Corporate life insurance is an important financial protection for companies, but the rules around tax can be complex. Generally, life insurance proceeds received by corporations due to the death of the insured are not taxable, and this is true for both permanent and term life insurance policies. However, the specifics vary depending on the country and the type of corporate structure involved. For example, in the US, death benefits are tax-free for the beneficiary of the policy, but any interest received on the payout is taxable. In Canada, the proceeds of a life insurance policy paid to a private corporation are added to its capital dividend account, from which tax-free distributions can be made to shareholders.

What You'll Learn

Life insurance proceeds are generally not taxable

Life insurance can provide important financial protection for individuals and businesses alike. For individuals, it can be used to cover debts, funeral expenses, and provide financial support for family members after death. For businesses, life insurance can be used to pay off corporate debt, buy out shareholders' estates, and provide liquidity to redeem a deceased owner's shares.

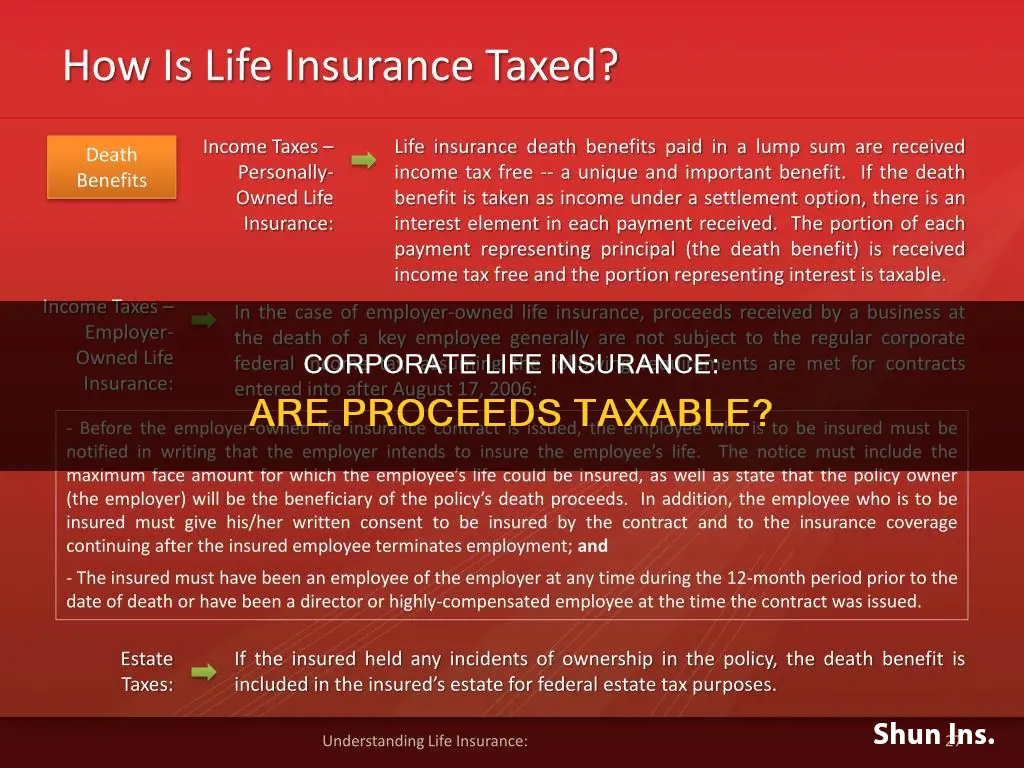

The tax treatment of life insurance proceeds can vary depending on the specific circumstances and the jurisdiction. In the US, the tax-exempt status of life insurance proceeds is outlined in Sec. 101(a)(1) of the tax code, which states that "gross income does not include amounts received [...] under a life insurance contract, if such amounts are paid by reason of the death of the insured." This means that any money received as a beneficiary of a life insurance policy due to the death of the insured person is generally not taxable.

However, it is important to note that there may be certain exceptions to this rule. For example, if the policy was transferred for cash or other valuable consideration, the exclusion for the proceeds may be limited. Additionally, any interest received on life insurance proceeds is generally taxable.

