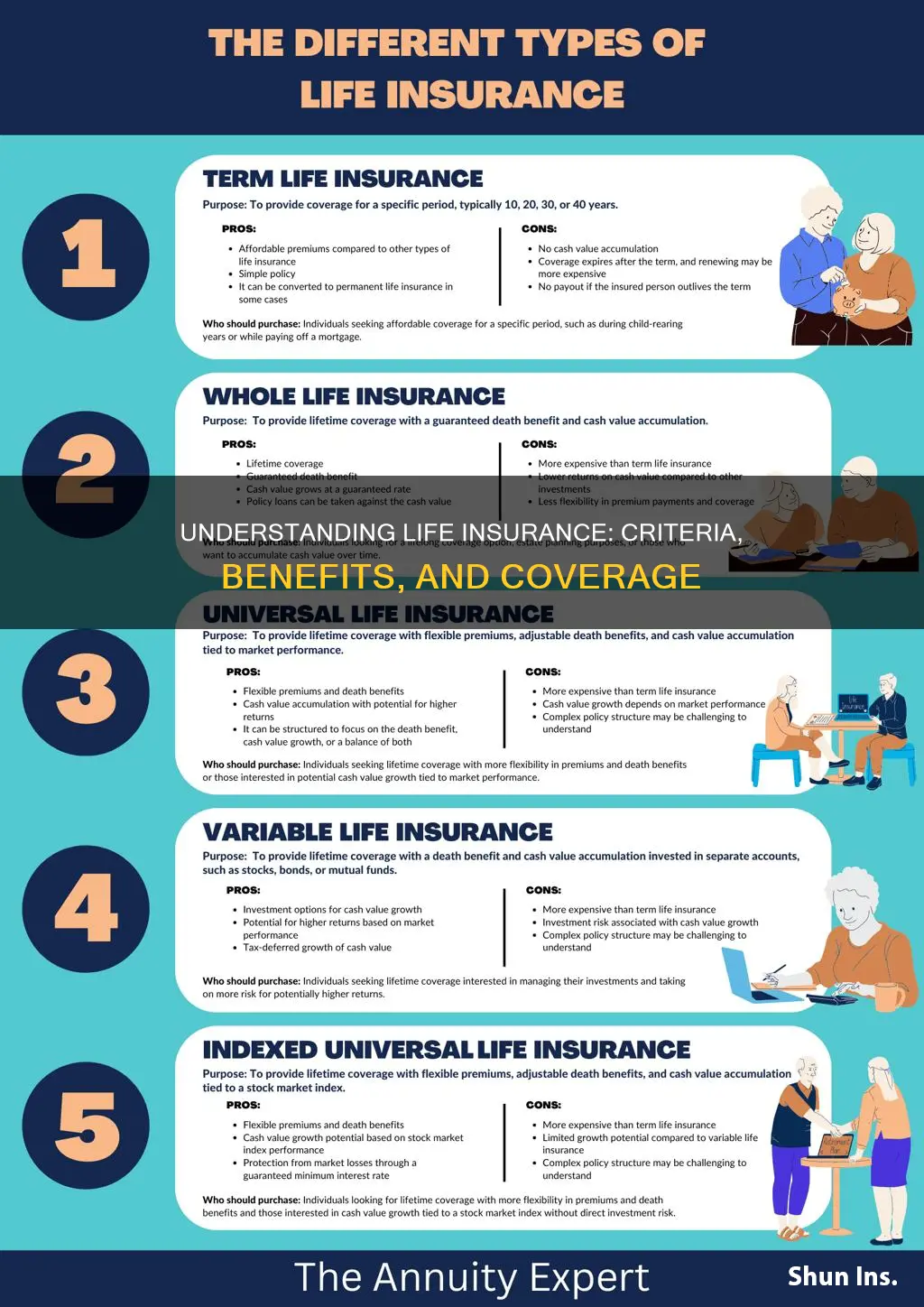

Life insurance is a financial safety net that provides coverage and financial protection for individuals and their families. The criteria for qualifying for life insurance typically involve several key factors. Firstly, age plays a significant role, as younger individuals often have lower premiums due to a longer life expectancy. Secondly, health and medical history are crucial; insurers may require a medical examination or ask about pre-existing conditions to assess the risk. Additionally, lifestyle factors such as smoking, alcohol consumption, and occupation can impact eligibility and premium costs. Income and financial responsibilities are also considered, as the amount of coverage needed may vary based on an individual's financial obligations. Understanding these criteria is essential for individuals to determine their eligibility and choose the appropriate life insurance policy to meet their specific needs.

What You'll Learn

- Age and Health: Younger, healthier individuals often qualify for lower premiums

- Income and Dependents: Higher income and dependents may require more coverage

- Lifestyle Factors: Smoking, drinking, and extreme sports can impact insurance eligibility and rates

- Medical History: Pre-existing conditions or recent health issues may affect coverage and costs

- Financial Goals: Long-term financial goals influence the desired coverage amount and type of policy

Age and Health: Younger, healthier individuals often qualify for lower premiums

Age and health are critical factors in determining life insurance eligibility and premium costs. Younger, healthier individuals often qualify for lower premiums, as they are considered lower-risk candidates for insurance companies. This is because life expectancy increases with age, and younger people generally have a longer lifespan, reducing the likelihood of an insurance payout. Additionally, a healthy lifestyle can significantly impact premium rates. Insurance providers often offer more competitive rates to individuals who maintain a balanced diet, engage in regular physical activity, and avoid harmful habits like smoking or excessive alcohol consumption. These factors contribute to a person's overall health and longevity, making them less prone to certain illnesses and health conditions that could lead to premature death.

When it comes to age, younger individuals typically have more favorable rates due to their extended life expectancy. As people age, the risk of developing chronic diseases, such as heart disease, cancer, or diabetes, increases, which can impact life expectancy and, consequently, insurance premiums. Older individuals may also face higher rates due to the potential for pre-existing health conditions, which could lead to more frequent medical interventions and increased healthcare costs.

