Whole life insurance is a type of permanent life insurance that covers you for your entire life. It is different from term life insurance, which only provides coverage for a certain number of years. Whole life insurance policies are designed to provide coverage until the insured's death, and they usually include a cash value account, which the policy owner can draw on or borrow from.

You can cancel a whole life insurance policy at any time, but there may be penalties for doing so, especially if you cancel during the first few years of coverage, known as the surrender period. The surrender period can last up to 10 years or more, and there may be steep surrender fees during this time. After the surrender period, you are more likely to keep some of your cash value earnings, but you could still pay surrender charges.

If you stop paying your whole life insurance premiums, your insurer will offer you non-forfeiture options, which allow you to stop paying premiums but still get some value from your policy. Common non-forfeiture options include cancelling the policy and cashing out, keeping the death benefit for a shorter term, or taking a reduced paid-up option.

If you want to cancel your whole life insurance policy, start by calling your insurance company to discuss your options.

| Characteristics | Values |

|---|---|

| Cancellation Period | You can cancel a whole life insurance policy at any time. |

| Cancellation Process | Call your insurance company. |

| Cancellation Options | Surrender the policy for its cash value, exchange it for another policy or an annuity tax-free, or sell it in a life settlement. |

| Surrender Value | The cash value of whole insurance minus any surrender fees. |

| Surrender Charges | Surrender charges are listed in your policy contract. |

| Cash Surrender Value | The cash surrender value is your current cash value minus any fees associated with maintaining your policy. |

| Cash Surrender Value Tax | The cash surrender amount you receive is higher than the cost basis of the policy, you’ll be taxed on the amount over the cost basis. |

| Nonforfeiture Options | Cancel the policy and cash out, keep the death benefit for a shorter term, or take a reduced paid-up option. |

What You'll Learn

How to cancel a whole life insurance policy

Cancelling a whole life insurance policy is a significant decision that can arise due to various reasons. Understanding the process of cancelling a life insurance policy is crucial to ensure you don’t face unexpected consequences. The steps involved can vary depending on the type of policy you have, but rest assured, it’s generally a straightforward process. Here is a step-by-step guide on how to cancel a whole life insurance policy:

Step 1: Understand the policy terms and conditions

Before making any decisions, it is important to review the fine print of your policy. The policy is a contract, and the terms are binding, so it is essential to understand the exact steps you must take to cancel your whole life policy. The policy documents will outline the underwriting terms and conditions, including the steps required to cancel the policy and any associated fees or penalties.

Step 2: Evaluate your reasons for cancellation

There are several valid reasons why you might want to cancel your whole life insurance policy. These include:

- Change in financial situation: If you are experiencing financial difficulties, such as job loss, divorce, or other financial hardships, you may no longer be able to afford the premiums.

- Policy is no longer needed: If your major obligations, such as paying off your home or finishing your children's education, are fulfilled, the coverage provided by the whole life policy may no longer be necessary.

- Dissatisfaction with the policy or provider: You may find that the customer service is poor, or the premiums are too high compared to what is available elsewhere.

Step 3: Explore alternative options

Before cancelling your whole life insurance policy, it is worth considering alternative options that may better suit your needs. Here are some alternatives to explore:

- Ask for a new medical exam: If your health has improved, you may qualify for lower premiums.

- Lower your coverage amount: You may be able to decrease your coverage amount to reduce your premium payments while still maintaining some level of coverage.

- Use the policy's cash value: If you have built up cash value in your whole life policy, you may be able to use it to cover your premium payments or other expenses.

- Switch to a different policy: You may be able to find a new insurer with lower rates or a policy that better suits your current needs.

