Life insurance rates can vary significantly due to a multitude of factors, including age, health, lifestyle, occupation, and the amount of coverage desired. Younger individuals typically pay lower premiums as they are considered less risky, while older individuals may face higher rates due to increased health risks. Additionally, factors like smoking, excessive alcohol consumption, and dangerous hobbies can impact premiums. The amount of coverage also plays a crucial role, with higher coverage amounts generally resulting in higher premiums. Understanding these factors can help individuals make informed decisions when choosing a life insurance policy.

What You'll Learn

- Age: Younger individuals typically pay less due to longer life expectancy

- Health: Medical history and current health impact premium costs

- Lifestyle: Smoking, drinking, and risky hobbies can increase insurance rates

- Occupation: Certain jobs with higher risk profiles may lead to higher premiums

- Coverage Amount: The higher the death benefit, the more expensive the policy

Age: Younger individuals typically pay less due to longer life expectancy

Younger individuals often benefit from lower life insurance premiums due to a combination of factors, primarily their age and the associated statistical probabilities. Life insurance companies calculate rates based on extensive data and risk assessments, and age is a critical factor in this process. As individuals get older, the likelihood of their passing away increases, making them statistically more expensive to insure. This is because older individuals are more likely to have pre-existing health conditions, a higher risk of accidents, and a shorter remaining life expectancy compared to younger people.

For younger people, the opposite is true. Their lower risk profile is a significant advantage when it comes to life insurance rates. Younger individuals have a longer life expectancy, which means they are less likely to make a claim on their policy during the initial years of coverage. This reduced risk allows insurance providers to offer more competitive rates to this demographic. Additionally, younger individuals are generally healthier, with fewer health issues that could lead to higher insurance costs.

The concept of risk assessment is at the heart of this variation in life insurance rates. Younger individuals are considered low-risk candidates for life insurance due to their age and health. Insurance companies can offer lower premiums because they predict a lower chance of paying out on these policies in the short term. This is a strategic decision based on statistical data and risk management.

Furthermore, younger individuals often have more time to build their financial portfolios and accumulate assets, which can be used to pay off any outstanding debts or provide financial security for their loved ones. This financial stability can also contribute to more favorable insurance rates. In summary, younger individuals typically pay less for life insurance due to their age, which is a key determinant of risk and life expectancy, ultimately influencing the overall cost of insurance policies.

Update Your Address: Exide Life Insurance Guide

You may want to see also

Health: Medical history and current health impact premium costs

Life insurance rates can vary significantly based on an individual's health and medical history. This is because insurance companies assess the risk associated with insuring a particular individual, and health factors play a crucial role in this evaluation. One of the primary considerations is the person's current health status and any pre-existing medical conditions. For instance, individuals with chronic illnesses such as diabetes, heart disease, or cancer may face higher insurance premiums due to the increased likelihood of requiring medical attention or facing health complications in the future. Similarly, those with a history of smoking, excessive alcohol consumption, or drug use might also be viewed as higher-risk candidates, potentially leading to elevated premium costs.

The impact of medical history is profound, as past health issues can influence future health outcomes. For example, a person with a history of heart attacks or strokes is likely to be considered a higher-risk policyholder, which may result in more expensive insurance premiums. Additionally, the timing and severity of past health events can also be factors. A minor health issue that has been managed effectively might not significantly affect premium rates, but a major health crisis that required extensive medical intervention could lead to substantial increases in insurance costs.

Current health is another critical aspect. Insurance companies often require medical examinations or health assessments to determine an individual's overall health and assess the risk of future claims. This can include checking blood pressure, cholesterol levels, and other vital health indicators. For instance, high blood pressure or cholesterol levels might indicate a higher risk of cardiovascular issues, potentially impacting premium rates. Similarly, the presence of any ongoing medical treatments or medications can also influence the cost of insurance.

Furthermore, the frequency and nature of doctor visits, hospitalizations, and any ongoing medical treatments can all contribute to the calculation of insurance premiums. Individuals with a history of frequent illnesses or those requiring regular medical attention may be charged higher rates. This is because such factors suggest a higher likelihood of future health-related claims, which insurance companies aim to mitigate through premium adjustments.

In summary, health and medical history significantly influence life insurance rates. Insurance providers carefully consider an individual's current health status, past medical issues, and ongoing treatments to determine the level of risk associated with insuring them. By evaluating these factors, insurance companies can set appropriate premium costs to ensure financial protection for policyholders while managing their risk exposure. Understanding these considerations can help individuals make informed decisions when selecting life insurance coverage.

Life Insurance Proceeds: Tax-Free to Living Trust?

You may want to see also

Lifestyle: Smoking, drinking, and risky hobbies can increase insurance rates

Lifestyle choices play a significant role in determining life insurance rates, and certain habits can impact the cost of coverage. One of the most influential factors is smoking. Insurance companies consider smokers to be high-risk individuals due to the increased likelihood of health issues and premature death. The harmful chemicals in cigarettes can lead to various health problems, including lung cancer, heart disease, and respiratory issues, which can result in higher insurance premiums. Similarly, excessive alcohol consumption can also raise insurance rates. Heavy drinking can contribute to liver damage, accidents, and other health complications, making it a risky behavior for insurers.

