Life insurance medical exams are a routine part of the application process. They are similar to annual physicals and include a verbal questionnaire and a physical exam. The physical exam involves measuring an applicant's height and weight, checking their blood pressure, and collecting blood and urine samples. The blood and urine tests are used to screen for drug use, which can affect an applicant's approval and premiums. While most life insurance companies conduct drug tests, there are some no-medical-exam policies that allow applicants to skip the exam if they meet the insurer's qualifications.

| Characteristics | Values |

|---|---|

| Test type | Blood test, urine test |

| Test location | Home, workplace, local exam centre |

| Test time | 15-30 minutes |

| Test components | Height, weight, pulse, blood pressure, EKG, health questionnaire |

| Blood test components | Liver function, cardiovascular function, drug use, nicotine use, prescription drugs |

| Urine test components | Drug use, nicotine use |

What You'll Learn

Blood and urine tests are used to screen for drug use

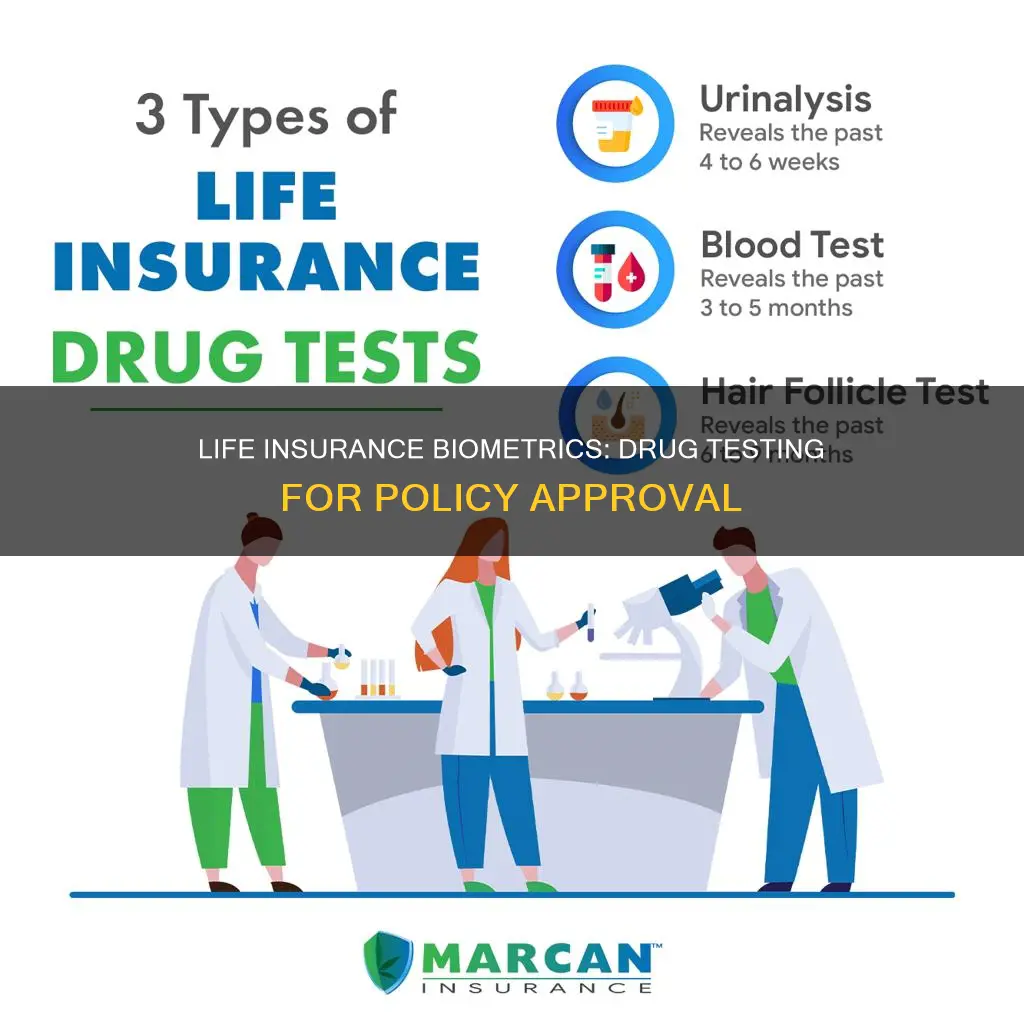

Blood and urine tests are commonly used to screen for drug use. Blood tests are often used in emergencies, such as a potential overdose, and can provide precise results. Urine tests, on the other hand, are the most common method for drug screening due to the ease of sampling. They can detect the presence of drugs within hours to several days before the test.