Step 4: Contact your insurance company

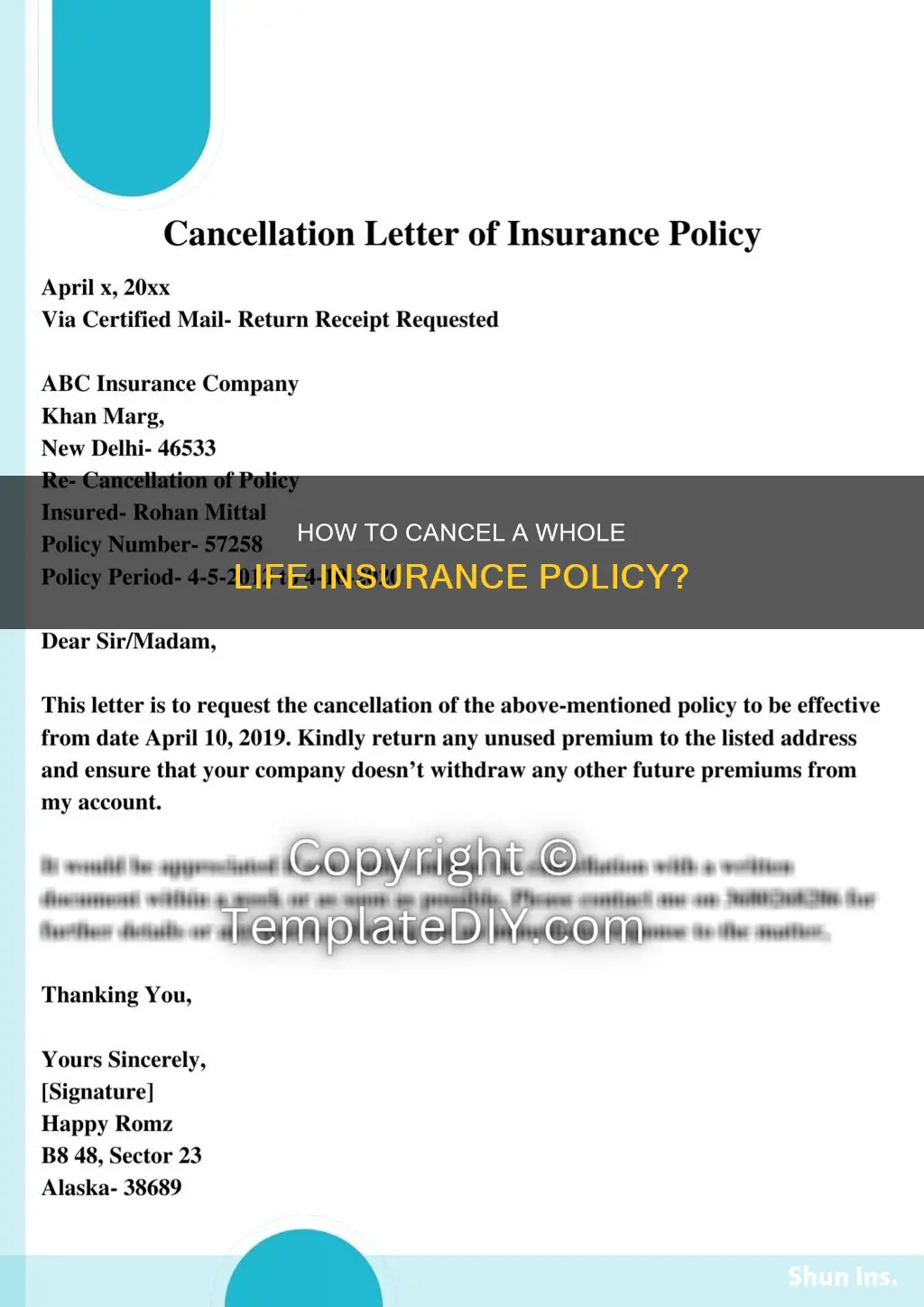

Once you have decided to cancel your whole life insurance policy and explored alternative options, it's time to contact your insurance company. You can do this by calling them directly or by sending a written notice. Be sure to have your policy number and other relevant information ready when you make the call.

