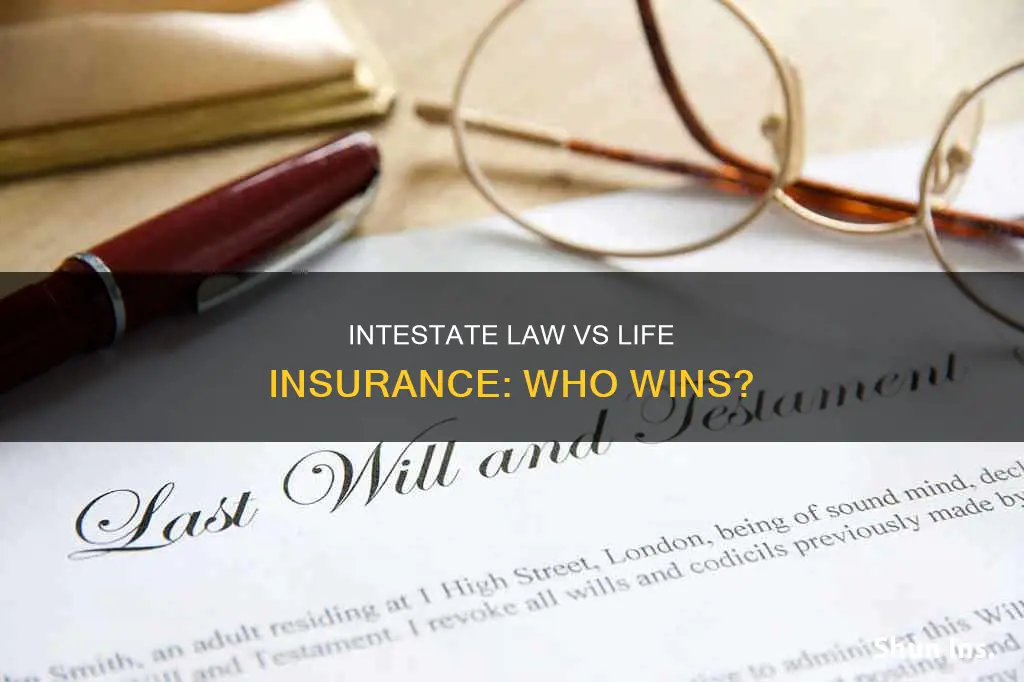

Intestate law, or the law of intestate succession, refers to the distribution of property when a person dies without a will. When someone dies intestate, their assets are distributed according to predetermined rules and guidelines, which vary from state to state. Typically, the surviving spouse is first in line to inherit assets, followed by children, parents, siblings, and extended family. If no immediate family can be identified, the assets become the property of the state.

Life insurance policies are generally not governed by a will, and the proceeds are paid directly to any named beneficiaries. However, if no beneficiary is named, the proceeds may be paid to the owner's estate and distributed according to the will of the insured or, in the absence of a will, according to intestate succession laws.

In community property states, the policyholder's spouse is automatically considered the beneficiary, and the life insurance payout will go to the spouse even if another beneficiary is named. In some states, certain beneficiary designations, such as to an ex-spouse, are automatically revoked upon divorce.

What You'll Learn

Intestate succession laws

Not all property is subject to intestate succession laws. Assets that are not part of the decedent's estate include property held in a living trust or an irrevocable trust, life insurance policies with named beneficiaries, payable-on-death (POD) bank accounts, and retirement accounts with named beneficiaries. These assets will be distributed to the named beneficiaries or surviving co-owners, regardless of the existence of a will.

If a person dies without a will, their assets will be distributed according to the intestate succession laws of their state of domicile (their primary residence). The laws outline specific groups or classes of heirs, with the order of priority for distribution determined by the closeness of the legal relationship to the decedent. The groups are generally as follows:

- The decedent's surviving spouse: In some states, inheritance rights are protected, and certain heirs cannot be disinherited.

- Biological and adopted children: A trustee or guardian manages the inheritance for minor children. Stepchildren are not included unless they are legally adopted or named in a will or trust.

- Grandchildren: If one of the decedent's children is deceased, their children will split the share their parent would have inherited.

- Siblings of the decedent

- Descendants of the decedent's siblings: Nieces and nephews

- Descendants of grandparents: Aunts and uncles

If none of the above exist, the entire estate may be transferred to the state, a process known as escheat.

While the specific laws and property distribution percentages vary by state, the overarching principle of intestate succession laws is to ensure that the decedent's property is fairly distributed among their closest relatives in a legally recognized manner.

Equitable Life Insurance: Does It Cover Medicare in Florida?