The metabolic processes that break down drugs in the body occur at different speeds for different drugs, so the timeframe for detecting certain drugs can vary widely. For example, amphetamines are typically detected in their original form, whereas other drugs are detected as metabolites, which can remain in the body for longer.

Urine tests are often used to detect alcohol, amphetamines, benzodiazepines, opiates/opioids, cocaine, and marijuana (THC). Blood tests can be used to detect alcohol levels and are also used to screen for amphetamines, barbiturates, benzodiazepines, opioids, and opiates.

Life Insurance on an Ex-Spouse: Is It Possible?

You may want to see also

Drug tests can detect prescription and recreational drugs

Drug tests can be performed on samples of blood, hair, saliva, breath, or, most commonly, urine. They can detect both prescription and illegal drugs, including:

- Amphetamines/methamphetamines

- Barbiturates (e.g. phenobarbital and secobarbital)

- Benzodiazepines (e.g. alprazolam or clonazepam)

- Opioids/opiates (e.g. heroin, codeine, oxycodone, morphine, hydrocodone, and fentanyl)

- Cocaine

- Marijuana (THC)

- Phencyclidine (PCP)

- Methadone

- Tricyclic antidepressants

- Ecstasy

- Alcohol (ethanol)

The tests can also detect nicotine and cotinine, which is an alkaloid found in tobacco.

The purpose of a drug test is to look for drug use and misuse, including the misuse of prescription medications. This can include taking prescription medicines in a different way or for a different purpose than prescribed, such as using a prescription pain reliever to relax or taking someone else's prescription.

It's important to note that a positive test for a prescription drug does not necessarily mean that the person is abusing the drug, as there is no way for the test to indicate acceptable levels compared to abusive levels of prescribed drugs.

Drug tests are commonly used for pre-employment screening, medical testing and diagnostics, legal testing, monitoring for prescription drug misuse, and athletic testing.

Selling Life Insurance: Strategies for Success

You may want to see also

Drug tests can detect nicotine and cotinine

Life insurance companies use blood and urine tests to screen for nicotine and cotinine, which can affect your application approval and premiums. If you test positive for nicotine, you will likely be classified as a smoker, even if it is from a nicotine patch or other cessation product. Tobacco users often face higher insurance rates, so some people try to quit before the exam to get better rates. However, it is important to be honest on the application, as lying about smoking status can lead to denied coverage or policy cancellation.

The detection of nicotine and cotinine in the body can vary depending on factors such as the type and amount of tobacco used, as well as individual genetic differences in how the body processes nicotine. Generally, nicotine will leave the blood within 1-3 days after stopping tobacco use, while cotinine can remain detectable for 1-10 days. In urine samples, neither nicotine nor cotinine will be detectable after 3-4 days of abstinence. Saliva tests are considered the most sensitive method for detecting cotinine and can do so for up to 4 days, while hair testing can accurately detect long-term tobacco use for up to 1-3 months.

It is important to note that nicotine replacement therapies, such as patches or gum, can also result in positive tests for nicotine and cotinine. If you are using these products to quit smoking, be sure to disclose this information to the testing administrator to avoid any misunderstandings.

Full Coverage Life Insurance: What Does It Mean?

You may want to see also

Drug tests can detect marijuana use

Urine tests are the most common method for detecting marijuana use, and they can typically detect the presence of THC metabolites for 3 to 30 days after use. However, heavy or chronic users may test positive for longer periods, ranging from 15 to 90 days. Saliva tests have a much shorter detection window, usually up to 24 hours, but some evidence suggests that oral tests can detect THC for up to 30 or even 44 hours after use. Blood tests can only detect THC for a few hours, and they are less commonly used due to their invasive nature.