Maintaining a healthy lifestyle is essential for securing lower life insurance premiums. This includes regular exercise, a balanced diet, and avoiding harmful habits. Insurance companies often have specific guidelines or classifications for different health statuses. For instance, they may categorize individuals as preferred, standard, or substandard based on their health and lifestyle choices. Preferred rates are typically offered to those with excellent health, while standard or substandard rates may be applied to individuals with pre-existing conditions or unhealthy habits.

In summary, younger and healthier individuals often benefit from lower life insurance premiums due to their extended life expectancy and reduced risk of certain health conditions. Insurance companies consider age and health as key factors in assessing risk and determining premium costs. By maintaining a healthy lifestyle, individuals can improve their chances of securing more competitive rates and ensuring they are eligible for the coverage they need. It is always advisable to consult with insurance professionals to understand the specific criteria and requirements for different life insurance policies.

Life Insurance: Millions of Americans Unprotected

You may want to see also

Income and Dependents: Higher income and dependents may require more coverage

When considering life insurance, one of the key factors that determines the appropriate coverage is an individual's income and the number of dependents they have. This is because these factors directly impact the financial responsibilities and obligations one has towards their family. Higher income levels often translate to greater financial commitments, and thus, a more comprehensive insurance policy may be necessary to ensure the well-being of one's loved ones in the event of an untimely demise.

For individuals with higher incomes, the potential financial loss to their family can be significant. A higher salary often means a larger contribution to household expenses, mortgage or rent payments, and other financial commitments. In the event of the insured's death, the family would need to cover these expenses, and a life insurance policy can provide the necessary financial support to ease the burden. The coverage amount should ideally be sufficient to cover at least a year's worth of income to provide a safety net for the dependents.

