Life insurance is a crucial financial tool for individuals with families or businesses to protect. For those without a Social Security Number, it can be challenging to obtain life insurance, but it is not impossible. Some companies offer life insurance policies to individuals with an Individual Taxpayer Identification Number (ITIN), which is often used by immigrants to comply with tax laws. This type of insurance is also available to non-US citizens, including green card holders, visa holders, and those without any legal documentation. The requirements and rates for life insurance with an ITIN may vary depending on the company and the individual's circumstances, but it is an option worth exploring for those in need of financial protection for their loved ones.

| Characteristics | Values |

|---|---|

| Is it possible to get life insurance with a tax ID number? | Yes |

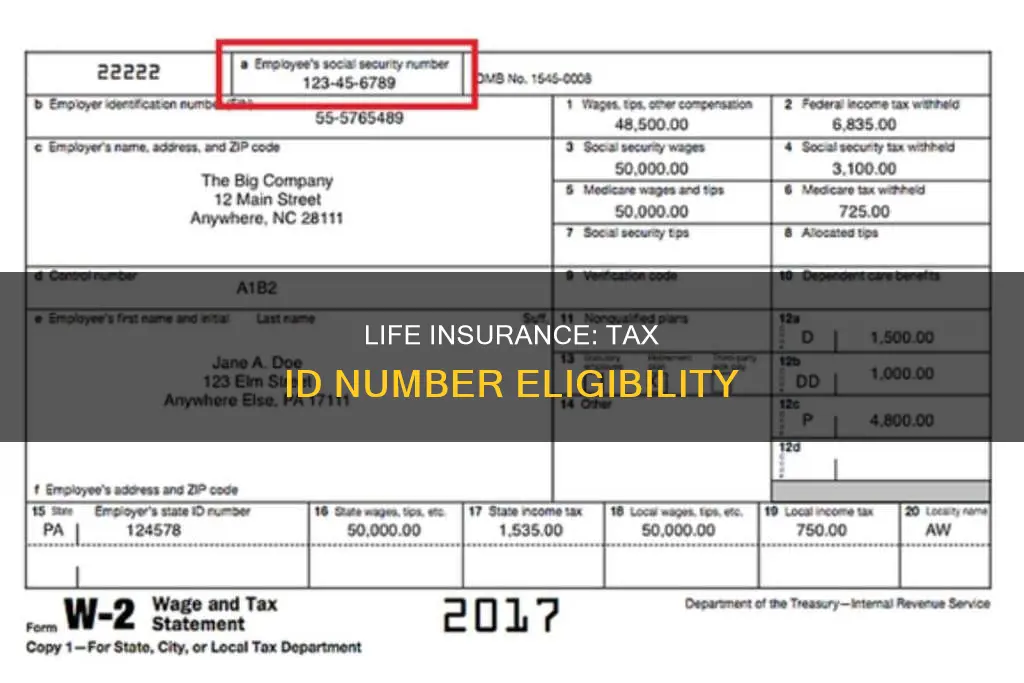

| What is a tax ID number? | A 9-digit identification number that the Internal Revenue Service (IRS) assigns to individuals and businesses for tax purposes |

| What type of tax ID number can be used to get life insurance? | Individual Taxpayer Identification Number (ITIN) |

| Who can get life insurance with an ITIN? | Immigrants, non-US citizens, non-permanent residents, foreign nationals, undocumented immigrants |

| What type of life insurance can be obtained with an ITIN? | Term life insurance, whole life insurance, permanent life insurance |

| What are the requirements for getting life insurance with an ITIN? | Financial ties to the US, valid visa, proof of residency, medical records, US bank account |

| Are there any restrictions on getting life insurance with an ITIN? | Must be in the US for the entire application and policy acceptance process, some companies may not approve coverage |

What You'll Learn

Life insurance for non-US citizens: requirements and eligibility

Non-US citizens can get life insurance in the United States, but the requirements and eligibility criteria can vary depending on several factors, including residency status, type of visa, and length of stay in the country. Here is a comprehensive guide to help you understand the process and make an informed decision.

Requirements for Non-US Citizens:

Residency Status:

Most insurance providers require proof of legal residency, such as a valid visa or a green card. Green card holders are considered permanent residents and have similar options for life insurance coverage as US citizens. However, some insurance companies may require at least two years of permanent residency before offering coverage.

Documentation:

Essential documents include identification proof such as a passport, visa, Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or other government-issued ID. A completed foreign resident questionnaire, which includes basic questions about health, work status, and history of residence in the US, may also be necessary.

Financial Connections:

Demonstrating financial ties to the US can strengthen your application. This can include property ownership, a US bank account, or other liquid or non-liquid US-based assets.

