Life insurance payouts are generally not subject to income taxes or estate taxes, but there are certain exceptions. The type of policy, the size of the estate, and how the benefit is paid out can determine if life insurance proceeds are taxed. For example, if the payout is held by the insurance company for a given period, the beneficiary may have to pay taxes on the interest generated. Similarly, if the policyholder names their estate as the beneficiary, the person inheriting the estate may have to pay estate taxes. In some cases, the cash value of life insurance is also taxable, especially if the inheritance is a large sum.

What You'll Learn

Interest on life insurance payouts

Generally, life insurance payouts are not taxable. If you are the beneficiary of a life insurance policy, you do not need to include the payout in your gross income when filing taxes. However, there is an exception when it comes to the interest accrued on life insurance payouts.

Any interest accrued on a life insurance payout is taxable and must be reported as interest received. This means that if your life insurance payout earns interest before it is paid out to you, you will need to pay taxes on that interest income. The specific form you will need to fill out will depend on the type of income document you receive, such as a Form 1099-INT or Form 1099-R. You can refer to Topic 403 for more information about interest received and how to report it on your taxes.

It is important to note that if the life insurance policy was transferred to you for cash or other valuable consideration, there may be additional tax implications. In this case, the exclusion for the proceeds may be limited to the sum of the consideration you paid, any additional premiums you paid, and certain other amounts. There are some exceptions to this rule, so be sure to consult with a tax professional or refer to Publication 525, Taxable and Nontaxable Income, for more detailed information.

U.S.A.A. Life Insurance: What You Need to Know

You may want to see also

Estate tax

If the beneficiary isn't named in your policy, your life insurance benefits will go into a taxable estate. The first $11.7 million is not taxed at a federal level—this is the threshold. Anything above this amount is subject to being taxed. State regulations have a lower chance of exemption and vary depending on location.

If the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period.

If the policyholder names an estate rather than an individual as a beneficiary, the person or people inheriting the estate might have to pay estate taxes. This is a common mistake that can increase the likelihood of taxes being owed.

To avoid federal taxation on life insurance proceeds, you'll need to transfer ownership of your policy to another person or entity. This must be done at least three years before your death.

Mercury's Life Insurance: What's the Verdict?

You may want to see also

Inheritance tax

In most cases, beneficiaries do not need to pay taxes on the life insurance death benefit they receive, especially if they receive it as a lump sum. However, there are some specific scenarios where you may have to pay federal or state inheritance taxes.

If the life insurance policy goes into an estate, the value of the estate may be subject to inheritance tax. If the policy doesn't have any named beneficiaries, the life insurance proceeds may be included in the deceased's estate. If the value of the estate exceeds the federal estate tax threshold, which was $13.61 million as of 2024, estate taxes must be paid on the amount that is over the limit. Some states also assess inheritance or estate taxes, depending on the estate's value and where the deceased lived.

If you are the beneficiary of a life insurance policy, you may have to pay inheritance tax on any interest accrued by the policy. For example, if the death benefit is $500,000 but it earns 10% interest for one year before being paid out, the beneficiary will owe taxes on the $50,000 growth.

If the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. When a death benefit is paid to an estate, the person or persons inheriting the estate may have to pay estate taxes.

To avoid paying any inheritance taxes on life insurance proceeds, a taxpayer will need to transfer ownership of the policy to another person or entity.

Life Insurance: Assigning Your Beneficiaries and Their Future

You may want to see also

Generation-skipping tax

Life insurance proceeds are generally not taxable for beneficiaries, but there are some situations in which they are taxed. For instance, if the beneficiary is not an individual but an estate, the person(s) inheriting the estate may have to pay estate taxes. Additionally, if the policyholder chooses to delay the benefit payout, leading to interest accumulation, the beneficiary will be taxed on the interest generated.

Now, onto the Generation-Skipping Transfer (GST) Tax:

The GST tax is imposed when you transfer property during your life or upon your death to a "skip person", or someone two or more generations below you, like a grandchild or great-nephew. The GST tax is in addition to any gift taxes or estate taxes assessed on the transfer. The GST tax rate is the highest federal gift and estate tax rate in effect, which is currently 40%.

- Outright Transfers to Skip Persons: An outright gift of a life insurance policy to a skip person is generally subject to gift tax and GST tax, unless you give up all ownership rights. The gift is valued on the date of the transfer, and the value should be obtained from the insurance company.

- Transfers to a Trust: When all the beneficiaries of a trust are skip persons, transfers to that trust are typically subject to the GST tax. The trust must meet specific requirements to qualify for the annual GST tax exclusion. Each individual has a lifetime GST exemption, which was $11.58 million in 2020.

- Leveraging the GST Tax Exemption: You can allocate the GST exemption against the discounted value of the premiums compared to the ultimate value of the insurance proceeds. However, in inter vivos transfers (transfers made while the person is living), the allocation of the GST exemption is postponed until the end of an estate tax inclusion period.

- Regulations and Compliance: The IRS can modify the generation-skipping rules when applied to trust equivalents, such as life estates and insurance contracts. In some cases, the beneficiary of an insurance contract may be required to pay the GST tax. If the direct skip value is less than $250,000, the executor is responsible for filing and paying the GST tax; otherwise, the insurance company pays the GST tax.