In Canada, the tax consequences of life insurance proceeds are outlined in the Income Tax Act, specifically in the definition of "capital dividend account" in subsection 89(1) and paragraph 53(1)(e). The net proceeds of a life insurance policy (the proceeds minus the adjusted cost basis of the policy) are added to the capital dividend account of a private corporation, which can then be distributed tax-free to shareholders.

It is always recommended to consult with a financial or tax advisor to understand the specific tax implications of life insurance proceeds in your jurisdiction.

Weed Smokers: Can You Get Life Insurance?

You may want to see also

Interest on proceeds is taxable

Corporate life insurance is a complex topic and the rules and taxation are subject to interpretation in some cases. Generally, life insurance proceeds received by corporations due to the death of the insured person are not taxable. However, interest received on these proceeds is taxable and should be reported as such.

In the United States, the Internal Revenue Service (IRS) states that life insurance proceeds are not includable in gross income and do not need to be reported. However, any interest received on the proceeds is taxable and should be reported as interest received. This is in accordance with Section 101(a)(1) of the tax code, which states that "gross income does not include amounts received [...] under a life insurance contract, if such amounts are paid by reason of the death of the insured."

In Canada, the Canada Revenue Agency (CRA) has similar guidelines. The net proceeds of a life insurance policy (proceeds minus the adjusted cost basis of the policy) received by a private corporation are added to its capital dividend account. A tax-free distribution of this amount can then be made to the corporation's shareholders. The capital dividend account is meant to preserve the character of non-taxable receipts, such as the proceeds of certain life insurance policies, in the hands of the corporation's shareholders.

It's important to note that the rules and regulations regarding corporate life insurance can vary by jurisdiction and specific circumstances. While the interest on proceeds is generally taxable, there may be exceptions or special considerations depending on the structure of the insurance policy and the nature of the corporation. For example, in the US, if the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for the proceeds may be limited to the sum of the consideration paid, additional premiums, and certain other amounts.

To summarise, while corporate life insurance proceeds are generally not taxable, the interest received on these proceeds is typically taxable. This interest should be reported as income, and it's important for corporations and beneficiaries to consult relevant tax authorities and professionals to ensure compliance with the specific rules and regulations in their jurisdiction.

DCU's Term Life Insurance Offer: What You Need to Know

You may want to see also

Proceeds are taxable if the policy was transferred for cash

Corporate life insurance is a complex topic and the rules and taxation policies can vary between countries and even states. Generally, life insurance proceeds received by a corporation due to the death of the insured person are not taxable. However, there are certain situations where the proceeds may be taxable, for example, if the policy was transferred for cash or other valuable consideration. In this case, the tax exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts. This means that if a corporation has purchased a life insurance policy from another entity for cash, the proceeds they receive upon the death of the insured person may be subject to taxation.

There are a few key things to keep in mind regarding corporate life insurance and taxation. Firstly, it is important to ensure that the corporation is named as the beneficiary and policy owner, with the shareholder or employee named as the insured person. Secondly, premiums paid on corporate life insurance policies are typically not tax-deductible, although they can still be financed by corporate dollars. Finally, the tax treatment of life insurance proceeds can vary depending on the type of policy, such as term or permanent life insurance, and the specific circumstances of the policy and the insured person.

In the United States, the Internal Revenue Service (IRS) provides guidance on the tax treatment of life insurance proceeds. According to the IRS, if a corporation receives life insurance proceeds due to the death of the insured person, those proceeds are generally not includable in gross income and do not need to be reported. However, any interest received on the proceeds is taxable and should be reported. Additionally, if the policy was transferred to the corporation for cash or other valuable consideration, the tax exclusion for the proceeds is limited. This means that the taxable amount of the proceeds may be higher in this case.

In Canada, the Canada Revenue Agency (CRA) has provided information on the tax consequences of life insurance proceeds received by a private corporation or partnership. The net proceeds of a life insurance policy, which is the proceeds minus the adjusted cost basis of the policy, are added to the corporation's capital dividend account. This allows the corporation to make a tax-free distribution of this amount to its shareholders. However, it is important to note that this information has been archived by the CRA and may not reflect the most current tax regulations.

It is always recommended to consult with a financial or tax advisor to understand the specific rules and regulations that apply to corporate life insurance in your jurisdiction. The taxation of life insurance proceeds can be complex and subject to interpretation, and there may be additional considerations or exceptions not covered in this text.

Life Insurance and Suicide in Texas: What's Covered?

