Navigating the complexities of insurance can be challenging, especially when it comes to understanding where to send your documents. If you're wondering where do I send my Globe Life Insurance, it's important to know that the process can vary depending on your specific situation. Whether you're making a claim, updating your policy, or simply seeking information, knowing the correct address and method of communication is crucial. This guide will provide you with the necessary details to ensure your Globe Life Insurance documents reach the right place, helping you stay informed and protected.

What You'll Learn

- Customer Service: Contact options, hours, and support channels

- Policy Management: Online tools, app, and account access

- Claims Process: Steps, documentation, and payment methods

- Agent Assistance: Find local agents, phone numbers, and email

- International Coverage: Global support, policy transfer, and claims abroad

Customer Service: Contact options, hours, and support channels

If you're looking to reach out to Globe Life Insurance for any inquiries or concerns, it's important to know the best contact options and their availability. Here's a comprehensive guide to help you navigate the customer service channels:

Contact Options:

- Phone: The primary method of communication is through their customer service phone line. You can reach them at [insert phone number here]. This number is typically available during standard business hours, which are usually Monday to Friday, 8:00 AM to 6:00 PM, and sometimes extended hours on select days.

- Email: For written correspondence, you can send your inquiries to [insert email address here]. This is a convenient option for detailed questions or if you prefer written records of your communication.

- Online Chat: Globe Life Insurance might offer a live chat feature on their website, allowing you to connect with a representative in real-time. This can be especially useful for quick questions or if you need immediate assistance.

- Social Media: Many insurance companies are now active on social media platforms. Check their official pages on Facebook, Twitter, or Instagram to see if they provide customer support through these channels.

Hours of Operation:

It's essential to be aware of the operating hours to ensure you reach the right department or representative. Standard business hours for customer service are generally Monday to Friday, 8:00 AM to 5:00 PM. However, it's advisable to check for any specific department hours, as some teams might have extended hours or different schedules. For instance, the claims department may have different hours for processing claims.

Support Channels:

- Customer Service: This is the primary support channel for general inquiries, policy information, and assistance with various issues.

- Claims Department: If you need to file a claim or have questions about a claim, contact this department. They will guide you through the process and provide necessary documentation.

- Agent Assistance: Globe Life Insurance might offer a network of independent agents who can provide personalized advice and support. You can locate your nearest agent through their website or by calling the main customer service number.

- Online Resources: Explore their website for a wealth of information, including policy documents, FAQs, and online tools to manage your policy.

Remember, for any specific policy-related matters, it's best to have your policy number or other relevant details ready to ensure a smooth and efficient interaction with their customer service team.

Securities-Backed Life Insurance: Unlocking Financial Strength and Security

You may want to see also

Policy Management: Online tools, app, and account access

Managing your life insurance policy online can be a convenient and efficient way to stay on top of your coverage. Many insurance providers, including Globe Life, offer digital tools and resources to help policyholders manage their insurance easily. Here's a guide on how to access and utilize these online resources for policy management:

Online Tools and Resources:

Globe Life likely provides an online portal or customer dashboard where you can access your policy information. This platform might be accessible through their website or a dedicated mobile app. By logging into your account, you can view essential details about your life insurance policy. This includes policy numbers, coverage amounts, beneficiaries' information, and payment history. Online tools can also allow you to update personal details, such as your address or contact information, ensuring your policy remains accurate and up-to-date.

App Access:

In addition to the online portal, Globe Life might offer a mobile application for policy management. The app provides on-the-go access to your policy details, making it convenient to check your coverage while traveling or during emergencies. With the app, you can quickly locate important documents, such as your insurance certificate or policy summary, and even receive notifications about upcoming policy reviews or payments. The app's user-friendly interface ensures that managing your insurance is just a tap away.

Account Management:

Online account access allows you to take control of your insurance journey. You can initiate the process of adding or removing beneficiaries, updating payment methods, or making changes to your policy. For instance, if you wish to increase your coverage, you can do so online, ensuring a seamless process. Additionally, you can view past payment receipts, policy statements, and other relevant documents, all accessible from your secure online account. This level of transparency and control empowers you to make informed decisions about your insurance.

When utilizing these online tools and resources, it is essential to ensure the security of your personal and policy information. Globe Life might provide two-factor authentication or other security measures to protect your account. Regularly review your account activity and be cautious of any suspicious behavior. By actively managing your policy online, you can stay informed, make necessary adjustments, and ensure your life insurance remains a valuable asset.

Life Insurance and Cirrhosis: What Coverage is Offered?

