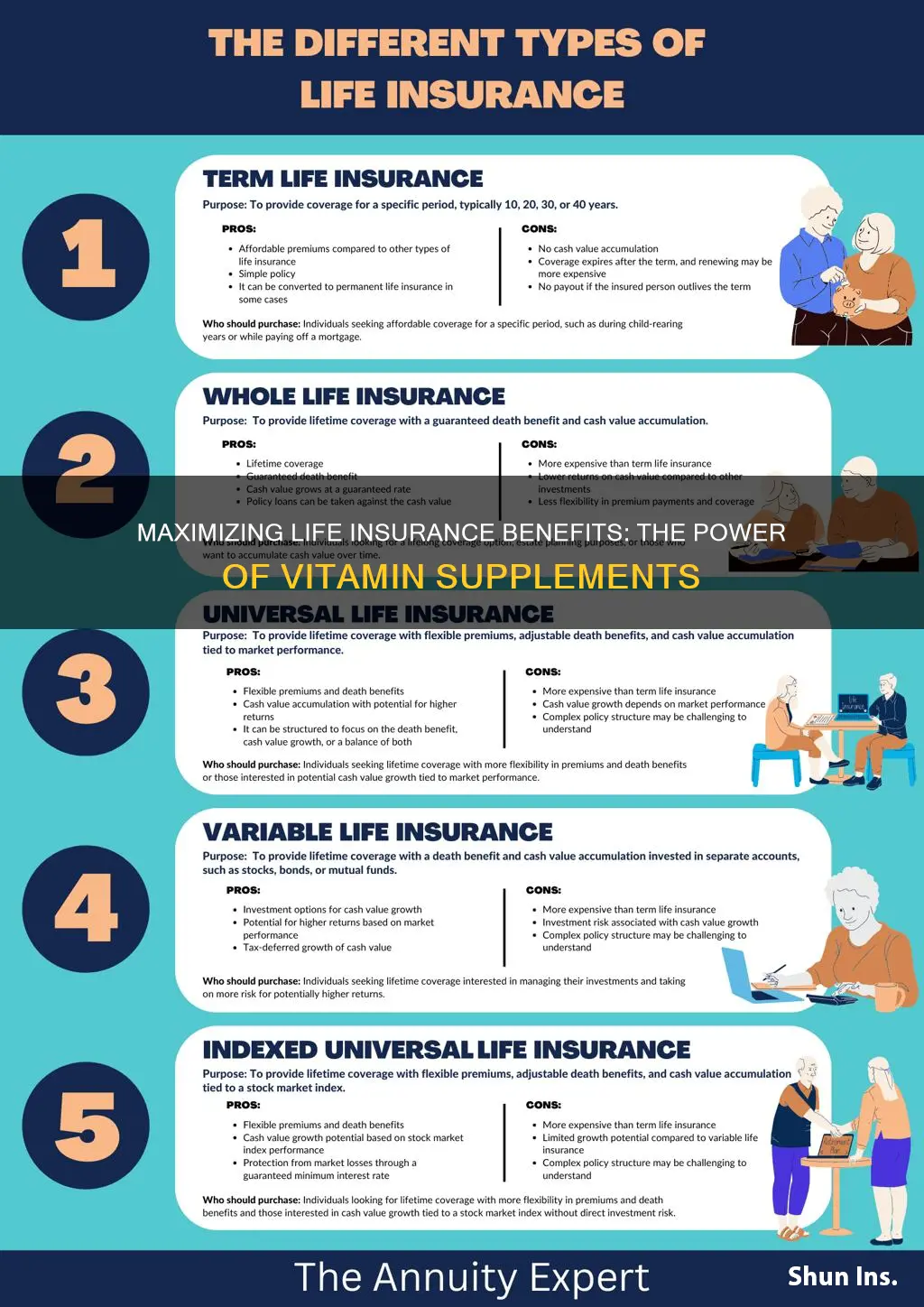

When considering life insurance, adding a supplement can provide additional benefits and coverage tailored to your specific needs. These supplements can offer various advantages, such as extended coverage for critical illnesses, accidental death insurance, or income replacement in the event of a disability. By understanding the different options available, you can make an informed decision to enhance your life insurance policy and ensure comprehensive protection for yourself and your loved ones.

What You'll Learn

- Enhanced Coverage: Additional benefits like critical illness or accident coverage can extend policy protection

- Longevity Support: Supplements may provide income for the policyholder during retirement or extended periods

- Tax Advantages: Certain supplements offer tax benefits, reducing overall insurance costs

- Customized Plans: Tailored supplements allow for personalized insurance policies to meet specific needs

- Financial Security: Added benefits ensure financial stability for beneficiaries in the event of the insured's death

Enhanced Coverage: Additional benefits like critical illness or accident coverage can extend policy protection

When considering life insurance, it's important to understand the various benefits and add-ons that can enhance your policy's coverage and provide comprehensive protection. One of the key areas to explore is the addition of supplementary benefits, which can significantly extend the scope of your insurance. These additional benefits often include critical illness coverage and accident insurance, both of which offer valuable financial protection.

