Termination Dividend Life Insurance is a unique type of life insurance policy that offers a special feature: the potential to accumulate and distribute dividends. Unlike traditional life insurance, where the primary purpose is to provide a death benefit to beneficiaries, this policy is designed to provide a financial safety net and potential investment opportunities. The policyholder can choose to invest a portion of their premiums in a separate account, which may earn dividends based on the performance of the insurance company's investment portfolio. These dividends can then be used to enhance the policy's death benefit, provide additional coverage, or be withdrawn as cash value. This type of insurance provides a way for individuals to potentially build wealth over time while also ensuring financial security for their loved ones.

What You'll Learn

- Definition: Termination Dividend Life Insurance is a type of policy that pays out dividends if the insurer's profits allow

- Benefits: It offers potential financial rewards and guaranteed death benefit

- Dividend Payout: Dividends are paid out to policyholders when the insurer's profits exceed expenses

- Guaranteed Death Benefit: The policy guarantees a death benefit, even if dividends are not paid

- Flexibility: Policyholders can choose to take dividends as cash value or additional coverage

Definition: Termination Dividend Life Insurance is a type of policy that pays out dividends if the insurer's profits allow

Termination Dividend Life Insurance is a unique and specialized form of life insurance policy that offers an additional layer of financial security and potential returns to policyholders. This type of insurance is designed to provide a safety net for the insured individual and their beneficiaries while also allowing the insurer to share a portion of its profits with the policyholders.

In simple terms, a Termination Dividend Life Insurance policy is a life insurance contract with a twist. It is structured in a way that, in addition to providing a death benefit (a lump sum payment upon the insured's passing), it also has the potential to generate dividends. These dividends are essentially a share of the insurer's profits, and they can be paid out to the policyholder or their designated beneficiaries. The key factor here is that the payment of dividends is dependent on the insurer's financial performance and profitability.

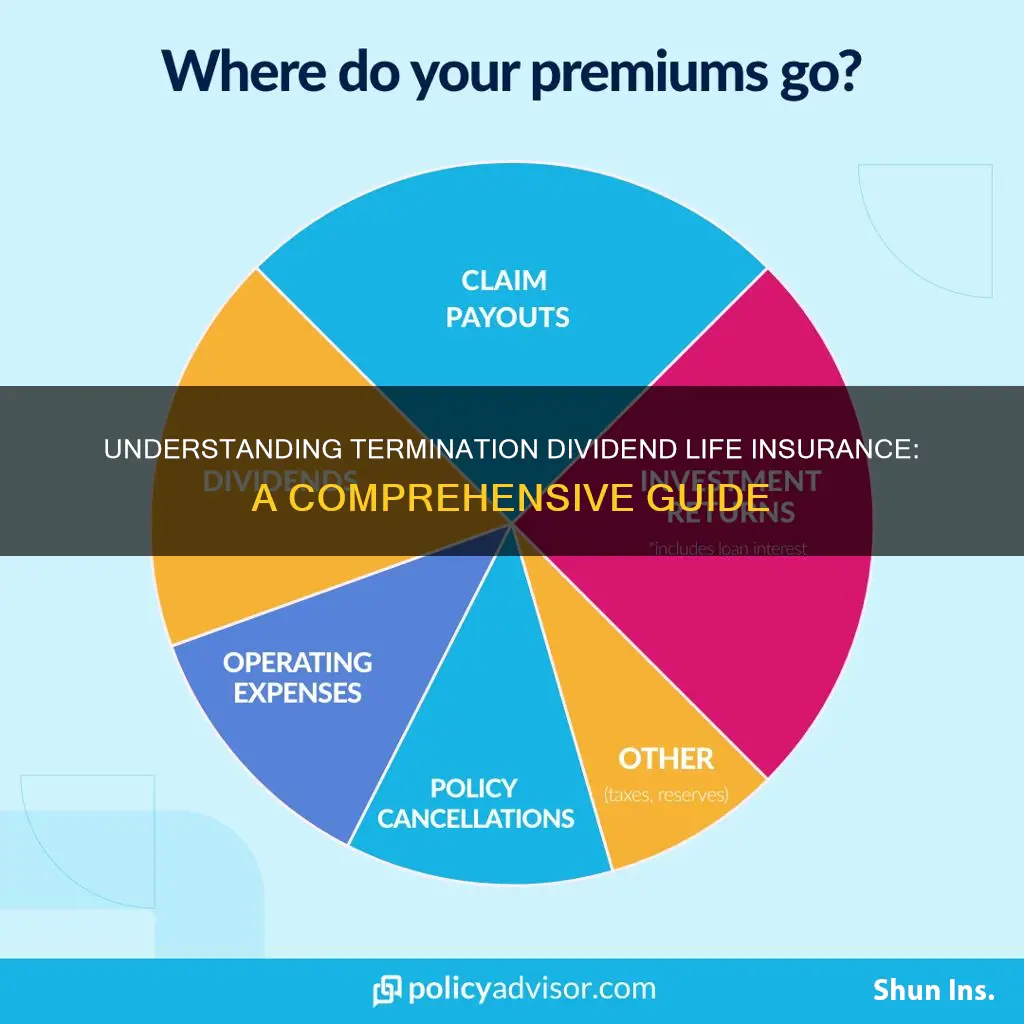

The way it works is that the insurer sets aside a portion of the premiums collected from policyholders into a separate account or fund. This fund is then invested, and the returns generated are used to pay out dividends. If the insurer's profits are substantial, the policyholders may receive a higher payout than the basic death benefit, providing an extra financial boost. This feature is particularly attractive to those seeking not only insurance coverage but also an opportunity to potentially increase their returns over time.

