Term life insurance is a type of insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. Unlike permanent life insurance, which offers lifelong protection, term life insurance policies have a fixed duration, after which the policy expires and the death benefit ceases to exist. The maximum term offered by insurance companies for term life insurance policies varies, with some companies offering terms of up to 40 years. It is important to note that the availability of longer terms depends on the company and the specific policy being offered.

| Characteristics | Values |

|---|---|

| Typical term length | 10, 15, 20, 25, 30 years |

| Maximum term length | 35 or 40 years |

| Ability to renew | Yes, but at a higher rate |

| Conversion to permanent life insurance | Yes, but at a higher rate |

| Typical age limit | 80 to 90 years old |

What You'll Learn

What is the maximum term for term life insurance?

Term life insurance is a type of insurance that provides a death benefit for a specified period. It is a contract between a policyholder and an insurance company, which states that if the insured person passes away within the time period of the policy, the insurer will pay a death benefit to the beneficiaries named on the policy. The key features of term life insurance are that it is generally the cheapest way to buy life insurance, it has a specific length of time when rates are locked in, and there is no cash value in the policy.

The most common term lengths for term life insurance are 10, 15, 20, 25, and 30 years. Some companies offer longer terms of 35 and 40 years. The term length chosen should be based on financial responsibilities, such as a mortgage or children's education. The longer the policy term, the higher the premium is likely to be due to increasing costs of insurance and the increased likelihood of death as the policyholder ages.

When the term life insurance policy expires, the policyholder can either renew it for another term, possibly convert it to permanent coverage, or let the policy lapse. The maximum term for term life insurance depends on the insurance company and can range from 30 to 40 years, with some companies offering terms up to a certain age, usually between 80 and 90 years old.

Term life insurance is a good option for those who want substantial coverage at a low cost and for a specific period. It is important to consider the length of financial commitments when choosing a term life insurance policy to ensure that the coverage lasts as long as needed.

Pancreatitis: Can You Still Get Life Insurance?

You may want to see also

What is term life insurance?

Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The death benefit is the amount of money paid to beneficiaries after the insured dies and will only be paid out if the insured dies during this time period. This can be issued in a variety of ways, such as a lump-sum payment or as annuities.

Term life insurance is usually the least costly life insurance available because it offers a death benefit for a restricted time and doesn’t have a cash value component like permanent insurance. For example, a healthy, non-smoking 30-year-old man could get a 30-year term life insurance policy with a $250,000 death benefit for an average of $18 per month as of October 2024. At age 50, the premium would rise to $67 a month.

Term life insurance is attractive to young people with children. Parents can obtain substantial coverage for a low cost, and if the insured dies while the policy is in effect, the family can rely on the death benefit to replace lost income. These policies are also well-suited for people with growing families, as they can maintain the coverage needed until their children reach adulthood and become self-sufficient.

Term life insurance policies typically last for a set period of time, such as 5, 10, 15, 20, 25 or 30 years. In some cases, you can find 40-year term life insurance. The longer the policy, the higher the premium is likely to be. That's because you're locking in your rate for a longer period, and as you age, health problems tend to crop up and your likelihood of dying increases.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value (the payout amount) and factors such as age, gender, and health. In some cases, a medical exam may be required. The insurance company may also inquire about your driving record, current medications, smoking status, occupation, hobbies, family history, and similar information.

If you die during the policy term, the insurer will pay the policy's face value to your beneficiaries. This cash benefit—which is not typically taxable—may be used by beneficiaries to settle your healthcare and funeral costs, consumer debt, mortgage debt, and other expenses. However, beneficiaries are not required to use the insurance proceeds to settle the deceased's debts.

There is no payout if the policy expires before your death or you live beyond the policy term. You may be able to renew a term policy at expiration, but the premiums will be recalculated based on your age at the time of renewal.

THC Use and Life Insurance: What's the Impact?

You may want to see also

How much does term life insurance cost?

Term life insurance is often considered a temporary policy, providing coverage for a certain period, such as 10, 20, or 30 years. The cost of term life insurance depends on various factors, with age and gender being the most significant determinants. The average cost of a term life insurance premium is around $160 per year, much lower than what people typically expect.

For instance, a healthy 30-year-old woman can secure a $20,000 term life insurance policy for less than $8 per month, while a 55-year-old woman may obtain the same coverage for around $25.50 per month. The premium for a $50,000 policy for a 25-year-old woman is approximately $14 per month, but it increases to $60 per month for a 55-year-old woman. For men, the same $50,000 policy would cost a 25-year-old male about $22.50 and a 55-year-old male $86.50.

The length of the term also influences the cost, with a 10-year term typically being less expensive than a 25-year term. The amount of coverage is another critical factor, with a $10,000 death benefit costing less than a $100,000 death benefit.

Other factors that can impact term life insurance rates include health, tobacco use, lifestyle and hobbies, occupation, and financial history. Maintaining a healthy weight, managing medical conditions, avoiding high-risk activities, and applying early can help lower the premium.

Term life insurance is generally the most affordable option compared to permanent life insurance, which lasts a lifetime and includes a cash value component. The average cost of life insurance is $26 per month for a 40-year-old purchasing a 20-year, $500,000 term life policy, the most common term length and amount sold.

Understanding Life Insurance Contracts: Insuring Agreement Explained

You may want to see also

What happens when term life insurance expires?

When a term life insurance policy expires, it typically ends without any action required from the policyholder. The insurance company sends a notice, and since there is no cash value to the policy, the policyholder does not receive any money back unless they have a return-of-premium feature included in their policy. Once the term life insurance policy expires, the policyholder can either renew it, convert it to permanent coverage, or let it lapse.

