When taking out a life insurance policy, you must name a beneficiary who will receive the payout, also known as the death benefit, in the event of your death. While many people choose their spouse or children as beneficiaries, it is possible to name your parents. However, there are a few things to keep in mind when considering this option. Firstly, you need to obtain your parent's consent before taking out a life insurance policy on them. Secondly, you should assess their coverage needs by evaluating their debts and your family's income goals. This will help you determine the amount of coverage you need. Additionally, it is important to consider the impact of your death on your parents' finances. If they are financially dependent on you, naming them as beneficiaries can help ensure their financial stability. Finally, when choosing a life insurance policy, research different options such as term, whole, or final expense life insurance to find the one that best aligns with your needs.

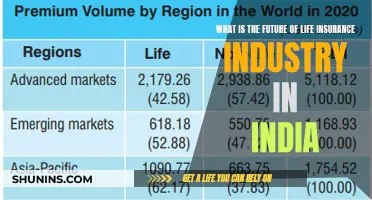

| Characteristics | Values |

|---|---|

| Can an adult have their parents as life insurance beneficiaries? | Yes |

| Who can be a life insurance beneficiary? | Anyone with insurable interest, usually a spouse, child, parent or sibling |

| Is consent required? | Yes, the insured parent must consent |

| Can a beneficiary be changed after the policyholder's death? | No |

| Can there be multiple beneficiaries? | Yes |

| Can a minor be a beneficiary? | Yes, but they cannot receive the benefit directly |

What You'll Learn

Can adult children receive a payout?

Yes, adult children can receive a payout from their parents' life insurance policy if they are listed as beneficiaries. When taking out a life insurance policy, you must designate at least one beneficiary who will receive the benefit of the policy after your death. While this is typically a spouse or family member, it is also possible to name multiple people, including adult children, as beneficiaries.

In the case of multiple beneficiaries, you can outline the percentage of the policy payout that each will receive. For example, you could allocate 70% to a spouse and 30% to an adult child. It is important to be specific with names and include Social Security numbers to prevent confusion and speed up the payout process.

If you have minor children, you may want to set up a trust to manage and distribute the funds, as minors cannot directly receive a life insurance payout. In this case, you would name the trust as the beneficiary. Alternatively, you can name a highly trustworthy adult custodian as the beneficiary, who will be responsible for managing the funds until your children are no longer minors.

It is worth noting that life insurance policies are separate from your will or other aspects of your estate. Therefore, it is essential to regularly review and update your life insurance policy and its beneficiaries, especially after major life events such as marriage, birth, divorce, or death.

American Income Life Insurance: Commission-Based Agent Pay Structure?

You may want to see also

What are the requirements for becoming a beneficiary?

To become a beneficiary, there are several requirements that need to be met. Here is a detailed list of what you need to know:

- Consent: It is essential to obtain consent from the person for whom you want to take out a life insurance policy. This is true whether you are an adult child considering a policy for your parent or a parent considering a policy for yourself.

- Insurable Interest: To purchase a life insurance policy for someone else and name yourself as the beneficiary, you must have insurable interest. This means that you are dependent on that individual and would suffer financially if they passed away.

- Impact of Death: When choosing a beneficiary, it is recommended to select the person who would be most financially impacted by your death. This could be a spouse, child, parent, or even a close friend.

- Multiple Beneficiaries: You can name more than one beneficiary and specify the percentage of the payout each person will receive. For example, you could allocate 70% to your spouse and 30% to your adult child.

- Contingent Beneficiaries: It is advisable to name a secondary or contingent beneficiary who will receive the benefit if the primary beneficiary is no longer alive or able to accept the payout.

- Specific Information: When naming beneficiaries, provide their full legal names, Social Security numbers or Tax IDs, contact information, and dates of birth. This ensures accuracy and speeds up the payout process.

- Annual Review: It is recommended to review your life insurance policy and its beneficiaries at least once a year. You should also update your policy and beneficiaries after any major life events, such as marriage, birth, divorce, or death.

- Avoid Naming Your Estate: Avoid naming your estate as the beneficiary, as this can lead to a lengthy and costly legal process known as probate. Instead, name a person, people, or organisation as the beneficiary.

- Consider a Trust: If you have minor children or special needs dependents, consider establishing a trust to manage and distribute the funds. This ensures that the money is used for their benefit and can avoid probate.

- Government Assistance: If your beneficiary receives government assistance, be mindful that a large sum of money from a life insurance payout may affect their eligibility. Consult an expert to navigate this situation effectively.

- Communication: Keep your beneficiaries informed about your plans and provide them with copies of the policy. It is also essential to discuss your wishes with them and seek their input.

- Update Information: Ensure that the information of your beneficiaries, such as contact details, is up to date. Outdated information can cause unnecessary complications and delays in receiving the benefits.

- Consent for Minor Beneficiaries: If you name a minor as a beneficiary, be aware that they cannot legally access the life insurance death benefit until they reach the age of majority (18 or 21, depending on the state). You will need to name a custodian or set up a trust to manage the funds until the minor reaches the required age.

By meeting these requirements, you can effectively designate and manage beneficiaries for your life insurance policy.

Irrevocable Life Insurance Trust: Protecting Your Wealth and Legacy

You may want to see also

What are the best types of life insurance policies for parents?