You may want to see also

Claims Process: Steps, documentation, and payment methods

The claims process for Globe Life Insurance can vary slightly depending on the specific policy and the type of claim being made. However, here is a general step-by-step guide to help you navigate the process:

Step 1: Notify Globe Life Insurance

The first step is to inform Globe Life Insurance about your claim as soon as possible. You can typically do this by contacting their customer service department. Provide them with the necessary details, including your policy number, the reason for the claim, and any relevant information or documentation. They will guide you on the next steps and may ask for additional information to process the claim efficiently.

Step 2: Gather Required Documentation

Globe Life Insurance will require specific documents to process your claim. The necessary paperwork may include:

- Death certificate (if the claim is for a deceased policyholder)

- Medical records or reports (for critical illness or disability claims)

- Police report (in cases of accidental death or disability)

- Proof of identity and relationship (for beneficiaries)

- Policy documents and any additional information related to the claim

Ensure that you provide accurate and complete documentation to avoid delays. Globe Life Insurance will guide you on what specific documents they need based on the nature of your claim.

Step 3: Complete and Submit the Claim Form

Globe Life Insurance will provide you with a claim form to fill out. This form typically includes details about the policyholder, the beneficiary, the nature of the claim, and any supporting evidence. Carefully review the instructions and provide all the required information. You can usually submit the form online, by mail, or through the designated customer service channel.

Step 4: Review and Approve the Claim

Once Globe Life Insurance receives your claim, they will review the documentation and supporting evidence. This process may take some time, and the company will notify you of their decision. If the claim is approved, they will process the payment according to the terms of your policy. If additional information is needed, they will contact you to request further documentation.

Payment Methods:

- Lump Sum Payout: If the policy is a term life insurance, the payout is often a lump sum amount. This can be received via direct deposit, check, or another agreed-upon method.

- Regular Payments: For policies with a long-term payout structure, such as whole life insurance, payments may be made regularly (monthly, quarterly, or annually) until the death benefit is fully paid out.

- Beneficiary Designation: Ensure that the beneficiary information is up-to-date to receive the payout efficiently.

Remember, it's essential to stay in communication with Globe Life Insurance throughout the process to ensure a smooth and timely resolution to your claim.

Younger People Get Cheaper Term Life Insurance Rates

You may want to see also

Agent Assistance: Find local agents, phone numbers, and email

If you're looking to manage your Globe Life Insurance policy, it's essential to have easy access to local agents who can provide assistance and guidance. Here's a step-by-step guide to help you find the right support:

- Online Search: Begin by searching for "Globe Life Insurance local agents" or "Globe Life Insurance customer service" on your preferred search engine. This will provide you with a list of results, including official company websites, agent directories, and customer support pages. Look for the official Globe Life Insurance website, as it will have the most accurate and up-to-date information.

- Official Website: Visit the official Globe Life Insurance website. They often have a dedicated section for 'Find an Agent' or 'Agent Locator'. This section typically includes a search tool where you can enter your zip code or city to find nearby agents. You might also find contact information, such as phone numbers and email addresses, for each agent or office.

- Contact Information: Once you've identified local agents, gather their contact details. Look for phone numbers and email addresses provided on the company's website or agent profiles. Having direct contact information ensures you can reach out for policy-related inquiries, updates, or any other assistance you may require.

- Phone and Email Support: When you have a list of local agents, you can choose the most convenient one based on proximity or personal preference. Call the phone number provided to speak with an agent directly. They can answer your questions, assist with policy management, and guide you through any necessary actions. Alternatively, you can send an email to the provided address, and the agent will respond at their earliest convenience.

Remember, having access to local agents can be invaluable for any insurance-related matters. They can provide personalized assistance and ensure your policy remains up-to-date and aligned with your needs. Always keep your agent's contact information handy for quick access during emergencies or routine inquiries.

Calculating Age for Life Insurance: What You Need to Know

You may want to see also

International Coverage: Global support, policy transfer, and claims abroad

When considering international coverage for your life insurance policy, it's important to understand the options available to ensure you receive the support and protection you need, no matter where your travels take you. Globe Life Insurance offers a range of international coverage options designed to provide global support, facilitate policy transfers, and streamline the process of making claims abroad.

Global Support:

Globe Life Insurance provides a comprehensive global support system for its international policyholders. This includes a 24/7 emergency assistance service that can be accessed from anywhere in the world. In the event of an emergency, such as a medical crisis or travel-related incident, the assistance team can provide immediate help, including medical referrals, emergency transportation, and legal assistance. Additionally, Globe Life offers a dedicated international customer service team that can assist with policy inquiries, claim processes, and general support, ensuring that you have access to the necessary resources no matter your location.

