An insurance contract is a legally binding agreement between an insurance company and an insured party. The insuring agreement is a crucial part of this contract, outlining the insurance company's promises and what is covered by the policy. In a life insurance contract, the insuring agreement will specify that the insurer will pay a sum of money to the insured person's beneficiaries upon their death, in exchange for premium payments made during their lifetime. This agreement is typically an all-risk coverage, meaning all losses are covered except those specifically excluded. Understanding the insuring agreement is essential to verifying that the policy meets one's needs and to grasp the responsibilities of both parties in the event of a loss.

| Characteristics | Values |

|---|---|

| Type of contract | Legal contract |

| Parties involved | Insurance company and insured party |

| Purpose | Transfer the risk of a significant financial loss or burden from the insured to the insurer |

| Exchange | Insured pays a premium; insurer promises a payout in the event of a claim |

| Enforceability | Must contain all essential elements of a contract |

| Elements | Offer and acceptance, consideration, legal capacity, legal purpose |

| Offer | Provided by the party wanting insurance by submitting a proposal form |

| Acceptance | Provided by the insurance company agreeing to provide insurance |

| Consideration | Exchange of items of value, whether money, services, or goods |

| Legal capacity | Both parties must be of sound mind and not under the influence of drugs or alcohol |

| Legal purpose | Must not entail any illegal activities |

| Named-perils coverage | Only perils specifically listed in the policy are covered |

| All-risk coverage | All losses are covered except those specifically excluded |

What You'll Learn

Insuring agreements outline the scope of coverage

An insurance contract is a legally binding agreement between an insurance company and an insured party. Insuring agreements are a section of the insurance contract in which the insurance company outlines the scope of coverage, specifying the circumstances under which it will provide insurance. This section is a summary of the major promises of the insurance company, stating what is covered.

The insuring agreement will detail the services and benefits that the insurance company will provide in exchange for premium payments. For example, in an auto insurance contract, the insurance agreement will specify that in exchange for payment, the insurance company will cover legal liability, accident benefits, and physical damage, subject to the terms specified in the contract.

The insuring agreement is usually contained in a coverage form, from which the entire policy is constructed. It outlines a broad scope of coverage, which is then narrowed by exclusions and definitions. Exclusions are circumstances that are not covered by the insurance company, and these are outlined in the latter part of the contract. Exclusions are necessary to ensure the financial stability of the insurance company, as agreeing to cover all circumstances could lead to bankruptcy.

The insuring agreement is an important section of the insurance contract as it provides clarity on what is covered. However, disagreements can still arise regarding the interpretation of the insuring agreement, sometimes resulting in lawsuits. It is, therefore, essential for insured parties to thoroughly understand the insuring agreement and the entire insurance contract to avoid problems and disagreements with the insurance company in the event of a loss.

Pension Retiree Life Insurance: Can You Expect an Increase?

You may want to see also

Insuring agreements are narrowed by exclusions

An insurance agreement is a legal contract between an insurance company and an insured party. The insured agrees to pay a premium, while the insurer promises a payout in the event of a claim. The insuring agreement is a summary of the insurer's major promises, stating what is covered.

Excluded Perils or Causes of Loss

Under a homeowners policy, for example, floods, earthquakes, and nuclear radiation are typically excluded perils.

Excluded Losses

An example of an excluded loss under an automobile policy is damage due to wear and tear.

Excluded Property

Personal property, such as an automobile, a pet, or an airplane, is often excluded from homeowners' policies.

It is important to note that multi-peril policies may have specific exclusions and conditions for each type of coverage. For instance, collision coverage, medical payment coverage, and liability coverage may have different exclusions. Therefore, it is crucial to carefully read the insuring agreement and understand the specific exclusions that apply to your policy.

Life Insurance Benefits: Interest Accrual After Death?

You may want to see also

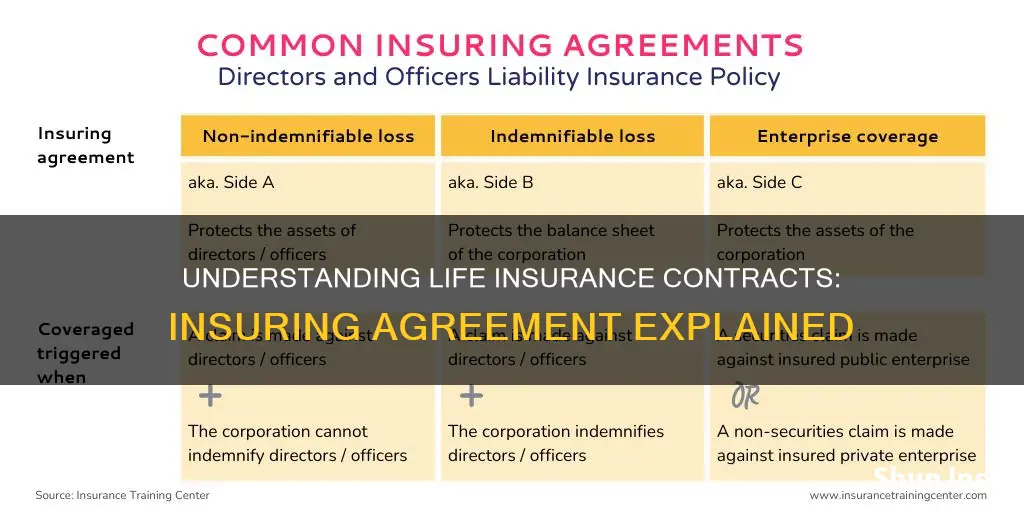

Insuring agreements are part of the insurance policy

An insurance policy is a legal contract between the insurance company (insurer) and the person(s), business, or entity being insured (insured). An insurance agreement allows the risk of a significant financial loss or burden to be transferred from the insured to the insurer. In exchange, the insured promises to pay a small, guaranteed payment called a premium.