The number of dependents also plays a crucial role in determining the insurance coverage. Dependents can include a spouse, children, or other family members who rely on the insured's income for their financial needs. If the insured has a large family that depends on their income, the life insurance policy should be substantial enough to replace the lost income and cover the expenses associated with raising and supporting the dependents. This ensures that the family can maintain their standard of living and have the financial resources to provide for their children's education, healthcare, and other essential needs.

For example, a family with multiple children and a mortgage or rent payment would require a more extensive life insurance policy compared to a single individual with no dependents. The insurance company will assess the specific circumstances and may offer different coverage options to cater to these varying needs. It is essential to carefully evaluate one's financial situation and the number of dependents to determine the appropriate coverage, ensuring that the policy provides adequate financial protection for the family.

In summary, when assessing the criteria for life insurance, income, and the number of dependents are critical considerations. Higher income levels and a larger number of dependents often necessitate more extensive coverage to ensure the financial security of the family. By understanding these factors, individuals can make informed decisions about their life insurance policies, providing peace of mind and financial stability for their loved ones.

Understanding Life Insurance: Payouts and Procedures

You may want to see also

Lifestyle Factors: Smoking, drinking, and extreme sports can impact insurance eligibility and rates

Lifestyle choices play a significant role in determining insurance eligibility and can directly influence the cost of life insurance policies. Insurance companies often consider an individual's lifestyle when assessing risk and setting premiums, as certain habits and activities can impact an individual's health and longevity.

Smoking is a well-known risk factor and can significantly affect life insurance rates. Regular smoking can lead to various health issues, including lung cancer, heart disease, and respiratory problems. Insurance providers often view smokers as high-risk candidates due to the increased likelihood of developing these health conditions. As a result, smokers may face higher premiums or even be denied coverage altogether. Quitting smoking can be a crucial step in improving insurance eligibility and potentially lowering rates over time.

Excessive alcohol consumption is another lifestyle factor that can impact insurance. Heavy drinking can contribute to liver damage, cardiovascular problems, and an increased risk of accidents or injuries. Insurance companies may consider individuals with a history of alcohol abuse or dependency as high-risk, leading to higher insurance costs or limited coverage options. Reducing alcohol intake or seeking professional help can positively influence insurance rates and overall health.

Engaging in extreme sports and adventurous activities can also have an effect on life insurance. These activities often involve a higher risk of injury or death, which may result in more expensive insurance premiums. Sports like skydiving, bungee jumping, rock climbing, or racing motorcycles are typically considered high-risk hobbies. Insurance providers may require additional medical assessments or charge higher rates for individuals participating in such activities. It is essential for policyholders to disclose their hobbies and ensure that their insurance coverage aligns with their lifestyle choices.

In summary, lifestyle factors, including smoking, drinking, and extreme sports participation, can significantly impact life insurance eligibility and rates. Insurance companies assess risk based on an individual's habits and health status. By making positive lifestyle changes, such as quitting smoking, moderating alcohol consumption, or seeking medical advice for extreme sports participation, individuals can improve their insurance prospects and potentially secure more affordable coverage. Understanding these lifestyle impacts is crucial for anyone seeking life insurance to ensure they receive appropriate coverage at a reasonable cost.

Life Insurance and Terrorism: What Coverage Looks Like

You may want to see also

Medical History: Pre-existing conditions or recent health issues may affect coverage and costs

When it comes to life insurance, your medical history plays a crucial role in determining your eligibility and the cost of your policy. Insurance companies assess the risk associated with insuring an individual by considering various health factors, including pre-existing conditions and recent health issues. This evaluation helps them understand the likelihood of future health-related claims and set appropriate premiums.

Pre-existing conditions refer to any health issues or diseases that you had before obtaining life insurance. These could include chronic illnesses like diabetes, heart disease, or cancer, as well as conditions such as asthma, allergies, or mental health disorders. Insurance providers will carefully review your medical records to assess the severity and management of these conditions. For instance, a person with a history of severe asthma attacks may face higher premiums or even be deemed uninsurable by some companies.