Engaging in risky hobbies and activities can also affect life insurance rates. Extreme sports, such as skydiving, scuba diving, or rock climbing, are often associated with higher insurance premiums. These activities typically involve a higher risk of injury or death, which can lead to increased costs for insurers. Additionally, hobbies like racing cars, riding motorcycles, or participating in dangerous competitions may also impact rates. Insurance providers consider these activities when assessing the risk profile of an individual, as they can significantly increase the likelihood of claims.

Furthermore, lifestyle choices related to health and fitness can also influence insurance rates. A sedentary lifestyle or obesity may result in higher premiums due to the associated health risks. Conversely, maintaining a healthy weight and engaging in regular physical activity can lead to lower insurance rates, as it indicates a reduced risk of certain health conditions. It's important for individuals to be aware of these factors and make informed decisions to potentially lower their insurance costs.

In summary, lifestyle factors, including smoking, drinking, and engaging in risky hobbies, can significantly impact life insurance rates. Insurance companies use these factors to assess the likelihood of claims and determine the level of risk associated with an individual. By understanding these influences, people can take steps to improve their health, adopt safer hobbies, and potentially secure more affordable insurance coverage.

Life Insurance Loans: Are They Truly Amortized?

You may want to see also

Occupation: Certain jobs with higher risk profiles may lead to higher premiums

Occupation plays a significant role in determining life insurance rates, as certain jobs are considered riskier than others. Insurance companies often assess the likelihood of an individual's death or the occurrence of a critical illness, and their occupation is a key factor in this evaluation. For instance, professions that involve hazardous work, such as construction, mining, or emergency services (police, firefighters), are inherently more dangerous and may result in higher insurance premiums. These jobs often expose individuals to a higher risk of accidents, injuries, or even fatal outcomes.

The nature of the work and the associated risks are carefully considered by insurance providers. For example, construction workers might face the risk of falling from heights, operating heavy machinery, or being exposed to dangerous materials. Similarly, emergency responders deal with high-stress situations, often in dangerous environments, which can increase the chances of accidents or health complications. As a result, insurance companies may charge higher premiums to account for the elevated risk associated with these occupations.

Additionally, jobs that require physical labor or involve repetitive motions can also impact insurance rates. Occupations like manual laborers, factory workers, or athletes may have a higher incidence of work-related injuries or health issues. These professions often demand physical exertion, which can lead to muscle strains, back problems, or other chronic conditions over time. Insurance providers take these factors into account when calculating premiums, as individuals in these lines of work may require more extensive medical coverage.

It's important to note that the specific risks associated with a job can vary. Some occupations may have a higher risk of sudden death due to stress or physical exertion, while others might have a higher risk of long-term health issues. Insurance companies analyze these risks and categorize jobs accordingly, which directly influences the premium amounts. This is why individuals in high-risk professions often pay more for life insurance compared to those in lower-risk careers.

Understanding the impact of occupation on life insurance rates is crucial for individuals seeking coverage. By being aware of how their job may affect their premiums, people can make informed decisions when choosing a policy. Some insurance providers offer specialized plans for specific occupations, providing tailored coverage options to meet the unique needs of different professions.