Critical illness insurance is a powerful addition to your life insurance policy. It provides financial support if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. This benefit ensures that you have the necessary funds to cover medical expenses, ongoing treatment costs, and even daily living expenses during a challenging period. By having this coverage, you can focus on your recovery and well-being without the added stress of financial burdens.

Accident coverage is another essential supplement to consider. This benefit provides financial assistance in the event of accidental injuries or disabilities. It covers medical expenses, rehabilitation costs, and even income replacement if you are unable to work due to an accident. With accident insurance, you can ensure that unexpected accidents do not lead to financial hardship, allowing you to focus on your recovery and getting back to a normal lifestyle.

By incorporating these additional benefits into your life insurance policy, you can create a more comprehensive safety net. Enhanced coverage through critical illness and accident insurance provides peace of mind, knowing that you are protected against significant health-related financial risks. These benefits can be tailored to your specific needs, ensuring that your life insurance policy is a powerful tool for safeguarding your loved ones and your financial future.

When reviewing your life insurance options, it's advisable to consult with a financial advisor or insurance specialist who can guide you through the various benefits and help you choose the most suitable add-ons. They can assist in customizing your policy to meet your unique requirements, ensuring that you have the necessary coverage to protect your loved ones and provide financial security for your family's long-term well-being.

Understanding the Life Insurance License: What You Need to Know

You may want to see also

Longevity Support: Supplements may provide income for the policyholder during retirement or extended periods

The concept of longevity support in life insurance is an innovative approach to ensuring financial security for individuals during their retirement years. This feature is a valuable addition to traditional life insurance policies, offering a unique benefit that can significantly impact one's financial well-being in the long term. Longevity support supplements, when integrated into a life insurance policy, can provide a steady income stream for the policyholder, especially during retirement, when other sources of income may diminish.

When considering the inclusion of longevity support, it is essential to understand the potential financial advantages it offers. This benefit is designed to provide a regular income to the policyholder, ensuring a consistent financial flow that can be relied upon during retirement. The income generated from this supplement can be a significant source of financial security, allowing individuals to maintain their standard of living and cover essential expenses. For those approaching retirement, this feature can be a crucial safety net, providing peace of mind and financial stability.

The mechanism behind longevity support supplements is straightforward. As the policyholder ages, the insurance company may offer a predetermined amount of income based on the policy's terms. This income can be structured in various ways, such as a fixed annual payment or a variable amount that increases with the policyholder's age. The key is to provide a financial incentive that encourages individuals to outlive their expected lifespan, thus benefiting from the policy's longevity support feature.

Incorporating longevity support into a life insurance policy can be particularly advantageous for those with long life expectancies or a family history of longevity. It provides an additional layer of financial protection, ensuring that individuals can maintain their financial independence and quality of life as they age. Moreover, this benefit can be tailored to individual needs, allowing policyholders to choose the level of support that aligns with their retirement goals and expectations.

When exploring this option, it is advisable to consult with financial advisors or insurance professionals who can provide personalized guidance. They can help individuals understand the specific terms, conditions, and potential benefits of adding longevity support to their life insurance policies. By doing so, policyholders can make informed decisions and ensure that their financial plans are optimized to meet their long-term goals.

Life Insurance Policyholders: Who Are They?

You may want to see also

Tax Advantages: Certain supplements offer tax benefits, reducing overall insurance costs

When it comes to life insurance, the addition of certain supplements can provide significant tax advantages, ultimately reducing the overall cost of your insurance policy. These tax benefits are a valuable feature that can make your insurance coverage more affordable and financially advantageous. Here's a detailed look at how these supplements can offer tax relief:

Understanding Tax Advantages: Tax advantages in the context of life insurance supplements refer to the ability to claim deductions or credits on your tax return. This is particularly beneficial for individuals who are looking to optimize their tax situation and potentially lower their taxable income. By taking advantage of these tax benefits, you can effectively reduce the financial burden associated with your life insurance premiums.

Supplements with Tax Benefits: One of the key supplements that offer tax advantages is the "Critical Illness Supplement." This supplement is designed to provide financial support if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. The tax benefit arises when you claim the deduction for the premiums paid for this supplement. By doing so, you can reduce your taxable income, which may lead to a lower tax liability. Additionally, some life insurance policies with an investment component, such as whole life or universal life insurance, may also offer tax advantages on the investment portion of the policy.

Reducing Overall Insurance Costs: The tax benefits associated with these supplements can directly impact your insurance costs. When you claim the deductions or credits, you essentially reduce the amount of income subject to taxation, which, in turn, lowers your overall tax liability. This reduction in tax can be applied to the premiums of your life insurance policy, making it more affordable. For example, if you are in a higher tax bracket, the tax savings from the supplement can result in a significant decrease in your insurance expenses.

Maximizing Tax Efficiency: To maximize the tax advantages, it is essential to understand the specific rules and regulations governing these supplements in your jurisdiction. Consulting with a tax professional or insurance advisor can provide valuable insights into the eligible expenses and the potential tax benefits. They can guide you in structuring your insurance policy and supplements to optimize your tax situation. Additionally, staying updated on any changes in tax laws related to life insurance supplements is crucial to ensure you take full advantage of the available benefits.

