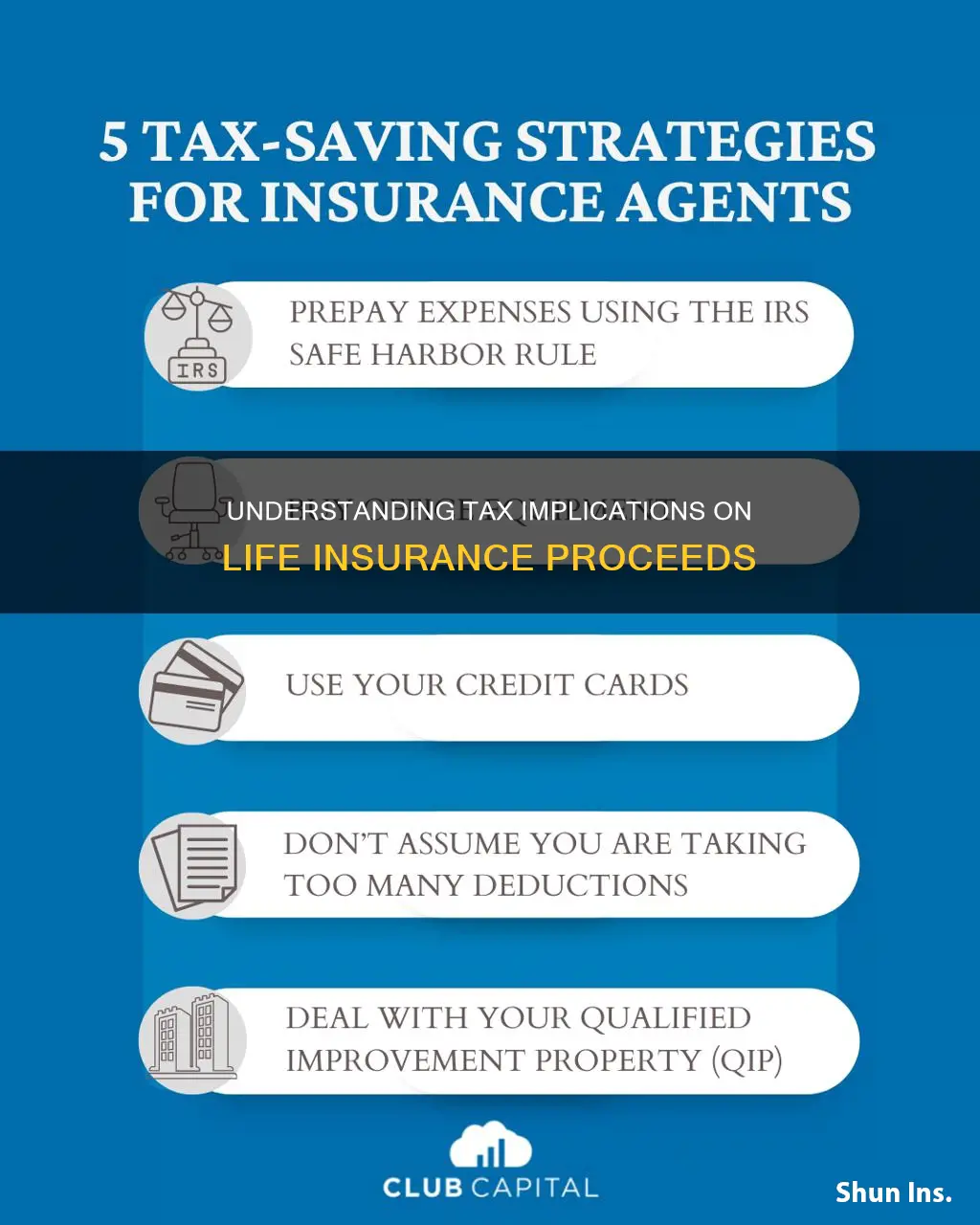

Life insurance is often seen as a reliable way to provide for loved ones after death. One of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs or securing their future. However, there are a few situations where taxes could come into play, and it's important to know when that might happen.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | No, life insurance proceeds are not taxable income. |

| Are there exceptions? | Yes, there are certain exceptions. |

| What are the exceptions? | If the policy is paid out in installments, the interest accrued will be taxable. If the policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary, the value of the estate may trigger estate taxes. If the policyholder withdraws more than their cumulative premium payments from a whole life policy, the excess may be subject to income taxes. If the policyholder surrenders their whole life insurance policy and the surrender proceeds exceed the cumulative premiums, the excess may be subject to income taxes. If the policyholder sells their whole life policy and the sales proceeds exceed the cumulative premiums, the excess may be subject to income taxes. If the death benefit is greater than $50,000, the employer-paid premiums for coverage over $50,000 are subject to income taxes. |

What You'll Learn

Interest on life insurance payouts is taxable

Life insurance payouts are generally not taxable, but there are certain exceptions. One such exception is when the payout is made in installments; in this case, the interest accrued will be taxable.

If a beneficiary chooses to receive their payout as an annuity (a series of payments over several years) instead of a lump sum, any interest accrued by the annuity account may be subject to taxes. This is because interest income is almost always taxable at some point.

The same is true for participating whole life insurance policies that pay dividends to policyholders. While the dividends themselves are not taxed, any interest earned on those dividends is considered taxable income and must be reported.

If you are a beneficiary and you receive a life insurance payout, you will not need to pay taxes on the death benefit, but you will need to pay taxes on any interest accrued.

