USAA provides insurance and financial services to U.S. military members, veterans, and their families. The company offers term, whole, and universal life insurance policies, which are available to the general public, even those without a military connection. USAA's life insurance policies include additional benefits for military personnel and their families, such as expedited coverage approval during deployment, coverage during wartime, and a $25,000 severe injury benefit. While USAA has limited options for no-medical-exam coverage and fewer policy options overall, the company's strong financial stability, as indicated by its A++ rating from AM Best, makes it a good choice for life insurance, especially for those on active duty.

| Characteristics | Values |

|---|---|

| Types of Life Insurance Offered | Term, Whole, Universal |

| Number of Policies | 5 |

| Membership | Provides access to other financial products and advice |

| Coverage Limits | Term policies range from $100,000 up to $10 million |

| Coverage Restrictions | Some policies are not available in all states |

| Application Process | Online, over the phone |

| Customer Service | Phone, no customer service email, no live chat |

| Financial Strength Rating | A+ |

What You'll Learn

USAA life insurance pros and cons

USAA provides a range of insurance and financial services to US military members, veterans, and their families. Its life insurance products are also available to the general public. Here are some pros and cons of USAA life insurance:

Pros

- USAA offers term, whole, and universal life insurance policies.

- Membership provides access to other financial products and advice.

- USAA has a Survivor Relations Team to help members cope with the death of a loved one and manage their accounts.

- The company has a Military Severe Injury Benefit Rider, providing $25,000 for certain injuries sustained during military service.

- USAA has a high financial strength rating and has received fewer complaints than expected for a company of its size.

- The company offers a child term rider, allowing you to add your children to your policy.

- USAA provides detailed information about its policies on its website, along with online quotes.

- The company offers specialised coverage for active-duty and retired military personnel.

- USAA has flexible coverage and age restrictions.

- The company offers a Life Events Option rider, allowing new policyholders aged 18-35 to add $100,000 in coverage without additional underwriting.

- USAA has a Level Term V policy with extra benefits for military members, including coverage during war and a $25,000 payment for severe injuries.

Cons

- USAA's term life insurance rates are higher than most competitors.

- The company has a maximum issue age of 70 for term life insurance, which is lower than some competitors.

- Some policies are not available in all states, including New York and Montana.

- USAA does not offer a same-day decision on policies as applicants typically go through the underwriting process.

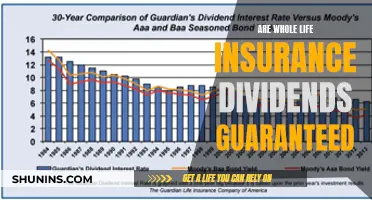

- The company does not pay dividends on its whole life insurance policies.

Life Insurance and Short-Form Death Certificates: What's Accepted?

You may want to see also

USAA life insurance plans

USAA offers a range of life insurance plans, including term, whole, and universal policies. Term life insurance provides coverage for a defined period, while whole and universal life insurance policies are permanent.

Term Life Insurance Options

USAA offers two term life insurance options: Level Term V and Essential Term. Level Term V insurance is available until the age of 70 and offers coverage ranging from $100,000 to $10 million. It includes additional benefits for active-duty military personnel, such as coverage during wartime and a $25,000 payment for severe injuries. Essential Term insurance does not require a medical exam but is only available to those aged 21 to 35 and has a coverage cap of $100,000.

Whole Life Insurance Options

USAA offers two types of whole life insurance: Simplified Whole Life and Guaranteed Whole Life. Simplified Whole Life allows coverage up to $10 million and has flexible payment options. Guaranteed Whole Life is available to individuals aged 45 to 85 (50 to 75 in New York) and offers coverage from $2,000 to $25,000. This policy does not require underwriting and generally pays within 24 hours of death.

Universal Life Insurance Options

USAA's Universal Life Accumulator policy is a form of permanent coverage that accumulates tax-deferred cash value. It offers flexible payment options and a guaranteed interest rate of 1%. Additionally, USAA sells an indexed universal life insurance policy, which ties the cash value growth to a market index.