Step 5: Understand the consequences and consider your beneficiaries

When you cancel a whole life insurance policy, your beneficiaries will no longer have the financial protection provided by the policy. Consider discussing your decision with your beneficiaries beforehand to ensure they are aware of the change. Additionally, take a global approach to your finances and estate planning to ensure you have sufficient assets to protect your loved ones.

Step 6: Follow through with the cancellation

After you have contacted your insurance company and provided the necessary information, they will guide you through the final steps to cancel your whole life insurance policy. This may include completing any necessary forms or online processes. Make sure to confirm that the cancellation is finalized to avoid any potential lapses in communication.

Selling Life Insurance Part-Time: Is It Possible?

You may want to see also

Surrender fees and cash value

Surrender Fees

When you surrender a whole life insurance policy, you may be charged a surrender fee, especially if you haven't held the policy for many years. Surrender fees can significantly reduce or even eliminate the cash value you receive upon cancellation. These fees decrease over time, but it's crucial to understand that the cash value may not be as high as expected if you surrender the policy prematurely.

Cash Value

Whole life insurance policies accumulate a cash value over time, and this value can be accessed in various ways, such as through policy loans or by using it to pay premiums. The cash value grows slowly in the first few years of the policy but accelerates as funds compound with tax-deferred interest.

When you surrender a whole life insurance policy, you receive the cash surrender value, which is the cash value minus any surrender fees or charges. In the early years of the policy, the cash value may not be worth surrendering due to the high surrender fees. It's important to review your policy contract to understand the specifics of your cash surrender value and how it is paid out.

If the cash surrender value you receive upon surrendering your policy exceeds the total amount of premiums you've paid, you may owe income taxes on the difference. Therefore, it's essential to consider the potential tax implications before making a decision.

Alternatives to Surrendering Your Policy

Instead of surrendering your whole life insurance policy, you may consider the following alternatives:

- Withdrawal: You can typically take a cash withdrawal from your policy, which will not be subject to income taxes if it's less than the amount paid into the policy. However, doing so will likely reduce your death benefit.

- Loans: You can borrow money against your policy's cash value, and the amount varies depending on the insurer. Policy loans typically have lower interest rates than personal loans, and there is no loan application or credit check required. If you choose not to repay the loan, the outstanding balance will be deducted from your death benefit.

- Use Cash Value to Pay Premiums: You may be able to use the cash value in your policy to pay your insurance premiums, making it easier to maintain your coverage. However, if the cash value becomes too low, your policy may lapse.

In conclusion, when considering cancelling your whole life insurance policy, be sure to review the surrender fees and cash value carefully. There are also alternatives to surrendering your policy that can help you access your cash value while maintaining your coverage.

Mass Mutual Life Insurance: Drug Testing Requirements

You may want to see also

Non-payment of premiums

If you have a term life insurance policy, non-payment of premiums is a straightforward way to cancel your policy. Simply stop sending in your premium payments. If you have automatic payments set up, you may need to contact your insurance company to end these transfers.

On the other hand, if you have a permanent life insurance policy, such as whole life insurance, non-payment of premiums can be more complex. Permanent life insurance policies typically accumulate a cash value over time, which can be used to pay premiums or borrow against. If you stop paying your premiums, the insurance company will use the cash value to pay any premiums until the cash value runs out and the policy lapses.

It's important to note that non-payment of premiums may have tax implications, especially if you have a permanent life insurance policy with accumulated cash value. Withdrawing more than you've contributed to the cash value may be taxable. Therefore, it's recommended to consult with a financial advisor or tax professional before making any decisions.

