Life insurance is a financial safety net that ensures your loved ones are financially protected in the event of your death. When it comes to life insurance rates, age is a critical factor. As we get older, the likelihood of passing away increases, which elevates the risk for insurers. This means that policy costs increase with age due to the heightened chance of a death benefit claim. While health, medical history, and lifestyle choices also influence pricing, age remains the primary driver of insurance rates. This text will explore how age impacts life insurance rates and other factors that come into play when determining these rates.

| Characteristics | Values |

|---|---|

| Whole life insurance | Premiums do not vary with age |

| Term life insurance | Premiums increase with age |

| Permanent life insurance | Premiums do not increase with age |

| Guaranteed life insurance | Premiums are expensive |

What You'll Learn

Whole life insurance premiums do not increase with age

Life insurance rates are determined by a few factors, including age, health, gender, lifestyle, type of policy, and coverage amount. Typically, the older you are, the more expensive your premiums will be. This is because the cost of life insurance is based on actuarial life tables that predict a person's likelihood of dying while the policy is in force.

However, this is not always the case. Whole life insurance premiums do not increase with age. Whole life insurance is a type of permanent life insurance policy that provides coverage for the entirety of the policyholder's life, rather than for a specified term. Whole life policies are structured to pay death benefits to beneficiaries in exchange for regular premium payments, assuming premiums are paid and other terms and conditions are met.

Unlike some other life insurance policy types, whole life premiums remain consistent throughout the duration of the policy. This means that, even as the policyholder ages, their premium payments will not increase. This is a significant advantage of whole life insurance, providing peace of mind and financial stability for policyholders and their beneficiaries.

For example, a $500,000 whole life insurance policy for a 30-year-old non-smoker in good health costs an average of $451 per month. While factors such as health, gender, occupation, and hobbies can influence the cost, the premium will remain the same throughout the policyholder's life.

In contrast, term life insurance policies typically have fixed premiums for the duration of the term, which can range from 10 to 30 years. Once the term ends, the policyholder can choose to renew the policy, usually at a higher rate. Permanent life insurance policies, on the other hand, may have level (fixed) or variable premiums. If they are variable, they usually rise with the age of the policyholder.

Therefore, while age is a critical factor in determining life insurance rates, it does not impact all policies in the same way. Whole life insurance premiums remain constant throughout the policy, providing a consistent and reliable level of coverage for the policyholder and their beneficiaries.

Sildenafil: Impact on Life Insurance Coverage and Costs

You may want to see also

Term life insurance premiums increase with age

Age is a primary factor influencing life insurance premium rates, whether the policy is term or permanent. Term life insurance premiums are established when the policy is bought and remain the same every year. However, when the term ends, the policyholder can either end their coverage or renew their policy, usually at a higher rate.

