and Reputation:

A well-established insurer with a strong market presence is often a good indicator of financial stability. Established companies have a track record of managing risks and paying claims, which can provide peace of mind to policyholders. Additionally, a positive reputation in the industry and among customers is a sign of a financially sound company.

Compare and Analyze:

When comparing different life insurance policies, compare the financial ratings and stability of the insurers. This will help you identify companies that are more likely to honor their commitments. It's also beneficial to analyze how the insurer's financial health has evolved over time, as market conditions can impact their stability.

By carefully assessing the financial strength and ratings of insurers, you can make an informed decision when choosing life insurance. This ensures that your policy will provide the necessary financial security for your loved ones, even in the face of unforeseen circumstances. Remember, a financially strong insurer is a reliable partner in safeguarding your future.

Life Insurance Agents: High Earning Potential?

You may want to see also

Customer Service: Review customer satisfaction and support availability

When evaluating customer satisfaction and support availability in the life insurance industry, it's crucial to consider several key factors that contribute to a positive and reliable customer experience. Firstly, the availability and responsiveness of customer support channels are essential. A comprehensive support system should include multiple communication avenues such as phone, email, live chat, and social media. Customers should be able to reach out for assistance at any time, and the response time should be prompt, ideally within a few minutes during business hours. Quick response times demonstrate a commitment to customer service and can significantly impact overall satisfaction.

Another critical aspect is the knowledge and expertise of the customer support team. Agents should be well-trained and equipped to handle a wide range of inquiries, from policy details and claim processes to addressing complex financial concerns. They should possess the ability to provide accurate and clear information, ensuring that customers feel informed and supported throughout their insurance journey. Regular training sessions and access to comprehensive resources can empower support staff to deliver exceptional service.

Customer satisfaction surveys and feedback mechanisms are invaluable tools for gauging the effectiveness of customer service. Companies should encourage customers to provide feedback after interactions, allowing them to rate their experience and share suggestions. This feedback should be analyzed to identify areas of improvement, such as common issues, long wait times, or knowledge gaps in the support team. By addressing these concerns, insurance providers can enhance their customer service and build a positive reputation.

Additionally, the company's overall customer service philosophy and culture play a significant role. A customer-centric approach, where the focus is on building long-term relationships and understanding individual needs, can set a life insurance provider apart. Personalized service, where agents take the time to listen and tailor solutions, can lead to higher customer loyalty and satisfaction. It is also beneficial to have a dedicated customer success team that proactively reaches out to clients, ensuring their needs are met and providing additional support when required.

In summary, customer satisfaction and support availability are vital components of a successful life insurance provider. By offering multiple support channels, ensuring knowledgeable staff, utilizing feedback, and adopting a customer-centric culture, companies can deliver exceptional service. Prompt responses, comprehensive training, and a personalized approach will contribute to a positive customer experience, fostering trust and long-term relationships. Regularly reviewing and improving these aspects can help insurance companies stay competitive and meet the evolving needs of their customers.

Maximizing Life Insurance Benefits: Understanding Spouse Coverage

You may want to see also

Flexibility: Consider policy customization and rider options

When evaluating life insurance options, flexibility is a key aspect to consider, especially in terms of policy customization and rider add-ons. This aspect allows you to tailor your life insurance policy to your specific needs and changing circumstances. Here's a breakdown of why flexibility is essential and how to approach it:

Policy Customization: Life insurance policies can vary significantly in their structure and coverage. One of the most flexible options is term life insurance, which provides coverage for a specified period, such as 10, 20, or 30 years. This type of policy is highly customizable, allowing you to choose the coverage amount, duration, and even the payment term (annual, monthly, etc.). For instance, if you're a young professional with a growing family, you might opt for a 20-year term policy with a higher coverage amount to ensure your family's financial security during this critical period. As your life circumstances change, you can adjust the policy accordingly, extending or reducing coverage as needed.

Riders and Add-ons: Life insurance companies often offer a range of riders or add-ons that provide additional benefits and flexibility. These riders can be attached to your base policy, enhancing its value. For example, an accidental death benefit rider increases the payout if the insured dies due to an accident, providing extra financial security. A critical illness rider covers the policyholder if they are diagnosed with a critical illness, offering a tax-free cash payout. Another common rider is the waiver of premium, which allows the insured to suspend premium payments if they become disabled, ensuring the policy remains in force. These riders can be added or removed as your risk profile or financial goals evolve, providing a level of customization that ensures your policy remains relevant.

Flexibility in life insurance is about having the option to adapt your policy to your life's changing needs. It empowers you to make informed decisions and ensures that your insurance coverage remains a valuable asset over time. When comparing policies, consider the customization options and the variety of riders available. This approach allows you to create a comprehensive and personalized life insurance plan that suits your unique circumstances and provides the necessary financial protection.

In summary, flexibility in life insurance is about finding a balance between a solid foundation of coverage and the ability to adapt as your life progresses. By understanding the customization options and rider add-ons, you can make an informed decision, ensuring that your life insurance remains a valuable and relevant financial tool throughout your life.

Contacting AIG Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is a pure insurance product, offering a death benefit if the insured dies during the term. Permanent life insurance, on the other hand, is a type of whole life insurance that provides coverage for the entire lifetime of the insured. It includes a savings component, allowing the policyholder to accumulate cash value over time, which can be borrowed against or withdrawn.

The choice depends on your financial goals and risk tolerance. Whole life insurance offers lifelong coverage and a guaranteed death benefit, making it a good option for long-term financial security and wealth accumulation. Term life is more affordable and provides coverage for a specific period, making it suitable for temporary needs, such as covering mortgage payments or providing for dependent children.

Yes, several factors can impact the cost of life insurance. Age is a significant determinant, as younger individuals generally pay lower premiums. The amount of coverage you choose also affects the price. Additionally, your health, lifestyle, and family medical history can influence rates. Non-smokers and individuals with a healthy weight and blood pressure may qualify for lower premiums. It's essential to provide accurate and up-to-date health information to get an accurate quote.