Recent health issues are also taken into account, as they can provide insights into an individual's overall health and potential future risks. This includes recent hospitalizations, surgeries, or significant medical procedures. For example, if you have recently undergone major heart surgery, the insurance company will consider the procedure's success and any associated complications. They may also ask about any ongoing treatments or medications you are taking to manage your health.

The impact of medical history on life insurance coverage and costs can be significant. Insurance companies often use medical underwriting, a process that involves a detailed review of your health information, to determine the terms of your policy. Pre-existing conditions may result in higher premiums, policy exclusions, or limited coverage options. In some cases, individuals with severe health issues may be denied coverage altogether. However, it's important to note that some companies offer specialized policies for those with pre-existing conditions, which can provide coverage despite the challenges.

Additionally, recent health issues can influence the underwriting process. If you have recently experienced a health scare or a minor medical event, the insurance company may still consider it when assessing your risk. This could potentially lead to higher premiums or a need for additional medical information. It is essential to be transparent and provide accurate details about your medical history to ensure you receive the most suitable coverage.

Life Insurance and Credit: Any Connection?

You may want to see also

Financial Goals: Long-term financial goals influence the desired coverage amount and type of policy

Long-term financial goals play a crucial role in determining the appropriate life insurance coverage for individuals. These goals are often tied to significant life events and milestones that require financial planning and security. When considering life insurance, it is essential to evaluate your long-term financial objectives to ensure that the policy adequately protects your interests and those of your loved ones.

One of the primary long-term financial goals that influence life insurance decisions is retirement planning. Many people aim to secure their financial future during their retirement years, and life insurance can be a valuable tool to achieve this. The coverage amount should be sufficient to provide financial support for the policyholder's retirement expenses, including living costs, healthcare, and any desired retirement lifestyle. For instance, if an individual wants to ensure their spouse can maintain their standard of living in the event of their passing, a substantial life insurance policy might be necessary.

Another critical aspect is the payment of debts and liabilities. Long-term financial goals often involve managing and eventually paying off substantial debts, such as a mortgage, business loans, or personal debts. Life insurance can be structured to cover these debts, ensuring that the financial burden doesn't fall solely on the surviving beneficiaries or loved ones. By including debt repayment as a financial goal, individuals can determine the necessary coverage to settle these obligations and provide financial relief to their families.

Additionally, long-term financial goals may include funding education expenses for children or dependents. Many people aim to secure their children's future by providing educational resources and financial support. Life insurance can be utilized to create a dedicated fund for education, ensuring that the policyholder's children have the means to pursue their academic aspirations, even in the absence of the primary breadwinner. This long-term goal significantly impacts the desired coverage amount and the policy's structure.

Furthermore, long-term financial goals can also encompass business succession planning. For business owners, ensuring the continuity of their enterprise is a significant objective. Life insurance can be strategically used to provide financial support for business operations, allowing for a smooth transition in the event of the policyholder's passing. This goal influences the coverage amount and the type of policy, often requiring specialized business insurance solutions.

In summary, long-term financial goals are pivotal in shaping the criteria for life insurance. By aligning the policy with personal objectives, such as retirement planning, debt management, education funding, and business succession, individuals can ensure that their life insurance coverage is tailored to their specific needs. Understanding and addressing these financial goals will lead to a more comprehensive and effective life insurance strategy.

Microbusinesses: Group Life Insurance Options and Benefits

You may want to see also

Frequently asked questions

The main factor is age, as life insurance companies typically offer lower rates to younger individuals due to statistical models showing lower mortality rates. However, age is not the sole determinant, and many other factors come into play.

Pre-existing medical conditions can impact your ability to obtain life insurance or may result in higher premiums. Insurance companies often require medical exams or ask for detailed health information to assess the risk associated with insuring an individual.

Yes, lifestyle choices and habits play a significant role. Smokers, for instance, may face higher premiums or even be denied coverage. Additionally, occupation and hobbies can also be factors, as certain high-risk professions or extreme sports may affect the insurance company's decision.