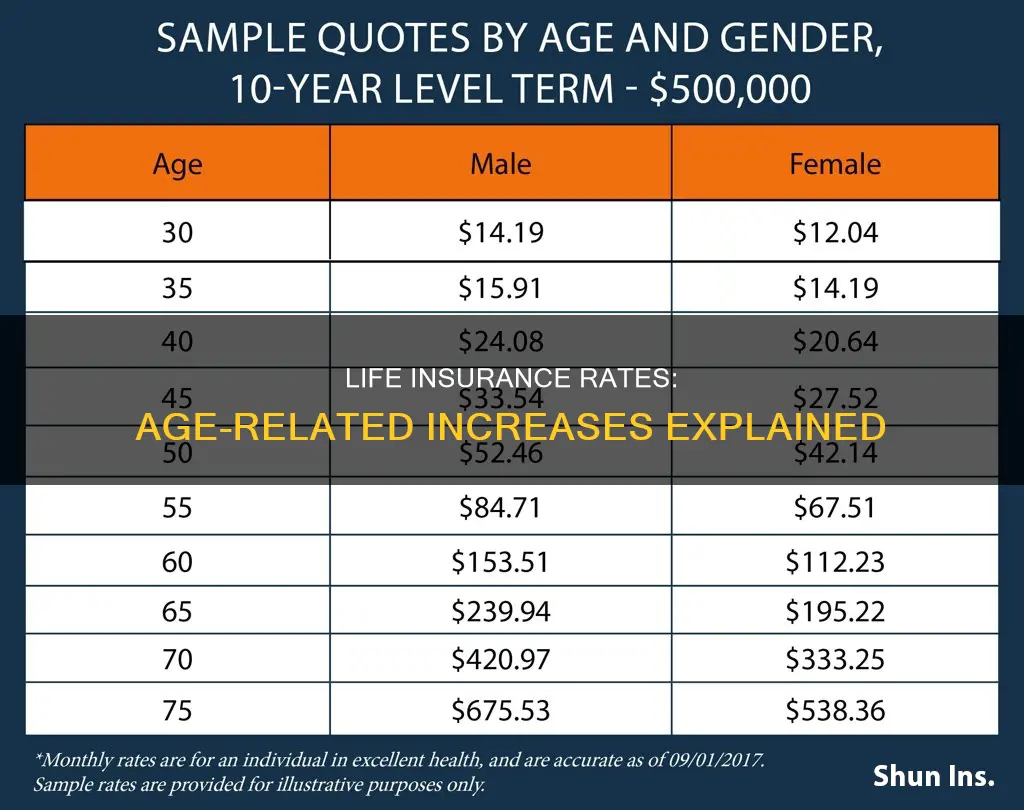

The older someone is when they purchase a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of the policyholder dying while the policy is in force. The older someone is, the more likely they are to become ill or die, so the cost of insurance increases.

The annual premium for a term life insurance policy is determined at the time of purchase and set for the duration of the policy. Typically, the premium amount increases on average by about 8% to 10% for every year of age. For example, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

To hold term life insurance prices steady, insurers spread the premiums that would be paid over 10, 20, or 30 years and average them into one payment. This means that instead of paying low premiums when young and very high premiums when older, the policyholder pays the same amount every year.

Term life insurance is typically the most affordable policy type because it only offers coverage for a limited number of years. If the policyholder does not pass away during the term, the coverage expires without a death benefit being paid out.

Young adults are often in good health and may only need a minimum amount of coverage, which might translate to lower rates. Many individuals will find that a term life insurance policy offers adequate coverage for their needs and budget. Young families often purchase term life insurance because it’s a more affordable option at a time when they’re typically the most financially vulnerable.

Middle-aged adults may benefit from a term life insurance policy that is in effect until they hit retirement. For instance, instead of purchasing a 30-year policy, a middle-aged adult might purchase a 10-year policy if they’re only a decade out from retiring.

Older adults might have a harder time purchasing life insurance. Many insurers stop issuing new life insurance policies to seniors over a certain age, usually around 80. Life insurance for seniors can often be cost-prohibitive, depending on their health and the type of coverage they qualify for.

Canceling Life Insurance Direct Debit: What You Need to Know

You may want to see also

Permanent life insurance is more expensive but has advantages

Permanent life insurance is more expensive than term life insurance, but it has advantages.

Permanent life insurance typically lasts your entire life and builds cash value, but it’s more expensive than term life. Permanent life insurance generally covers you for the rest of your life and pays out regardless of when you die—as long as your policy remains in force. These types of policies also include a cash value component that you can withdraw from or borrow against while you’re still alive. Depending on the policy, you may be able to adjust your premium payments and coverage amount to fit your needs.

Whole life insurance policies have fixed premiums and a cash value component that accumulates over time. Insurers may offer different payment schedules, such as paying premiums up to age 100, paying premiums for a fixed number of years, or single-payment policies. When you die, your beneficiaries typically receive the face amount of the policy, not the face amount plus cash value. You can withdraw money or borrow against the cash value during your lifetime—but if you don't pay it back, the insurer will reduce the life insurance death benefit by the same dollar amount.

Universal life insurance allows you to adjust your premiums and death benefit, giving you flexibility as your financial circumstances change. You can also combine the cash value with the death benefit to increase the payout to your beneficiaries, though the premiums will be more expensive if you choose this option.

Variable life insurance offers policyholders the opportunity to put their cash value in investments of their choosing, which can make this type of coverage riskier than whole or universal life. You may have the option to include the cash value in the death benefit. Premiums are typically fixed, and returns on the cash value are not guaranteed.