Guaranteed Issue Life Insurance

USAA also offers guaranteed issue life insurance, also known as final expense insurance, which is designed to cover burial or funeral costs. These policies are available to individuals aged 45 to 85 (50 to 75 in New York) and offer coverage up to $25,000.

Riders

USAA offers several riders, which are additional benefits that can be added to a life insurance policy. These include the Child Term Rider, Waiver of Premium Benefit, Military Severe Injury Benefit, Accelerated Death Benefit, and Accidental Death Benefit.

Availability and Cost

USAA's life insurance policies are available to everyone, not just military service members, although some policies are not available in certain states, such as New York and Montana. The cost of USAA life insurance depends on various factors, including age, health, and lifestyle, and can be obtained by requesting a quote from the company.

Health Insurance: High Costs and Life Changes

You may want to see also

USAA life insurance pricing

USAA offers term, whole, and universal life insurance policies. The cost of a USAA life insurance policy depends on a host of factors, including age, sex, and location. The company's term life insurance rates are higher than most of its competitors.

USAA's term life insurance policy is available for 10, 15, 20, 25, or 30 years, with coverage ranging from $100,000 to $10 million. The monthly rate for a 20-year, $500,000 term life insurance policy for a nonsmoking man and woman in excellent health is $61.28 and $74.18, respectively.

USAA's whole life insurance policy is available for those aged between 15 days and 85 years, with coverage ranging from $2,000 to $10 million.

The company's universal life insurance policy is available for those aged 20 to 90, with coverage starting at $50,000. This policy is not available in New York.

USAA also offers a guaranteed issue life insurance policy for those aged 45 to 85 (50 to 75 in New York), with coverage ranging from $2,000 to $25,000. This policy is not available in Montana.

Health Insurance: Does It Cover Air Ambulance Services?

You may want to see also

USAA life insurance financial stability

USAA has a high financial strength rating, with an A++ (Superior) rating from AM Best. This is the highest possible rating and indicates that USAA has a strong ability to pay future claims. The company has also had a low volume of consumer complaints, with a complaint index of 0.283 over the past three years, which is lower than expected for a company of its size.

USAA has been in business for over 100 years and has over 13 million members. It was founded in 1922 by a group of Army officers to provide car insurance to military members. Over the years, USAA expanded its services to include banking, investment, and insurance products for military personnel and their families.

USAA's life insurance products have been available since 1963 and are open to the general public, not just military members. The company offers term, whole, and universal life insurance policies with flexible coverage options and additional benefits for military personnel.

MetLife's Permanent Life Insurance: What You Need to Know

You may want to see also

USAA life insurance accessibility

USAA life insurance is available throughout the US. However, it's important to note that USAA life insurance policies are not available in all states. For example, its universal life policy is not offered in New York, and its guaranteed whole life policy is not available in Montana.

USAA life insurance is accessible to the general public, including those without a military connection. However, the company does offer exclusive perks for veterans, active-duty military personnel, and their families. These benefits include expedited coverage approval during deployment, coverage during wartime, a $25,000 payment for certain severe injuries, and guaranteed coverage after leaving the military.

USAA provides term life insurance and three types of permanent life insurance policies: simplified whole life, universal life, and guaranteed whole life. The eligibility requirements and availability of these policies vary based on age, location, and health status.

The company's website offers multiple ways to receive a quote and access customer support. USAA's Survivor Relations Team assists members in coping with the death of a loved one and managing their USAA accounts.

Dialysis and Life Insurance: What's Covered and What's Not

You may want to see also

Frequently asked questions

No, USAA life insurance products are available to the general public. However, membership provides access to other financial products and advice.

USAA offers term, whole, and universal life insurance policies.

The coverage limits vary depending on the policy. Term policies range from $100,000 to $10 million, while the universal policy starts at $50,000. The whole life policies can start as low as $2,000 and go up to $10 million.

Yes, USAA offers several benefits for active-duty and retired military members, including coverage during wartime, a $25,000 severe injury benefit, and guaranteed coverage after leaving the military.

You can get a quote and apply for a life insurance policy online or over the phone. USAA does not have local agents or brokers.