An insuring agreement is a section of an insurance contract where the insurance company specifies the circumstances under which it will provide coverage in exchange for premium payments. It is a summary of the insurer's major promises and states what is covered. Insuring agreements outline a broad scope of coverage, which is then narrowed by exclusions and definitions.

There are two basic forms of insuring agreements: named-perils coverage and all-risk coverage. Named-perils coverage only covers the perils specifically listed in the policy, while all-risk coverage includes all losses except those that are explicitly excluded. Life insurance policies typically fall under all-risk coverage.

The insuring agreement is an essential part of the insurance policy as it provides clarity on the specific circumstances under which the insurance company will provide coverage. It is crucial for insured individuals to understand the terms of the insuring agreement to avoid problems and disagreements with the insurance company in the event of a loss.

In the context of a life insurance contract, the insuring agreement outlines the insurer's commitment to pay a sum of money to the named beneficiaries upon the death of the insured person. The insured person's beneficiaries will receive the policy's death benefit, provided the policyholder has paid the required premiums.

Understanding the insuring agreement in a life insurance contract is vital for individuals seeking to purchase life insurance. It helps them make informed decisions about their coverage and ensure that their loved ones are financially protected in the event of their death.

Life Worth Living Cincinnati: Exploring Insurance Options

You may want to see also

Insuring agreements are a summary of the insurer's promises

An insurance policy is a legal contract between the insurance company (the insurer) and the person(s), business, or entity being insured (the insured). The insuring agreement is a summary of the insurer's promises and a critical component of the insurance contract. It outlines the circumstances under which the insurer agrees to provide coverage and the benefits that the insured can expect to receive. This agreement is usually found within a coverage form, which serves as the foundation for the insurance policy.

In a life insurance contract, the insuring agreement typically includes a promise from the insurer to pay a sum of money, known as the death benefit, to the named beneficiaries upon the death of the insured person. This agreement is legally binding, and the insurer is obligated to fulfil their promises as long as the insured person pays the required premiums and meets the terms of the policy.

The insuring agreement in a life insurance contract may also specify the scope of coverage, detailing the risks and perils that are covered by the policy. Life insurance policies are often all-risk policies, meaning they cover all losses except those specifically excluded. Exclusions are an important aspect of the insuring agreement, as they outline the circumstances under which the insurer will not provide coverage. These exclusions are crucial for insurers to manage their financial risks and ensure they do not promise coverage for losses that could lead to bankruptcy.

Additionally, the insuring agreement may include provisions for additional services provided by the insurer. For example, the insurer may agree to defend the insured in a liability lawsuit or offer certain benefits beyond the death benefit. It is important to note that the insuring agreement is subject to the terms, conditions, and exclusions specified in the insurance contract.

Overall, the insuring agreement is a critical component of a life insurance contract, as it summarises the insurer's promises and provides clarity on the coverage, benefits, and exclusions of the policy. It is essential for insured individuals to carefully review the insuring agreement to understand their rights and the obligations of the insurer in the event of a loss or claim.

Fidelity's Life Insurance Offerings: What You Need to Know

You may want to see also

Insuring agreements are either named-perils or all-risk coverage

An insuring agreement is a part of an insurance policy that outlines the insurer's promises to the insured. It is a summary of the insurer's major promises and states what is covered by the policy. Insuring agreements are either named-perils or all-risk coverage.

A named-perils insuring agreement covers only losses incurred due to perils specifically listed in the policy. The policyholder must prove that the loss arose from a peril named in the policy. Named-perils policies are common in property insurance and are often used for employment practices liability and cyber insurance policies. This allows insurance companies to better define and cover known risks.

On the other hand, an all-risk insuring agreement covers losses from any cause unless explicitly excluded in the policy. The burden of proof falls on the insurance company to prove that an exclusion applies to the cause or event triggering the policy. All-risk policies are also known as comprehensive policies and are commonly used for general liability and errors and omissions policies.

Life insurance policies are typically all-risk policies, covering all losses except those specifically excluded. It is important to carefully review insurance policies to understand the coverage, exclusions, and the burden of proof in the event of a claim.

Meemic's Life Insurance Offer: What You Need to Know

You may want to see also

Frequently asked questions

An insuring agreement is a section of an insurance contract where the insurance company specifies the circumstances under which it will provide coverage in exchange for premium payments.

An insuring agreement outlines the scope of coverage, which is then narrowed by exclusions and definitions. The insurance company agrees to pay losses for covered perils, provide certain services, or defend the insured in a liability lawsuit.

There are two basic forms of insuring agreements: named-perils coverage and all-risk coverage. Named-perils coverage only covers the perils specifically listed in the policy, while all-risk coverage covers all losses except those specifically excluded.

The purpose of an insuring agreement is to specify exactly what is covered by the insurance policy. This is important because agreeing to cover all circumstances would be costly for the insurance company. By outlining the scope of coverage, the company can manage its financial risk and ensure its long-term viability.