It's important to note that the availability of dividends and the amount paid out are not guaranteed and can vary from year to year based on the insurer's performance. Policyholders should understand that while this type of insurance offers an additional benefit, it is still primarily a life insurance product, and the primary purpose is to provide financial security for the insured's loved ones.

Termination Dividend Life Insurance is a specialized and often lesser-known aspect of the insurance industry, providing an extra layer of value to policyholders. It is a testament to the creativity and flexibility of insurance providers in offering products that cater to diverse financial needs and preferences.

Life Insurance Denial: What You Need to Know

You may want to see also

Benefits: It offers potential financial rewards and guaranteed death benefit

Termination Dividend Life Insurance is a unique and powerful financial tool that provides individuals with a range of benefits, particularly in the context of life insurance. This type of insurance policy is designed to offer both financial security and potential rewards, making it an attractive option for those seeking to protect their loved ones and build long-term wealth.

One of the key advantages of Termination Dividend Life Insurance is the potential for financial rewards. Unlike traditional term life insurance, where premiums are typically paid out as a death benefit upon the insured's passing, this policy takes a different approach. It allows the insurance company to reinvest a portion of the premiums into the policy's investment component. Over time, these investments can generate dividends, which are then paid out to the policyholder or their beneficiaries. This feature provides an opportunity for policyholders to accumulate wealth, as the dividends can be reinvested or withdrawn, offering a potential source of additional income.

The guaranteed death benefit is another critical aspect of this insurance. In the event of the insured's death, the policy will pay out a predetermined amount, ensuring financial security for the policyholder's family. This guarantee provides peace of mind, knowing that the financial obligations of the deceased will be met, and the beneficiaries will receive the intended support. The death benefit can be customized to fit the specific needs of the individual and their family, offering tailored financial protection.

Additionally, the policy's investment component can provide long-term financial growth. The insurance company invests the premiums and any accumulated dividends in various financial instruments, such as stocks, bonds, or mutual funds. This strategic investment approach aims to maximize returns over time, potentially outpacing the growth of traditional savings accounts or fixed-income investments. As the investment portfolio grows, so does the potential for higher dividends, creating a cycle of financial growth and security.

In summary, Termination Dividend Life Insurance offers a compelling package of benefits. It provides a guaranteed death benefit, ensuring financial security for loved ones, while also presenting the opportunity for financial rewards through dividend payments. The investment component of the policy allows for potential long-term wealth accumulation, making it a versatile and attractive financial tool for those seeking both protection and growth. Understanding the mechanics of this insurance can empower individuals to make informed decisions about their financial future.

Health vs Life Insurance: What's the Real Difference?

You may want to see also

Dividend Payout: Dividends are paid out to policyholders when the insurer's profits exceed expenses

Dividend Payout: A Unique Feature of Term Life Insurance

Term life insurance is a type of insurance policy that provides coverage for a specific period, known as the "term." One of the unique features of term life insurance is the concept of "dividend payout." When an insurance company offers term life insurance, it operates similarly to a mutual fund or an investment company. The insurer invests the premiums collected from policyholders and aims to generate profits. If the insurer's profits exceed its expenses, it can distribute a portion of these profits back to the policyholders in the form of dividends.

Dividend payout is a way for insurance companies to share their success with the policyholders. It is essentially a return on the policyholder's investment in the insurance policy. When the insurer declares a dividend, it means that the policyholders will receive a portion of the surplus earnings as a bonus. This can be a significant benefit, especially for those who have been paying premiums for a long time and have accumulated a substantial amount of money in the policy's cash value.

The process of dividend payout typically involves the following steps: First, the insurance company evaluates its financial performance and determines if it has generated sufficient profits. If the insurer's earnings exceed its expenses, it will declare a dividend amount. This declaration is usually made on an annual or semi-annual basis. Once declared, the dividend is paid out to the policyholders, often in the form of additional coverage, increased cash value, or a lump-sum payment.

It's important to note that not all term life insurance policies offer dividend payout. This feature is more common in traditional life insurance policies, especially those issued by mutual insurance companies. In some cases, the insurer may choose to reinvest the profits back into the policyholder's account instead of distributing them as dividends. Policyholders should carefully review the terms and conditions of their specific insurance policy to understand the potential for dividend payout.