Health Information:

Like US citizens, non-citizens must undergo a medical exam or provide health records as part of the life insurance application process.

Types of Life Insurance Available for Non-US Citizens:

There are two main types of life insurance policies available:

Term Life Insurance:

This type of insurance provides coverage for a specified term, often 10, 20, or 30 years. It is generally more affordable and straightforward, making it a popular choice for those with financial responsibilities like mortgages or children.

Whole Life Insurance:

Whole life insurance offers lifetime coverage and includes a cash value component that grows over time. While more expensive, it provides additional benefits such as tax-deferred cash value accumulation and tax advantages on distributions.

Challenges and Considerations for Non-US Citizens:

Country of Origin:

Some insurance providers may restrict coverage based on your country of origin due to political or economic instability. Additionally, your country of residence may impact eligibility, as some countries do not allow their residents to purchase insurance outside their home country.

Travel Plans:

Frequent travel outside the US can affect your eligibility or result in higher premiums.

Language Barriers:

Ensure you fully understand the policy terms and conditions, and consider seeking translation services if needed.

How to Apply for Life Insurance as a Non-US Citizen:

Choose an Insurer:

Research and select an insurance company experienced in handling non-citizen applications. Not all insurance companies offer the same flexibility, so working with a broker that has access to multiple carriers can be beneficial.

Gather Documents:

Prepare the necessary documentation, including identification, proof of residency, financial documents, and health records.

Medical Exam:

Schedule and complete any required medical examinations, which are typically performed in the US.

Submit Application:

Accurately fill out the application form, providing all the required information. Be transparent about your residency status and visa type.

Review Terms:

Carefully review the policy terms and conditions before finalizing your decision to ensure you understand the coverage and any restrictions.

While non-US citizens can obtain life insurance in the United States, the eligibility criteria and requirements can vary depending on their individual circumstances. It is essential to work with experienced brokers and carefully review the terms and conditions to secure the best coverage for your needs.

How to Cancel a Whole Life Insurance Policy?

You may want to see also

Types of life insurance available for non-US citizens

Yes, non-US citizens can get life insurance in the United States, although the specific requirements and types of policies available will depend on their residency status, visa type, and how long they plan to stay in the country. Here is a breakdown of the types of life insurance available for non-US citizens:

Term Life Insurance

Term life insurance provides coverage for a specified term, often 10, 20, or 30 years. It is generally more affordable and simpler than other types of life insurance. This option is ideal for those with children or a mortgage who need budget-friendly coverage. Term life insurance is also customizable, with options to adjust the term length, coverage amount, and add riders for a small annual fee. After the term ends, the coverage lapses, and you must apply for a new policy, typically at a higher premium due to increased age and health risks.

Whole Life Insurance

Whole life insurance offers lifetime coverage with a guaranteed death benefit and fixed premiums. It also includes a cash value component that grows over time and can be borrowed against. While whole life insurance provides excellent coverage and asset-building benefits, the initial cost is significantly higher than term insurance.

Universal Life Insurance

Universal life insurance provides permanent coverage and builds cash value with flexibility. You can adjust the premiums and death benefit level within a certain range and choose how to build cash value. However, this flexibility requires careful management to ensure the policy account value remains above a certain level to avoid coverage lapse.

When applying for life insurance as a non-US citizen, it is recommended to work with a broker who can help navigate the requirements and find the best coverage options. The application process will depend on the type of identification and documentation verifying legal status in the US. A Social Security Number or Tax ID is typically required, along with proof of US ties, income or assets, and residency or legal status.

Life Insurance: Can Pre-Existing Conditions Affect Your Coverage Increase?

You may want to see also

How to apply for life insurance as a non-US citizen

How to apply for life insurance as a nonUS citizen

Non-US citizens can get life insurance in the United States, but the process is more complex and depends on several factors, such as residency status, visa type, and length of stay in the US. Here is a step-by-step guide on how to apply for life insurance as a non-US citizen:

Step 1: Choose an Insurer

Not all insurance companies offer the same flexibility when it comes to life insurance for non-citizens. It is important to research and choose an insurer with experience handling non-citizen applications. Some recommended companies include Lincoln Financial, Prudential, and Transamerica.

Step 2: Gather Documents

The specific documents required may vary depending on your situation, but here is a list of commonly requested documents:

- Passport and visa documents

- Proof of residency or legal status in the US, such as a green card, valid visa, or state-issued ID (e.g., driver's license)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) (a Tax Identification Number or TIN is often required for administrative and tax purposes)

- Proof of US ties, such as property ownership or a US bank account

- Proof of income or assets

Step 3: Medical Exam

Most life insurance policies require a medical exam or health questionnaire to evaluate your health and insurance risk. Schedule and complete any required medical examinations. If you have health records, be prepared to provide them.