You may want to see also

Life insurance beneficiaries

There are two types of beneficiaries: primary and contingent. A primary beneficiary is the person (or persons) first in line to receive the death benefit from your life insurance policy. This is typically a spouse, child, or other family member. In the event that your primary beneficiary dies before or at the same time as you, you can also name at least one backup beneficiary, known as a "secondary" or "contingent" beneficiary, who will receive the death benefit if the primary beneficiaries are all deceased.

It is important to keep your beneficiary designations up to date as your life changes (marriage, children, divorce, etc.). For example, if you get divorced and remarry but do not update your beneficiaries, your former spouse is still the legal heir to those accounts if you named them as the beneficiary while you were married.

If you do not name a beneficiary on your retirement or other financial documents, and you do not have a will, state laws will determine who inherits your assets, which can take many months until your loved ones can access those funds. Intestacy laws vary from state to state, but generally, the surviving spouse is first in line to inherit assets, followed by children, parents, siblings, and extended family. If no immediate family can be identified, the assets become the property of the state.

In community property states, the policyholder's spouse is automatically considered the beneficiary, and the policyholder must receive the spouse's permission to list anyone else as the beneficiary. In these states, the spouse has the right to a portion of the life insurance proceeds if community property was used to pay the life insurance premiums.

Life Insurance and Suicide: What Families Need to Know

You may want to see also

Probate court

The probate court process starts when the executor or family member files a petition for probate, the will, and a copy of the death certificate. The probate court then appoints an executor for the deceased's estate, who is responsible for distributing the estate to the beneficiaries and performing other administrative duties. The executor must notify creditors, beneficiaries, inventory the deceased's assets, pay outstanding bills, sell assets if necessary, pay taxes, and file a final tax return. Once these tasks are completed, the remaining assets are distributed to the beneficiaries, according to the will.

The probate court oversees the executor's activities and handles any issues that may arise, such as ruling on the authenticity of a contested will. If there is no will, the court decides who receives the decedent's assets, based on the laws of the jurisdiction in place. This is known as the law of intestate succession, which outlines the distribution of assets among surviving family members.

Chase Bank: Life Insurance for Account Holders?

You may want to see also

Non-probate vs probate assets

When planning your estate, it is important to understand the difference between probate and non-probate assets. Probate is the process through which a court determines how to distribute your property after your death. Some assets are distributed to heirs by the court (probate assets), while others bypass the court process and go directly to your beneficiaries (non-probate assets).

Probate Assets

Probate assets are those held in the individual's name only, with no beneficiary designation or living beneficiary, and not held as joint tenants with rights of survivorship. These assets must pass through probate court and are distributed according to the will, or if there is no will, to the next of kin according to state law. Examples include real estate, stocks, or a bank account titled in the owner's name alone.

Non-Probate Assets

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust as the beneficiary. Non-probate assets pass directly to the surviving joint owner or designated beneficiary and can be claimed without the involvement of probate court. Examples include life insurance policies, 401(k)s, IRAs, annuities, and assets with a payable-on-death (POD) or transfer-on-death (TOD) designation.

It is important to note that a beneficiary designation generally takes precedence over a will. Therefore, it is crucial to review and update beneficiary designations, especially after major life changes, to ensure your wishes are clear and legally documented.

Chest Pain: Can It Impact Your Life Insurance Eligibility?

You may want to see also

Dying without a will

In the state of Victoria, Australia, if someone dies without a will, the law, or rules of intestacy, will decide who inherits their assets. If the deceased left behind a partner, the entire estate goes to them. If there are also children from another relationship, some of the estate may go to those children, but this depends on the amount of money in the estate. If there are no children, the estate is distributed to the next of kin, usually a spouse, domestic partner, or child of the deceased.

In the United States, the rules vary by state. In Florida, if someone dies without a will, their estate, including any life insurance death benefits, will be distributed to their heirs according to Florida's intestate succession laws. In Illinois, if there is no will, state laws will determine who inherits the assets, and it can take months for loved ones to access those funds.

To avoid dying intestate, it is important to have a valid will in place. However, it is also crucial to regularly review and update beneficiary designations on insurance policies, pensions, retirement plans, and other financial documents, especially after major life changes such as marriage, divorce, or the birth of a child.

How My Dad's Death Impacts My Insurance Rates

You may want to see also

Frequently asked questions

Intestate is the legal term for when someone dies without a will. In this case, the probate court will appoint an administrator to manage the deceased's estate and distribute the assets according to a predetermined hierarchy.

Yes, a beneficiary designation supersedes a will. If you get married, divorced, or have a new grandchild and update your will but not your beneficiary, the information on your beneficiary designation will override your will.

If you don't name a beneficiary, it may be unclear who is entitled to the funds, which can delay the benefit payment. In the case of retirement accounts, your assets will likely be held in probate, a legal process where a court determines how to distribute your assets.

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products, such as life insurance coverage or retirement accounts.