- Annual Exclusion: The annual gift tax exclusion can typically be applied to gifts to skip persons. For 2022, the annual exclusion is $16,000, and for 2023, it is $17,000.

- Estate and Gift Tax Considerations: Life insurance proceeds may be subject to estate or gift taxes under certain circumstances. If you own a life insurance policy on another person and you die before them, the policy's value on your death date is included in your gross estate for estate tax purposes. Incidents of ownership, such as the right to change beneficiaries or borrow against the policy, also impact estate tax liability.

Life Insurance Payout: Impact on Scholarship Money

You may want to see also

Income tax

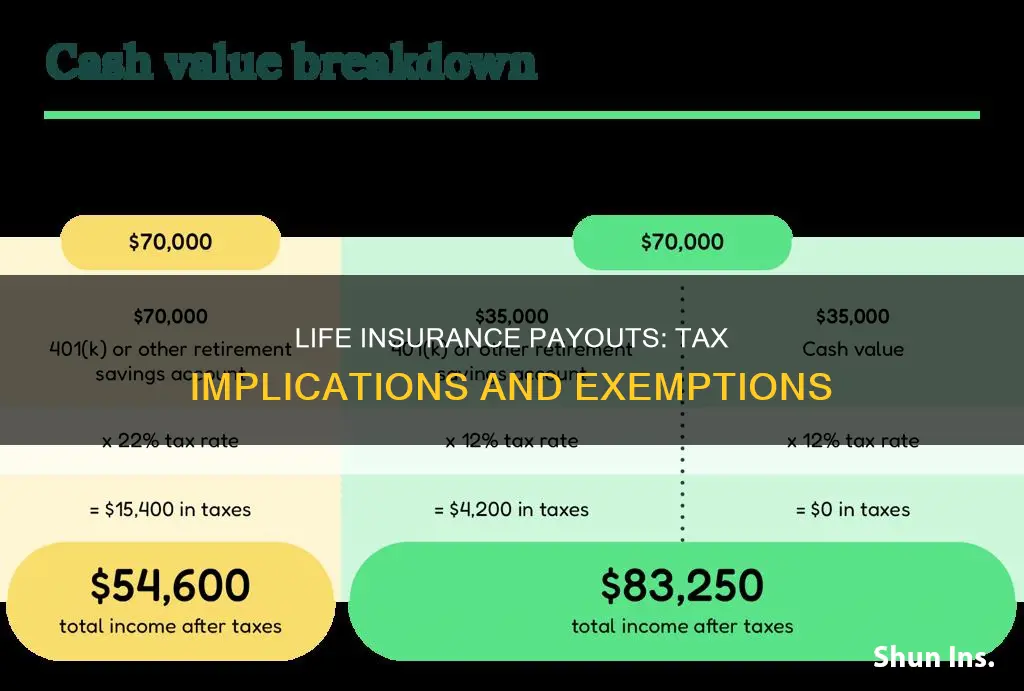

In most cases, life insurance proceeds are not considered taxable income. However, there are certain instances where the beneficiary can be taxed. Most commonly, the cash value of life insurance is taxable when the inheritance is a particularly large sum.

Estate Tax

If you surrender a permanent life insurance policy, you will typically receive the cash surrender value, which is your policy's cash value minus any fees. You don't have to pay taxes on the principal when it's returned, but any cash value your policy has accrued will be taxed as income.

Inheritance Tax

The inheritance tax is a tax placed upon the recipient for any inherited cash payouts, properties, and other assets. Iowa, Kentucky, Nebraska, New Jersey, Maryland, and Pennsylvania are currently the only states that enforce this tax.

Generation-Skipping Tax

Similar to the estate tax, the generation-skipping tax is imposed on any assets that skip a generation. They are only enforced when they exceed the same threshold.

When Withdrawing Money from Cash Value

Both whole life insurance and universal life insurance policies earn interest, referred to as cash value, and policyholders may be able to make withdrawals or take out a loan against the balance. If the withdrawal or loan is more than the total amount of premiums you've paid, the excess can be taxed.

When You Sell a Life Insurance Policy

If you sell your life insurance policy for cash, the profits are worth more than what you have paid so far, and this life insurance payout can qualify for income tax.

When the Beneficiary is an Estate

If your estate is the beneficiary of your life insurance policy, the death benefit may be subject to estate taxes. In 2024, the federal estate tax ranges from 18% to 40%, depending on how much of the estate is over $13.61 million, the exclusion limit.

Military Life Insurance: Discharge and Your Coverage

You may want to see also

Frequently asked questions

For the most part, beneficiaries don't need to pay taxes on the life insurance death benefit they receive, especially if they receive it as a lump sum. However, there are some exceptions.

If the life insurance policy goes into an estate, and the value of the estate exceeds the federal estate tax threshold, estate taxes must be paid on the amount that's over the limit. Some states also assess inheritance or estate taxes.

If a beneficiary chooses to receive their payout as an annuity (a series of payments over several years) instead of a lump sum, any interest accrued by the annuity account may be subject to taxes.

If you withdraw more than your cumulative premium payments, you may have to pay income taxes on the excess. Likewise, if you borrow against the cash value and the loan is still outstanding when the policy is terminated or surrendered, the loan amount in excess of the cumulative premiums may be subject to income taxes.

If you surrender the policy and your surrender proceeds exceed the cumulative premiums, the excess may be subject to income taxes.