Depositing Life Insurance Checks: Mobile Options Explored

You may want to see also

Estate taxes may apply if the policy is part of the deceased's estate

In most cases, life insurance proceeds are not taxable. However, estate taxes may apply if the policy is part of the deceased's estate. This typically occurs when the policy has no named beneficiaries, and the proceeds are included in the estate. If the value of the estate exceeds the federal estate tax threshold, which was $13.61 million as of 2024, estate taxes must be paid on the amount over the limit. Some states also have their own inheritance or estate taxes, which depend on the value of the estate and the location of the deceased's residence.

It is important to note that named beneficiaries generally do not have to pay estate taxes on the proceeds of a life insurance policy. However, if the proceeds are included in the estate, the value of the estate may increase, triggering a taxable event if the estate is near the tax exemption limit.

To avoid potential estate tax implications, careful planning is necessary. One strategy is to set up an Irrevocable Life Insurance Trust (ILIT) and name it as the owner and beneficiary of the policy. If structured properly, the trust can help pay estate taxes without increasing the value of the estate. Another option is to ensure that the policy is not owned by the insured but rather transferred to another person or entity. This removes the proceeds from the taxable estate, but it is important to note that the original owner gives up all rights to the policy after the transfer.

Consulting a financial advisor or a qualified tax professional is essential when dealing with life insurance and estate planning to ensure that all tax implications are considered and addressed.

Tricare for Life: Primary Insurance and You

You may want to see also

Surrendering your policy may incur taxes

Surrendering your life insurance policy may incur taxes. If you no longer want to keep your life insurance policy, you can surrender it to the insurance company in exchange for a cash payment. If you surrender the policy and the cash you receive is more than the cumulative premiums, the excess may be subject to income taxes. However, if the cash value is less than the total premiums you paid, you will likely not pay taxes on the cash payment you receive from the insurer.

When you surrender your policy, the cash surrender value (CSV) is the amount you receive after any fees are deducted. If the CSV is higher than the amount of premiums you've paid into the policy (your cost basis), the excess is taxable as ordinary income. For example, if you've paid $30,000 in premiums and the CSV of the policy is $45,000, the $15,000 difference would be taxed as ordinary income, possibly pushing you into a higher tax bracket for that year.

If you've borrowed against your policy's cash value and the loan is still outstanding when the policy is terminated or surrendered, the loan amount in excess of the cumulative premiums may also be subject to income taxes.

To avoid unexpected tax consequences, it's recommended to consult a financial advisor when considering surrendering your life insurance policy.

Life Insurance for Marathon Runners: What's Covered?

You may want to see also

Selling your policy may incur taxes

Selling your life insurance policy may incur taxes. This is known as a life settlement, and it can trigger income and capital gains taxes. If you sell your policy for more than you've paid in premiums, the gain on that amount could be taxed. Here's a more detailed explanation of the taxation of life insurance policy sales:

The portion of the sale amount you receive that is equal to what you've paid in premiums (your "cost basis") will not be taxed. However, if you sell your policy and the sales proceeds exceed your cumulative premiums, the excess may be subject to income taxes. But if the surrender value is less than the cumulative premiums you paid for the policy, you likely won't pay income taxes on the cash payment you receive from the insurer.

The portion that exceeds your cost basis but is less than the cash value of the policy is subject to income tax. Lastly, any amount above the cash value is subject to capital gains tax. Additionally, the new owner of the policy may face taxes on any death benefit they receive that exceeds what they paid for the policy, plus any premiums they've continued to pay.

To avoid unexpected tax consequences, it's recommended to consult a financial advisor when shopping for the best life insurance.

Borrowing Against Universal Life Insurance: Is It Possible?

You may want to see also

Withdrawing more than the cost basis is taxable

Withdrawing more than the cost basis of a life insurance policy is generally considered taxable income. The cost basis is the total amount of premiums paid into the policy. Withdrawing more than this amount will likely result in income taxes on the excess. This is because the IRS treats the withdrawal as taxable income, and you will need to report it as such.

For example, let's say you've paid $50,000 in premiums (your cost basis) over the years, and the cash value of your policy has grown to $80,000. If you decide to withdraw $60,000, the first $50,000 is tax-free, but the remaining $10,000 would be considered taxable income and reported to the IRS. It's important to note that the withdrawal amount up to your cost basis is generally not subject to taxation.

Similarly, if you borrow against the cash value of your policy and the loan is still outstanding when the policy is terminated or surrendered, the loan amount that exceeds your cost basis may also be subject to income taxes. This is because the outstanding loan balance above your cost basis will be treated as taxable income.

It's worth noting that permanent life insurance policies, such as whole life or universal life insurance, often have a cash value component that can grow over time. Withdrawing more than your cost basis from these policies can trigger income taxes on the excess amount.

To avoid unexpected tax consequences, it is recommended to consult a financial advisor or a qualified tax professional when making decisions about your life insurance policy, especially if you are considering withdrawing more than your cost basis. They can guide you through the tax implications and help you make informed choices.

Life Insurance and Arthritis: What You Need to Know

You may want to see also

Frequently asked questions

In most cases, beneficiaries do not have to pay taxes on life insurance proceeds. However, there are some exceptions. For example, if the beneficiary chooses to receive the payout in installments, any interest accrued will be taxable.

Life insurance proceeds are generally not considered taxable income. However, there are certain situations where taxes may be owed, such as if the proceeds are paid out in installments and accrue interest.

Yes, estate taxes may apply if the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary. If the estate's value exceeds the federal estate tax threshold, estate taxes must be paid.