Colonial Life Disability Insurance: What You Need to Know

You may want to see also

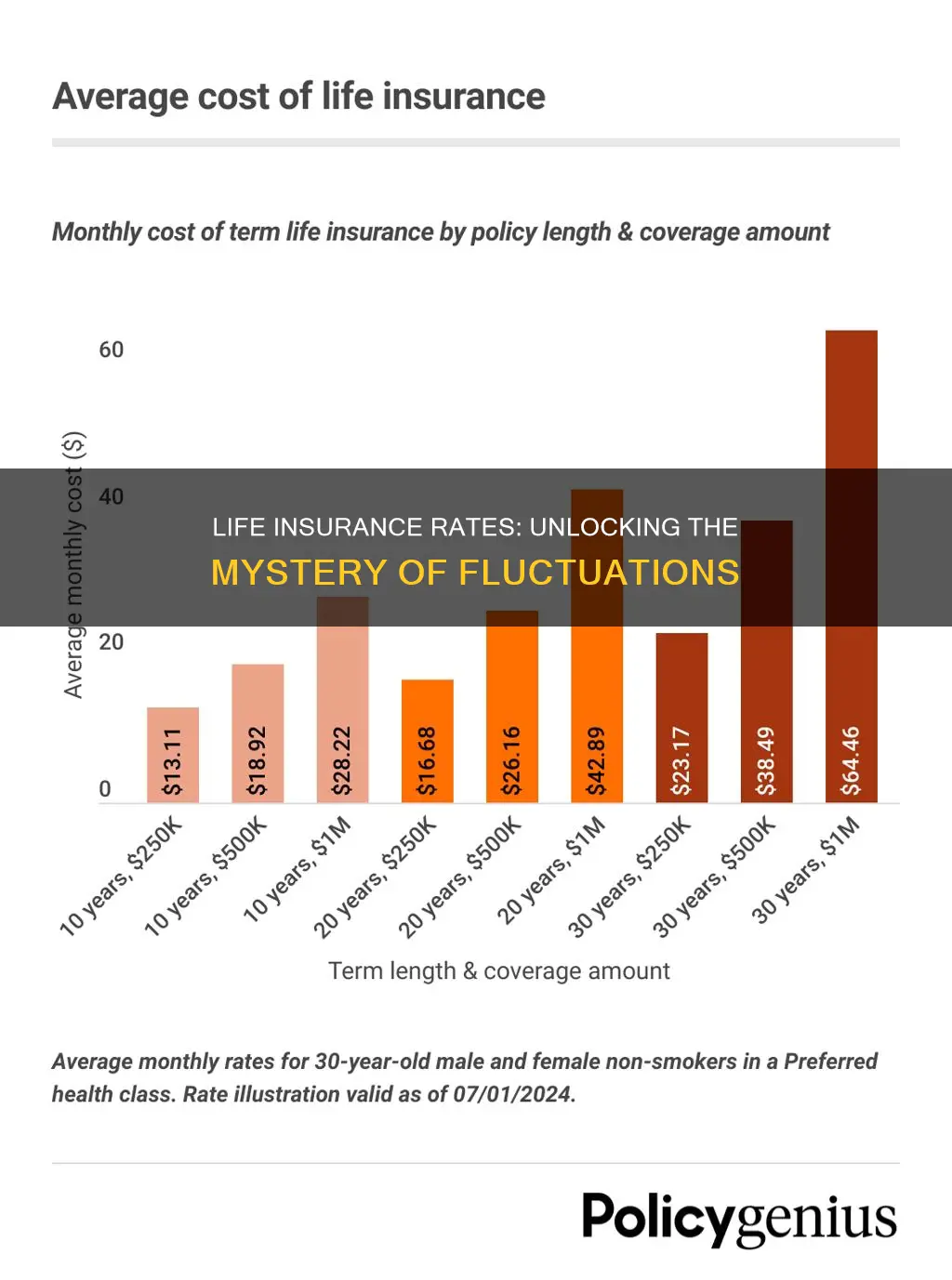

Coverage Amount: The higher the death benefit, the more expensive the policy

The relationship between the coverage amount and the cost of a life insurance policy is a fundamental aspect of understanding why rates vary. When it comes to life insurance, the death benefit, or the amount paid out upon the insured individual's death, is a critical factor in determining the policy's price. The higher the death benefit, the more the insurance company is exposed to potential financial risk, and as a result, the policy becomes more expensive.

In simple terms, a higher death benefit means a larger payout to the beneficiaries when the insured person passes away. This increased financial obligation on the part of the insurance company is a key reason why rates escalate with higher coverage amounts. The insurance provider must ensure that they have sufficient funds to meet this larger financial commitment, which often translates to higher premiums for the policyholder.

The calculation of the premium involves assessing the likelihood and potential cost of paying out the death benefit. With a higher coverage amount, the insurance company faces a greater potential loss, and thus, they charge more to mitigate this risk. This is especially true for whole life insurance policies, where the death benefit is guaranteed and the premiums are typically higher compared to term life insurance, which offers coverage for a specified period.

Additionally, the age and health of the insured individual also play a role in determining the premium. Older individuals may have higher life insurance rates due to an increased risk of death, and their policies might also be more expensive if they opt for higher coverage amounts. Similarly, those with pre-existing health conditions may face higher rates, as the insurance company considers the potential medical costs associated with the higher death benefit.

In summary, the coverage amount, specifically the death benefit, is a significant contributor to the variation in life insurance rates. The insurance company's responsibility to honor the death benefit at a higher amount results in increased premiums, making it essential for individuals to carefully consider their coverage needs and budget accordingly. Understanding this relationship can help policyholders make informed decisions when selecting life insurance coverage.

Understanding Life Insurance: Unlocking Account Value

You may want to see also

Frequently asked questions

Life insurance rates can vary significantly due to several factors. Firstly, age plays a crucial role, as younger individuals typically have lower rates as they are considered less risky. The type of policy, such as term or permanent life insurance, also impacts the cost. Additionally, the amount of coverage required and the individual's health and lifestyle choices, including smoking, alcohol consumption, and medical history, can all contribute to the final quote.

An applicant's health and lifestyle choices are critical factors in determining life insurance rates. Insurers often consider medical history, including pre-existing conditions, chronic illnesses, or recent health scares. For instance, individuals with a history of heart disease or diabetes may face higher premiums. Lifestyle factors like smoking, excessive drinking, drug use, or extreme sports participation can also increase rates due to the perceived higher risk of death or illness.

Yes, financial and employment status can influence life insurance rates. Insurers may assess an individual's financial situation to determine their ability to pay premiums. A stable financial position with a steady income and assets can result in lower rates. Conversely, those with significant debts, low income, or limited assets might face higher premiums. Employment status is also a factor; certain professions deemed high-risk, such as construction workers or pilots, may pay more for life insurance.