In summary, certain supplements added to life insurance policies can offer substantial tax advantages, which can lead to reduced insurance costs. By understanding the tax benefits associated with these supplements and maximizing their potential, individuals can make informed decisions about their insurance coverage, ensuring a more financially efficient and cost-effective approach to life insurance.

Universal Group Life Insurance: Good Idea or Not?

You may want to see also

Customized Plans: Tailored supplements allow for personalized insurance policies to meet specific needs

When it comes to life insurance, one size does not fit all. The traditional approach often falls short in addressing the unique circumstances and requirements of individuals. This is where the concept of "tailored supplements" comes into play, offering a revolutionary way to customize insurance policies and ensure comprehensive coverage.

Customized plans are designed to provide a personalized insurance experience, taking into account the specific needs and preferences of each individual. These supplements are like add-ons or enhancements to the standard life insurance policy, allowing policyholders to fill in the gaps and create a policy that truly suits their lifestyle and financial goals. By offering flexibility and customization, insurance providers can cater to a diverse range of customers.

The process of creating a tailored supplement involves a detailed assessment of the policyholder's circumstances. This includes evaluating their health, age, occupation, financial situation, and any other relevant factors. For instance, a young professional with a high-risk job might opt for additional coverage against accidental injuries or critical illness. Conversely, an elderly individual with a fixed income may prefer a policy focused on income replacement and long-term care. By understanding these specific needs, insurance companies can design policies that provide the necessary benefits.

These personalized supplements can offer a wide array of benefits, such as increased coverage amounts, extended policy terms, or the inclusion of specific riders. For example, a rider might provide additional coverage for disability, which is particularly relevant for individuals with physically demanding jobs. Another benefit could be the option to add a term life insurance component, ensuring that the policyholder's loved ones are financially protected for a specified period. The key is to provide options that cater to various life stages and risk profiles.

In summary, customized plans and tailored supplements are essential in modern insurance practices. They empower individuals to take control of their financial security and make informed decisions about their insurance coverage. With these personalized policies, people can ensure that their life insurance is not just a product but a solution, providing peace of mind and comprehensive protection throughout their lives. This approach also encourages a more proactive and engaged relationship between policyholders and insurance providers.

Who Can Be a Life Insurance Beneficiary as an Adult?

You may want to see also

Financial Security: Added benefits ensure financial stability for beneficiaries in the event of the insured's death

When considering life insurance, one of the most valuable benefits you can add is financial security for your loved ones. This additional benefit ensures that your beneficiaries receive a substantial financial payout in the event of your death, providing them with the necessary support to maintain their standard of living and cover essential expenses. By supplementing your life insurance policy with this feature, you offer a safety net that can significantly impact the well-being of your family or designated recipients.

Financial security is a critical aspect of life insurance, as it addresses the potential financial challenges that beneficiaries may face after the insured's passing. Without this added benefit, the impact of losing a primary income source could be devastating for those who depend on the insured's earnings. The financial stability provided by this supplement allows beneficiaries to cover immediate costs, such as funeral expenses, outstanding debts, and daily living expenses, ensuring they are not burdened with financial strain during a difficult time.

The amount of financial security provided can vary depending on the insurance policy and the specific terms chosen. Typically, this benefit is a lump sum payment, which can be a significant financial cushion for the beneficiaries. It enables them to make necessary adjustments to their lifestyle, such as relocating to a more affordable area, paying off debts, or investing in assets that generate income. Moreover, this financial support can help beneficiaries maintain their long-term financial goals, such as purchasing a home, funding their children's education, or starting a business.

In addition to the immediate financial relief, the added benefit of financial security can also have long-term advantages. It provides peace of mind, knowing that your loved ones will be taken care of, even in your absence. This reassurance can reduce stress and anxiety, allowing beneficiaries to focus on healing and moving forward with their lives. Furthermore, the financial stability gained from this supplement can contribute to the overall financial health of the beneficiary's household, ensuring that essential expenses are met and long-term financial objectives remain on track.

In summary, adding financial security to a life insurance policy is a wise decision that provides invaluable support to your beneficiaries. It ensures that your loved ones are financially protected and can maintain their standard of living even in the face of tragedy. By supplementing your life insurance with this benefit, you demonstrate your commitment to the well-being of your family and take a proactive approach to securing their financial future.

Life Insurance for F1 Drivers: Who Needs It?

You may want to see also

Frequently asked questions

Adding a supplement to your life insurance policy can provide additional benefits and coverage tailored to your specific needs. It allows you to enhance your policy with features like critical illness coverage, accident insurance, or income replacement benefits, ensuring a more comprehensive safety net for your loved ones.

The cost of a supplement will vary depending on the chosen benefits and your individual circumstances. Typically, supplements are offered at an additional premium, as they provide extra protection and coverage. The premium is determined by factors such as your age, health, lifestyle, and the specific benefits you select.

Absolutely! One of the advantages of supplements is the flexibility they offer. You can choose the benefits that align with your priorities and customize the supplement to suit your personal situation. Whether it's adding coverage for a specific health condition, extending the policy term, or including additional riders, you have control over the design of your supplement.