Hair analysis is a highly sensitive method for detecting marijuana use and can provide a detection window of up to 90 days. This method involves testing a 1.5-inch hair sample, which reflects drug use over the past 3 months. It is important to note that false positives may occur with hair tests if an individual comes into contact with a marijuana user or handles the drug directly.

The frequency of marijuana use also plays a significant role in detection times. For example, a person who smokes cannabis 3 to 4 times a week may test positive for 5 to 7 days, while daily or more frequent users may test positive for 30 days or longer. Additionally, individuals with higher body fat concentrations may metabolize marijuana at a slower rate, resulting in longer detection times.

It is worth noting that life insurance companies typically test for marijuana use during the medical exam, and most companies allow some level of marijuana consumption. However, the frequency of use and insurer-specific rules will determine whether an individual qualifies for the best rates or is classified as a smoker, resulting in higher premiums.

Social Security: Life Insurance for Seniors?

You may want to see also

Failing a drug test can lead to higher premiums or a declined application

Failing a drug test can have serious consequences for your life insurance application. While it may not automatically result in a declined application, it will certainly impact the underwriting process and could hurt your chances of approval. Drug use increases your risk of premature death, and insurance companies will take this into account when determining your eligibility and premiums.

If you test positive for drugs on your medical exam, the life insurance company will likely ask follow-up questions to confirm the findings, which can delay the application process. They may inquire about the frequency and severity of your drug use, the reasons behind it, and any withdrawal symptoms you have experienced. Being honest and upfront about your drug use is crucial, as providing false information can lead to accusations of insurance fraud.

If you are a current drug user, especially of hard drugs or painkillers that have not been prescribed, you will most likely be deemed ineligible for coverage. Most life insurance companies require applicants to be clean for at least two to five years before applying, with no relapses. Even if you have been clean for a while, your premiums may still be higher due to the increased risk associated with drug use.

For tobacco and nicotine users, the consequences may include significantly higher premiums, up to two to three times higher than non-smokers. This is because tobacco use is associated with a higher risk of health issues and premature death. If you lied about smoking on your application, the insurer may consider this fraud and decline your application or cancel your policy.

Marijuana use is treated differently by life insurance companies. While some may classify marijuana users as smokers and offer similar rates as tobacco users, others may be more lenient and determine coverage and premiums based on the frequency of cannabis use. It is important to note that even in states where marijuana use is legal, insurance companies may not accept it as medically necessary and could still use it as a reason to deny coverage.

In summary, failing a drug test can lead to higher premiums or a declined application. The specific consequences depend on the type of drug, the frequency of use, and the policies of the insurance company. Being honest and seeking independent advice if necessary are important steps to take when applying for life insurance.

Banks Selling Insurance: Unemployed, Covered or Exploited?

You may want to see also

Frequently asked questions

Yes, most reputable life insurance companies conduct drug tests as part of the medical exam. This is usually done through urine and blood tests.

Life insurance drug tests can detect a wide range of drugs, including amphetamines/methamphetamines, cocaine, opiates, phencyclidine (PCP), barbiturates, benzodiazepines, and marijuana. They also test for nicotine and prescription drugs.

Drug testing helps insurance companies determine the applicant's risk level. Drug users have a higher risk of premature death than non-drug users, which affects the insurance company's assessment of the applicant's life expectancy and overall risk.

Failing a life insurance drug test can lead to a delay in the application process as the company will ask follow-up questions to confirm the findings. It may also result in higher premiums or even a declined application, especially for hard drugs or painkiller use.

It is your right to refuse a drug test, but the insurance company also has the right to deny your application. They may require a drug test to get a full picture of your health risks, especially if there are signs or suspicions of drug use.

Note: While I could not find specific information about "biometrics" in relation to life insurance drug tests, I assumed you were referring to the standard medical exam and drug testing procedures.