Lawyers: Life Insurance Agents? Exploring Dual Careers

You may want to see also

Alternatives to cancellation

Alternatives to Cancelling Your Whole Life Insurance Policy

If you are considering cancelling your whole life insurance policy, there are several alternatives you can explore before making a final decision. Here are some options to help you reduce your premiums or adjust your coverage without completely giving up your life insurance protection:

- Reduce your coverage amount: Contact your insurer to discuss the possibility of decreasing your coverage amount, which can lower your premiums and help you customise your coverage to your current financial obligations.

- Use your cash value to cover your premiums: If you have a permanent policy, you may be able to use the accumulated cash value to cover your premiums until you can afford to pay them out-of-pocket. However, this will reduce the death benefit for your beneficiaries.

- Ask for a new medical exam: If your health has improved since purchasing your policy, such as quitting smoking or losing weight, you may be able to qualify for lower premiums. Most insurers will reconsider your rates if you have maintained positive lifestyle changes for at least a year.

- Borrow against your policy: If you need cash, you can take out a loan against the cash value of your policy. Keep in mind that this will incur interest, and if you pass away before repaying the loan, your loved ones will receive a lower death benefit.

- Shop for a new policy: Compare quotes from different companies to see if you can find a new policy with more competitive rates that better suits your needs.

- Switch to paid-up status: If you have a whole life policy, you may be able to use the cash value to pay all your premiums, which will decrease your death benefit.

- Pay with dividends: If your policy is with a mutual company, you may be able to use any dividends earned based on the insurer's financial performance to pay your premiums.

Dialysis and Life Insurance: What You Need to Know

You may want to see also

Whole life insurance vs term life insurance

Whole Life Insurance vs. Term Life Insurance

The main difference between whole life insurance and term life insurance is that whole life insurance is more expensive and covers you for your entire life, whereas term life insurance is cheaper and only covers you for a set number of years.

Whole Life Insurance

Whole life insurance is a form of permanent life insurance that covers you for your entire life rather than a fixed period of time. It tends to be more expensive than term life insurance because it pays a survivor benefit regardless of when the individual passes and also accrues cash value over time. Whole life insurance policies will remain in effect for the duration of the insured person's lifespan, as long as the premiums are paid. This is in contrast to term life policies that end after a specified period of time. Whole life insurance policies may include a cash value that will grow over time as you pay your premiums and from a guaranteed interest rate. You may be able to borrow against the equity or withdraw some of the money. However, if you die before the loan is repaid in full, the death benefit may be reduced by the amount still owed. You may also be able to surrender the policy and receive the cash value.

Term Life Insurance

Term life insurance lasts for a specific period, called the term, and pays the beneficiary a guaranteed death benefit only if the insured dies during the term. It tends to be much cheaper than whole life coverage because it offers temporary rather than lifelong coverage and doesn’t build cash value. Term life insurance is generally the most affordable life insurance because it’s temporary and has no cash value. The way term life insurance works is simple: It covers you for a fixed period of time, such as 10, 20 or 30 years, and pays out if you die during the term. If you outlive the term and your coverage ends, your beneficiaries won’t receive any money. Most policies are a type of level term life; the death benefit and life insurance premiums are guaranteed to stay the same throughout the term.

How to Secure Life Insurance for Your Partner

You may want to see also

Frequently asked questions

Yes, you can cancel your whole life insurance policy at any time, but you’ll face penalties if you cancel during the first few years of your coverage, called the surrender period.

The cash surrender value is the amount of money you will receive when you cancel your whole life insurance policy. It is the cash value minus any surrender fees.

If you stop paying your whole life insurance premiums, your insurer will offer you nonforfeiture options or apply one by default. This is different from what happens with term life insurance, which simply ends when you stop paying premiums.

If your main reason for canceling your whole life insurance is the high premiums, lowering your death benefit or choosing a nonforfeiture option are the least complicated ways to reduce your costs.

Whole life insurance provides coverage throughout the life of the insured person. It has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest. Whole life insurance is more expensive than term life insurance. Premiums of a whole life policy are usually significantly higher than term premiums because the policy accumulates cash value and covers you for your whole life.