In summary, dividend payout is a unique aspect of term life insurance, allowing policyholders to benefit from the insurer's success. It provides an opportunity for policyholders to receive a return on their investment and can be a valuable feature when considering different life insurance options. Understanding the concept of dividend payout can help individuals make informed decisions about their insurance coverage and financial planning.

Adjustable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Guaranteed Death Benefit: The policy guarantees a death benefit, even if dividends are not paid

Guaranteed death benefit is a crucial feature of certain life insurance policies, particularly those with a termination dividend structure. This feature ensures that the policyholder or their beneficiaries receive a specified amount of coverage, regardless of the performance of the insurance company or the payment of dividends. It provides a level of security and predictability that is especially valuable for individuals and families who rely on the financial protection offered by life insurance.

In the context of termination dividend life insurance, the guaranteed death benefit is a promise made by the insurance company. When you purchase such a policy, the insurer agrees to pay out a predetermined sum upon your death, as long as the policy is in force. This benefit is not dependent on the accumulation of dividends, which are essentially surplus earnings that the company reinvests or distributes to policyholders. The guaranteed death benefit ensures that the policy's value is secure, even if the company's financial performance varies or if dividends are not paid out.

The importance of this guarantee becomes evident when considering the volatility of investment markets and the potential impact on insurance companies. If an insurance policy's value were solely dependent on dividend payments, the death benefit could fluctuate, leaving policyholders and their families with uncertain coverage. However, with a guaranteed death benefit, individuals can have peace of mind knowing that their loved ones will receive the intended financial support, even in challenging economic times.

This feature is particularly beneficial for those who require consistent financial protection, such as individuals with dependents or those who have significant financial obligations. By guaranteeing the death benefit, the policy ensures that these obligations are met, providing a sense of security and stability. It also allows policyholders to plan for the future with greater confidence, knowing that their insurance coverage will not be compromised by market fluctuations.

In summary, the guaranteed death benefit in termination dividend life insurance policies offers a reliable and secure form of financial protection. It ensures that the death benefit remains constant, providing a safety net for policyholders and their beneficiaries. This feature is especially valuable in an uncertain economic environment, where consistent and predictable insurance coverage is essential for long-term financial planning.

Assessing Life Insurance: Coverage Adequacy and Your Needs

You may want to see also

Flexibility: Policyholders can choose to take dividends as cash value or additional coverage

The concept of termination dividend life insurance offers policyholders a unique level of flexibility, allowing them to make strategic decisions regarding their insurance coverage. This type of policy is designed to provide both financial security and the ability to adapt to changing circumstances. One of its key advantages is the option to utilize the dividends generated by the policy in two distinct ways.

Firstly, policyholders can choose to take the dividends as cash value. This means that instead of using the dividends to increase the death benefit, they can opt to accumulate the cash value over time. The cash value can grow tax-deferred, providing a valuable asset that can be borrowed against or withdrawn when needed. This option is particularly useful for those who prefer a more conservative approach, ensuring that the policy's value builds up steadily without the immediate need to increase coverage.

Alternatively, policyholders can decide to use the dividends to enhance their insurance coverage. By allocating the dividends to the death benefit, they can increase the policy's value without the need for additional premium payments. This strategy is beneficial for individuals who want to ensure that their loved ones are adequately protected, especially if their financial situation changes or if they wish to provide a larger financial safety net. The flexibility here lies in the ability to adjust the policy's value according to one's evolving needs and financial goals.

This feature of termination dividend life insurance empowers individuals to make informed choices based on their personal financial strategies. It provides a unique blend of security and adaptability, allowing policyholders to navigate life's uncertainties with confidence. Whether one prioritizes building a substantial cash reserve or maximizing the insurance coverage, this type of policy offers a tailored solution to meet specific requirements.

In summary, termination dividend life insurance provides policyholders with the freedom to decide how to utilize the dividends generated by their policy. This flexibility enables them to make decisions that align with their financial objectives, ensuring that their insurance coverage remains relevant and valuable throughout their lifetime.

Term Life Insurance: Maximum Coverage Duration Explained

You may want to see also

Frequently asked questions

Termination dividend life insurance is a type of whole life insurance policy that offers an additional feature of receiving dividends. These dividends are a portion of the policy's profits and can be used to increase the cash value of the policy or taken as a lump sum. This type of insurance is particularly attractive to those seeking long-term financial security and the potential for tax-advantaged growth.

When you purchase a termination dividend life insurance policy, a portion of your premium goes towards building cash value, which accumulates over time. The insurance company then allocates a percentage of its profits (the termination dividends) to this cash value. These dividends can be reinvested to grow the policy further or withdrawn as needed. The policyholder has the flexibility to decide how to utilize these dividends, making it a customizable financial tool.

The key advantage is the potential for higher returns compared to traditional term life insurance. Termination dividends provide an opportunity for policyholders to benefit from the insurance company's success. Additionally, the cash value accumulation can be used to pay for future expenses, provide a financial safety net, or even be borrowed against (loan value). This type of policy also offers lifelong coverage, ensuring protection for your loved ones even if you outlive the policy term.