Renewing a Term Life Insurance Policy

Some term life insurance policies offer the option to renew coverage annually after the initial term expires. While this option tends to be more expensive due to age-related risk increases, it can be useful for those who develop health issues that make obtaining a new insurance policy challenging. The premium will increase based on the policyholder's current age during each renewal.

Converting a Term Life Insurance Policy to Permanent Coverage

Many term life insurance policies include a conversion rider, which allows the policyholder to change their term policy into a permanent policy without undergoing a new medical exam. Conversion riders often have expiration dates, and not all policies allow conversion up until the end of the term. Partial conversions are also possible, where the policyholder converts only a portion of their term policy to permanent coverage to balance the need for permanent coverage with manageable payments.

Letting a Term Life Insurance Policy Lapse

If the policyholder no longer needs life insurance coverage when their term policy expires, they can choose to let the policy lapse by stopping premium payments. However, it is important to carefully evaluate whether continued coverage is needed, considering factors such as dependents, outstanding debts, business obligations, and special needs dependents.

Life Insurance: Haram's Financial Risk and Uncertainty

You may want to see also

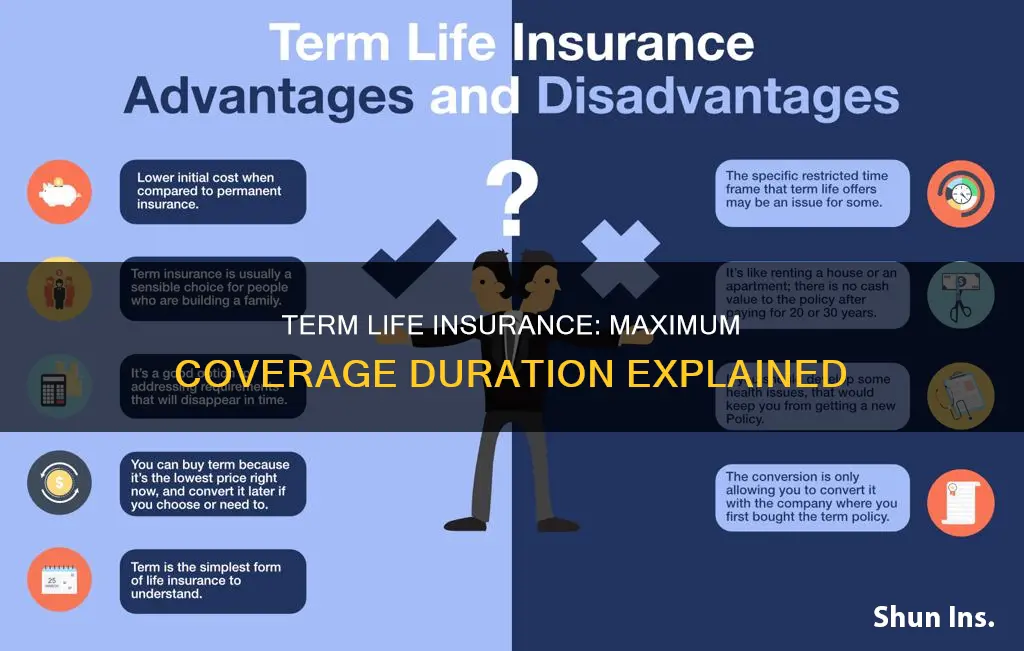

What are the pros and cons of term life insurance?

Term life insurance is a type of policy that offers financial protection for a set period, usually 10 to 30 years, although some companies offer 40-year terms. If the insured person dies during the term, a death benefit is paid to their beneficiaries. This type of insurance is often sought by individuals who need coverage during specific times in their lives, such as parents with young children or those with a mortgage or significant debt.

Pros of Term Life Insurance

- Affordability: Term life insurance is usually the least costly option as it offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance.

- More coverage available: With term life insurance, you can buy $10 million or more in life insurance at an affordable price.

- Tax-free death benefit: The death benefit paid to beneficiaries is tax-free.

- Flexible payment and policy options: You can choose to pay premiums monthly, quarterly, semi-annually, or annually, and select a coverage term of one year or more, usually in increments of five years.

- No penalty for canceling: You can cancel your term life insurance policy at any time without incurring fees or penalties.

Cons of Term Life Insurance

- Temporary coverage: Term life insurance only offers coverage for a specified period, so it may not be suitable for those with permanent life insurance needs, such as funeral expenses or long-term care for a dependent.

- No cash value: Term life insurance doesn't build cash value, so there is no savings component to borrow or withdraw from. If you cancel the policy, you don't get any money back unless you have a "return of premium" feature, which comes at a higher cost.

- Lower age cap: Term life insurance has a lower age limit than permanent life insurance, typically extending up to 80-90 years, and it may be more difficult to obtain a policy for 30 years if you are over 60.

Life Insurance Riders: Juvenile Policy Add-ons Explained

You may want to see also

Frequently asked questions

Term life insurance policies are generally sold in lengths of 5, 10, 15, 20, 25, or 30 years. Some companies offer longer terms of 35 and 40 years. The maximum term available to you will depend on your age, with most policies ending between the ages of 80 and 90.

Term life insurance is a type of life insurance that provides coverage for a specific period. It tends to be more affordable than permanent life insurance but does not build cash value.

When a term life insurance policy expires, the coverage ends, and you no longer need to make premium payments. You may have the option to renew the policy annually, buy a new policy, or convert it to permanent life insurance.

In most cases, no. Term life insurance policies do not build cash value, so there is no cash value to withdraw.

The cost of term life insurance depends on various factors, including age, health, gender, and the coverage amount. It is generally the cheapest way to buy life insurance, with average monthly costs for a $1 million 20-year term policy ranging from $42 to $51 for a 30-year-old non-smoking female or male of average health, respectively.