Step 4: Submit Application

Fill out the application form accurately, providing all the necessary information. Be prepared to complete extra paperwork depending on your immigration status and documentation. You may also need to provide a foreign resident questionnaire, which includes basic questions about your health, employment status, and travel history.

Step 5: Review Terms

Before finalizing your decision, carefully review the policy terms and conditions. Understand the specific requirements and guidelines of the insurance company regarding non-US citizens.

Additional Considerations:

- Country of Origin: Some insurers may restrict coverage based on your home country due to political or economic instability.

- Travel Plans: Frequent travel outside the US can affect eligibility or premiums.

- Language Barriers: Ensure you fully understand the policy terms and conditions, and consider seeking translation services if needed.

- Cost: If you are applying with an ITIN, you may have to pay slightly higher premiums due to the inability to track your entire financial history.

Life Insurance: TIAA's Offerings and Your Options

You may want to see also

Companies that offer life insurance for non-US citizens

Yes, non-US citizens can get life insurance in the United States, but the process can be more challenging and options may be more limited. The eligibility and requirements vary based on several factors, including residency status, type of visa, and length of stay in the US. Here are some companies that offer life insurance for non-US citizens:

Lincoln Financial

Lincoln Financial is a good choice for those with existing health conditions and daily marijuana users. It offers a diverse array of life insurance policies, including competitive no-medical exam and high-net-worth options. However, term life insurance is not available in New York. Lincoln Financial is Policygenius's top pick for the best life insurance for green card holders.

Prudential

Prudential is one of the best options for visa holders, as it accepts applications from many different kinds of visa holders who have been US residents for over a year. The company has been in business for 150 years and serves nearly four million policyholders. Prudential is Policygenius's top pick for the best life insurance for visa holders.

Transamerica

Transamerica is Policygenius's top pick for the best life insurance for immigrants to the US. It is one of the oldest and largest life insurance companies, with over 12 million active accounts. It offers affordable rates for almost every age and the option to skip the medical exam for those under a certain age or coverage amount. However, it may not be a good option for people with a history of cancer, alcohol abuse, or asthma.

Assurity and Banner Life

Assurity and Banner Life offer no-medical-exam life insurance for immigrants. Banner Life/William Penn offers coverage ranging from $100,000 to $1,000,000.

Guardian

Guardian is one of the few providers that offer coverage for high-net-worth foreign nationals who are not US residents but have significant business, financial, and family ties in the US. Their Global Citizens Program provides concierge life insurance services for foreign nationals.

Motorcycle Riders: Life Insurance Options and Obstacles

You may want to see also

What is an ITIN number?

An ITIN, or Individual Taxpayer Identification Number, is a 9-digit number issued by the Internal Revenue Service (IRS) to individuals who are required to have a US taxpayer identification number but do not have and are not eligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA). It is a tax processing number that helps individuals comply with US tax laws and provides a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers.

ITINs are issued regardless of immigration status because both resident and nonresident aliens may have a US filing or reporting requirement under the Internal Revenue Code. They do not serve any purpose other than federal tax reporting. An ITIN will not authorise work in the US, provide eligibility for Social Security benefits, or qualify a dependent for Earned Income Tax Credit Purposes.

ITINs are available for certain nonresident and resident aliens, their spouses, and dependents who cannot obtain an SSN. To obtain an ITIN, individuals must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number, and provide documentation substantiating foreign/alien status and true identity. This can be done by mailing the documentation along with the Form W-7 to the address shown in the Form W-7 Instructions, presenting it at IRS walk-in offices, or processing the application through an Acceptance Agent authorised by the IRS.

Life Insurance: Medication's Impact on Eligibility

You may want to see also

Frequently asked questions

Yes, you can get life insurance with a Tax ID Number or Individual Taxpayer Identification Number (ITIN).

No, not all insurance companies will accept a Tax ID Number. It is important to work with a life insurance carrier that is geared towards foreign nationals and can offer more favorable options.

The requirements vary depending on the insurance company, but generally, you will need to have financial ties to the US, such as being married to a US citizen, working for a US company, or owning property in the US. You will also need to be in the US for the entire application process and have a US bank account.

The type of life insurance you can get may depend on your residency status and the insurance company. Some companies only offer permanent insurance to non-US citizens, while others offer term life insurance as well.

You will need to work with an insurance broker or carrier that accepts Tax ID Numbers and complete the application process, which may include a medical exam. The entire process must be done in the US, and you will need to be in the country to accept the policy.