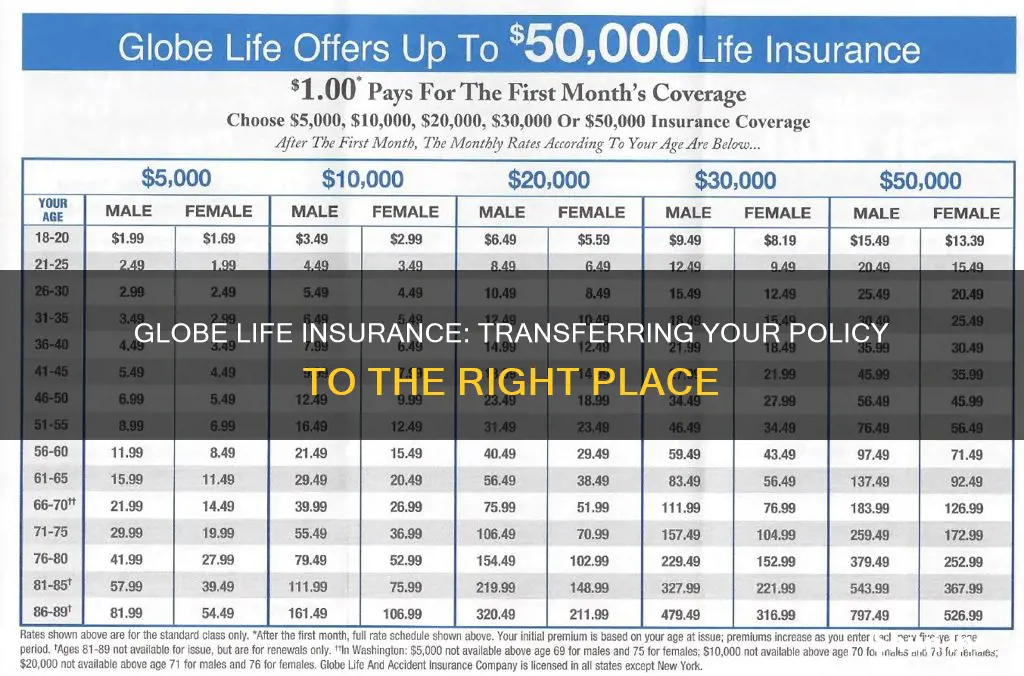

Policy Transfer:

Transferring your life insurance policy internationally can be a seamless process with Globe Life. When moving to a new country or relocating, you may want to consider transferring your policy to maintain coverage. Globe Life allows policyholders to transfer their policies, ensuring that your coverage remains intact. This process involves updating your personal details, reviewing the policy terms in your new location, and potentially making adjustments to suit your new circumstances. The company provides clear guidelines and support to ensure a smooth transition, allowing you to focus on your new adventures without worrying about insurance complexities.

Claims Abroad:

Making a claim while traveling internationally can be a concern, but Globe Life has streamlined this process to provide peace of mind. When a covered event occurs, such as the death of the insured, the claims process can be initiated from anywhere in the world. Globe Life's international claims team is equipped to handle these situations efficiently. They will guide you through the necessary steps, which may include providing supporting documents, arranging for the transfer of the deceased's remains, and ensuring that the claim is processed promptly. The company's global reach and understanding of international procedures ensure that you receive the support and compensation you are entitled to, even in challenging circumstances.

In summary, Globe Life Insurance offers a robust international coverage program that includes global support, policy transfer assistance, and efficient claims processing abroad. These features are designed to provide you with the necessary protection and support as you explore the world, ensuring that your life insurance policy remains a reliable companion wherever your travels take you.

Depression's Impact: Life Insurance Complications

You may want to see also

Frequently asked questions

You can make payments to Globe Life Insurance by mailing your check or money order to the following address: Globe Life Insurance Company, P.O. Box 4040, Norman, OK 73070. Alternatively, you can set up automatic payments through your bank account or credit card.

For policy-related documents, correspondence, and updates, you can send them to the Policy Services department at Globe Life Insurance. Their address is: Globe Life Insurance Company, Policy Services, P.O. Box 4040, Norman, OK 73070.

You can update your address or contact details by contacting the Customer Service team. They can be reached via phone at 1-800-543-3562 or by email at [email protected]. Simply provide your policy number and the new information you wish to update.