Permanent life insurance is typically more expensive than term life insurance because of the lifelong coverage and investment opportunities. And certain policies require detailed investment attention, something you may not have the time or inclination to give.

Life Insurance Payouts: Tax Implications and Exemptions

You may want to see also

Life insurance for seniors

Types of Life Insurance for Seniors

There are several types of life insurance available for seniors, including:

- Term life insurance

- Whole life insurance

- Final expense insurance

- Simplified issue life insurance

- Guaranteed issue life insurance

Term Life Insurance

Term life insurance covers you for a set period, usually 10, 15, 20, 25, or 30 years. The older you are, the shorter the term length options may be, and the fees will likely rise as you age. Term life insurance is a good option for seniors who are in good health and have time-sensitive financial obligations, such as a mortgage or credit card debt.

Whole Life Insurance

Whole life insurance covers you for your entire life and offers a guaranteed payout. It is more expensive than term life insurance but can be a good option for those who want to leave money behind for their family. Whole life insurance also includes a cash value feature that can be used to take out loans or pay premiums.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a type of whole life insurance that covers funeral and burial costs. It has smaller coverage amounts but is active for the policyholder's entire life.

Simplified Issue Life Insurance

Simplified issue life insurance has fewer health restrictions and is a good option for those with health conditions that might disqualify them from conventional life insurance. It is more expensive and offers less coverage than traditional life insurance, but the application process is quicker.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance has no health restrictions and does not require a medical exam. It is a good option for those who need coverage quickly but is more expensive and offers less coverage.

Factors to Consider When Choosing Life Insurance for Seniors

When choosing life insurance for seniors, it is important to consider the following:

- How much coverage you need

- How much you can afford

- The length of coverage you need

- Your health and lifestyle

- The reputation of the insurance company

- The ease of the application process

Benefits of Life Insurance for Seniors

- Financial support for loved ones after your passing

- Help with covering funeral and burial costs

- Peace of mind for you and your family

- A safety net for your family to cover unexpected expenses

Unlocking Loan Options with Life Insurance Policies

You may want to see also

How life insurance rates are determined

Age is a pivotal factor in determining life insurance premiums. As individuals journey through life, the likelihood of passing away increases, which elevates the risk to insurers. This means that as applicants get older, policy costs increase due to the heightened chance of a death benefit claim.

However, age is not the only factor that determines life insurance rates. Here are some other factors that play a role:

Health Status and Medical History

People with pre-existing medical conditions or a family history of diseases may not live as long as healthy individuals with no health issues. Consequently, insurance companies may charge higher rates for those with health problems. During the application process, individuals are typically required to answer questions about their health history and undergo a short medical exam to assess their health status accurately.

Lifestyle Choices

Certain lifestyle choices and habits can also impact life insurance rates. For example, smoking and engaging in high-risk activities or hobbies, such as skydiving or rock climbing, may result in higher insurance premiums.

Gender

Actuarial data shows that women have a longer lifespan than men, and insurance companies may use this information to determine rates. As a result, men often pay more for life insurance than women.

Type of Policy and Coverage Amount

The type of life insurance policy chosen, such as term life insurance or permanent life insurance, also affects the premium. Term life insurance is typically more affordable since it only covers a limited period. In contrast, permanent life insurance provides coverage for an entire lifetime and is more expensive. Additionally, the coverage amount or death benefit selected will influence the premium, with higher coverage limits resulting in higher insurance rates.

Job and Occupation

An individual's job and occupation are also taken into account when determining life insurance rates. Applicants working in low-risk jobs or occupations often pay lower premiums compared to those engaged in high-risk roles or hazardous professions.

Life Insurance: Assigning Your Beneficiaries and Their Future

You may want to see also

Frequently asked questions

Age plays a pivotal role in determining life insurance premiums. Insurers assess premiums based on multiple personal rating factors, but an emphasis is placed on mortality risk, and the probability of death rises steadily as we get older.

No, they don't. Whole life policies are built to have consistent premiums for as long as you have the policy.

Premiums incrementally increase with age across all policy sizes. A 30-year-old pays nearly a fourth of the cost of a 50-year-old for identical coverage.

There is no single best age to purchase life insurance. The best time to buy it is as soon as you realize you need it.