You may want to see also

Death benefits are tax-free

In the case of corporate-owned life insurance (COLI), the tax implications can be more complex and may vary depending on the state and specific circumstances. While the death benefit from a COLI policy is generally tax-free for the corporation, there are certain criteria that must be met to retain this tax-advantaged status. For example, COLI policies can only be purchased for the highest-compensated third of employees, and the insured employee must receive written notification before the purchase of the policy.

Additionally, the tax consequences of life insurance proceeds received by a private corporation or partnership as a consequence of death are important to consider. In this case, the net proceeds of the life insurance policy, which is the amount received minus any adjusted cost basis or premiums paid, are typically added to the corporation's capital dividend account. This allows for a tax-free distribution of the amount to the corporation's shareholders.

It is worth noting that any interest received on life insurance proceeds is generally taxable and should be reported accordingly. Furthermore, if a policy was transferred for cash or other valuable consideration, the exclusion for the proceeds may be limited to the sum of the consideration paid, additional premiums paid, and certain other amounts.

Intestate Law vs Life Insurance: Who Wins?

You may want to see also

Corporate-owned life insurance (COLI) has complex rules and taxation

Corporate-owned life insurance (COLI) is a complex financial instrument with nuanced rules and taxation guidelines. COLI is a type of life insurance purchased by a corporation for its own use, and it differs from group life insurance policies that protect employees and their families. COLI can be structured in various ways to achieve different objectives, such as funding nonqualified plans, key person insurance, or buy-sell agreements.

One common use of COLI is to fund certain types of nonqualified plans, such as split-dollar life insurance policies. In this arrangement, the company recoups its premium outlay by naming itself as the beneficiary for the amount of the premium paid, with the remainder going to the insured employee. Other forms of COLI include key person life insurance, which pays the company a death benefit upon the death of a key employee, and buy-sell agreements, which facilitate the buyout of a deceased partner or owner's shares.

The tax rules pertaining to COLI are intricate and may vary between jurisdictions. While death benefits from life insurance policies are typically tax-free for individuals and groups, this treatment is not always extended to policies owned by corporations. To curb corporate tax evasion, COLI policies must meet specific criteria to maintain their tax-advantaged status. For instance, COLI policies can only be purchased for the highest-compensated third of employees, and these employees must be notified in writing about the company's intent to insure them and the coverage amount.

In some cases, the tax-free status of death benefits from COLI policies has been the subject of litigation, with the Internal Revenue Service (IRS) initially disallowing the exemption but later permitting tax-free payments to families and heirs. Additionally, money placed inside cash value policies by corporations grows tax-deferred for individuals.

The taxation of COLI proceeds can be intricate, and it's essential to consult a financial advisor or tax specialist to navigate the complexities and ensure compliance with the relevant regulations.

Life Insurance: Annual Increases and What They Mean for You

You may want to see also

Frequently asked questions

Generally, life insurance proceeds received by a corporation as a beneficiary due to the death of the insured person are not taxable. However, there are some complexities and variations depending on the jurisdiction and the type of corporate structure involved.

COLI is life insurance purchased by a corporation for its own use. The corporation is either the total or partial beneficiary on the policy, and an employee, owner, or debtor is listed as the insured. COLI can be structured in different ways to achieve various objectives, such as funding certain types of non-qualified plans or providing liquidity.

The tax rules pertaining to COLI can be complex and may vary depending on the jurisdiction. While the death benefit from life insurance is typically tax-free for individual and group policies, this is not always the case for policies owned by corporations. To maintain their tax-advantaged status, COLI policies must meet certain criteria, such as only being purchased for the highest-compensated third of employees.

In the context of S corporations, life insurance proceeds may impact the shareholders' ability to access cash on a tax-free basis. While premiums paid on corporate-owned life insurance are generally not deductible, they do not reduce the accumulated adjustments account (AAA), which is important for making tax-free distributions. Death benefits received by an S corporation increase the shareholders' stock basis and the other adjustment account (OAA).

Yes, there are some differences in the tax treatment of term and cash-value life insurance policies. While death benefits are generally tax-free for both types of policies, the surrender or sale of a cash-value policy may result in taxable income. The allocation of premiums between the insurance coverage and the investment component can impact the tax implications for shareholders and the corporation.