Yes, an adult can have their parents as beneficiaries of their life insurance policy. Now, what are the best types of life insurance policies for parents? Well, that depends on the parents' age, health, and financial situation, as well as the needs of the family. Here are some options:

Term Life Insurance

Term life insurance covers the policyholder for a set number of years, such as 10, 20, or 30 years. The policyholder must pass away during the term for the beneficiary to receive the death benefit. Term life insurance is typically more affordable than permanent life insurance, making it a good option for those who want to save money upfront. Protective, for example, offers term lengths of up to 40 years, which is longer than what most companies offer.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance, meaning the beneficiary will receive the death benefit regardless of when the policyholder passes away. While these plans can be more expensive, they guarantee benefits. Final expense life insurance is a type of whole life insurance specifically designed to cover end-of-life costs, such as funeral expenses, legal charges, and medical bills.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that combines features of term and whole life insurance. It offers lifelong coverage but typically builds minimal cash value, making it cheaper than whole life insurance.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance does not require a medical exam, and applicants cannot be turned down due to age or health issues. However, this option is one of the most expensive types of life insurance, and the death benefits are usually very low, ranging from $5,000 to $25,000. There is also a waiting period of two years before the beneficiary can receive the full payout, unless the cause of death was an accident.

When choosing a life insurance policy for parents, it's important to consider their age, health, and financial situation, as well as the needs of the family. Term life insurance may be sufficient for parents who want to cover a specific period, such as the duration of a mortgage or until their children are financially independent. On the other hand, whole life or universal life insurance may be more suitable for parents who want to ensure coverage regardless of when they pass away. Additionally, final expense or burial insurance can be a good option for covering end-of-life costs.

MetLife Insurance: Accidental Death Coverage and Exclusions

You may want to see also

How do you get life insurance for your parents?

Yes, you can buy life insurance for your parents, but you will need their consent and signature. You will also need to prove that you will be financially impacted by their death, which is known as having an "insurable interest". This means that you rely on their income or will be responsible for their debts after they pass away. Here is a step-by-step guide on how to get life insurance for your parents:

- Get your parents' consent: You will need to talk to your parents and get their verbal and physical signature. They will need to be legally competent to provide such consent.

- Figure out their coverage needs: Assess any debts your parents have, as well as the income goals for the family, to determine how much life insurance coverage you will need.

- Choose a life insurance policy and company: Research different types of life insurance policies, such as term, whole, or final expense life insurance, and choose the one that best aligns with your needs.

- Fill out an application: You will need to provide sensitive identification information, such as your parents' Social Security number, and answer questions about their health, lifestyle habits, and medical history. Depending on the company and the type of policy, your parents may also need to undergo a medical exam.

- Get approved and start paying premiums: Once the life insurance company approves the plan, you will need to start paying the premiums regularly to keep the policy active.

Remember that the cost of the life insurance policy will depend on your parents' age and health. The older and less healthy they are, the higher the premium will be. It is generally cheaper to purchase a life insurance policy when your parents are younger and healthier. Additionally, as the purchaser of the policy, you will be the policy owner and will be responsible for setting yourself and/or other close loved ones as the beneficiaries.

Cognitive Tests: Guardian Whole Life Insurance Requirements

You may want to see also

What are the benefits of life insurance for adult children?

Yes, an adult can have their parents as life insurance beneficiaries. In fact, it is quite common for adult children to be beneficiaries of their parents' life insurance policies and vice versa.

Benefits of Life Insurance for Adult Children

Life insurance policies for parents can help create financial stability and peace of mind for adult children. Here are some of the benefits:

- Financial benefits: Life insurance can provide financial benefits to adult children, especially if they are listed as beneficiaries. This can help them in their day-to-day lives and ensure they are taken care of in the event of the parent's death.

- End-of-life care and funeral expenses: Life insurance benefits can help adult children navigate and pay for end-of-life care and funeral expenses. This can be a significant financial burden, and life insurance can provide a safety net during a difficult time.

- Access to benefits early: Depending on the type of life insurance policy, adult children may be able to access benefits early in an emergency. This can be a lifeline if unexpected expenses arise.

- Guaranteed insurability: By taking out a life insurance policy on their parents, adult children can guarantee that their parents have coverage, even if they develop a health condition later in life. This is especially relevant if there is a family history of genetic medical conditions.

- Locked-in low rates: Taking out a life insurance policy for a parent when they are young will lock in lower rates. Rates will increase as the child gets older, so this can be a cost-effective strategy.

- Financial security: Life insurance can provide financial security for adult children, especially if they are financially dependent on their parents. It ensures that they will have a source of funds to fall back on in the event of their parent's death.

It is important to note that, when taking out life insurance on parents, adult children must get their parents' consent and may need to provide information on how their parents' death would financially impact them. Additionally, adult children should consider the impact of life insurance on their overall financial picture and ensure they have adequate coverage for themselves first.

Corporate Life Insurance: Are Proceeds Taxable?

You may want to see also

Frequently asked questions

Yes, an adult can have their parents as life insurance beneficiaries. In fact, it is quite common for adults to choose their parents as beneficiaries, especially if they have cosigned on mortgages, student loans, or other financial agreements.

Having parents as life insurance beneficiaries can provide financial stability and peace of mind. It ensures that the death benefit can be used to cover end-of-life expenses, funeral costs, and any debts or loans the adult may have cosigned with their parents.

To add your parents as life insurance beneficiaries, you will need their consent and may need to provide information on how their death would financially impact you. You will also need to choose a life insurance policy and company, fill out an application, and get approved before starting to pay premiums.

The type of life insurance policy you choose depends on your specific needs and circumstances. Term life insurance offers coverage for a set period, and the beneficiary receives the death benefit if the policyholder passes away during that term. Whole life insurance is more expensive but provides a guaranteed benefit regardless of when the policyholder passes away. Final expense life insurance is designed specifically to cover end-of-life costs, such as funeral expenses and medical bills.

It is important to review and update your life insurance policy and beneficiaries regularly, especially after major life events. Additionally, it is essential to be specific when naming beneficiaries, providing their full legal names and Social Security numbers to prevent any confusion and speed up the payout process.